መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » ካናዳ

Brief History of Canada

- History of Canada

- Hierarchical structure

- The Constitution of Canada

- Federal Government

- Provincial Government

- Election

History of Canada

Let me take you on a new home journey named “Canada”. In this journey, you learn about Canadian society’s history, Social and cultural Norms, values, and beliefs.

Indigenous Peoples

The history of Canada begins with the presence of various Indigenous Peoples who inhabited the land for thousands of years before the arrival of Europeans. These Indigenous groups included the First Nations, Inuit, and Metis, each with their distinct cultures and societies.

European Exploration

European exploration of Canada started in the 15th century, with explorers such as John Cabot, Jacques Cartier, and Samuel de Champlain venturing to North America and establishing early colonies.

New France

In the 17th century, French colonization began in Canada, particularly in the region of modern-day Quebec. The French established settlements and developed a fur trade with the Indigenous Peoples.

British Dominion

In 1763, after the Seven Years’ War (also known as the French and Indian War), France ceded its Canadian territories to Great Britain through the Treaty of Paris. The British took control of Canada, and it became a British colony.

Confederation

On July 1, 1867, the British North America Act (now known as the Constitution Act, of 1867) united the provinces of Canada, New Brunswick, and Nova Scotia into the Dominion of Canada. This event is celebrated as Canada’s Confederation and marked the birth of the country.

Expansion and the West

During the late 19th and early 20th centuries, Canada expanded westward, adding more provinces and territories to the Dominion. The Canadian Pacific Railway played a crucial role in connecting the country from coast to coast.

World Wars and Modernization

Canada actively participated in both World War I and World War II, earning recognition for its military contributions. After the wars, Canada experienced significant economic growth and modernization.

Social and Political Changes

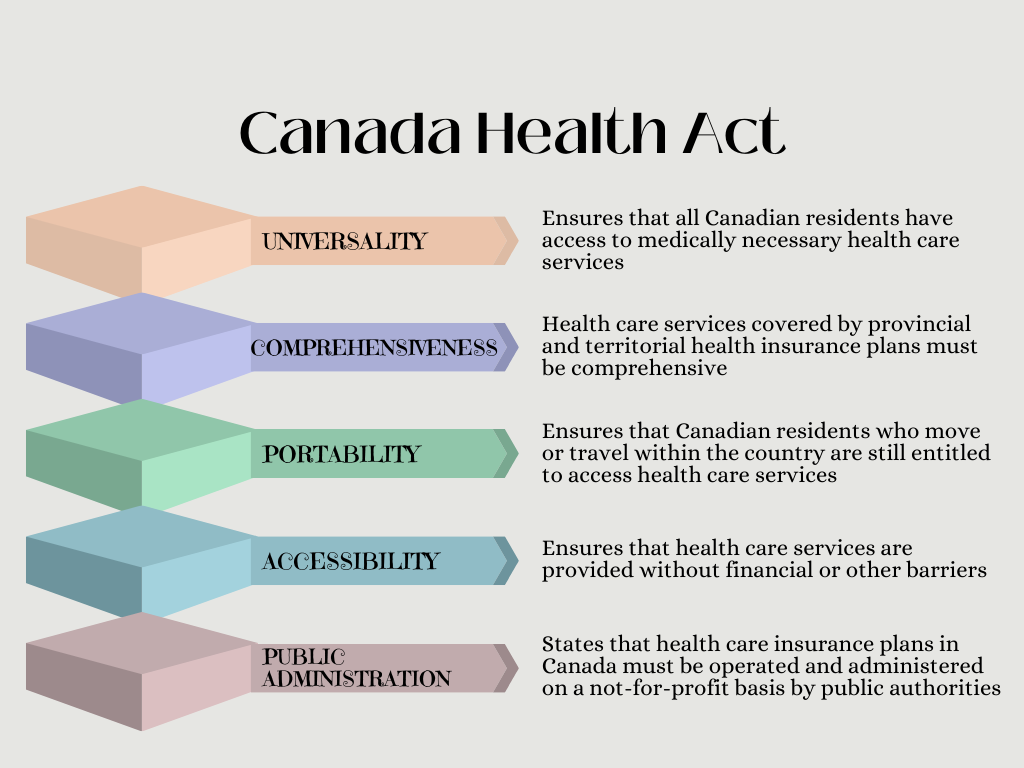

Throughout the 20th century, Canada underwent various social and political changes. Notable milestones included the implementation of universal healthcare, the recognition of bilingualism, and the establishment of the Canadian Charter of Rights and Freedoms in 1982.

Quebec Sovereignty Movement

In the latter half of the 20th century, there were movements in Quebec advocating for the province’s independence from Canada. Referendums were held in 1980 and 1995, with the latter narrowly rejecting sovereignty.

Contemporary Canada

Today, Canada is a diverse and multicultural nation, known for its commitment to democracy, human rights, and social welfare. It remains a constitutional monarchy with Charles III as the reigning monarch and a parliamentary democracy.

Canada has continually evolved over the centuries, and its history reflects a rich tapestry of Indigenous heritage, European colonization, and the contributions of diverse immigrant communities.

It is now one of the world’s leading industrialized nations and a prominent player in international affairs.

Great Canadian Discoveries and Inventions

Canadians have made various discoveries and inventions. Some of the most famous are listed below.

Alexander Graham Bell: Hit on the idea of the telephone at his summer house in Canada.

Joseph-Armand Bombardier: Invented the snowmobile, a lightweight winter vehicle.

Sir Sandford Fleming: Invented the world system of standard time zones.

Mathew Evans and Henry Woodward: Together invented the first electric light bulb and later sold the patent to Thomas Edison who, more famously, commercialized the light bulb.

Reginald Fessenden: Contributed to the invention of the radio, sending the first wireless voice message in the world.

Dr. Wilder Penfield: Was a pioneering brain surgeon at McGill University in Montreal, and was known as “the greatest living Canadian.”

Dr. John A. Hopps: Invented the first cardiac pacemaker, used today to save the lives of people with heart disorders.

SPAR Aerospace / National Research Council: Invented the Canadarm, a robotic arm used in outer space.

Mike Lazaridis and Jim Balsillie: Of Research in Motion (RIM) a wireless communications company known for its most famous invention, the BlackBerry.

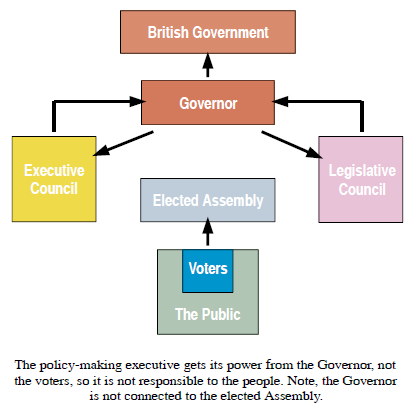

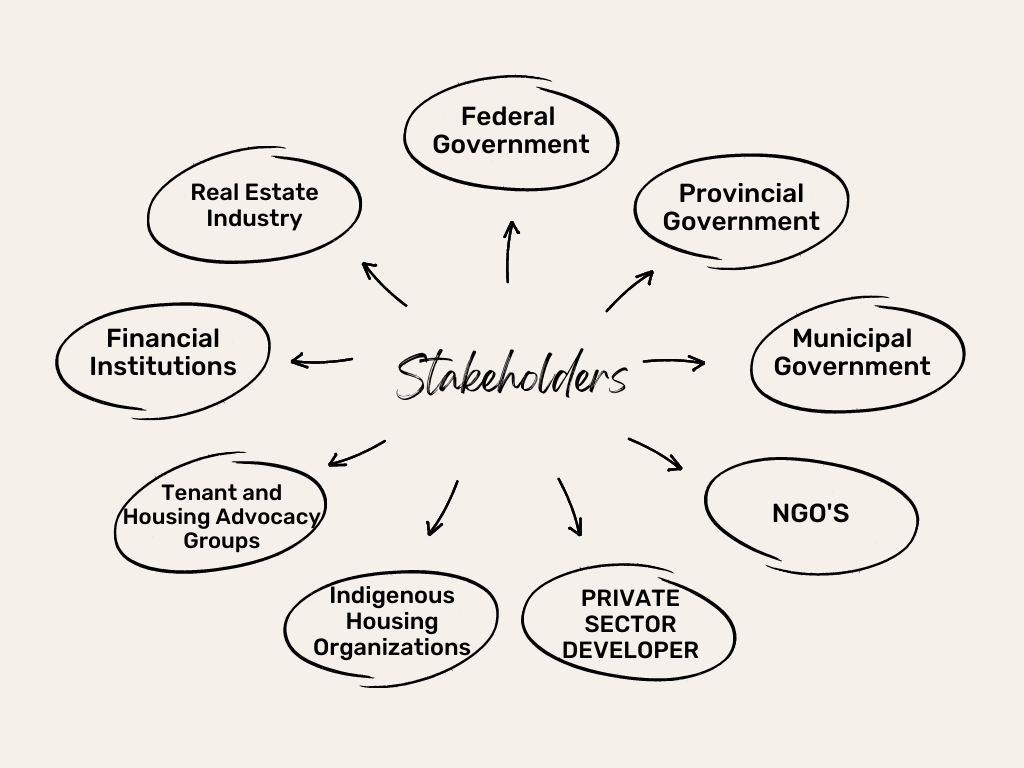

Hierarchy structure of Canada

Canadian government observed below hierarchy structure to run the matters of the state.

Head of State: The Monarch of the United Kingdom. The monarch is the ceremonial and symbolic head of state in Canada.

Governor General: The representative of the Monarch in Canada. The Governor General is appointed by the Monarch on the advice of the Prime Minister of Canada.

Executive Branch

Prime Minister: The head of government and leader of the party with the most seats in the House of Commons. The Prime Minister oversees the executive branch of government.

Cabinet Ministers: Appointed by the Prime Minister, they head various government departments and ministries, form the Cabinet, and assist in decision-making.

Legislative Branch

Parliament: The bicameral legislative body comprising two chambers:

House of Commons: Members of Parliament (MPs) elected by the public in federal elections represent different electoral districts (ridings).

Senate: Senators appointed by the Governor General on the advice of the Prime Minister. They review and suggest amendments to legislation proposed by the House of Commons.

Judicial Branch

Supreme Court of Canada: The highest court in the country, responsible for interpreting laws and ensuring their constitutionality.

Provinces and Territories

Canada is divided into ten provinces and three territories, each with its own government:

Provinces: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Quebec, Saskatchewan.

Territories: Northwest Territories, Nunavut, Yukon.

Provincial and Territorial Governments

Each province and territory has its own government structure with a Premier as the head of the provincial/territorial government.

Provinces have a legislative assembly (unicameral) or legislative council (historically bicameral), while territories have legislative assemblies.

Municipalities

Cities, towns, and villages in Canada are governed by municipal governments. They handle local matters like public works, public safety, and community services.

