መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » እንግሊዝ

Overview of England

- History of England

- Hierarchical structure

- The Constitution of England

- Federal Government

- Local Government

- Elections

Brief History of England

The history of England is a long and complex story that spans thousands of years. Here is a brief overview of some key periods and events in English history:

Ancient and Roman Periods (Pre-5th Century AD): The earliest known inhabitants of what is now England were various Celtic tribes. In 43 AD, the Roman Empire invaded and established control over the region, which they called Britannia. The Romans built roads, towns, and forts, leaving a lasting impact on the region’s culture and infrastructure.

Anglo-Saxon Period (5th to 11th Century): After the decline of the Roman Empire, Germanic tribes, primarily the Angles, Saxons, and Jutes, began migrating to the British Isles. Over time, they established several separate kingdoms, which eventually merged into the kingdoms of Wessex, Mercia, Northumbria, and East Anglia. These kingdoms were later united under King Alfred the Great of Wessex to resist Viking invasions.

Viking Invasions and Danelaw (8th to 11th Century): Viking raids and invasions from Scandinavia, particularly Denmark, and Norway, greatly impacted England during this period. The Vikings established the Danelaw, a region where Norse laws and customs prevailed. Eventually, the Viking influence diminished, and England started to reassert its control.

Norman Conquest (1066): In 1066, William the Conqueror, Duke of Normandy (in modern-day France), successfully invaded England, defeating King Harold II at the Battle of Hastings. This marked the beginning of Norman rule in England, bringing significant changes to its culture, language (Old English mixed with Old Norman to form Middle English), and governance.

Medieval Period (11th to 15th Century): The medieval period saw the consolidation of England as a kingdom under various monarchs. The Magna Carta, signed in 1215, limited the power of the monarchy and laid the groundwork for constitutional principles. The Hundred Years’ War with France (1337-1453) and the Wars of the Roses (1455-1487) between the rival houses of Lancaster and York were significant conflicts during this era.

Tudor and Stuart Periods (16th to 17th Century): The Tudor dynasty, starting with Henry VII, brought stability and the English Renaissance. The Church of England was established during the reign of Henry VIII, separating from the authority of the Pope. The Stuart dynasty succeeded the Tudors, and their reign included the English Civil War (1642-1651) between Parliamentarians and Royalists, resulting in the temporary establishment of a republic known as the Commonwealth under Oliver Cromwell.

Glorious Revolution and Constitutional Monarchy (Late 17th Century): The Glorious Revolution of 1688 led to the overthrow of King James II and the establishment of a constitutional monarchy under William III and Mary II. This event laid the foundation for the modern British constitutional system, with the Bill of Rights of 1689 reaffirming limits on royal power and the rights of Parliament and the people.

Industrial Revolution and Colonial Expansion (18th to 19th Century): The Industrial Revolution brought significant technological and economic advancements to England, transforming it into a global economic powerhouse. The British Empire expanded during this time, acquiring colonies across the world.

Modern Era (20th Century Onward): England and the United Kingdom played significant roles in both World Wars. After World War II, decolonization led to the independence of many British colonies. England’s role in global politics and economics continued, and the country underwent significant social and cultural changes, including the rise of the welfare state, immigration from former colonies, and shifts in popular culture.

This overview touches on just a fraction of England’s rich and diverse history. The story of England is shaped by the interactions of its people, its changing political landscape, and its influence on the world stage.

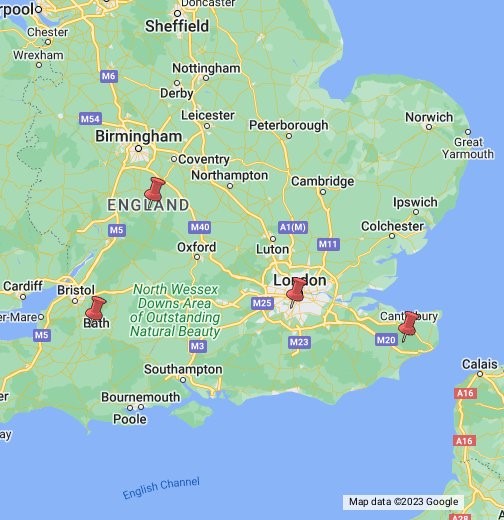

Hierarchy structure of England

Monarch: England is a constitutional monarchy, which means it has a reigning monarch who serves as the ceremonial head of state. However, the monarch’s powers are largely symbolic and are exercised within the boundaries of the constitution.

Parliament: The United Kingdom Parliament consists of two houses: the House of Commons and the House of Lords. The Parliament is responsible for creating and passing laws, scrutinizing the government’s actions, and representing the interests of the public. The House of Commons is composed of Members of Parliament (MPs) who are elected by the public in general elections. The House of Lords is made up of appointed members, including life peers, bishops, and hereditary peers.

Prime Minister: The Prime Minister is the head of government and is typically the leader of the political party that holds the majority in the House of Commons. The Prime Minister leads the executive branch of the government, makes policy decisions, and represents the UK internationally.

Cabinet: The Cabinet is composed of senior government ministers chosen by the Prime Minister. Each minister is responsible for a specific government department, such as health, education, defense, etc. The Cabinet collectively makes major policy decisions and implements government initiatives.

Government Departments: Each government department is responsible for specific areas of public policy and administration. These departments are led by ministers who are part of the Cabinet. Examples of government departments include the Department of Health and Social Care, the Home Office, and the Ministry of Defense.

Local Government: England is divided into various local government areas, including counties, districts, boroughs, and unitary authorities. Each of these areas has its local government structure

responsible for providing essential services such as education, transportation, and public safety.

Devolved Administrations: While the term “England” usually refers to the entire country, it’s important to note that the United Kingdom also consists of other nations with their devolved governments. Scotland, Wales, and Northern Ireland each have their devolved parliaments/assemblies with varying degrees of legislative power. England, however, does not have a separate devolved parliament or assembly and is largely governed by the UK Parliament.

Judiciary: The judiciary in England operates independently of the other branches of government. It interprets the law, administers justice, and ensures that laws are applied fairly. The highest court in the land is the Supreme Court of the United Kingdom, which handles the most complex and significant legal cases.

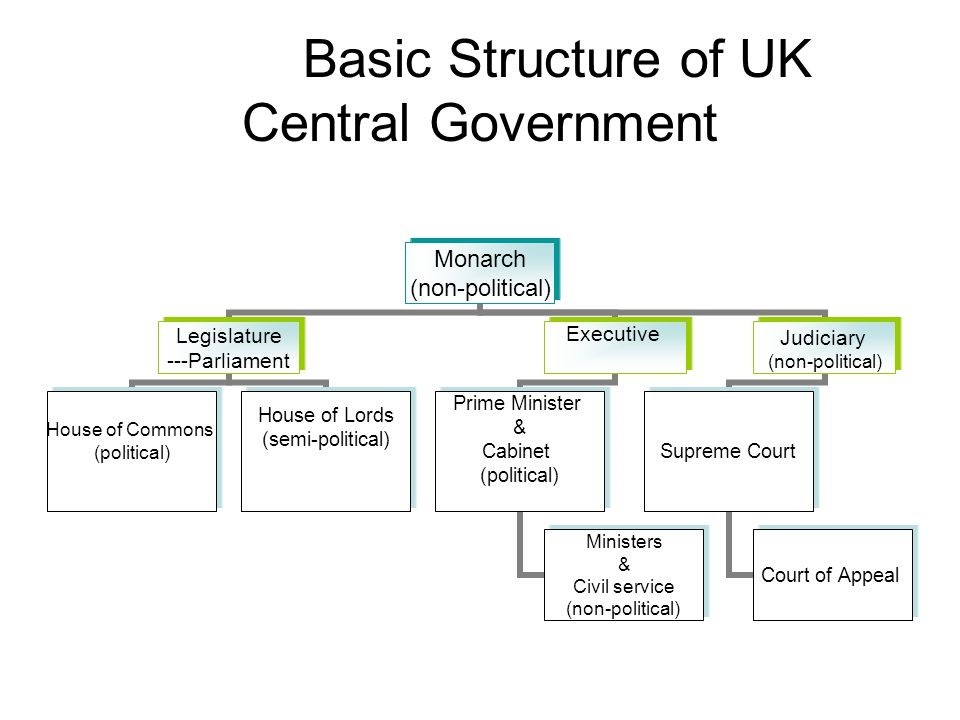

The Constitutions

England does not have a single, codified constitution like some countries. Instead, it relies on a combination of written statutes, historical documents, common law, conventions, and precedents. The constitution of England is largely unwritten and is often referred to as an “uncodified” or “unwritten” constitution. It has evolved over centuries and is based on various legal and historical sources. Here’s an overview of the key components that make up the Constitution of England:

Statute Law: Statute law consists of written laws passed by the UK Parliament, which apply to England, Wales, Scotland, and Northern Ireland. These laws cover a wide range of topics, including civil rights, criminal law, constitutional matters, and more. One of the most important constitutional statutes is the Human Rights Act 1998, which incorporates the European Convention on Human Rights into UK law.

Common Law and Judicial Precedent: England’s legal system is based on the common law tradition, where legal principles are established through court decisions and judicial precedents. The decisions of higher courts, especially those of the Supreme Court of the United Kingdom, shape the legal landscape and contribute to constitutional norms.

Magna Carta: The Magna Carta, signed in 1215, is a foundational historical document that established principles of limited government, the rule of law, and the protection of individual rights. While many of its specific provisions are no longer in force, its principles have had a lasting influence on constitutional development.

Constitutional Conventions: Conventions are unwritten practices and traditions that have evolved and guide the behavior of government institutions. These conventions include matters like the role of the Prime Minister, the dissolution of Parliament, and the relationship between the monarch and Parliament.

Royal Prerogatives: The royal prerogatives are historic powers and privileges that were traditionally exercised by the monarch. Over time, many of these prerogatives have been codified into law or limited by constitutional changes. For example, the power to declare war or sign treaties now requires parliamentary approval.

European Union Membership: While England was a part of the United Kingdom’s membership in the European Union (EU), EU law had a significant impact on the legal landscape. However, the UK’s exit from the EU (Brexit) has led to changes in this regard.

Devolution: The devolution of powers to Scotland, Wales, and Northern Ireland has resulted in the establishment of separate legislatures and governments with authority over certain policy areas. This has added a layer of complexity to the constitutional framework.

It’s important to note that the constitution of England is closely intertwined with the constitution of the United Kingdom as a whole. While England has its distinct historical and legal aspects, much of its governance and legal framework is tied to the wider UK context.

