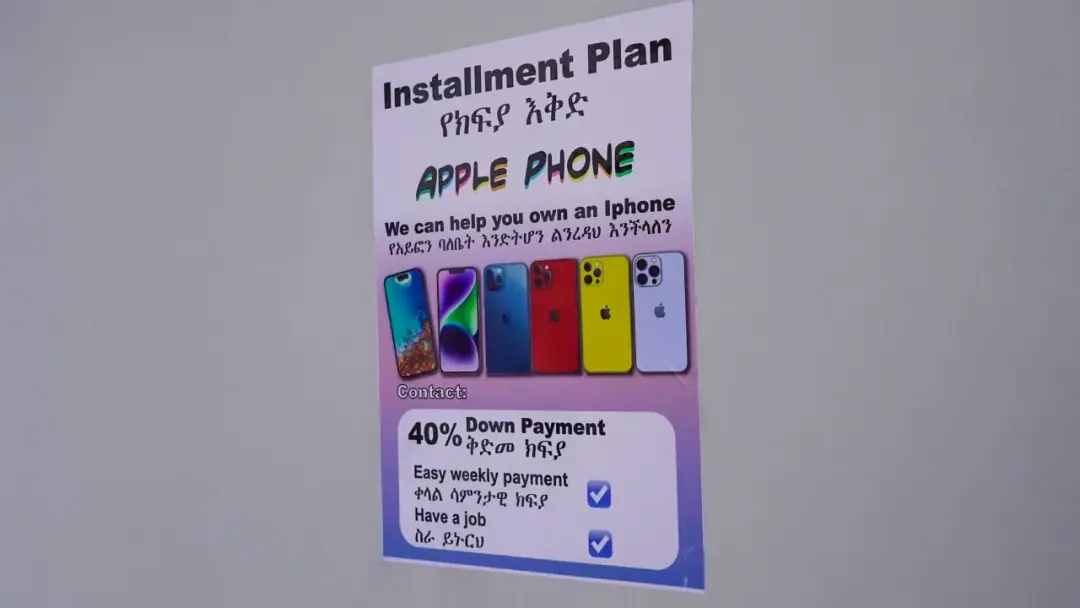

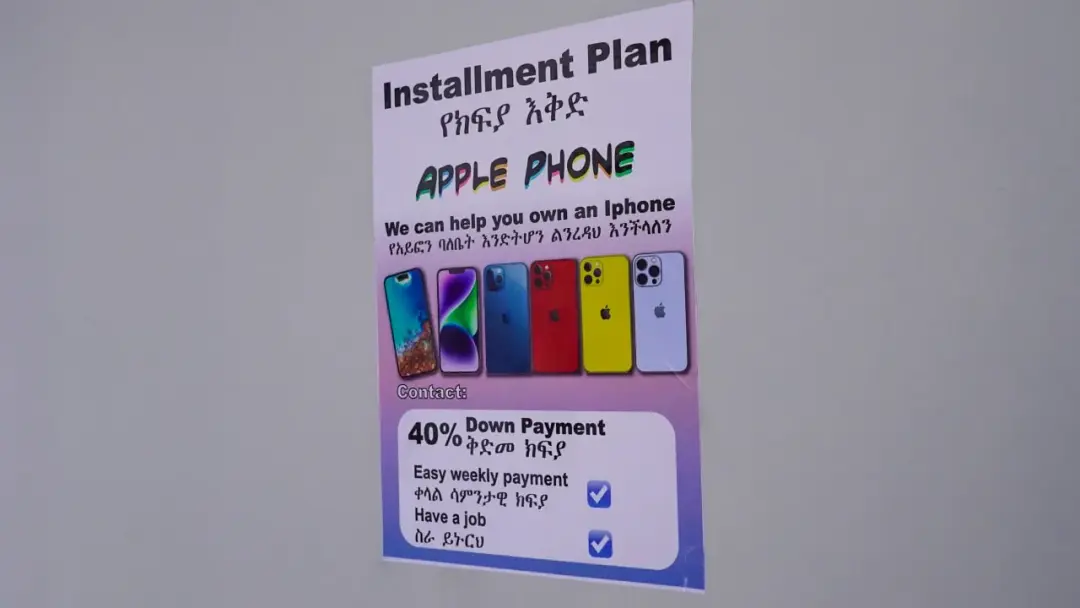

An uncanny marketing scheme for smartphones has been buzzing through Addis Ababa over the past few weeks, offering devices on a credit basis. Phone vendors across the capital have plastered their shops and online profiles with advertisements of the scheme, which facilitates the purchase of iPhones, Infinix, and Tecno mobiles with a 40% downpayment.

Backed up by a foreign business group, the credit scheme offers prospective customers loans worth up to 60% of the phone’s value, repayable over three months at a 35% interest rate with weekly installments.

One of the 15 local agents working with the group, says no additional collateral besides the phone will be required to access the credit facility. He indicates that the phones can be blocked remotely if the debtor fails to make payments on time.

“You can purchase the phone you want from the shops we work with,” he told Shega.

The Agent points out that buyers can access a phone as soon as they fill out a form, pay the down payment, and provide a copy of their identification card.

“You can pay as little as 40,000 birr for a 100,000 birr phone, and we can cover the rest. He stresses, “You can pay us back later.”

According to the loan agreement obtained by Shega, the group refers to this contract as a ‘User Lease & Service Agreement.’ Under its terms, buyers enter into a lease arrangement with the company for the phone, with weekly payments labeled as ‘rent expenses.’

The agreement states, “Party A [the company] retains ownership of the leased equipment during the lease term. If Party B [the buyer] fails to meet their obligations, does not pay the rent on time, or cannot be reached, Party A reserves the right to lock the mobile phone (with the unlocking fee to be borne by Party B).”

No Comment Found.