This hierarchical structure demonstrates the levels of governance in Canada, from the Monarch and federal government down to provincial/territorial and municipal authorities. Each level has its responsibilities and powers, contributing to the overall governance of the country.

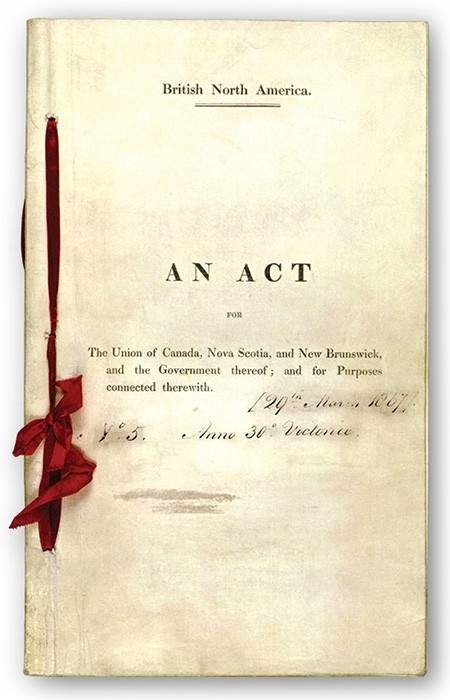

The Canadian Constitutions

A constitution provides the fundamental rules and principles that govern a country. It creates many of the institutions and branches of government and defines their powers.

The constitution of Canada provides the rules that Canada’s government must follow both in terms of how the government operates politically, as well as what it can and cannot do to its citizens.

Constitution Act, 1867 (formerly British North America Act, 1867): This is the foundational document of the Canadian constitution. It established Canada as a federal dominion and divided legislative powers between the federal government and the provinces. The Act also created the framework for the federal Parliament, the division of powers, and the federal-provincial relationship.

Constitution Act, 1982: This act represents a significant milestone in Canada’s constitutional development. It was patriated from the United Kingdom, meaning Canada gained full control over its constitution. The Constitution Act, of 1982, includes two essential elements:

The Canadian Charter of Rights and Freedoms: The Charter is a part of the Constitution Act, of 1982, and it guarantees fundamental rights and freedoms to all Canadians. These rights include freedom of expression, religion, and equality before the law.

The Amending Formula: The Constitution Act, 1982, outlines the process for amending the Canadian constitution. It requires the consent of the federal government and a specified number of provinces representing a certain percentage of the population.

Constitutional Conventions: These are unwritten practices and customs that are considered binding and essential to the functioning of the Canadian political system. Examples include the principles of responsible government and the role of the Governor General.

Court Decisions: Judicial interpretations of the constitution, particularly by the Supreme Court of Canada, have played a significant role in shaping constitutional principles and understanding the division of powers.

Treaties and Agreements: Certain treaties and agreements with Indigenous Peoples are considered constitutional and form part of Canada’s legal framework.

Other Legislation: Certain other laws are considered constitutional because they play a crucial role in governing Canada’s institutions and defining its political system.

It’s important to note that the Canadian constitution is not a single written document like some other countries. Instead, it consists of multiple sources that collectively form the country’s constitutional framework. The Constitution Act, of 1867, and the Constitution Act, of 1982, are the most critical written components, while conventions, court decisions, treaties, and other laws complement the overall constitutional structure.

Federal Government of Canada

The federal government system in Canada is structured with three branches: the Executive, the Legislative, and the Judicial.

Executive Branch: The Executive branch is headed by the Prime Minister, who is the head of government and the leader of the political party with the most seats in the House of Commons.

The Prime Minister is responsible for appointing Cabinet Ministers who head various government departments and agencies.

Legislative Branch: The Legislative branch is known as the Parliament of Canada and consists of two houses: the House of Commons and the Senate.

The House of Commons is made up of Members of Parliament (MPs) who are elected by Canadian citizens during federal elections. Each MP represents a specific electoral district.

The Senate is made up of Senators who are appointed by the Governor General on the advice of the Prime Minister. Senators represent different regions of Canada.

Judicial Branch: The Judicial branch is independent and is responsible for interpreting and applying the laws of Canada.

The Supreme Court of Canada is the highest in the country and plays a crucial role in interpreting the Canadian Constitution and the Canadian Charter of Rights and Freedoms.

Division of Powers

The division of powers between the federal government and the provinces/territories is outlined in the Canadian Constitution, particularly in the Constitution Act, of 1867, and the Constitution Act of, 1982.

The federal government has authority over matters of national concern, such as defense, foreign affairs, criminal law, immigration, and currency.

The provinces and territories have jurisdiction over areas like education, healthcare, transportation, property, and civil rights.

Role of the Monarch

Canada is a constitutional monarchy, and the monarch represents the symbolic and ceremonial aspects of the federal system.

The Governor-General, acting on behalf of the monarch, performs various constitutional and ceremonial duties, including the formal approval of laws and the dissolution of Parliament for elections.

Indigenous Self-Government

The Canadian federal system recognizes and works toward the establishment of Indigenous self-government for Indigenous peoples in Canada. It involves negotiating agreements that grant more autonomy and decision-making powers to Indigenous communities.

Provisional Government Role in Canada

Certainly! Provincial and territorial governments play a crucial role in the federal system of Canada. Each province and territory have its government, which is responsible for making laws and decisions on matters that fall within their jurisdiction. Here’s a more detailed elaboration.

Provinces and Territories

Canada is divided into ten provinces and three territories, each with its government. The provinces are the most populous regions, while the territories are more sparsely populated and located in the northern parts of the country.

Areas of Jurisdiction

Matters within provincial and territorial jurisdiction are outlined in the Constitution Act, of 1867 (formerly known as the British North America Act, of 1867). These areas are known as “provincial powers.”

Some of the key areas under provincial and territorial jurisdiction include education, healthcare, natural resources (e.g., forestry, mining), transportation (except for international and interprovincial railways and pipelines), property and civil rights, municipal institutions, and incorporation of companies.

Provincial and Territorial Legislatures

Each province and territory have its legislature, which is responsible for making laws and regulations specific to that region.

The legislative body in provinces is typically known as the Legislative Assembly (e.g., Legislative Assembly of Ontario), while in territories, it is called the Legislative Assembly (e.g., Legislative Assembly of Yukon).

Premiers and Territorial Leaders

The head of the provincial government is known as the Premier, while in territories, it is referred to as the Territorial Leader (e.g., Premier of Yukon).

Premiers and territorial leaders are elected by the citizens of their respective provinces or territories during provincial and territorial elections.

Lieutenant Governors and Commissioners

Each province has a representative of the federal government known as the Lieutenant Governor. In territories, the representative is called the Commissioner.

Lieutenant Governors and Commissioners perform ceremonial duties, such as the formal approval of provincial or territorial legislation on behalf of the federal Crown.

Provincial and Territorial Constitutions

Each province and territory have its constitution, which includes laws specific to that region. These laws must be consistent with the Canadian Constitution.

The provincial and territorial constitutions may differ from each other, reflecting the unique needs and circumstances of each region.

Interprovincial Relations

While provinces and territories have significant autonomy in their respective areas of jurisdiction, there are times when their interests overlap. In such cases, they may collaborate through interprovincial and territorial agreements to address shared challenges or implement joint initiatives.

Overall, the provincial and territorial governments in Canada play a crucial role in shaping policies and legislation that directly impact the daily lives of their residents. Their autonomy within the federal framework allows for diversity and flexibility in governance, recognizing the unique needs and interests of each region.

Electoral system of Canada

Canada follows a federal electoral system that combines elements of both the First-Past-The-Post (FPTP) and Single Member Plurality (SMP) systems. Here’s an overview of the election system of Canada.

Federal Elections

Federal elections in Canada are held to elect members to the House of Commons, the lower house of the Parliament of Canada.

Fixed Election Date

Canada has fixed election dates. Federal elections are scheduled to be held on the third Monday of October every four years. However, the Prime Minister has the authority to request the Governor General to dissolve Parliament and call an election before the scheduled date under certain circumstances.

Electoral Districts

Canada is divided into 338 electoral districts (also known as ridings or constituencies), each represented by one Member of Parliament (MP).

First-Past-The-Post (FPTP) System

The FPTP system means that the candidate who receives the most votes in each electoral district becomes the MP for that district.

The winning candidate doesn’t need to obtain an absolute majority (more than 50% of the votes); they only need to have more votes than any other candidate.

Single Member Plurality (SMP) System

The SMP system is another term used interchangeably with the FPTP system. It emphasizes that each electoral district elects only one representative.

Party System

Canada has a multi-party system, and various political parties compete in federal elections. The major parties include the Liberal Party, the Conservative Party, the New Democratic Party (NDP), the Bloc Québécois (which primarily runs candidates in Quebec), and the Green Party.

Formation of Government

To form a government and have the Prime Minister, a party needs to win the majority of seats in the House of Commons (at least 170 out of 338 seats). If no party obtains a majority, it leads to a hung parliament, and parties may need to form coalitions or rely on the support of other parties to govern.

Voting Eligibility

To be eligible to vote in federal elections, a person must be a Canadian citizen, at least 18 years old, and registered on the electoral roll.

Advance Voting and Special Ballots

Canadians have options for advance voting, allowing them to cast their ballots before the official election day.

Special ballots are available for Canadians who are unable to vote in person, such as those residing outside the country or unable to attend a polling station due to disability or illness.

Immigration System of Canada

- Immigration Overview

- Types of Immigration

- Asylum

- The Asylum Process

Canada’s immigration goals are to strengthen the economy, reunite families, and help refugees. This comprehensive Canada Visa page outlines everything that you need to know about Canada’s Immigration Levels Plan.

Each year, the federal Department of Immigration, Refugees and Citizenship Canada (IRCC) releases a new Immigration Levels Plan which it uses to guide its operations.

In 2022, IRCC welcomed more than 437,000 immigrants to Canada. In 2023, Canada’s newcomer target is 465,000 new permanent residents (PRs). In 2024, Canada will aim to welcome an additional 485,000 immigrants. In 2025, the target is another 500,000 new permanent residents. The following table summarizes Canada’s immigration targets between 2023-2025 by immigration class:

| Immigration Class | 2023 | 2024 | 2025 |

| Economic | 266,210 | 281,135 | 301,250 |

| Family | 106,500 | 114,000 | 118,000 |

| Refugee | 76,305 | 76,115 | 72,750 |

| Humanitarian | 15,985 | 13,750 | 8,000 |

| Total | 465,000 | 485,000 | 500,000 |

Canada has one of the world’s oldest populations and also one of the world’s lowest birth rates. This creates economic and fiscal pressures. Canada has a low rate of natural population growth which results in low rates of labor force and economic growth. Low economic growth makes it difficult for Canada to raise the taxes it needs to support social spending on services such as education, health care, and other important areas that provide high living standards in the country.