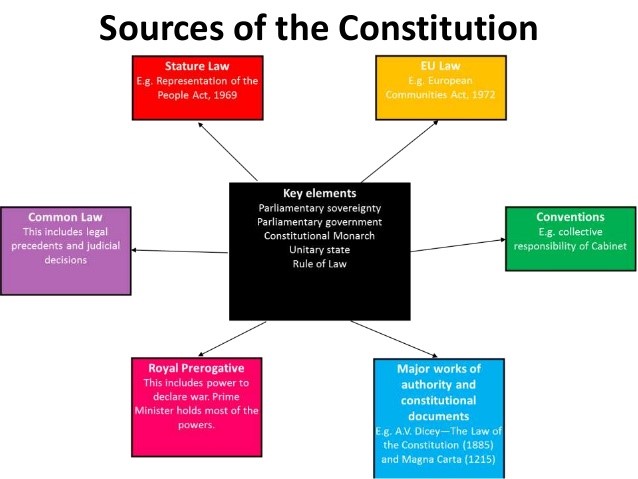

England Federal Government

England does not have a separate federal government; rather, it is part of the UK’s unitary government structure. The UK government operates as a whole, with governance and administration covering all constituent countries.

Executive branch: The executive branch of the United Kingdom government, which encompasses England as a constituent country, is responsible for translating laws into action, making crucial decisions, and managing various governmental functions. At its helm is the Prime Minister, the leader of the governing political party, who not only shapes policies but also represents the nation’s interests both domestically and internationally.

Assisting the Prime Minister is the Cabinet, comprising senior ministers who oversee specific government departments like healthcare, education, and defense. Together, they collaboratively formulate significant policy choices. The government departments, in turn, focus on distinct policy areas and play an active role in policy implementation.

The Civil Service, a body of professionals, supports this process by providing expertise and administrative assistance. Special advisors, appointed for their expertise, guide ministers in policy matters, while executive agencies and public bodies execute services and programs under the guidance of relevant government departments. Historically, the Royal Prerogative encompassed powers exercised by the monarch, such as treaty-making and declaring war, now largely regulated by legal frameworks.

Legislative branch: England does not have its own separate federal legislative branch, as it is part of the United Kingdom (UK) which operates under a unitary system rather than a federal one. However, I can explain the UK’s legislative branch, which includes England within its jurisdiction. The legislative branch of the UK is the Parliament, which consists of two houses: the House of Commons and the House of Lords.

The House of Commons is composed of Members of Parliament (MPs) who are elected by the public in general elections. It is the primary legislative body and is responsible for proposing, debating, and passing laws. The government is formed by the political party or coalition with the majority of seats in the House of Commons, and the Prime Minister, who is the head of government, comes from this majority party.

The House of Lords, on the other hand, is made up of appointed members, including life peers, bishops, and hereditary peers. While it reviews and suggests amendments to legislation, it generally doesn’t have the same legislative power as the Commons. The UK Parliament is responsible for creating laws, scrutinizing the government’s actions, and representing the interests of the public. It legislates on matters that affect the entire UK, including England, such as defense, foreign affairs, and immigration.

Judiciary branch: England does not have a separate federal judiciary branch, as it is a part of the United Kingdom (UK) which operates under a unitary system. The judiciary in the UK, including England, is independent of the other branches of government and plays a crucial role in interpreting and applying the law.

The highest court in the land is the Supreme Court of the United Kingdom, which handles the most complex and significant legal cases. Below the Supreme Court, there is a hierarchy of courts, including the Court of Appeal, the High Court, and various specialized courts that deal with specific areas of law.

Judges in the UK are appointed based on their legal expertise and impartiality, and they are responsible for interpreting laws, making judgments in legal disputes, and ensuring that justice is administered fairly and according to established legal principles. While the UK Parliament creates laws, the judiciary’s role is to interpret and apply these laws in cases brought before the courts. The judicial system in England, as a part of the UK, is an integral part of the country’s governance and legal framework.

Local Government System in England

The local government system in England is a complex structure that involves various levels of government responsible for delivering public services and governing local communities. Local governments play a crucial role in providing services such as education, transportation, housing, social services, and waste management to residents within their areas of jurisdiction. Here’s an overview of the local government system in England:

Counties and Unitary Authorities: England is divided into administrative regions known as counties and unitary authorities. Counties are further divided into districts. Unitary authorities are local authorities that have combined responsibilities of both county and district councils. These local governments are responsible for a range of services, including education, social services, waste management, and public transportation.

District and Borough Councils: Within counties, there are district and borough councils that have authority over specific geographic areas. They are responsible for local services such as waste collection, planning permission, and local housing. Borough councils often cover urban areas, while district councils cover more rural areas.

City Councils: Some larger towns and cities have city councils with additional powers and responsibilities compared to other local authorities. These councils oversee more extensive services, infrastructure, and urban planning.

Parish and Town Councils: These are the most local levels of government and operate in smaller communities within districts. They focus on neighborhood-level concerns and services, such as local parks, community centers, and local events.

Local Governance Structure: The structure of local government can vary based on the area’s population and needs. Some areas may have a two-tier system (county and district councils), while others have a unitary system (single-tier unitary authority). London has its unique governance structure with the Greater London Authority (GLA) responsible for strategic decisions and the individual London boroughs overseeing local services.

Elections and Governance: Local government officials, including councilors, are elected by residents in local elections. Councilors represent their constituents’ interests and make decisions on local policies and services. The local government structure is overseen by the Ministry of Housing, Communities, and Local Government at the national level.

Devolution: In addition to local government, there is also devolution in England, where certain regions have gained more autonomy in decision-making through devolution deals. This has resulted in the creation of Combined Authorities in some areas, which work on issues such as transportation and economic development.

England Elections

England is part of the United Kingdom (UK), which has a parliamentary democracy. The UK’s federal election system does not exactly correspond to the term “federal,” as the UK is a unitary state with devolved governments in Scotland, Wales, and Northern Ireland, but there isn’t a federal system in the same way as some other countries like the United States.

Federal election system: The UK’s federal election system primarily involves general elections to the House of Commons, which is the lower house of the UK Parliament. The House of Commons is responsible for making and passing laws, representing constituencies from all over the UK, including England. Here’s how the general election process typically works:

Election Timing: General elections in the UK are not held on a fixed schedule. The Prime Minister can call for an early general election if two-thirds of the House of Commons agrees or if there is a vote of no confidence. Otherwise, a general election is held every five years.

Constituencies: The UK is divided into geographical areas called constituencies. Each constituency elects one Member of Parliament (MP) to the House of Commons. The number of constituencies and their boundaries can change due to redistricting efforts.

Political Parties and Candidates: Various political parties compete in general elections by nominating candidates to stand for election in different constituencies. Each candidate represents a specific political party’s platform.

First Past the Post System: The UK uses a “first-past-the-post” electoral system. This means that the candidate with the most votes in a constituency wins, regardless of whether they receive an absolute majority of votes. This system can lead to parties winning a majority of seats in the House of Commons even if they do not receive the majority of the popular vote.

Forming a government: The political party that wins the most seats in the House of Commons usually forms the government. If a party wins an outright majority of seats (more than half), its leader becomes the Prime Minister. If no party wins an outright majority, a coalition government might be formed, where parties join together to reach a majority.

Role of the Monarch: The monarch’s role in the election process is largely ceremonial. The monarch gives royal assent to legislation, including the dissolution of Parliament and the calling of a general election. The monarch invites the leader of the majority party to form a government.

In England, as part of the United Kingdom, state or local elections refer to elections that take place at the regional or local level. These elections determine the composition of local government bodies and representatives who are responsible for managing and making decisions about various local issues. Here’s an overview of how state or local elections work in England:

Local Government Structure: England is divided into various administrative regions, including counties and unitary authorities. Each of these regions is further divided into smaller areas known as local government districts or boroughs. Local government is responsible for a range of services and functions, including education, transportation, housing, and more.

Types of Local Elections: Several types of local elections can occur in England:

- Local Council Elections: These elections determine the composition of local councils in boroughs, districts, and unitary authorities. Councils are responsible for local services and decisions.

- Mayoral Elections: Some cities, like London and Greater Manchester, have directly elected mayors who oversee certain aspects of local governance.

- Police and Crime Commissioner (PCC) Elections: PCCs are responsible for overseeing the police force in a given area. PCC elections are held in police force areas across England and Wales.

- Combined Authority Mayoral Elections: In regions with combined authorities (such as Greater Manchester and West Midlands), there are mayoral elections for these regional bodies that have devolved powers.

Voting System: The voting system used in local elections varies. Some areas use the first-past-the-post system, where the candidate with the most votes wins. Other areas use proportional representation systems, such as the Single Transferable Vote (STV) system, which allows voters to rank candidates in order of preference.

Election Frequency: Local elections do not follow a fixed schedule like general elections. They are usually held at different times in different areas, depending on the expiration of terms for council members, mayors, or other positions.

Candidates and Parties: Local elections see candidates from various political parties as well as independent candidates vying for positions. These candidates campaign on issues relevant to the local area and often focus on matters such as local services, infrastructure, and community development.

Importance of Local Elections: Local elections are crucial for shaping the policies and decisions that directly affect communities at the grassroots level. They allow residents to elect representatives who understand local concerns and work towards addressing them.

Voter Eligibility: To participate in local elections in England, individuals must be registered to vote and meet the eligibility criteria, which include being at least 18 years old and a British citizen, a citizen of a Commonwealth country, or a citizen of the Republic of Ireland.

Major Political parties

Conservative Party (The Tories): The Conservative Party, commonly known as the Tories, is one of the oldest and most prominent political parties in the United Kingdom. With a center-right ideology, the party emphasizes traditional values, free-market economic policies, and limited government intervention. The Conservatives often advocate for reducing taxes and regulations to promote business growth and economic prosperity. They also prioritize maintaining a strong national defense and often take a more cautious approach to social change, preferring to uphold existing social norms. Under leaders like Margaret Thatcher and more recently Boris Johnson, the Conservative Party has been associated with policies of privatization, fiscal responsibility, and a commitment to Brexit, the UK’s exit from the European Union.

Labour Party: The Labour Party has long been a significant force in UK politics, advocating for social justice, workers’ rights, and a fairer distribution of wealth. With its center-left to left-wing ideology, the party supports government intervention in the economy to address inequality and ensure access to essential services like healthcare and education. The Labour Party has historically been associated with trade unions and the working class. Under leaders like Tony Blair, the party embraced more centrist policies, and under Jeremy Corbyn, it shifted to a more left-wing stance with a focus on the renationalization of industries, social welfare expansion, and a commitment to environmental issues.

Liberal Democrats: The Liberal Democrats are a centrist party that emphasizes civil liberties, social justice, and environmental sustainability. With a strong commitment to individual rights and freedoms, the party has advocated for issues like same-sex marriage and drug decriminalization. The Liberal Democrats have positioned themselves as a middle ground between the more traditional left-right spectrum, often seeking pragmatic solutions to various challenges. They have also been vocal proponents of remaining in the European Union, advocating for a second referendum on Brexit. The party’s leaders, including Nick Clegg and Ed Davey, have sought to maintain a balance between economic liberalism and social progressivism.

Scottish National Party (SNP): The SNP is a center-left political party with a focus on Scottish nationalism and social democracy. It advocates for Scottish independence and aims to represent Scotland’s interests in the UK and international affairs. The party places a strong emphasis on social justice, healthcare, education, and environmental policies. Under leaders like Nicola Sturgeon, the SNP has been at the forefront of efforts to secure greater autonomy for Scotland and maintain a strong presence in the UK Parliament while also governing Scotland through the Scottish Parliament.

Green Party of England and Wales: The Green Party is a left-wing party with a strong emphasis on environmentalism, social justice, and progressive policies. It advocates for urgent action on climate change, the transition to renewable energy sources, and a focus on sustainable development. The party also supports social equality, affordable housing, and better public services. Green Party members have often been vocal advocates for social and environmental causes and have sought to influence mainstream politics with their platform

Immigration System of England

- Immigration Overview

- Types of Immigration

- Asylum

- The Asylum Process

England Immigration Overview

The immigration process in England involves individuals from foreign countries obtaining the necessary visas or permits to enter and stay legally. Different visa categories cater to purposes like work, study, family reunification, and more. Applicants must meet specific criteria, such as financial stability and adherence to health and security checks. Legal professionals assist with navigating complex laws and ensuring accurate documentation. Resources include government websites for up-to-date information, NGOs offering guidance, and online forums for shared experiences. Successful immigration demands understanding visa options, complying with regulations, and accessing reliable support throughout the journey.

Legal immigration: Legal immigration to England involves the process by which individuals from foreign countries enter and stay in England in compliance with the country’s immigration laws and regulations. This typically involves obtaining the appropriate visa or residence permit that corresponds to the purpose of their visit, such as work, study, family reunification, or other specific circumstances.

visa categories: The visa categories in England are distinct classifications that determine the purpose and duration of an individual’s stay in the country. These categories encompass a wide range of intentions, including tourism, work, study, family reunification, and more. Each visa category has specific eligibility requirements and conditions that applicants must fulfill.

Indefinite leave to remain” (ILR): The concept of a “green card” similar to the one found in the United States does not exist in the United Kingdom, including England. However, individuals seeking permanent residency in the UK can apply for settlement, often referred to as “indefinite leave to remain” (ILR). Indefinite leave to remain is a status that grants individuals the right to live and work in the UK without any time restrictions.

Eligibility: To be eligible for ILR, individuals typically need to have resided in the UK under a qualifying visa category for a specific period, usually five years or more, demonstrate good character, meet English language requirements, and fulfill certain other criteria depending on the visa route they’ve taken. Once granted ILR, individuals can enjoy many of the rights and benefits of UK citizens, although there may still be certain restrictions.

Application Process: The immigration process in England involves a series of steps that individuals from foreign countries must navigate to enter and stay legally. The process varies depending on the purpose of the visit, such as work, study, family reunification, or other specific circumstances. Generally, individuals need to apply for the appropriate visa or residence permit that aligns with their intentions.

This application usually requires submitting required documentation, such as a valid passport, proof of financial stability, sponsorship or job offer letters, and meeting health and security checks. Depending on the visa category, applicants might also need to demonstrate English language proficiency. Once the application is submitted, it goes through a review process by immigration authorities, which may involve interviews or additional inquiries. Upon approval, the individual can enter England and begin their stay as per the conditions of their visa.

Legal assistance: Legal assistance is vital when navigating England’s immigration process due to its intricate laws, changing regulations, and complex procedures. Immigration specialists offer accurate guidance, tailored advice, and help with documentation preparation, reducing errors that could lead to application rejections or delays. They mitigate risks, aid in appeals, save time and stress, and keep applicants informed about policy changes. Particularly important for complex cases, legal assistance prevents fraud, increases application success chances, and ensures compliance with all requirements, making the immigration journey smoother and more secure.

Resources and support for England’s immigration process: Resources and support for England’s immigration process are crucial for individuals seeking to navigate complex procedures effectively. Official government websites offer up-to-date information on visa categories, eligibility criteria, and application requirements. Legal experts specializing in immigration law provide personalized advice, document preparation, and guidance through the process.

Non-governmental organizations and community groups often offer workshops, information sessions, and resources to help individuals understand their options and rights. Additionally, online forums and discussion platforms allow applicants to share experiences and seek advice from others who have gone through similar processes. These resources collectively play a pivotal role in helping immigrants make informed decisions, ensure compliance with regulations, and successfully integrate into English society.

It’s important to note that immigration policies and regulations may change, so it’s advisable to consult the official UK government sources or legal experts for the most up-to-date information on permanent residency options in the UK.

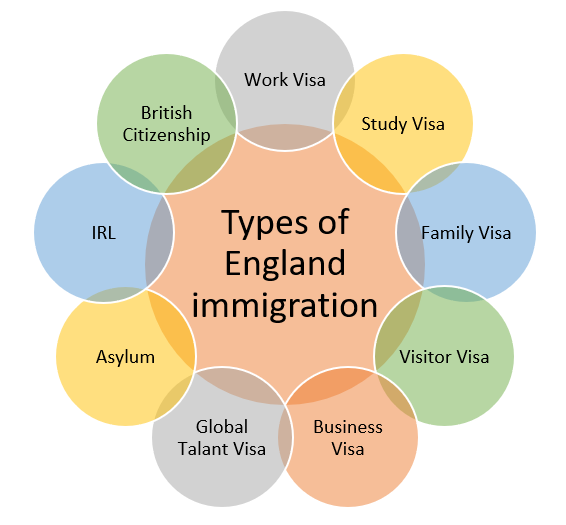

Types of Immigration

There are various types of immigration options available for individuals seeking to enter and stay in England legally. Some of the common types of immigration include:

Work Visas: Work visas are for individuals who have a job offer or sponsorship from a UK employer. Different work visa categories cater to skilled workers, innovators, entrepreneurs, and individuals with specialized skills.

Study Visas: Study Visas issued to those who Intended for international students pursuing education at recognized institutions in the UK. Students can obtain visas based on the duration and level of their courses.

Family Visas: Family visas allow individuals to join their family members who are already residing in the UK, such as spouses, partners, children, or elderly dependents.

Visitor Visas: Visit Visas granted For short-term stays, such as tourism, business meetings, or medical treatment. Visitors must adhere to the stipulated duration and purposes of their visit.

Investor and Entrepreneur Visas: Designed for individuals investing substantial funds or starting a business in the UK, contributing to the country’s economy.

Global Talent Visas: Aimed at individuals with exceptional talent or promise in the fields of science, engineering, humanities, medicine, digital technology, or the arts.

Asylum and Humanitarian Protection: Individuals who face persecution or danger in their home countries can seek asylum in the UK. Humanitarian protection is granted to those who don’t meet the refugee criteria but still need protection.

Ancestry Visas: Available to Commonwealth citizens with a grandparent born in the UK, allowing them to work and live in the country.

Settlement (Indefinite Leave to Remain): After fulfilling certain criteria, individuals can apply for settlement (ILR), granting them the right to stay in the UK without any time restrictions.

EU Settlement Scheme: Created following the UK’s exit from the EU, this scheme allows EU, EEA, or Swiss citizens who were living in the UK before a certain date to apply for settled or pre-settled status, depending on their duration of residence.

British Citizenship: After obtaining a settlement and meeting specific requirements, individuals can apply for British citizenship, which provides all the rights and responsibilities of a UK citizen.

It’s important to note that immigration policies and categories can change over time, so it’s advisable to refer to the official UK government sources for the most accurate and current information.

Asylum

Asylum: Asylum is a legal protection granted by a country to individuals who have fled their own country due to a well-founded fear of persecution based on factors such as their race, religion, nationality, political beliefs, or membership in a particular social group. This protection allows them to seek refuge and live in the host country, and they are typically shielded from being returned to their home country where they might face harm.

To be granted asylum, individuals usually need to provide evidence of the threats they face and demonstrate that they meet the criteria established in international and domestic laws.

Asylum Process: The asylum process in England involves a series of steps for individuals seeking refuge due to a well-founded fear of persecution in their home countries. Upon arrival, asylum seekers need to register their intent to seek asylum and undergo an initial screening interview where they provide basic information about their case. Following this, they attend a substantive interview where they provide detailed reasons for seeking asylum.

The Home Office then assesses their application, considering factors like the individual’s background and the situation in their home country. If the application is approved, the individual is granted refugee status, which allows them to stay in the UK and eventually apply for settlement. If the application is rejected, there is an appeal process.

Asylum Types in England

In England, there are two main types of asylums or protection that individuals can seek: refugee status and humanitarian protection.

Refugee Status: This is granted to individuals who can prove that they have a well-founded fear of persecution in their home country due to reasons such as their race, religion, nationality, political beliefs, or membership in a particular social group. To qualify for refugee status, individuals need to demonstrate that they cannot return to their home country because of the risk of harm they would face. If granted refugee status, individuals have the right to stay in the UK and access benefits, work, and education. They can also eventually apply for settlement.

Humanitarian Protection: This type of protection is granted to individuals who don’t qualify for refugee status but would still face a real risk of serious harm if they were returned to their home country. This harm could include the death penalty, torture, inhumane or degrading treatment, or a significant threat to their life due to an armed conflict. Like refugees, individuals with humanitarian protection are allowed to stay in the UK and access certain benefits and services.

It’s important to note that the assessment for both types of protection involves a thorough examination of an individual’s case, including their circumstances and the situation in their home country. The goal is to ensure that individuals in need of protection receive it while maintaining the integrity of the asylum process.

How to get Asylum in England

Start of Application: The Home Office expects that people genuinely in need of refugee protection will claim asylum immediately when they arrive in the UK. However, there can be many different reasons why people do not or cannot claim asylum immediately. If you did not claim asylum immediately, you must explain your reasons.

It is important to have a lawyer to assist you during the asylum process but remember that if you delay claiming asylum, there is a risk the Home Office might think you do not need refugee protection, or they may grant you a shorter period of leave. To register your application, contact to the Home Office (more details here). They will ask simple questions about you and your family. They will not ask why you’re claiming asylum. They will also ask for your postal or email address where they should send you a letter for an appointment for an interview at the Asylum Screening Unit.

Screening Interview: The first of two interviews that you will have with the Home Office is called the screening interview. At your screening interview, the Home Office will ask questions to establish who you are and how you arrived in the UK. They will also ask you to briefly state the reason or reasons why you are claiming asylum.

They will take your fingerprints and photo. They will then issue you with other papers confirming your details and that you have claimed asylum. You will be issued an ARC card within the next few weeks. The Home Office should give you a copy of your screening interview transcript. The Home Office will check their records to see if you have previously stayed in the UK.