As a result, Canada has been increasing its immigration levels since the late 1980s to increase its rate of population, labor force, and economic growth. Canada now depends on immigration for the majority of its population and labor force growth and a larger share of its economic growth.

Consider that Canada will have 9 million baby boomers reach the retirement age of 65 by the year 2030. This means that Canada will have fewer workers at a time when it’s social spending on health care will rise. To alleviate this challenge, Canada has been proactive by gradually raising its immigration targets for over 30 years now.

Immigration, Refugees and Citizenship Canada (IRCC), Canada’s federal immigration authority, admits 300,000 immigrants to Canada annually, mainly under the Economic Class and the Family Reunification Class.

Overview of the Canada Immigration Program

Economic immigration, which is a major driver of Canada’s economic growth, accounts for more than half of planned admissions through the multi-year levels plan.

Nearly half of the projected economic admissions will be through the federal Express Entry system programs:

- TheFederal Skilled Worker (FSW) Program

- TheFederal Skilled Trades Class (FSTC)

- TheCanadian Experience Class (CEC).

Canada’s Provincial Nominee Program (PNP) also plays an important role in terms of economic immigration. This program allows participating Canadian provinces and territories to nominate eligible immigration candidates who match local workforce needs for permanent residence.

The following are immigration programs included in Canada’s Multi-Year Immigration Levels Plan:

Economic Programs

- Federal Skilled Worker (FSW) Program

This Express Entry-managed program is for immigrants with the requisite education, work experience, proficiency in English and/or French and other skills need to establish themselves economically in Canada. - Federal Skilled Trades Class (FSTC)

The Express Entry-managed Federal Skilled Trades Class is for foreign workers with qualifications in a skilled trade. - Canadian Experience Class (CEC)

The Canadian Experience Class is managed by the Express Entry system and welcomes expressions of interest from foreign workers with Canadian work experience or recent graduates of Canadian educational institutions working in Canada. - Atlantic Immigration Pilot Program (AIPP)

The Atlantic Immigration Pilot allows designated Atlantic employers to recruit and hire foreign skilled workers or international graduates in the Atlantic Canada region (Newfoundland and Labrador, Prince Edward Island, Nova Scotia, and New Brunswick). - Caregivers Program

Canada allows eligible foreigners caring for children and people with high medical needs the opportunity to apply for Canadian permanent residence. - Federal Business (Start-Up Visa Program and Self-Employed Person)

Federal business class programs allow foreigners who meet eligibility requirements the chance to run new or pre-existing businesses in Canada. - Provincial Nominee Program (PNP)

This program allows participating provinces and territories to nominate eligible economic immigration candidates for Canadian permanent residence. - Quebec Skilled Worker Programand Quebec Business

The province of Quebec runs its immigration system outside the federal system.

Family Class Programs

Refugees and Protected Persons, Humanitarian and other

- Protected Persons in Canada and Dependents Abroad

- Privately-Sponsored Refugees

- Blended Visa Office Referred

- Government-Assisted Refugees

Asylum

Definition

Asylum refers to a place of refuge or protection granted by a country to individuals who are fleeing persecution, violence, or danger in their home country.

Explanation

Asylum is a fundamental human right recognized by international law. It provides a legal status that allows individuals, known as asylum seekers, to seek safety and live in another country while their claim for protection is assessed.

Reasons for Seeking Asylum

Individuals who seek asylum are often forced to do so due to reasons such as political persecution, religious discrimination, ethnic conflict, war, or other forms of violence in their home country.

International Legal Framework

The right to seek asylum is enshrined in the Universal Declaration of Human Rights and is covered by various international and regional agreements, such as the 1951 United Nations Convention Relating to the Status of Refugees.

The Asylum Process

When an asylum seeker arrives in a new country, they must apply for asylum by presenting their case to the appropriate authorities or agencies responsible for processing asylum claims. These agencies assess the merits of the claim and verify whether the person meets the criteria for refugee status under international law.

Approval and Rights

If their claim is approved, the asylum seeker is granted asylum and becomes recognized as a refugee. Asylum may be granted on a temporary or permanent basis, depending on the situation in the home country and the circumstances surrounding the asylum application. Once granted, the individual gains certain rights, such as the right to live and work in the host country and access basic services.

Challenges and Limitations

The process of seeking asylum can be complex and lengthy, and not all asylum applications are successful. Additionally, some countries may have specific policies or limitations on accepting asylum seekers based on their own domestic laws and immigration policies.

Conclusion

Asylum plays a crucial role in providing protection and support to individuals who are forced to flee their homes and seek safety in foreign countries due to life-threatening conditions or persecution in their home countries. It serves as a humanitarian response to those in need of safety and security beyond their borders.

Asylum process in Canada

Canada offers refugee protection to some people in Canada who fear persecution or who would be in danger if they had to leave. Some dangers they may face include

- Torture

- Risk to their life

- Risk of cruel and unusual treatment or punishment

If you feel you could face one of these risks if you go back to your home country or the country where you normally live, you may be able to seek protection in Canada as a refugee.

Requirements for Asylum

To make an asylum claim,

- You must be in Canada

- Can’t be subject to a removal order

Eligibility

If you make a refugee claim, we’ll decide if it can be referred to the Immigration and Refugee Board of Canada (IRB). The IRB is an independent tribunal that makes decisions on immigration and refugee matters.

Your refugee claim may not be eligible to be referred to the IRB if you

- Are recognized as a Convention refugee by another country that you can return to

- Were granted protected person status in Canada

- Arrived via the Canada–United States border

- Have made a refugee claim in another country, as confirmed through information-sharing

- Are not admissible to Canada on security grounds or because of criminal activity or human rights violations

- Made a previous refugee claim that was not found eligible

- Made a previous refugee claim that was rejected by the IRB

- Abandoned or withdrew a previous refugee claim

Methods to claim asylum

You must be in Canada to make your refugee claim. You can make your claim in 1 of 2 ways:

- In-person (when you arrive in Canada at a port of entry)

- Online (when you’re already in Canada)

The right time to claim asylum

You can claim refugee protection at any port of entry when you arrive in Canada. This means an airport, seaport, or land border.

A Canada Border Services Agency (CBSA) officer will ask you to complete the required application forms when you arrive. Normally, you’ll complete the forms at the port of entry.

While at the port of entry, the officer will also

- Ask you questions about your situation

- Collect your documentation and proof of identity

- Take your fingerprints and photo (biometrics)

If the officer decides your refugee claim is eligible

The officer will give you

- A refugee protection claimant document (RPCD), which will help you get access to the Interim Federal Health Programand other services in Canada

- A confirmation of referral letter, which confirms your claim has been referred to the Immigration and Refugee Board of Canada (IRB)

- A basis of claimform

- Instructions about completing your medical exam

You have 15 calendar days to complete the basis of the claim form and submit it to the IRB’s Refugee Protection Division office listed on your confirmation of referral letter.

If the officer tells you to come back for an interview

The officer will give you

- an information pamphlet

- an acknowledgment of the claim letter(which will help you get access to the Interim Federal Health Program and other services in Canada)

- instructions about completing your medical exam

You may have to return to the port of entry or go to an inland office for your interview.

The officer may also tell you to submit your refugee claim online. If you’re told to complete your claim online, the officer will give you instructions.

To complete your claim, you’ll need your

- Application number

- UCI

- Date of birth

You’ll find these on your

- Acknowledgment of the claim letter

- Refugee protection claimant document

If you need help completing your claim online, use the application guide.

How to Submit your claim in the IRCC portal

Follow these steps to submit your claim.

1.Get an invitation code

If it’s your first time using the IRCC portal, you need an invitation code to create an account. We’ll ask for your email and send you a code that you can use to sign up.

2.Sign up for a portal account

After we send you your invitation code, use it to create your portal account.

3.Complete the online form

If you need help completing your claim online, use the application guide.

If you make your claim at a port of entry

There are 4 possible results when you claim a port of entry. Your next steps will depend on what our Canada Border Services Agency (CBSA) officer decides to do after reviewing your claim.

1.The CBSA officer decides your claim is eligible

You’ll receive a notice from the Immigration and Refugee Board of Canada (IRB) about a hearing. You must complete your medical exam, and go to your hearing with the IRB

2.The officer schedules you for an interview

You must complete your medical exam, and go to your scheduled interview

3.The officer tells you to complete your claim online

You must complete your claim online, and complete your medical exam

To complete your claim online, you’ll need your application number, UCI, and date of birth.

You’ll find these on your acknowledgment of claim letter or refugee protection claimant document.

4.The officer decides your claim is not eligible

If you submit your claim online

After you submit your claim online, we’ll review it to make sure it’s complete. If it is, we’ll use your online account to send you:

- An acknowledgment of the claim letter (which will help you get access to the Interim Federal Health Programand other services in Canada)

- Instructions to complete your medical exam

- A letter with details about an in-person appointment, once we schedule it

You may not get this letter at the same time as your acknowledgment of the claim letter. We’ll send it to you only once we schedule your appointment.

If your claim is incomplete, we’ll tell you what’s missing. You’ll get an email if we update your account or upload a document for you. Make sure you check your email regularly.

Go to your appointment

Make sure you bring your original passport or any other identification documents you have to your appointment.

During your appointment, we’ll

- Review your application.

- Collect your fingerprints and photo (biometrics) and any required documents (if you haven’t already provided them)

- Conduct your eligibility interview to decide if your claim is eligible (if we can)

- Give you documents about the next steps.

If we don’t decide on your claim during this appointment, we’ll schedule you for an interview and give you the details. It’s mandatory to go to your interview.

Go to your interview

Changes to immigration-related appointments

If you’re in Canada

Any in-person appointments that were rescheduled due to the Government of Canada labor disruption are in the process of being rescheduled. You will be notified of your new appointment as soon as possible.

If you’re outside Canada

Overseas interviews are proceeding as scheduled unless indicated otherwise by the IRCC office abroad.

During your interview, we’ll decide if your claim is eligible. If we decide it is, we’ll refer it to the Immigration and Refugee Board of Canada (IRB).

After the interview, we’ll give you a refugee protection claimant document that matches our decision about your claim. If your claim is eligible, we’ll also give you a confirmation of referral letter that confirms we referred your claim to the IRB. These documents will help you

- Prove you are a refugee claimant in Canada.

- Get access to the Interim Federal Health Programand other services in Canada

If your claim is eligible

Go to your hearing If we refer your claim to the IRB, the IRB will send you a notice to appear for a hearing. This notice will tell you

- Where to go for your hearing

- When to get there

- When it starts

Find out how to prepare for your hearing in the IRB’s Claimant’s Guide.

After your hearing, the IRB will approve or refuse your refugee claim. Find out what to do after you get a decision.

The IRB will never call you to ask for money. Read more information about fraudulent calls demanding money.

After your hearing

After your refugee hearing, the IRB approves or rejects your refugee claim.

If the IRB accepts your claim, you get “protected person” status. This means you can stay in Canada, and you can apply to become a permanent resident of Canada.

If the IRB rejects your claim, you’ll have to leave Canada. You may be eligible to appeal the IRB’s decision. You may also have other options.

If your claim is not eligible

If your claim is ineligible, your claim won’t be referred to the IRB and you’ll be issued an enforceable removal order to leave Canada.

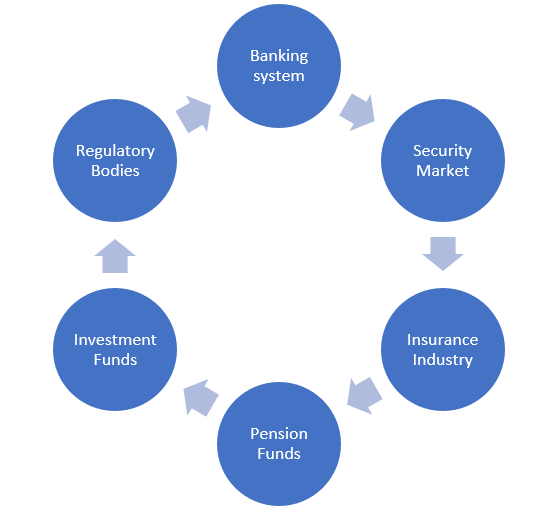

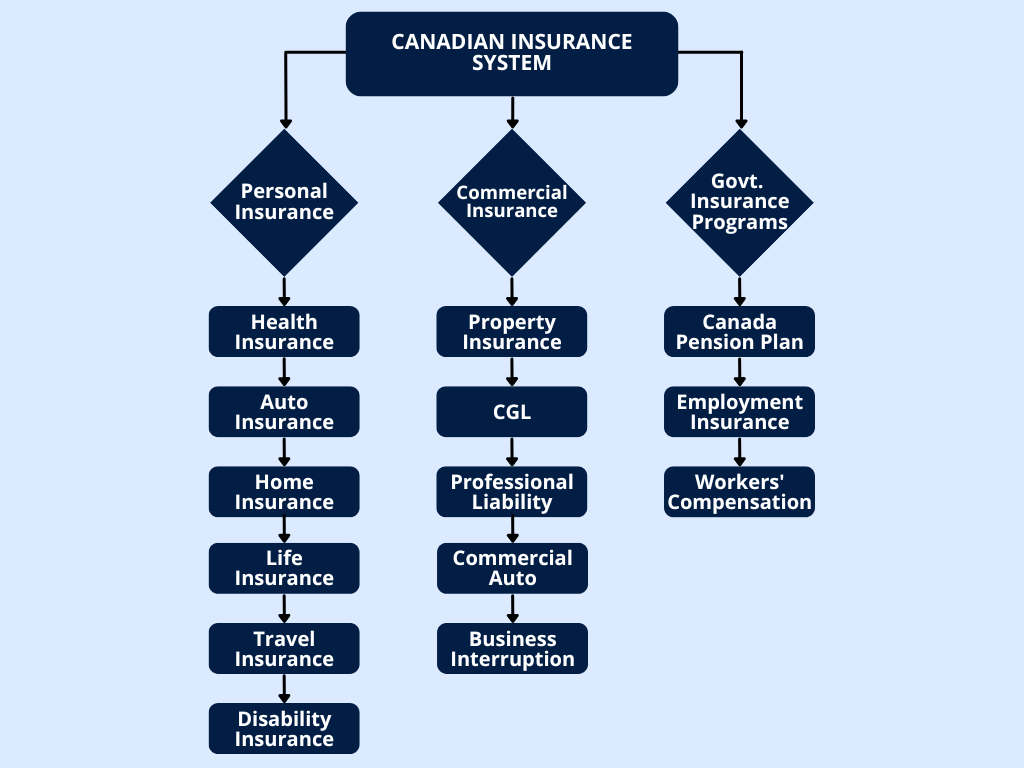

Canadian Financial System

- Overview of Canada’s Financial System

- Banking System

- Security Market

- Insurance Industry

- Pension Funds

- Investment Funds

- Regulatory Bodies

Canada’s financial system is one of the safest and strongest in the world. This is due in part to effective financial sector policy, regulation and supervision, liquidity support, deposit insurance, recovery and resolution strategies, and consumer protection and financial education.

Banking System

Canada has a strong and highly regulated banking sector. It includes chartered banks, credit unions, and foreign bank subsidiaries. The banking system provides a wide range of services, including deposit accounts, loans, mortgages, credit cards, and investment products. The Bank of Canada is the country’s central bank responsible for monetary policy and issuing currency. It manages the money supply and sets interest rates to achieve economic stability, low inflation, and sustainable growth.

Securities Market

Canada has a robust securities market where companies and governments raise capital through the issuance and trading of stocks and bonds. The Toronto Stock Exchange (TSX) is the primary stock exchange in Canada.

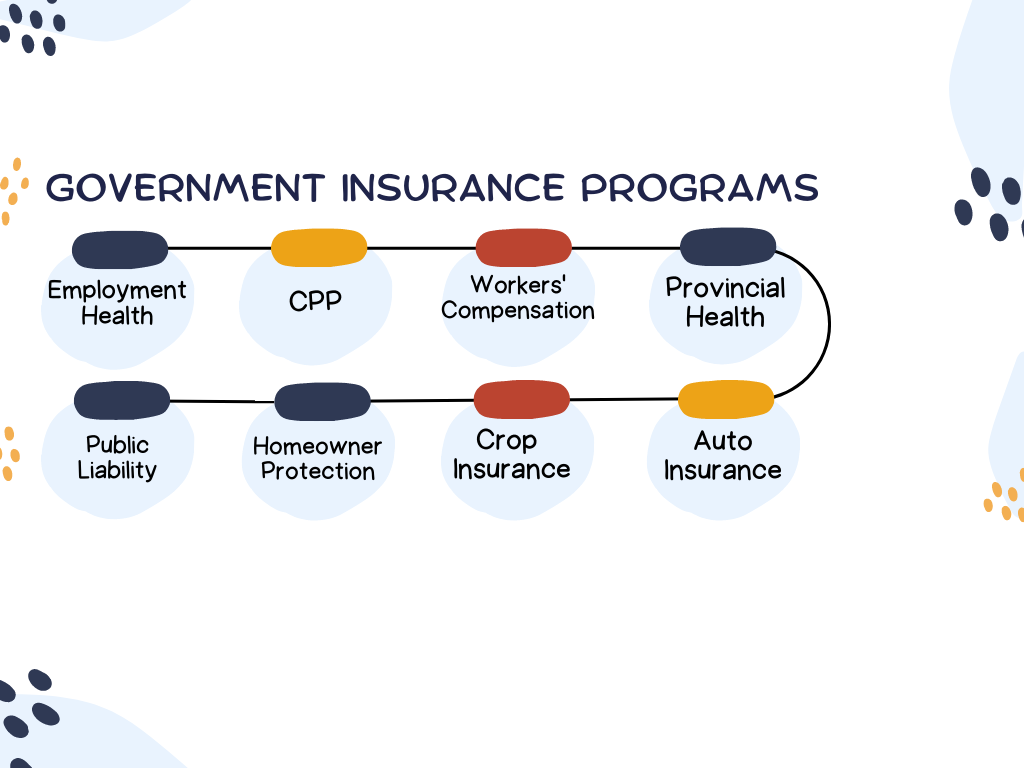

Insurance Industry

The insurance sector provides various types of coverage, such as life, property, casualty, and health insurance, offering protection against financial losses and uncertainties.

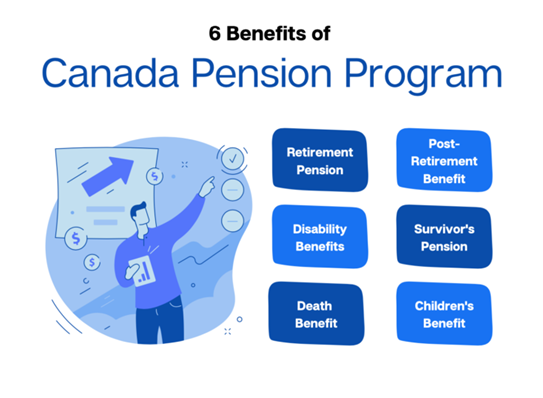

Pension Funds

Canada’s pension system is significant, with public and private pension funds managing substantial assets. The Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP) are the national public pension plans.

Investment Funds

Investment funds, such as mutual funds, exchange-traded funds (ETFs), and hedge funds, are popular investment vehicles for individuals and institutional investors alike.

Regulatory Bodies

Financial institutions in Canada are regulated and supervised by several agencies, including the Office of the Superintendent of Financial Institutions (OSFI) and the Financial Consumer Agency of Canada (FCAC). Provincial securities regulators oversee capital markets in their respective jurisdictions.

The banking system of Canada

A banking system is a collection of institutions that provides us with financial services. These organizations are in charge of running a payment system, making loans, accepting deposits, and assisting with investments.

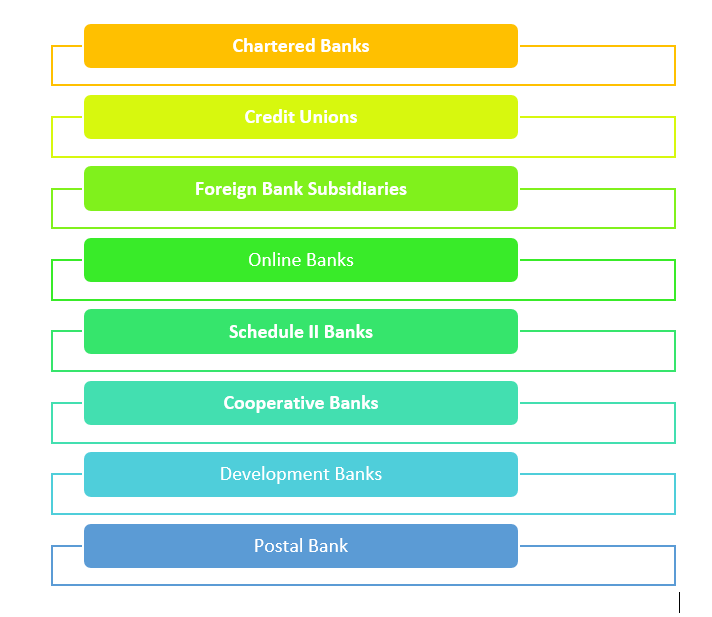

Major Players in the Canadian banking system are listed below

Chartered Banks

Chartered banks are large financial institutions that operate across Canada and are regulated by the federal government through the Office of the Superintendent of Financial Institutions (OSFI). They offer a wide range of services, including personal and commercial banking, mortgages, loans, investment products, and wealth management services. The “Big Five” banks (Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal, and Canadian Imperial Bank of Commerce) are examples of chartered banks in Canada

Credit Unions

Credit unions are cooperative financial institutions owned by their members. They operate at the provincial level and are regulated by provincial credit union regulators. Credit unions offer similar services to chartered banks, including savings and checking accounts, loans, mortgages, and investment products. They often serve specific communities or regions and are known for their community-focused approach.