The Home Office will offer you an interpreter, normally on the telephone, which is free. It is important that you are happy that you and the interpreter understand each other well.

Read more about claiming asylum on the website.

Asylum Interview: After your screening interview, you will have your asylum interview. The Home Office interviewer will ask about your family and social background. The interviewer will also ask you to confirm the basis for your claim, for example, that it is based on sexual orientation or gender identity or sex characteristics (e.g., being intersex). More than one reason may apply, for example, you may be at risk due to your sexual orientation or gender identity as well as being intersex if both are relevant to the reasons you had to leave your home country.

The interviewer should ask how you want to be addressed, for example, what name you want to use, and what words you want them to use to describe your sexual orientation, gender identity, or sex characteristics. They will ask you what you fear in your country of origin. They will ask you questions about how you came to realize your sexual orientation or gender identity, or that you were born with a variation of sex characteristics. If you claimed asylum because you are intersex, you may be asked questions about how and when you became aware that your sex characteristics varied from those typically expected of men and women. These are questions about your personal history. They may ask how you think and feel about yourself.

They will ask you to describe anything that might have happened to you in your country of origin or if relevant, about previous or current partners. The Home Office must not ask you to describe sexual acts. The questions will vary depending on the circumstances of your case.

At the end of the interview, you will have the opportunity to give additional information. You will also be asked if you have any other reasons to remain in the UK apart from those discussed in the interview.

The Home Office normally records the audio (just the sound) of the interviews. A written record of the interview and a recording on a memory stick is usually given to you before you leave the interview room if you have been interviewed in person. Otherwise, it may either be posted to you or provided to your lawyer electronically.

At your interview, you may be asked to complete a form in which you give permission, or “consent”, to the Home Office to request your medical records from your doctors. You do not have to give your consent for this if you do not want to. Refusing to consent should not affect the decision on your application. It is best to ask your lawyer’s advice before signing the consent form.

See our tips for how to prepare for your substantive interview.

Evidence: Evidence is anything that you give to Home Office to support your claim, including what you say. Interview records, statements, documents, letters, reports, and statements from other witnesses are all evidence. You need to explain in detail why you fear being persecuted in your country of origin. Many Home Office refusals of LGBTQI+ asylum claims are because they don’t believe the applicants are lesbian, gay, bisexual, trans, queer, or intersex.

It is therefore important to be prepared to talk about your experience with your sexual orientation, gender identity, or sex characteristics. This does not mean talking about sex, but how you came to be who you are as a person. You must get professional/certified translations for any evidence written in other languages into English.

Possible Outcomes: The Home Office will decide on your claim based on your interviews and evidence. This may take several months or even longer. Any delay in deciding on your application is unlikely to be connected to whether or not your claim will be successful.

There are five possible decisions or outcomes.

Outcome 1: Granted refugee status for 5 years

Outcome 2: Granted humanitarian protection for 5 years

Outcome 3: Granted another form of leave

The Home Office might give you ‘discretionary’ leave to remain in the UK or leave ‘outside the rules for a limited time (usually for two and a half years). This is rare but may be appropriate, for example, if you are in a relationship with a British citizen and there are exceptional circumstances why you cannot go back to your country of origin to apply for a visa to join your partner. You may also be granted discretionary leave to remain for other reasons.

Outcome 4: Refused with a right of appeal in the UK

Outcome 5: Refused, no right of appeal

The Home Office sometimes ‘certifies’ asylum claims as ‘unfounded’. This means they believe the asylum claim will not succeed, and there will not be a right of appeal. This can happen if the Home Office believes your country of origin is safe. In extremely rare cases, the Home Office will certify a claim if they think it is extremely unbelievable that the person is LGBTQI+. You can apply for a judicial review with the help of a lawyer.

Where a fresh claim has been made, the Home Office may deny all rights of appeal against refusal of asylum because there has been a previous appeal or opportunity to explain the asylum claim. You can apply for a judicial review with the help of a lawyer.

Read more about judicial reviews in the Right to Remain toolkit.

Appeals: If the Home Office refuses your application, you will normally have a right of appeal. You must send your appeal form to the First-tier Tribunal (Immigration and Asylum Chamber) within

14 days of the date the refusal letter was sent to you.

Your appeal will be decided by a judge of the First-tier Tribunal, which is a court of law. The judge is independent of the Home Office. You should prepare your case by responding to reasons why Home Office refused your claim.

You should expect to attend court and ‘give evidence’ by answering questions about your case from a home Office representative and the judge. Any witnesses you may have should also attend. You will be the ‘appellant’ and the Home Office will be the ‘respondent’.

Read more about appealing to the First-tier Tribunal and Upper Tribunal in the Right to Remain toolkit. You can also find information on appeals on the website.

Appeal Outcomes: There are two possible outcomes from the First-tier Tribunal.

Outcome 1: Appeal allowed

This means you have won. The Home Office should give you refugee status or humanitarian protection, or another type of leave if you win your appeal on a different basis, e.g., your private and family life in the UK.

However, the Home Office has 14 days to apply for permission to appeal against the determination of the First-tier Tribunal if they believe the judge made an ‘error of law’. If the Home Office gets permission to appeal, your case will be sent to the Upper Tribunal.

Outcome 2: Appeal dismissed

This means you have lost. Applying for permission to appeal to the Upper Tribunal.

You can apply for permission to appeal to the Upper Tribunal against the determination of the First-tier Tribunal if you believe that the judge made an ‘error of law’. ‘An error of law’ means that the judge made a mistake in the way they applied the law or considered the evidence and if they hadn’t made that mistake, they may have allowed your appeal.

You have to make the application in writing no later than 14 days after the determination was sent to you. Your lawyer will advise you whether an application for permission to appeal could be successful. You should send your application for permission to appeal to the First-tier Tribunal.

If the First-tier Tribunal refuses permission to appeal, you can apply to the Upper Tribunal directly. If the Upper Tribunal also refuses permission, you may be able to apply for a judicial review in very limited circumstances, with the help of a lawyer.

Upper Tribunal hearing: If the First-tier or Upper Tribunal permits you to appeal, there will be a hearing in the Upper Tribunal.

At the hearing, the Upper Tribunal will first decide if the First-tier Tribunal made an error of law. If the Upper Tribunal finds that there was an error of law, they will do one of two things:

- They will send the case back to the First-tier Tribunal to be heard again by a different judge.

- They will re-make the decision themselves. If the Upper Tribunal re-makes the decision, it will usually be done after another hearing. If the Upper Tribunal re-makes the decision, they can either allow or dismiss your appeal.

Alternatively, the Upper Tribunal can find that there was no error of law in the decision of the First-tier Tribunal and dismiss your appeal. Decisions of the Upper Tribunal can be appealed to the Court of Appeal, but this is complicated and you will need a lawyer to help you.

Making a fresh claim: If your appeal is dismissed and you cannot appeal further, it may be possible to make a ‘fresh claim’ for asylum but it is a complicated process.

You can make a fresh claim, or ‘further submissions’ if you can obtain new evidence or if there is a change in the situation of LGBTQI+ people in your country of origin. You must book an appointment to attend the Further Submissions Unit in Liverpool to submit your new evidence. In some circumstances, you will not be expected to go to Liverpool, e.g., if you are detained or cannot travel due to a medical problem.

You can read about the process of making a fresh claim on the website.

Financial System of England

- Overview of England’s Financial System

- Banking System

- Capital Market

- Investment Management

- Insurance Industry

- Federal Reserves

- Regulatory Bodies

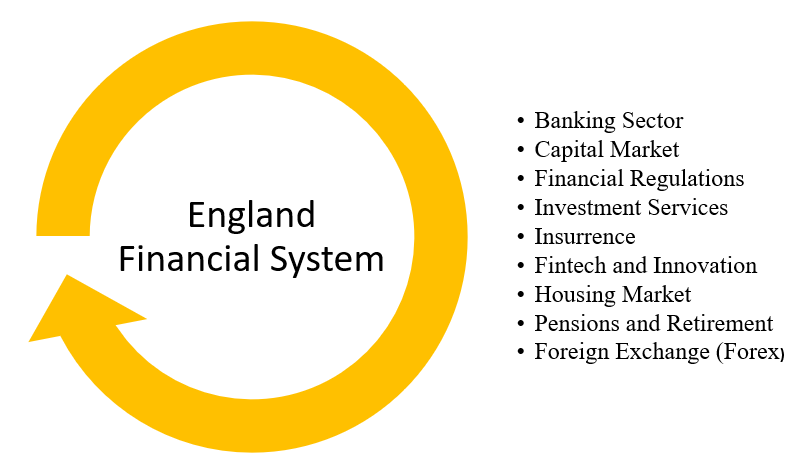

Overview of England’s Financial System

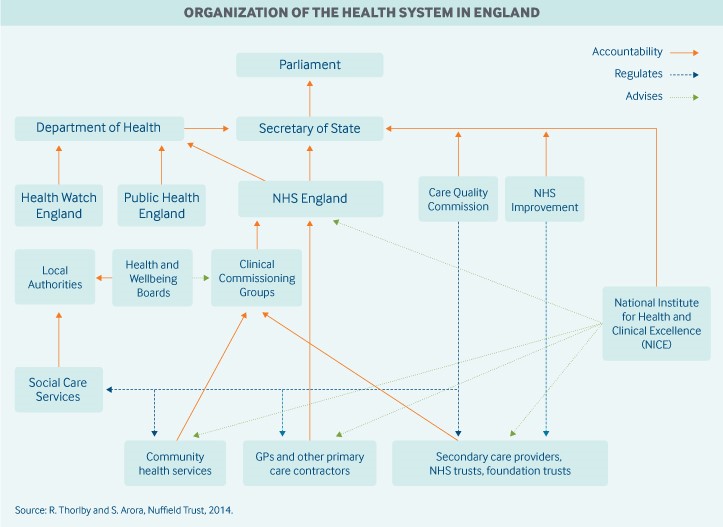

The financial system of England is one of the most developed and sophisticated in the world. It encompasses a wide range of institutions, markets, and services that facilitate the flow of money, investment, and credit throughout the economy. Here’s an overview of some key components of the financial system in England:

Banking Sector: The banking sector in England is robust and includes a mix of domestic and international banks. The Bank of England serves as the central bank and is responsible for monetary policy, issuing currency, and overseeing the stability of the financial system.

Capital Markets: The London Stock Exchange (LSE) is one of the world’s largest stock exchanges, providing a platform for companies to list their shares and raise capital from investors. The LSE also hosts various indices, including the FTSE 100 and FTSE 250, which track the performance of major companies.

Financial Regulation: The financial sector in England is regulated by several institutions, including the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). These bodies oversee different aspects of the financial system, ensuring its stability, consumer protection, and adherence to regulatory standards.