Foreign Bank Subsidiaries

Some foreign banks have established subsidiaries in Canada to operate and offer banking services in the country. These subsidiaries are subject to Canadian banking regulations and provide services similar to those of domestic chartered banks.

Online Banks

Online banks, also known as virtual banks or direct banks, operate primarily through online platforms without brick-and-mortar branches. They offer banking services exclusively online, allowing customers to manage their accounts and conduct transactions electronically.

Savings Banks

Savings banks in Canada focus on providing savings accounts, investments, and other deposit-related services. They may not offer a full suite of banking services like chartered banks but cater to customers looking for savings and investment options.

Schedule II Banks

Schedule II banks are foreign bank branches operating in Canada. They are regulated and supervised by OSFI and can conduct banking activities in the country under specific regulations.

Cooperative Banks

Cooperative banks are financial institutions owned and controlled by their members, who are typically customers or users of the bank’s services. They are different from credit unions in their legal structure and membership requirements.

Development Banks

Development banks focus on providing long-term financing for projects that promote economic development, infrastructure, and community development initiatives. They may have specialized lending programs and support targeted economic sectors.

Postal Banks

Canada Post, the national postal service, offers limited banking services in partnership with financial institutions. These services include savings accounts, money orders, and bill payments at select postal outlets.

It’s important to note that while these are the main types of banking institutions in Canada, there may be other niche or specialized financial institutions that provide specific banking services or operate in a particular region or sector. Additionally, the Canadian financial sector is constantly evolving, and new types of banking institutions or innovative financial services may emerge over time.

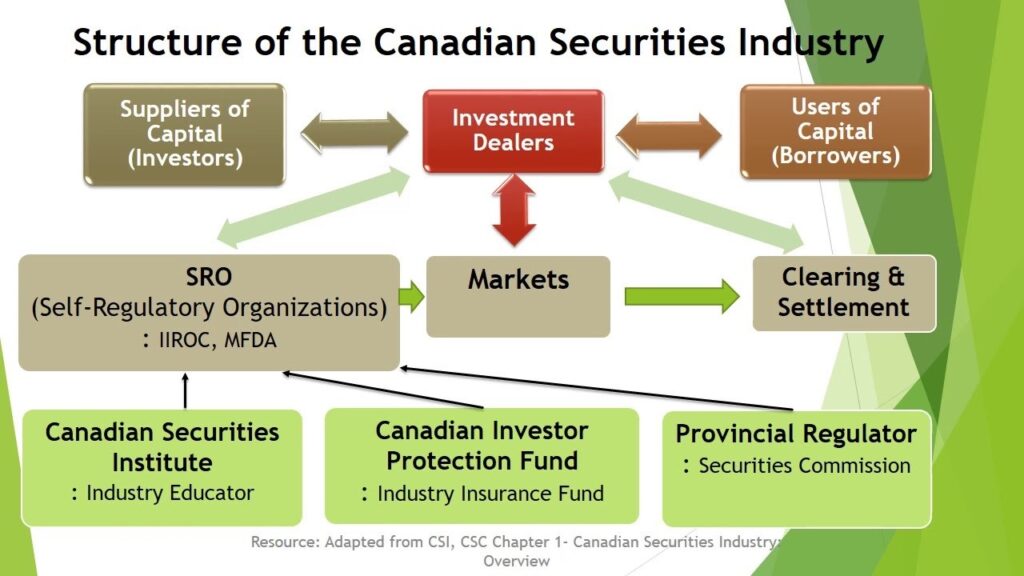

Overview of the Securities Market of Canada

The market in which securities are issued, purchased by investors, and subsequently transferred among investors is called the securities market. In Canada, the securities market refers to the marketplace where various financial instruments, such as stocks, bonds, and other investment products, are bought and sold.

The Canadian securities market comprises several key components, including:

Stock Exchanges

Canada has multiple stock exchanges where publicly traded companies list their shares for trading. The two primary stock exchanges are:

- Toronto Stock Exchange (TSX): The largest and most prominent stock exchange in Canada, listing a vast majority of the country’s largest companies across various industries.

- TSX Venture Exchange (TSXV): A subsidiary of the TSX, the TSXV is a junior stock exchange where early-stage and smaller companies list their shares.

Canadian Securities Exchange (CSE)

The CSE is an alternative stock exchange that focuses on small and emerging companies. It provides a platform for startups and entrepreneurial ventures to raise capital through public listing.

Fixed-Income Market

Canada has a robust fixed-income market where government and corporate bonds are traded. The fixed-income market provides a means for companies and governments to raise capital by issuing debt securities, and investors can buy and sell these bonds in the secondary market.

Derivatives Exchanges

Canadian derivatives exchanges facilitate the trading of financial instruments derived from underlying assets, such as options and futures contracts. The Montreal Exchange (MX) is one of Canada’s primary derivatives exchanges, offering a wide range of options and futures products.

Alternative Trading Systems (ATS)

ATS platforms are electronic trading venues that operate in parallel with traditional stock exchanges. They provide additional liquidity and alternative trading options for certain securities.

Over-the-Counter (OTC) Market

The OTC market consists of securities that are not listed on a formal exchange. Instead, they are traded directly between parties through broker-dealers or other intermediaries.

Convertible Securities Market

This segment of the securities market involves instruments that can be converted from one form to another, typically from bonds to shares of the issuing company’s common stock.

Foreign Exchange Market (Forex)

While not specific to Canada, the foreign exchange market is an essential component of the global financial system where currencies are exchanged and traded.

It’s important to note that the securities market in Canada, like in other countries, is subject to regulatory oversight to ensure fair and transparent trading practices, protect investors, and maintain market integrity. The Canadian securities market is regulated by provincial and territorial securities regulators in coordination with the Canadian Securities Administrators (CSA).

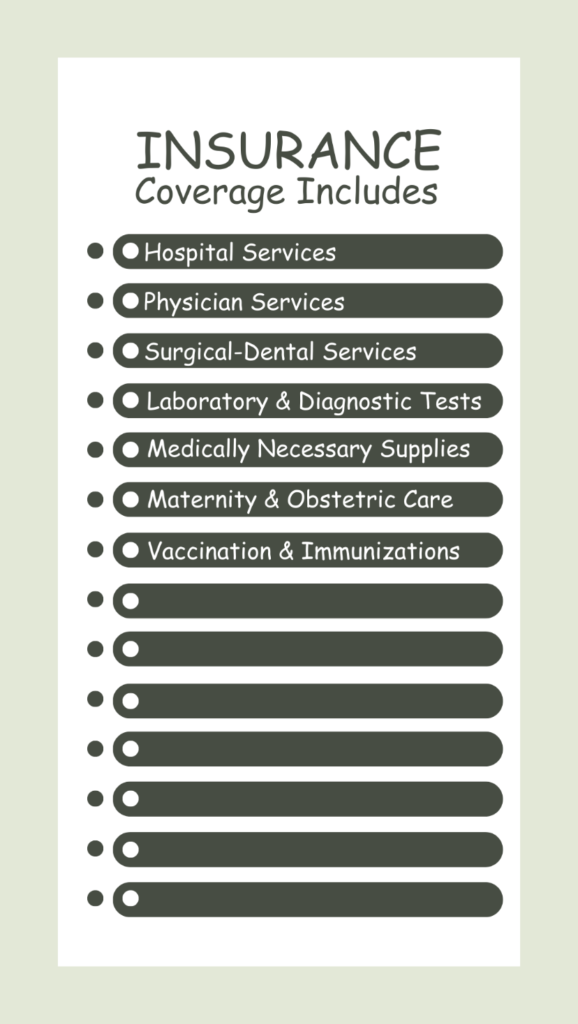

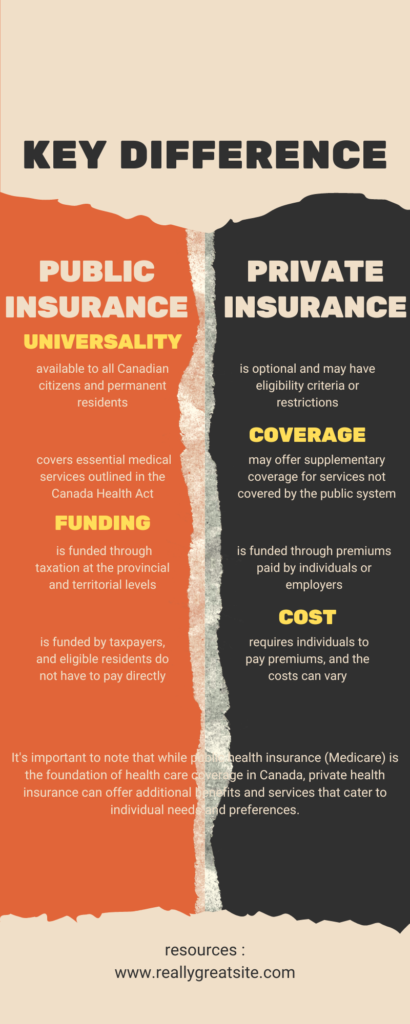

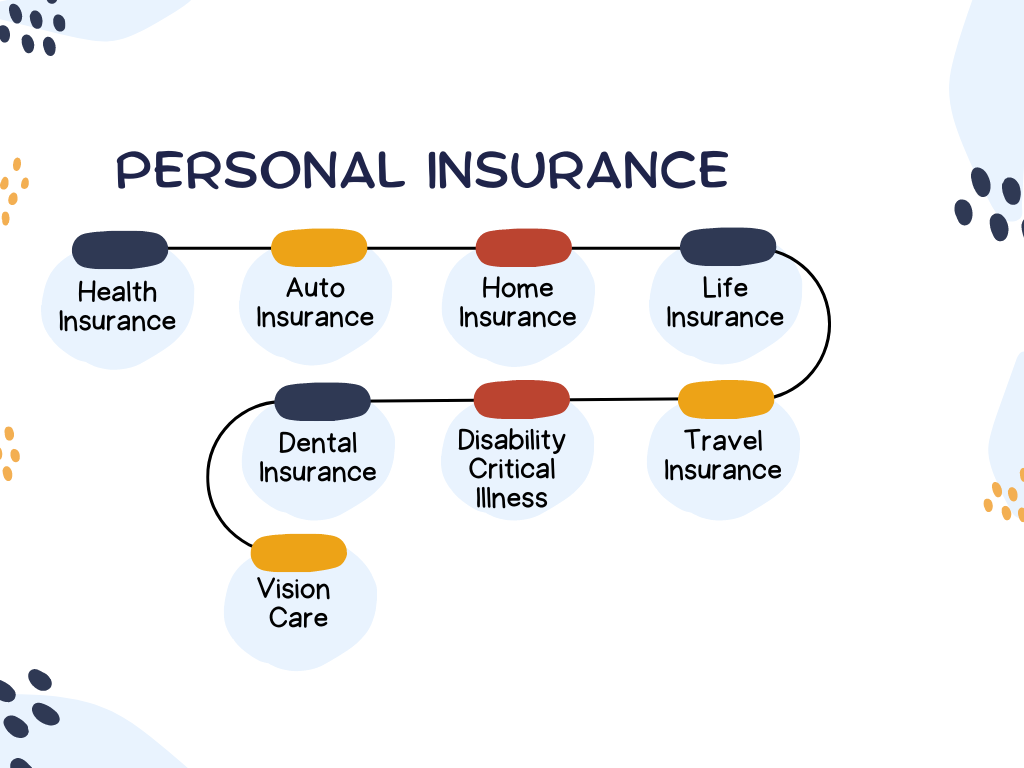

Insurance Overview in Canada

Insurance is a contract, represented by a policy, in which a policyholder receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured.

In Canada, various types of insurance coverage are available to individuals, businesses, and organizations to protect against financial losses and risks. The main types of insurance in Canada include:

Auto Insurance

Auto insurance is mandatory in Canada for anyone operating a motor vehicle. It provides coverage for damage and injuries resulting from automobile accidents. Auto insurance typically includes coverage for third-party liability, accident benefits, and optional coverage for collision and comprehensive damages.

Home Insurance

Home insurance provides coverage for damage to residential properties, including houses, condos, and apartments. It protects against risks like fire, theft, vandalism, and natural disasters. Home insurance may also include liability coverage for accidents that occur on the insured property.

Health Insurance

Canada has a publicly funded healthcare system that provides basic medical services to residents. However, private health insurance is available to supplement and cover additional healthcare expenses not covered by the government system. Private health insurance may include coverage for prescription drugs, dental care, vision care, and other medical services.

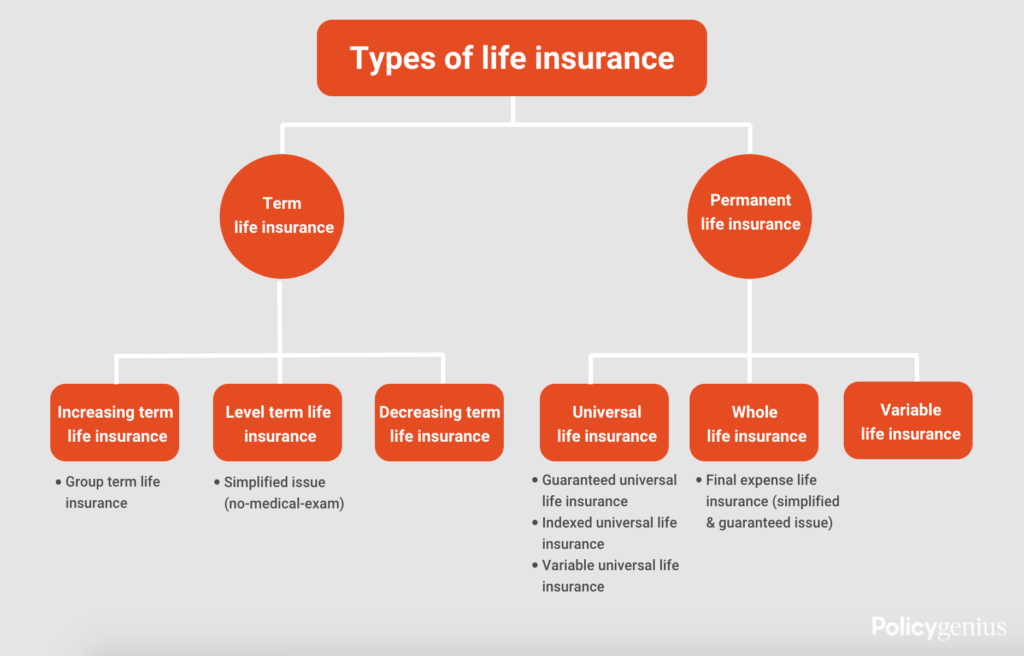

Life Insurance

Life insurance offers financial protection to the insured person’s beneficiaries in the event of their death. It provides a lump-sum payment, known as the death benefit, to the designated beneficiaries upon the policyholder’s passing. Life insurance can help replace lost income, pay off debts, and cover funeral expenses.

Disability Insurance

Disability insurance provides income replacement to individuals who are unable to work due to a disability or illness. It ensures that policyholders have a source of income during periods of temporary or permanent disability.

Travel Insurance

Travel insurance offers coverage for medical emergencies, trip cancellations, lost luggage, and other unforeseen events that may occur while traveling within Canada or abroad.