Investment Services: A range of investment services are offered, including asset management, wealth management, and investment banking. Many global investment banks have a significant presence in London.

Insurance and Reinsurance: The UK is a hub for the insurance and reinsurance industries, with Lloyd’s of London being a famous market for specialized insurance and risk management.

Fintech and Innovation: London is a global center for financial technology (fintech) innovation. Many fintech startups and companies operate in areas like digital payments, peer-to-peer lending, robo-advisors, and blockchain technology.

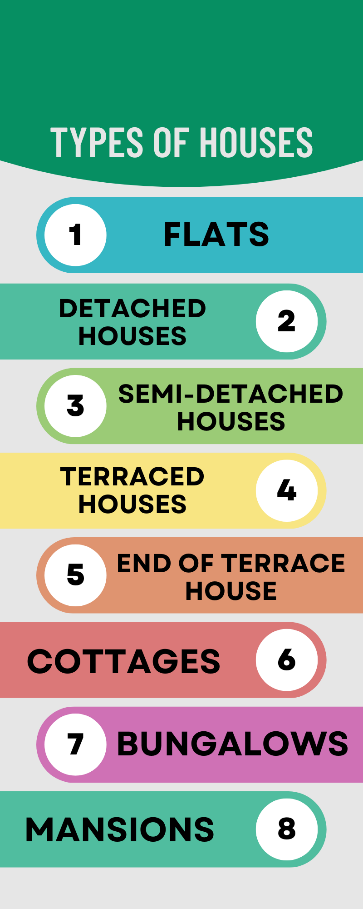

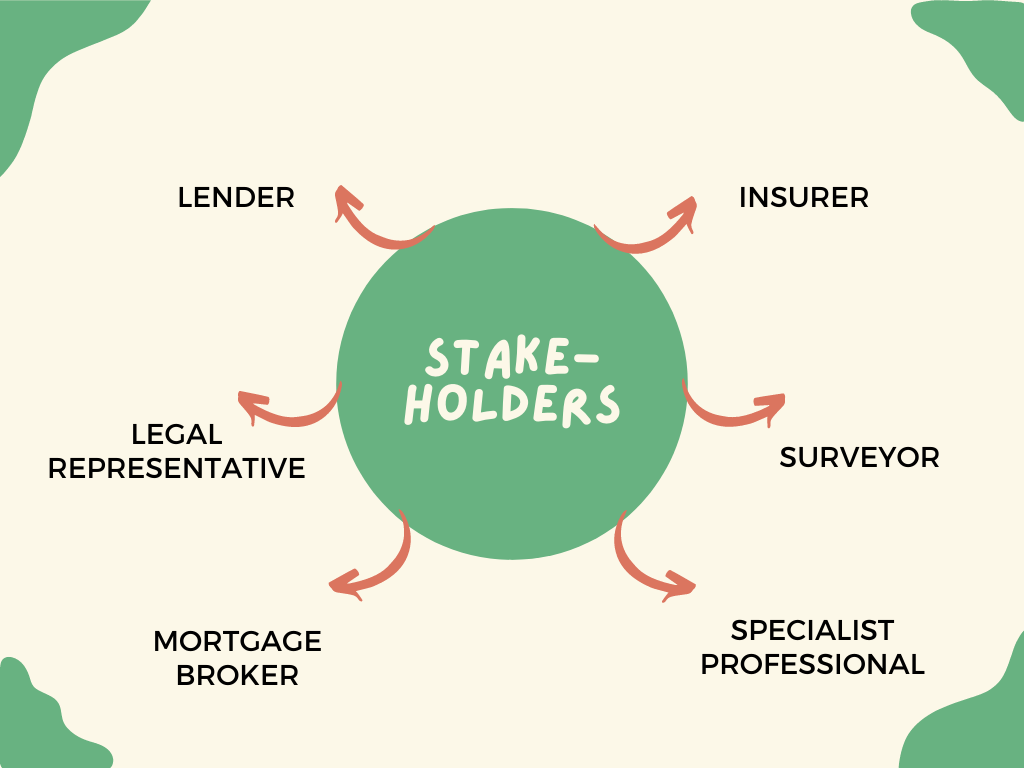

Housing Market: The housing market is a substantial component of the financial system, with property ownership and mortgages playing a significant role in the economy.

Pensions and Retirement: The UK has a well-developed pension system, including state pensions and private pension schemes, which play a crucial role in retirement planning.

Foreign Exchange (Forex) Market: London is a major hub for the global foreign exchange market, with a high volume of currency trading taking place daily.

Central Bank Operations: The Bank of England manages the country’s monetary policy, including setting interest rates and implementing measures to control inflation and promote economic stability.

Financial Services Trade: The City of London, often referred to as “The City,” is a global financial center and a hub for international financial services trade, including banking, insurance, and investment services.

The financial system in England is deeply interconnected with global financial markets and plays a vital role in the country’s economy. Its stability, regulation, and adaptability contribute to its reputation as a major financial hub on the international stage.

Banking Overview in England

The banking sector in England is a vital component of the country’s financial system, serving as a hub for domestic and international financial activities. It consists of various types of banks, financial institutions, and regulatory bodies that work together to facilitate the flow of funds, support economic activities, and ensure financial stability. Here’s a comprehensive overview of the banking sector in England:

Types of Banks:

Retail Banks: These banks provide services to individuals and households, including savings accounts, checking accounts, loans, mortgages, and credit cards.

Commercial Banks: These banks offer a range of financial services to businesses, such as business loans, trade finance, and cash management solutions.

Investment Banks: These institutions focus on investment and capital markets activities, including underwriting securities, mergers and acquisitions, and trading financial instruments.

Challenger Banks: These are newer, often digital-only, banks that compete with traditional banks by offering innovative services and user-friendly digital platforms.

Private Banks: Private banks cater to high-net-worth individuals and provide personalized financial and wealth management services.

Foreign Banks: Several international banks have a presence in London, using it as a base for their European operations.

Key Institutions:

Bank of England: As the central bank of England, it is responsible for issuing currency, managing monetary policy, and maintaining financial stability in the country.

Prudential Regulation Authority (PRA): This is a subsidiary of the Bank of England and oversees the prudential regulation and supervision of banks, insurers, and other financial institutions.

Financial Conduct Authority (FCA): The FCA regulates conduct in financial markets, ensuring that firms operate with integrity, treat customers fairly, and comply with relevant regulations.

Banking Services:

Deposits and Savings: Banks provide a safe place for individuals and businesses to store their funds, offering various types of accounts with varying interest rates and terms.

Loans and Credit: Banks offer various types of loans, including personal loans, mortgages, and business loans, which support consumption and investment.

Payment Services: Banks facilitate domestic and international payment transactions, including electronic funds transfers, direct debits, and mobile payments.

Investment Services: Investment banks provide advisory services for mergers and acquisitions, initial public offerings (IPOs), and capital raising.

Foreign Exchange (Forex): Banks facilitate currency exchange and offer forex trading services, contributing to London’s status as a global forex trading hub.

Challenges and Trends:

Digital Transformation: The rise of digital banking and fintech has led to increased competition and innovation in the sector, prompting traditional banks to adapt their services.

Regulatory Changes: Stringent regulations aim to ensure financial stability and consumer protection, but they also require banks to maintain compliance, which can be costly and complex.

Brexit Impact: The UK’s exit from the European Union has implications for banks’ operations, particularly those with cross-border activities.

Sustainability and ESG: Environmental, Social, and Governance (ESG) considerations are becoming more prominent in banking, with an emphasis on responsible lending and investing.

The banking sector in England plays a crucial role in supporting economic growth, managing monetary policy, and providing financial services to individuals, businesses, and governments. Its dynamics are shaped by regulatory changes, technological advancements, and global financial trends.

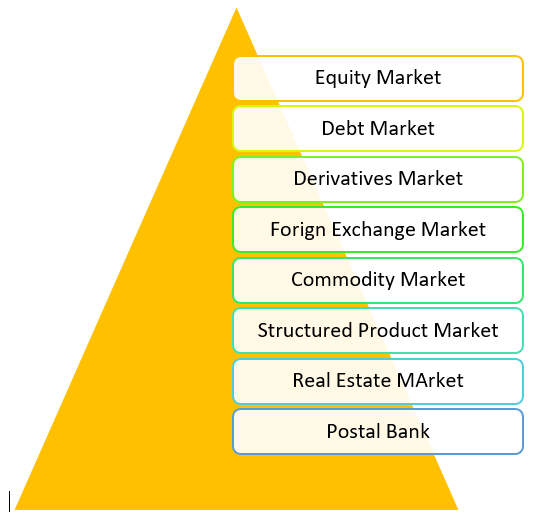

Capital Market

The capital market in England plays a vital role in facilitating the issuance and trading of various financial instruments, enabling companies and governments to raise funds for investments and projects. It consists of different segments that cater to different types of securities and investors. Here’s an overview of the capital market in England and its main types:

Equity Market: The equity market, often referred to as the stock market, is where shares (also known as stocks or equities) of publicly listed companies are bought and sold. The London Stock Exchange (LSE) is one of the world’s oldest and largest stock exchanges, comprising the Main Market and the Alternative Investment Market (AIM). The Main Market is for larger, more established companies, while AIM is a platform for smaller, growing companies.

Debt Market: The debt market, also known as the bond market, facilitates the issuance and trading of debt securities, such as bonds and debentures. Government bonds (gilts) are issued by the

UK government to finance its activities, while corporate bonds are issued by companies to raise funds for projects or operations. Debt securities represent loans made by investors to issuers, who promise to repay the principal amount along with interest over a specified period.

Derivatives Market: The derivatives market deals with financial contracts whose value is derived from underlying assets, indices, or benchmarks. It includes products like futures, options, and swaps, which can be used for risk management, speculation, and hedging purposes.

Foreign Exchange (Forex) Market: The forex market is where currencies are traded against each other, allowing participants to exchange one currency for another at an agreed-upon exchange rate. London is a global hub for forex trading, facilitating a significant portion of the world’s daily currency transactions.

Commodity Market: The commodity market involves trading in physical goods such as metals, energy resources, agricultural products, and other raw materials. It allows producers, consumers, and investors to manage price risks and access commodities for various purposes.

Structured Products Market: Structured products combine various financial instruments to create customized investment solutions. They often involve derivatives and offer unique risk-return profiles tailored to specific investor needs.

Real Estate Market: While not a traditional capital market, the real estate market also plays a significant role in England’s financial system. It involves the buying, selling, and development of properties, offering opportunities for investment and wealth accumulation.

The England capital market provides a platform for a wide range of investors, from individual retail investors to institutional players, to participate in various investment opportunities. It promotes capital formation, economic growth, and efficient allocation of resources by connecting those seeking funds with those who have funds to invest. The diverse segments within the capital market cater to different financial instruments and risk appetites, contributing to the overall financial ecosystem.