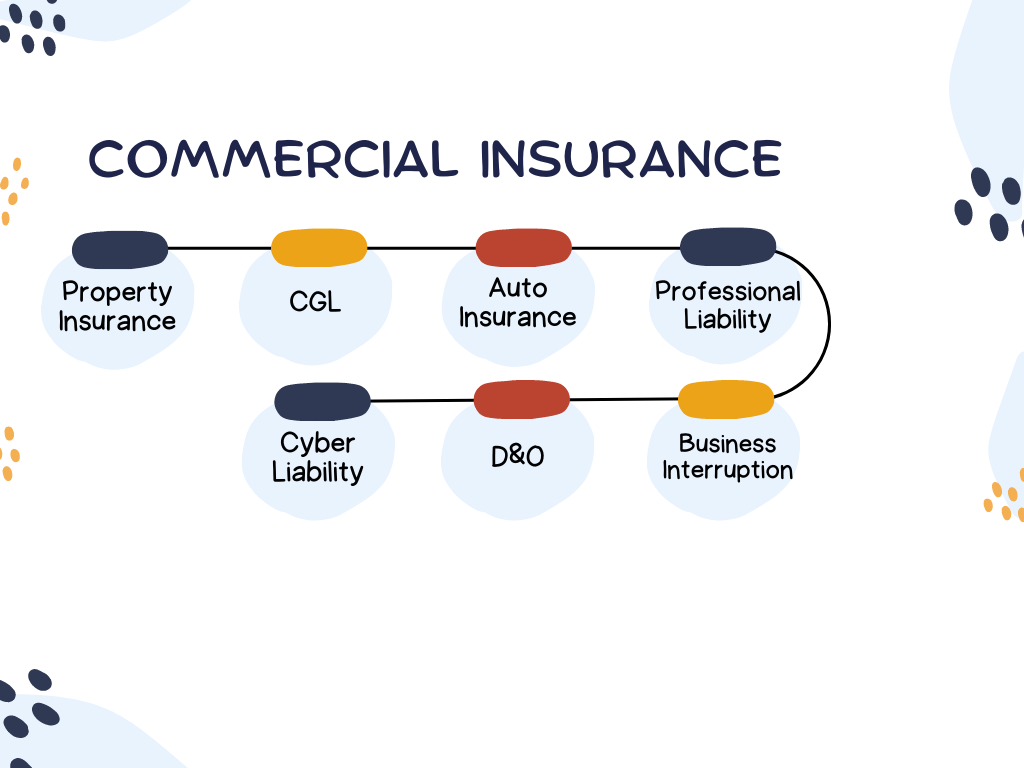

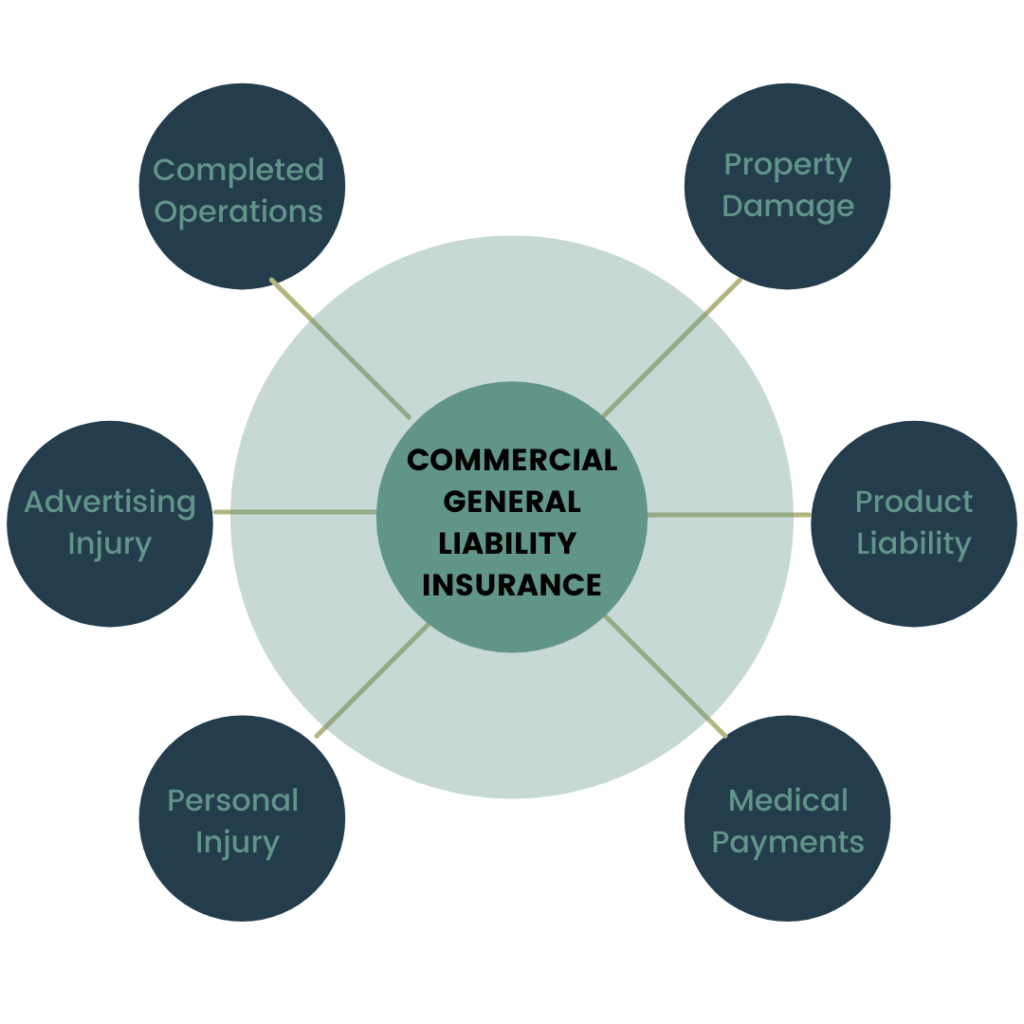

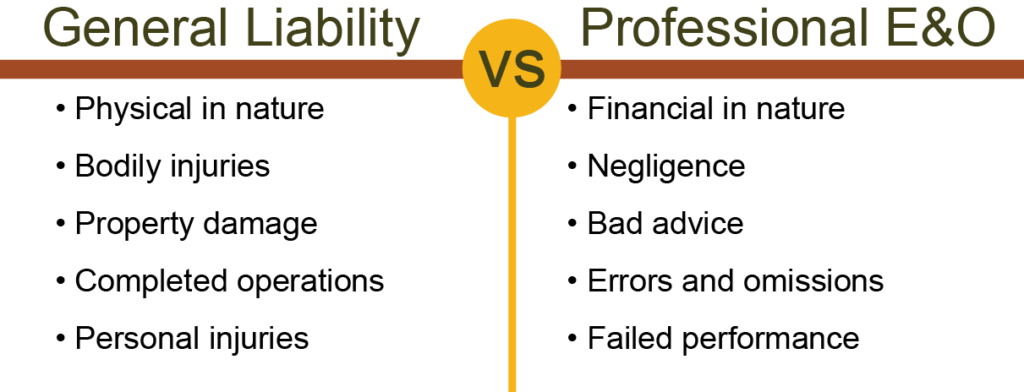

Business Insurance

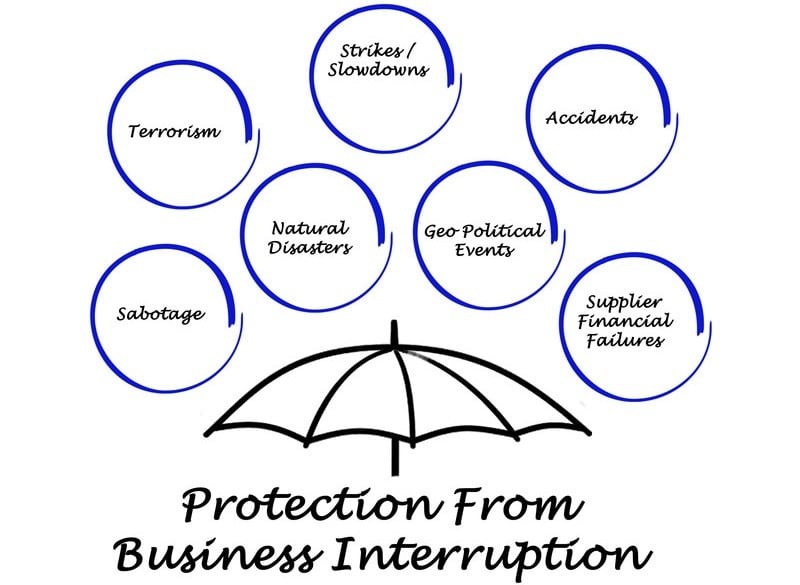

Business insurance provides coverage for businesses and organizations to protect against various risks, including property damage, liability, business interruption, and employee-related risks.

Liability Insurance

Liability insurance protects individuals and businesses against claims for bodily injury or property damage caused to others. It covers legal expenses and potential settlements or judgments resulting from lawsuits.

Pet Insurance

Pet insurance provides coverage for veterinary expenses and medical care for pets. It helps pet owners manage the costs of unexpected veterinary treatments.

Boat and Watercraft Insurance

This type of insurance provides coverage for boats and watercraft against physical damage, theft, and liability risks.

Critical Illness Insurance

Critical illness insurance pays a lump-sum benefit to the policyholder if they are diagnosed with a specified critical illness, such as cancer, heart attack, or stroke.

It’s essential to review and understand the specific terms and coverage of each insurance policy to ensure it meets your needs and provides adequate protection. Insurance requirements and regulations may vary between provinces and territories in Canada, so it’s advisable to consult with insurance professionals or companies to get the most suitable coverage.

Pension Funds in Canada

In Canada, various types of pension funds are available to help individuals save for retirement and secure their financial future. The main types of pension funds in Canada include:

Canada Pension Plan (CPP)

The Canada Pension Plan is a national, government-administered pension plan that provides income benefits to eligible Canadians in retirement, disability, and survivorship situations. Contributions to the CPP are mandatory for most employed individuals, and the benefits are based on the individual’s contributions and years of contribution to the plan.

Quebec Pension Plan (QPP)

Similar to the CPP, the Quebec Pension Plan is a provincial pension plan specific to residents of Quebec. It provides retirement, disability, and survivor benefits to eligible Quebecers. The QPP is administered separately from the CPP, but the two plans share similar principles.

Employer-Sponsored Pension Plans

Many employers in Canada offer pension plans to their employees as part of their employee benefits package. These pension plans can be defined benefit (DB) plans or defined contribution (DC) plans.

Defined Benefit (DB) Plans

In a defined benefit plan, the employer guarantees a specific retirement benefit to the employee based on a formula that considers factors such as salary and years of service. The employer bears the investment risk, and the employee receives a predetermined pension amount upon retirement.

Defined Contribution (DC) Plans

In a defined contribution plan, both the employer and the employee contribute to the plan, and the retirement benefit is determined by the performance of the investments in the employee’s account. The employee assumes the investment risk, and the pension amount will depend on the contributions and investment returns.

Registered Retirement Savings Plan (RRSP)

While not a pension fund per se, an RRSP is a popular individual retirement savings account in Canada. It allows individuals to contribute a portion of their income to the plan and deduct the contributions from their taxable income. The investments within the RRSP grow tax-free until retirement, at which point withdrawals are taxed as income.

Pooled Registered Pension Plan (PRPP)

The PRPP is a retirement savings option available to individuals, including self-employed individuals and employees of companies that do not offer a workplace pension plan. PRPPs are administered by financial institutions, and contributions are pooled and invested to provide retirement income.

Deferred Profit-Sharing Plans (DPSP)

DPSPs are employer-sponsored plans that allow employers to share profits with their employees. Employers make contributions to the plan, and the funds are invested on behalf of the employees. The employees receive their share of the plan’s assets upon retirement or other specified events.

It’s important to note that pension plans in Canada are subject to specific regulations and tax treatment. The availability and features of pension funds may vary depending on an individual’s employment status, province of residence, and other factors. It is advisable to seek guidance from financial advisors or pension plan administrators to understand the best retirement savings options based on individual circumstances.

Investments funds

Investment funds are investment products created with the sole purpose of gathering investors’ capital and investing that capital collectively through a portfolio of financial instruments.

In Canada, there are various types of investment funds available to investors, providing opportunities to diversify their portfolios and participate in different asset classes. The main types of investment funds in Canada include:

Mutual Funds

Mutual funds are one of the most popular types of investment funds in Canada. They pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers, and investors buy and sell units of the fund at the fund’s net asset value (NAV) based on the underlying securities’ performance.

Exchange-Traded Funds (ETFs)

ETFs are like mutual funds but trade on stock exchanges like individual stocks. They represent a basket of securities and offer investors the ability to buy and sell shares throughout the trading day. ETFs can track various indices or invest in specific asset classes, sectors, or strategies.

Index Funds

Index funds are a type of mutual fund or ETF designed to replicate the performance of a specific market index, such as the S&P/TSX Composite Index or the S&P 500. They aim to match the returns of the index they track, rather than trying to outperform it.

Money Market Funds

Money market funds invest in short-term, low-risk, highly liquid securities such as Treasury bills and commercial paper. They aim to provide investors with stable returns and capital preservation.

Bond Funds

Bond funds invest primarily in fixed-income securities, such as government bonds, corporate bonds, and municipal bonds. They offer investors exposure to the bond market while providing diversification across various issuers and maturities.

Equity Funds

Equity funds, also known as stock funds, invest primarily in stocks or equities of companies. They may focus on specific regions, sectors, or investment styles, such as growth or value investing.

Balanced Funds

Balanced funds, also called asset allocation funds, invest in a mix of stocks, bonds, and sometimes cash. They aim to provide a balanced approach to investing, combining growth potential with income and capital preservation.

Global and International Funds

Global and international funds invest in securities outside of Canada, providing exposure to foreign markets and international companies.

Sector-Specific Funds

These funds concentrate on specific sectors or industries, such as technology, healthcare, energy, or real estate. They allow investors to target areas of the market they believe have growth potential.

Alternative Investment Funds

Alternative funds invest in non-traditional assets, such as hedge funds, private equity, infrastructure, commodities, or real estate investment trusts (REITs). They are designed to diversify portfolios and potentially provide uncorrelated returns to traditional asset classes.

Ethical or Socially Responsible Funds

Ethical or socially responsible funds invest in companies that adhere to specific environmental, social, and governance (ESG) criteria. They aim to align investments with investors’ values and ethical considerations.

Investors should carefully consider their investment objectives, risk tolerance, and time horizon when choosing among different types of investment funds. It’s essential to conduct thorough research and, if needed, seek advice from financial professionals to make informed investment decisions

Financial regulatory bodies in Canada

In Canada, the financial system is regulated and supervised by several regulatory bodies, each responsible for overseeing specific aspects of the financial industry. The main financial regulatory bodies in Canada include:

Office of the Superintendent of Financial Institutions (OSFI)

OSFI is the primary federal regulator responsible for overseeing and regulating banks, insurance companies, trust and loan companies, and federally incorporated credit unions. Its mandate is to ensure the safety and soundness of financial institutions and protect the interests of depositors and policyholders.

Financial Consumer Agency of Canada (FCAC)

FCAC is a federal agency responsible for protecting consumers of financial products and services. It oversees and enforces consumer protection laws, ensuring that financial institutions comply with rules related to disclosure, transparency, and fair treatment of consumers.

Canadian Securities Administrators (CSA)

The CSA is an umbrella organization comprising the securities regulators of Canada’s provinces and territories. Its role is to coordinate and harmonize securities regulation across the country. The CSA develops and implements securities laws and regulations to promote fair and efficient capital markets.

Investment Industry Regulatory Organization of Canada (IIROC)

IIROC is a self-regulatory organization that oversees investment dealers and trading activity in Canada. It sets and enforces rules and regulations for investment firms and their registered representatives to ensure market integrity and investor protection.

Mutual Fund Dealers Association of Canada (MFDA)

The MFDA is another self-regulatory organization responsible for regulating mutual fund dealers in Canada. It sets and enforces rules for the distribution and sale of mutual funds to protect investors.

Provincial Securities Commissions

Each Canadian province and territory have its own securities commission responsible for regulating and supervising the capital markets within their jurisdiction. These commissions oversee securities offerings, trading activities, and investment advisors in their respective regions.

Canada Deposit Insurance Corporation (CDIC)

While not a regulatory body, CDIC is a federal Crown corporation responsible for providing deposit insurance to protect eligible deposits at member financial institutions in case of bank failure. It helps ensure stability and confidence in the banking system.