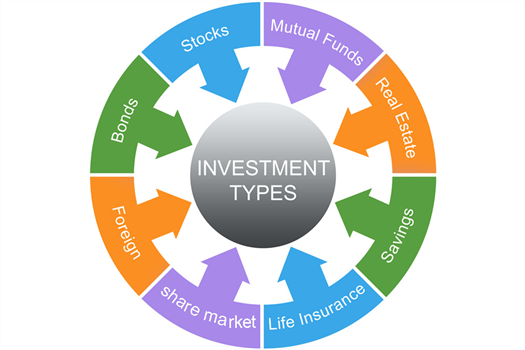

Investment management

Investment management in England involves the professional management of investment portfolios on behalf of individuals, institutions, and other clients. The goal of investment management is to maximize returns while considering the client’s risk tolerance and investment objectives. Here’s a brief overview of investment management in England:

Asset Management Companies: Asset management companies, also known as investment management firms or fund managers, provide professional expertise in managing various types of investment funds. These companies design and manage investment portfolios composed of a mix of assets, such as stocks, bonds, real estate, commodities, and alternative investments.

Types of Investment Funds:

Mutual Funds: Pooled investment vehicles that allow multiple investors to invest in a diversified portfolio managed by professionals.

Unit Trusts: Similar to mutual funds, unit trusts pool funds from investors to invest in a diversified portfolio of assets.

Investment Trusts: Closed-end funds that are publicly traded on stock exchanges, offering shares to investors.

Pension Funds: Managed on behalf of pension schemes to provide retirement benefits to employees or individuals.

Investment Strategies: Active Management: Investment managers actively research and select securities to outperform market benchmarks.

Passive Management (Indexing): Managers aim to replicate the performance of a specific market index, such as the FTSE 100, by investing in the same securities in the same proportion.

Client Services: Investment managers work closely with clients to understand their financial goals, risk tolerance, and investment time horizon. They tailor investment strategies and portfolio allocations to meet the specific needs of individual clients.

Performance Monitoring: Investment managers regularly monitor the performance of investment portfolios, adjusting asset allocations and making investment decisions based on market conditions.

Regulation and Compliance: Investment management firms are regulated by the Financial Conduct Authority (FCA) in the UK to ensure investor protection, transparency, and ethical practices.

Fee Structure: Investment management firms charge fees for their services, which can include management fees (a percentage of assets under management) and performance-based fees.

Ethical and Sustainable Investing: Many investment management firms in England offer socially responsible investment options that align with clients’ ethical and sustainability preferences.

Innovation and Technology: The industry is embracing technology to enhance investment processes, offer digital platforms, and provide clients with real-time access to their portfolios.

Investment management is a critical component of the financial services industry in England, enabling individuals and institutions to access professional expertise in building and managing diversified investment portfolios. It contributes to wealth creation, retirement planning, and the efficient allocation of capital within the broader financial ecosystem.

Insurance in England

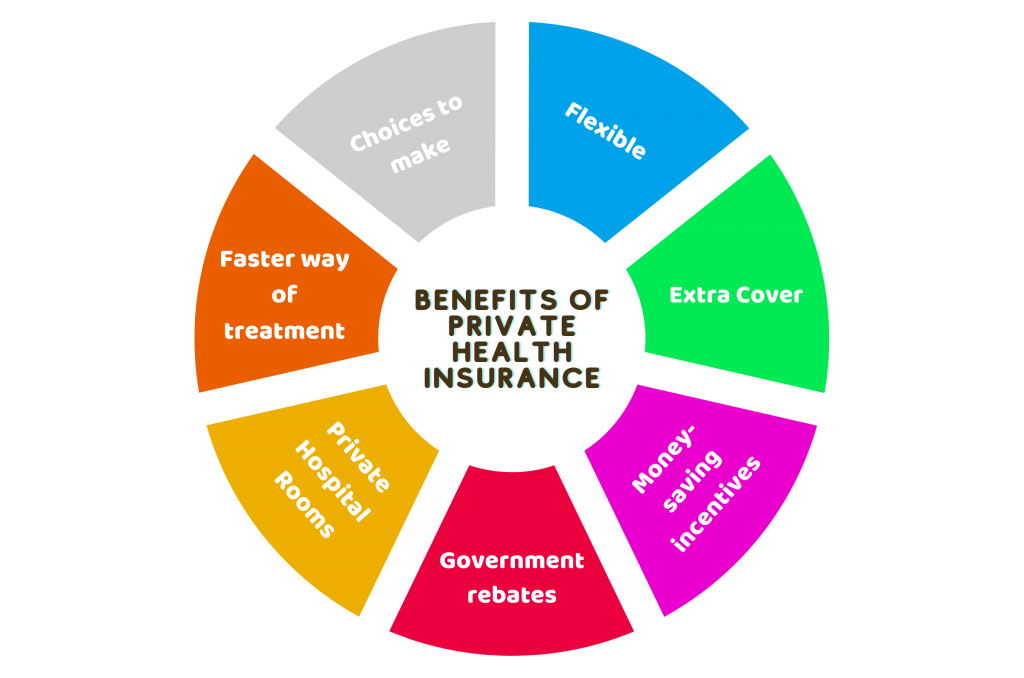

Insurance in England involves a contractual arrangement where individuals or businesses pay premiums to an insurance company in exchange for financial protection against specific risks or events. Here’s a brief overview of insurance in England:

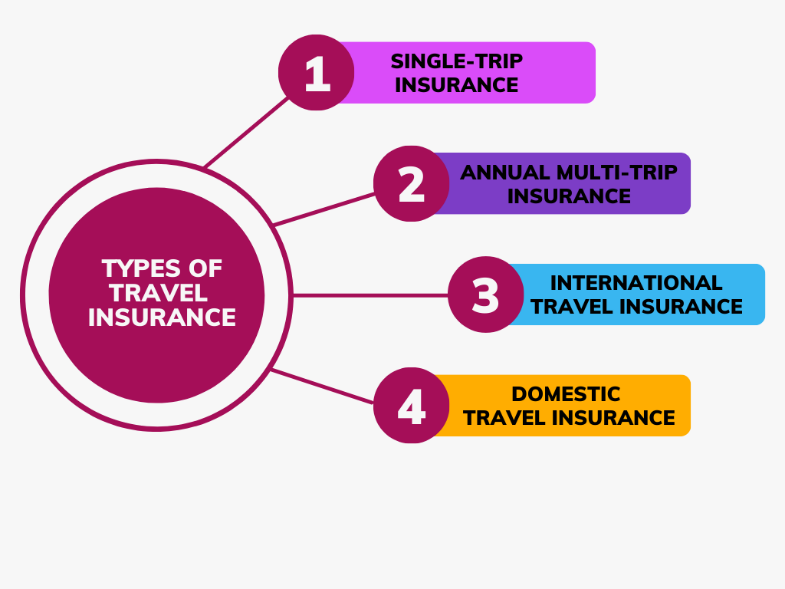

Types of Insurance:

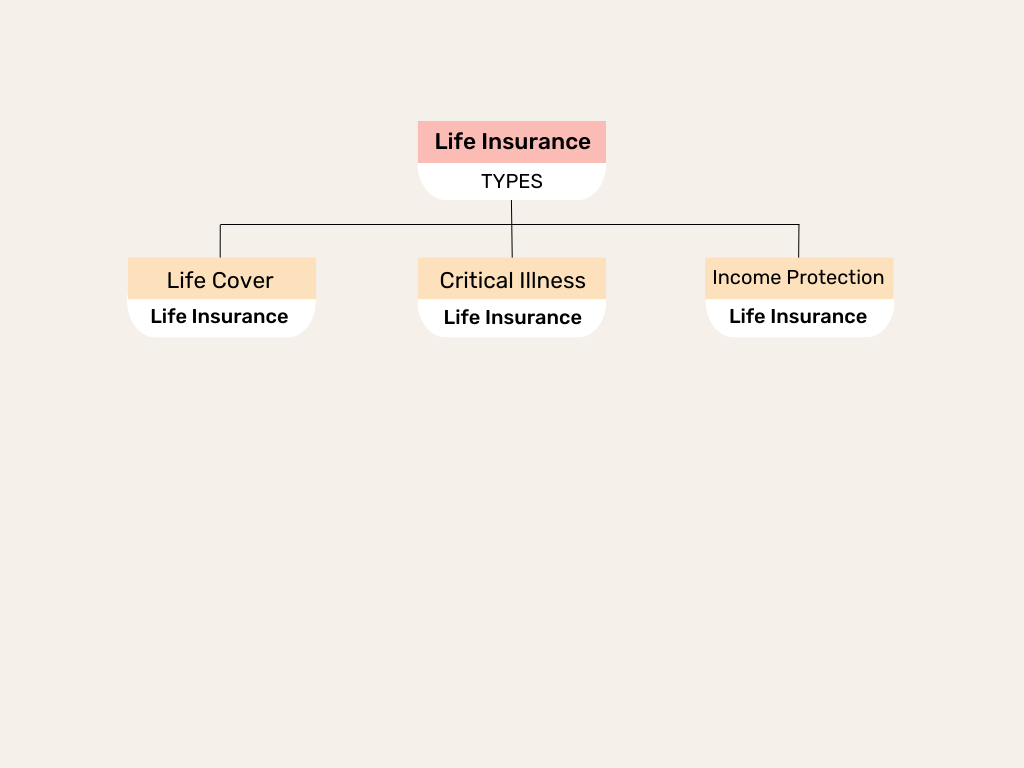

- Life Insurance: Provides a payout to beneficiaries upon the death of the insured person. It helps provide financial support to dependents and loved ones.

- Health Insurance: Covers medical expenses, treatments, and healthcare services. It can be provided by private insurers or the National Health Service (NHS).

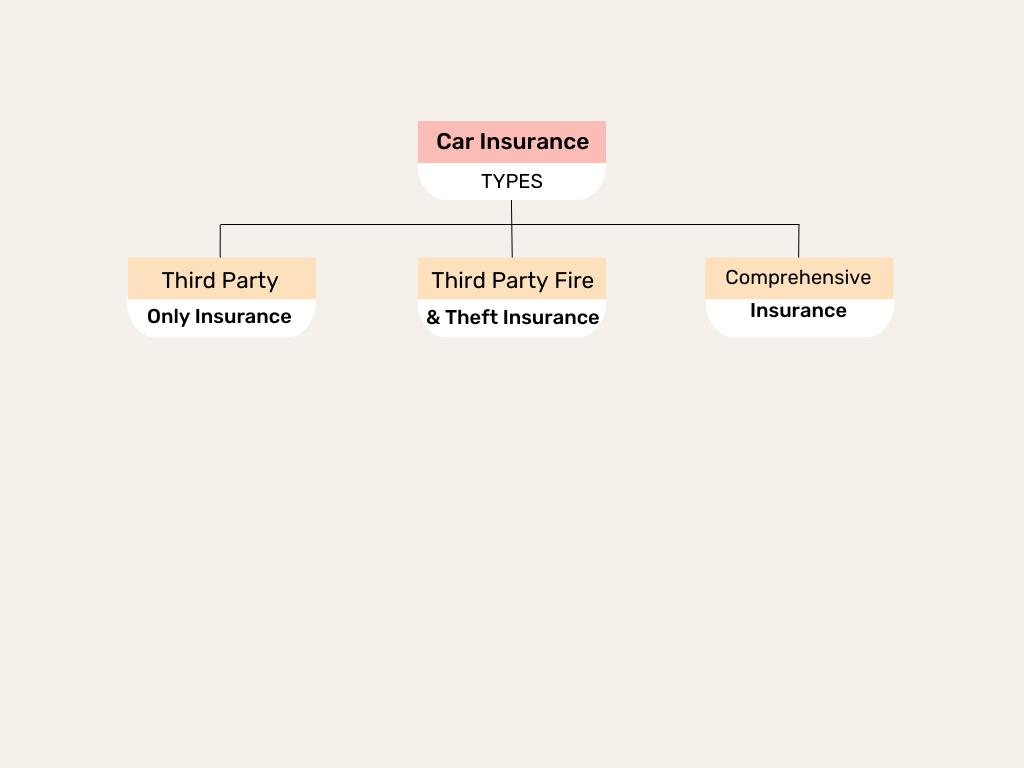

- Auto Insurance: Mandatory for drivers, auto insurance covers damages or liabilities resulting from accidents or theft involving vehicles.

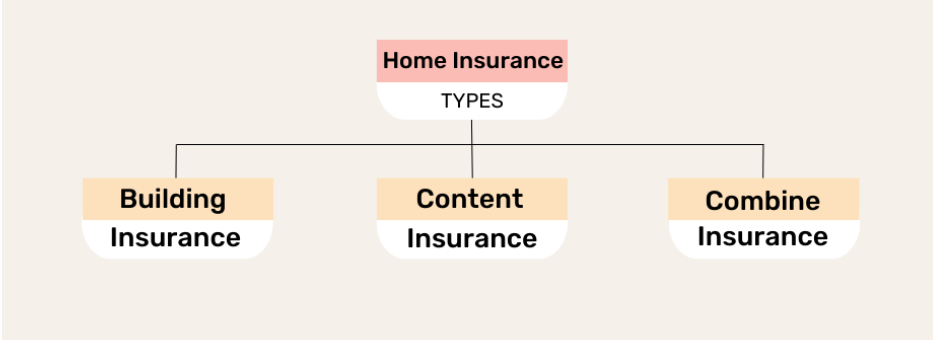

- Property Insurance: Includes home insurance for homeowners, covering damages to the property and its contents, and business property insurance for businesses.

- Liability Insurance: Protects individuals and businesses from legal claims arising from injuries, damages, or negligence.

- Travel Insurance: Provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related risks.

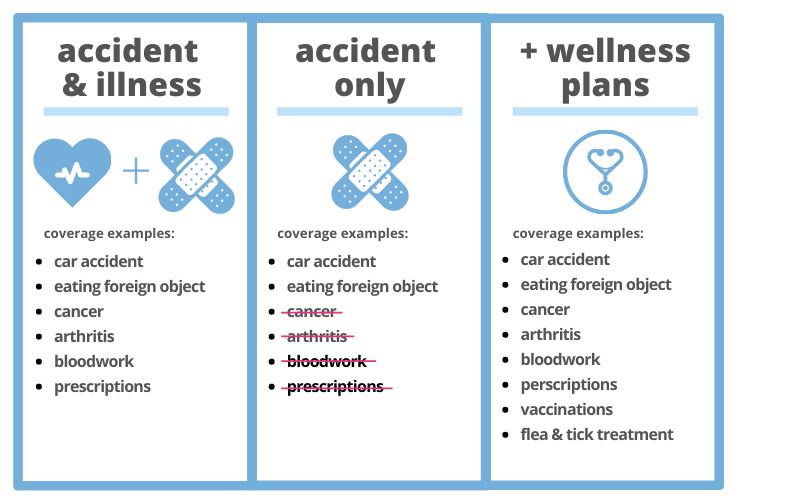

- Pet Insurance: Covers veterinary expenses and treatments for pets.

- Specialty Insurance: Covers unique risks, such as cyber insurance, marine insurance, and event cancellation insurance.

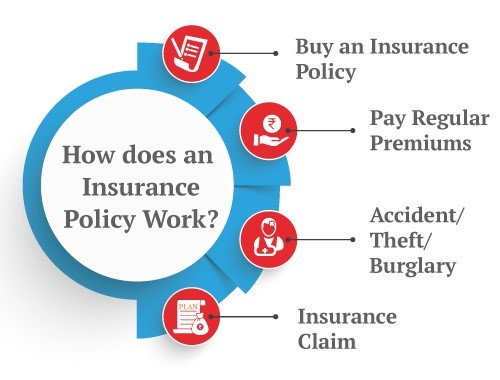

Premiums and Claims: Policyholders pay premiums, which are regular payments, to the insurance company. In the event of a covered loss or claim, policyholders can file a claim to receive compensation or benefits as outlined in their policy.

Underwriting and Risk Assessment: Insurance companies assess risks associated with policyholders to determine appropriate premiums. Underwriting involves evaluating factors such as age, health status, driving record, and property value.

Insurance Companies and Brokers: Insurance companies provide insurance products and services. Insurance brokers or agents help individuals and businesses find suitable insurance policies

and navigate the process.

Regulation and Consumer Protection: The insurance industry in England is regulated by the Financial Conduct Authority (FCA), which ensures fair treatment of consumers and adherence to regulations.

Insurance Pools and Guarantees: Some risks, such as those involving catastrophic events or high liabilities, may be covered by industry-specific insurance pools or government-backed schemes.

Importance of Insurance: Insurance provides financial security and peace of mind, helping individuals and businesses manage unexpected losses and expenses.

Innovation and Customization: The insurance industry is evolving with innovations such as usage-based insurance, parametric insurance, and more tailored coverage options.

Insurance is a crucial component of personal financial planning and risk management for businesses. It helps individuals and organizations mitigate financial losses resulting from unforeseen events and provides a safety net against various uncertainties.

Federal Reserve

It’s important to clarify that the Federal Reserve is not an institution in England; it’s the central banking system of the United States. The Federal Reserve, often referred to as the Fed, is responsible for conducting monetary policy, regulating financial institutions, and maintaining stability in the U.S. financial system.

In England, the corresponding institution is the Bank of England, which serves as the central bank for the United Kingdom. The Bank of England performs similar functions to those of the Federal Reserve in the U.S., including setting monetary policy, issuing currency, supervising banks, and ensuring financial stability.

Government regulation

Government regulation of the financial system in England is overseen by several regulatory authorities and laws that ensure the stability, integrity, and fairness of the financial industry. Here are some key aspects of government regulation related to the financial system in England:

Financial Conduct Authority (FCA): The FCA is the primary regulatory authority responsible for ensuring that financial markets operate with integrity and that consumers are protected. FCA regulates the conduct of financial firms, including banks, insurance companies, investment firms, and other financial intermediaries. It sets rules and standards for firms’ behavior, ensures market transparency, and takes action against misconduct or violations.

Prudential Regulation Authority (PRA): The PRA is a subsidiary of the Bank of England and focuses on prudential regulation, overseeing the safety and soundness of financial institutions. The PRA sets and enforces capital and liquidity requirements for banks, insurers, and other financial firms to ensure their stability and ability to absorb financial shocks.

Bank of England: The Bank of England plays a crucial role in maintaining financial stability and implementing monetary policy. It oversees and regulates payment systems, participates in financial market operations, and sets interest rates as part of its monetary policy responsibilities.

Financial Services Compensation Scheme (FSCS): The FSCS is a government-backed scheme that provides compensation to consumers if a regulated financial firm becomes insolvent or is unable to meet its obligations. It ensures that consumers’ deposits and investments are protected up to a certain limit.

Market Abuse Regulation (MAR): MAR aims to prevent and detect insider trading and market manipulation in financial markets. It sets rules for reporting suspicious transactions and insider information to ensure market integrity.

Consumer Protection: Regulations ensure that financial products are transparent and fair to consumers. Rules mandate clear disclosure of terms, fees, and risks associated with financial products to help consumers make informed decisions.

Regulations require financial institutions to have effective measures in place to prevent money laundering and the financing of terrorist activities. Reporting obligations help identify and report suspicious transactions.

Government regulation of the financial system aims to strike a balance between fostering innovation, ensuring market stability, protecting consumers, and preventing financial crimes. The regulatory landscape continues to evolve to address emerging challenges and maintain public trust in the financial sector.

England Credit System

- Overview of England Credit System

- Credit Score in England

- Credit Agencies

- Types of Credit Cards in England

- Sources of Credit Cards in England

- Types of Loans in England

Overview of England Credit System

When it comes to applying for any kind of finance, there is one element in particular that plays on every applicant’s mind – the credit score.

England does not have a single unified credit system. There are three main credit reporting agencies in England, such as Experian, Equifax, and TransUnion. These agencies collect and maintain credit information on individuals and assign them credit scores based on their credit history, repayment behavior, and other financial factors. Lenders and financial institutions use these credit scores to assess the creditworthiness of applicants.

Credit Score in England: A credit score is calculated based on your credit history. Simply put, your credit report is a record of your history of managing and repaying your debt. This will help lenders calculate a score that will serve as an indication of the type of borrower you are. These statistical numbers evaluate how creditworthy a consumer should be considered based on their existing credit history, and lenders can use this to evaluate whether an applicant is likely to repay the debts on time.

Your credit score is based on your credit report, which is created using information such as:

- Information from the electoral register

- Details of any court judgments or bankruptcies in your name

- A record of current and past credit commitments (for example, credit cards, loans, mortgages) that you’ve held in the last 6 years

- Details of any searches on your credit file

How to Improve Your Credit Score: Here are a few things you can do to improve your credit score:

- Make sure you’re registered on the electoral roll

- Check for any mistakes on your credit report

- Try to pay any bills or other credit repayments on time

- Check if you’re financially linked to another person, for example through a mortgage or joint bank account. If that person has a low credit score, it will affect yours as well

- Check for fraudulent activity on your credit report. For example, if someone applied for credit in your name without your knowledge.

- Try and reduce any outstanding debt or clear it off completely

Credit Agencies: In England, there are three official credit scoring companies and they use UK-specific criteria to determine creditworthiness. This means that, as in many countries, those immigrating to England won’t automatically benefit from their domestic credit rating. Instead, credit scoring agencies would first check that the applicant is on the UK electoral roll, to confirm personal information and residence details. They would then access other data, such as court records, to check whether they have had legal action taken against them due to debt. And they would likely also look at any credit links, for example, joint bank accounts or utility bills, and the strength of that connection’s credit.

There are three main credit agencies in England and those are Equifax, Experian, and Transunion. These three companies each acquire financial records from different institutions and compile a person’s credit score accordingly. For the most part, they each do the same thing but there can be differences in the institutions that report to each which can result in a different score from each.

Equifax: Equifax is one of the major credit reporting agencies that operate in England and many other countries around the world. Equifax sets up its credit reports a little differently. They first group accounts into an open or closed list which makes it easy to see current vs old credit. Equifax operates on an 81-month credit history system meaning they look at 7 years worth of transactions.

Equifax breaks down its report between revolving accounts (i.e. credit cards & charge cards), mortgages, installment loans, & other accounts like those from a debt collection agency.

Consumers have the right to request a free copy of their credit report from Equifax and other credit reporting agencies annually. Monitoring your credit report allows you to check for inaccuracies, detect potential identity theft, and track your credit health.

Equifax Credit Score Chart:

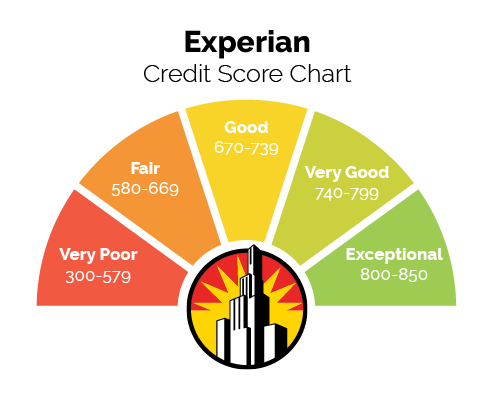

Experian: Experian is the most popularly used credit agency and as a result, is often seen as the most trusted credit rating in the UK. They break down their credit reports based on personal information, employment, accounts (including credit cards, loans & mortgages), and inquiries. Lenders often rely on Experian’s credit reports and scores when individuals apply for credit products such as loans, credit cards, and mortgages.

Experian provides this data monthly for each account as well as how long each account will stay on the report. Typically any transgressions such as a missed payment will stay on someone’s credit report for at least 6 years. Consumers can add personal notes to their accounts to explain any potentially damaging entries like a missed payment.

Transunion: Transunion creates its score based on the VantageScore 3.0 score system which takes into account your payment history for 40% of your score, and credit utilization for 20%. The length of your credit history contributes to 21%, and the total amount of recently reported balances makes up 11%. The remainder comes from new credit accounts which are responsible for 5% and your available credit makes up 3%.

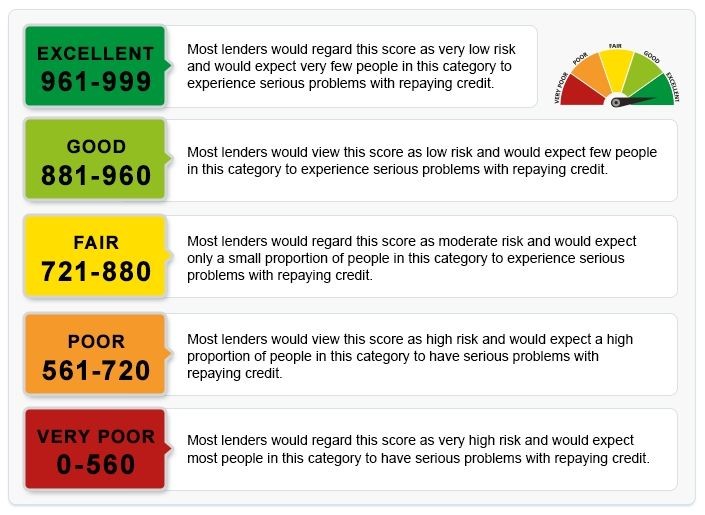

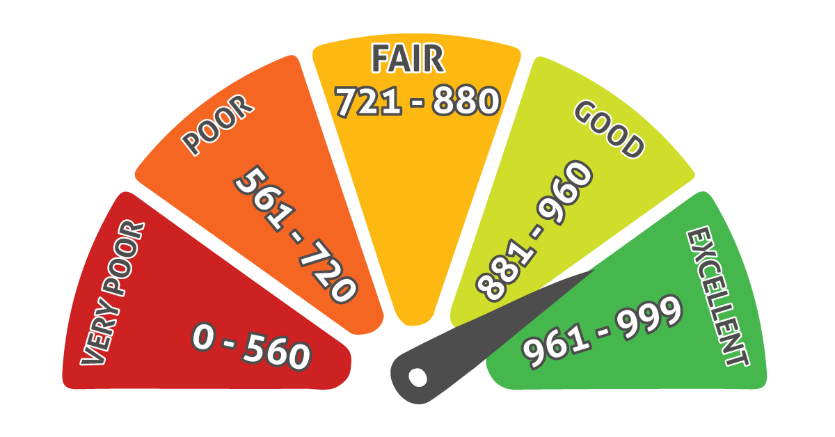

Credit Score Rating: Credit score ratings vary between different credit reporting agencies in England and usually all over the world. Each agency has its scoring system, so your credit score may vary slightly depending on which one you choose. However, you’ll probably find that you fall into the same category across all of them.

Credit Score |

Experian | Equifax | TransUnion |

| Fair | 721-880 | 380-419 | 566-603 |

| Good | 881-960 | 420-465 | 604-627 |

| Excellent | 961-999 | 466-700 | 628-710 |

Experian Credit Score: Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent.

Equifax Credit Score: Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent.

TransUnion Credit Score: TransUnion (formerly known as Callcredit) is the UK’s second-largest CRA and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent.

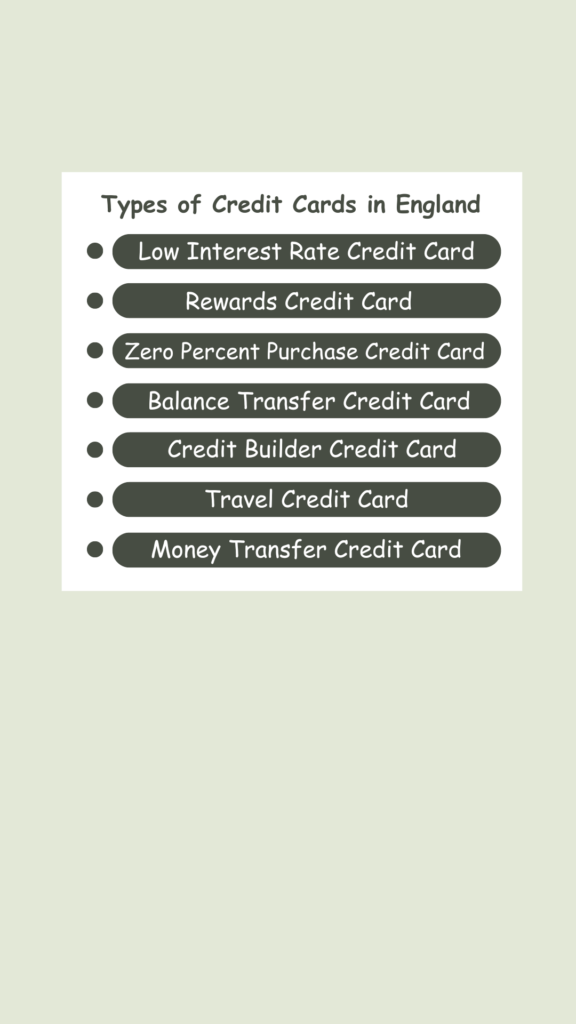

Types of Credit Cards in England: Credit cards can be a convenient way to pay for a range of things, but the type that’s right for you will depend on what you want to use them for. Various types of credit cards are available in England, catering to different financial needs and preferences. We will discuss here the most important ones that are mostly used in England:

Low-Interest Rate Credit Card: A low rate typically offers a lower interest rate on purchases. This type of credit card is worth considering if you’re likely to use it infrequently and won’t always pay off the bill in full. While these cards have a lower interest rate, you may have to pay an annual fee.

But watch out. Banks and credit card companies tend to use your credit history to set interest rates on their credit cards. This means that those with a poor credit history are generally offered a higher interest rate when they apply.

Rewards Credit Card: Rewards cards offer incentives such as cashback, points, or miles for every qualifying purchase made like air miles or shopping vouchers, when you use them. They may have a higher interest rate or an annual fee, so try to work out whether the rewards will outweigh the costs.

Zero Percent Purchase Credit Card: These can be useful if you plan to buy a big-ticket item and pay for it upfront, giving you a fixed period to repay without being charged interest. These cards offer 0% interest on purchases. Keep in mind that once the 0% interest period ends the purchase interest rate will change.

Balance Transfer Credit Card: These cards allow you to transfer existing credit card balances to a new card with a lower or 0% introductory interest rate. It means that it allows you to transfer the debt for a small percentage fee of the amount you’re transferring. This can be helpful if it means you’ll pay less interest and fees overall.

Like the 0% purchase card, this 0% interest period will end – so, ideally, you should try to clear your debt before it does. It’s also worth looking at what the rate will change to so you know what you’re in for over the longer term.

Credit Builder Credit Card: If you have little, or no, credit history because you’ve not borrowed much in the past, then these cards can help you build your credit score. Interest rates may be higher than other types of cards, but you can avoid interest as long as you pay off your balance in full each month.

Travel Credit Card: If you travel a lot, a travel credit card can make it cheaper for you to spend money overseas. They usually don’t charge a fee for making purchases or withdrawing cash overseas. Travel credit cards tend to have good exchange rates and some may offer reward points for spending. Interest rates may be higher than other types of cards, but you can avoid interest if you pay off your balance in full each month.

Money Transfer Credit Card: A money transfer card lets you move money from your credit card into your current account, for a fee. You may consider a money transfer credit card if you wanted to pay off an overdraft. This is different from a balance transfer credit card, where you move debt from one credit card to another.

It’s important to research and compare different credit card options based on your financial needs, spending habits, and goals. Each type of credit card comes with its own set of benefits and considerations, so be sure to read the terms and conditions before applying. Additionally, credit card offerings and features can change over time, so it’s recommended to visit the websites of reputable financial institutions in England to explore the most up-to-date credit card options available.

Sources of Credit Cards in England

In England, credit cards are offered by a variety of financial institutions, including banks, credit unions, and other card issuers. The following are the main sources to get your credit card:

When considering a credit card, it’s important to thoroughly research and compare the terms, fees, rewards, and benefits associated with each card. For the latest information, you should visit the websites of reputable financial institutions and card issuers in England to explore the most current credit card options available.

Types of Loans in England