Provincial and Territorial Insurance Regulators

Insurance regulation is primarily a provincial responsibility in Canada. Each province and territory have its insurance regulatory authority responsible for overseeing insurance companies and protecting policyholders’ interests.

These regulatory bodies work collaboratively to maintain the stability, integrity, and efficiency of the Canadian financial system while ensuring consumer protection and investor confidence. They enforce rules and regulations that promote fair and transparent financial markets and foster the soundness of financial institutions operating in Canada.

Canadian Credit System

- Canadian Credit System

- Credit Reporting Agencies

- Credit Score Types

- Credit Score Rating

- Credit Score Criteria

- Credit Card Types

- Sources of Credit Cards

- Loans

Canadian Credit System

The Canadian credit system is a comprehensive framework that assesses and manages individuals’ creditworthiness based on their credit history and financial behavior. It plays a critical role in determining an individual’s ability to access credit, such as loans, credit cards, and mortgages, and influences the terms and conditions offered by lenders and creditors.

The Canadian credit system is based on the collection, reporting, and analysis of credit-related information about individuals by credit reporting agencies. The credit system aims to assess individuals’ creditworthiness and financial responsibility to determine their eligibility for credit products, such as loans, credit cards, and mortgages.

Here are some of the important key factors of the Credit System related to any individual:

Credit Report

A credit report is a comprehensive record of an individual’s credit history and financial activities. It includes details about credit accounts, payment history, credit inquiries, and public records like bankruptcies or judgments.

Credit Score

A credit score is a numerical representation of an individual’s creditworthiness, derived from the information in their credit report. The most commonly used credit scoring model in Canada is the FICO Score, which ranges from 300 to 900.

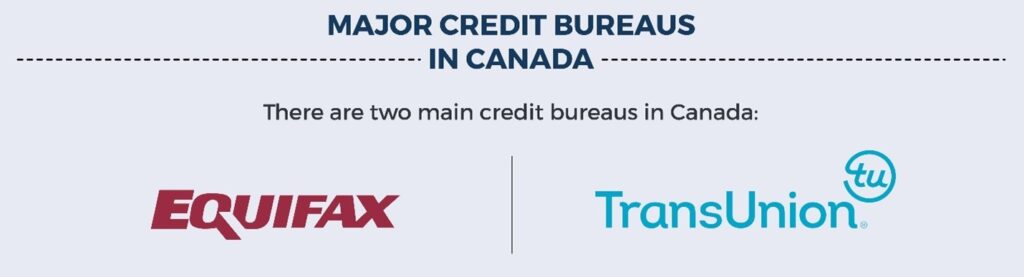

Credit Reporting Agencies of Canada

The two major credit reporting agencies in Canada are Equifax Canada and TransUnion Canada. These agencies collect and maintain credit information on individuals from various sources, including lenders, creditors, financial institutions, and public records. They compile this data to create credit reports and calculate credit scores, which are used by lenders and creditors to assess an individual’s creditworthiness and risk when applying for credit products.

1.Equifax Canada

Equifax Canada Inc. is a subsidiary of Equifax Inc., one of the largest credit reporting agencies globally. Equifax Canada collects and maintains credit information on Canadian consumers from various sources, including lenders, creditors, and public records.

Equifax Canada is a data, analytics, and technology company that believes knowledge drives progress. Equifax plays an essential role in helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Equifax’s unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward.

2.TransUnion Canada

TransUnion Canada is a subsidiary of TransUnion LLC, a leading global credit reporting agency. In Canada, TransUnion provides credit reporting services to consumers, businesses, and financial institutions.

TransUnion’s mission is to help people everywhere access the opportunities that lead to a higher quality of life. By helping organizations optimize their risk-based decisions and enabling consumers to understand and manage their personal information, TransUnion empowers both to take their destinies into their own hands.

Services:

Services for Consumers

These agencies offer credit monitoring services that allow individuals to track changes to their credit reports and receive alerts about potentially fraudulent activities.

Services for Businesses

These agencies provide credit reporting and risk assessment services to businesses and financial institutions to help them make informed decisions when extending credit to consumers or other

businesses.

Fraud Protection and Identity Theft Solutions

These agencies offer identity theft protection and fraud detection services to help consumers safeguard their personal and financial information.

Compliance with Privacy Laws

These agencies operate in compliance with Canadian privacy laws to protect consumers’ credit information and ensure data security.

Credit Education

These agencies provide educational resources and tools to help consumers understand credit reports, credit scores, and credit management.

These agencies play a significant role in the Canadian financial system by providing credit information and risk assessment services to lenders, businesses, and consumers.

Credit Score Types in Canada

In Canada, there are several types of credit scores used by different credit reporting agencies and lenders. The two most used credit scoring models are the FICO Score and the Vantage Score.

1.FICO Score

The FICO Score is developed by Fair Isaac Corporation (FICO) and is widely utilized by many financial institutions and lenders to assess an individual’s creditworthiness and determine credit eligibility and terms. The FICO Score, often called a Beacon Score, is a three-digit number that determines whether a person’s credit is good or bad.

FICO is not a credit bureau and does not collect credit information on Canadians. As a result, the FICO score is always based on the information collected by credit bureaus and helps lenders decide whether you’re a risk to loan money to. The FICO Score will determine how much you can borrow, your interest rates, and how long you have to pay back the loan.

FICO scores are calculated on your credit information. You can increase the score with good habits like carrying less than 30% debt at any given time and paying bills on time.

2.Vantage Score

The Vantage Score is a credit scoring model developed jointly by the three major credit reporting agencies: Equifax, Experian, and TransUnion. While the FICO Score has historically been more widely used in Canada, the Vantage Score is gaining popularity in the credit industry.

Similar to the FICO Score, the Vantage Score ranges from 300 to 900, with a higher score indicating a lower credit risk. Just like with the FICO Score, maintaining a positive credit history, making timely payments, and managing credit responsibly is essential for building and maintaining a strong credit profile with the Vantage Score.

Credit Score Rating

Credit score ratings provide a standardized way to categorize an individual’s creditworthiness based on their credit score. In Canada, credit scores range from 300 (very poor) to 900 (excellent) with the average Canadian credit score sitting at 650. According to TransUnion, a score above 650 will likely qualify you for a standard loan, while a score under 650 will likely make it difficult for you to receive new credit.

Excellent Credit

Credit Score Ranges from 800 to 900. Individuals with excellent credit scores are considered very low credit risks. They have a long and positive credit history, consistently make on-time payments, and maintain low credit utilization. Borrowers with excellent credit often qualify for the best interest rates and credit terms.

Good Credit

Credit Score Ranges from 720 to 799. Individuals with good credit scores are seen as having low credit risks. They have a positive credit history with few missed payments and responsible credit management.

Fair Credit

Credit Score Ranges from 650 to 719. Individuals with fair credit scores are considered moderate credit risks. They may have some negative marks on their credit history, such as late payments or higher credit utilization.

Poor Credit

Credit Score Ranges from 300 to 649. Individuals with poor credit scores are viewed as having higher credit risks. They may have a history of late payments, defaults, or high credit utilization.

It’s important to note that credit score ranges and rating categories may vary slightly between different credit reporting agencies and lenders. Additionally, credit score rating categories are not universal, and each lender or financial institution may have its specific criteria for determining creditworthiness.

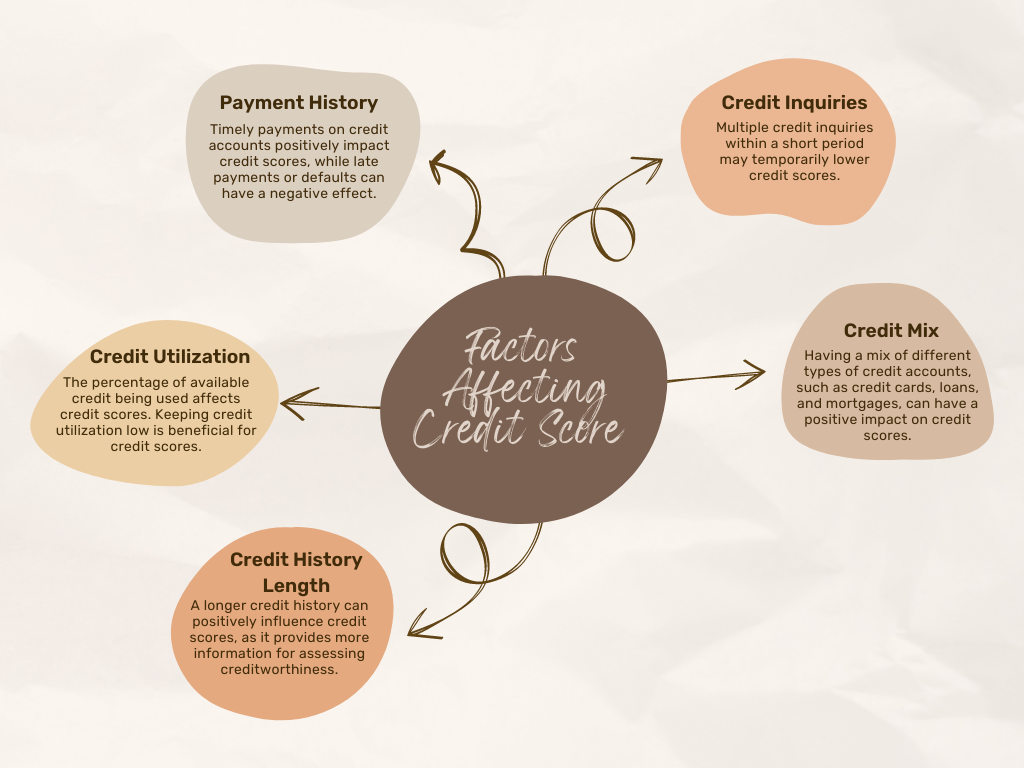

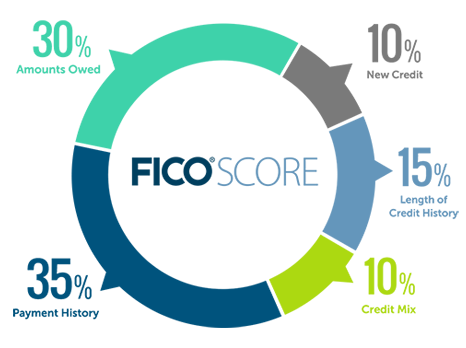

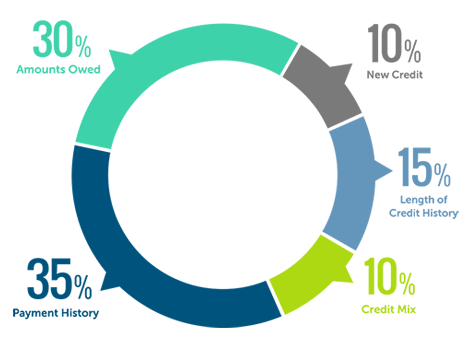

Credit Score Criteria

In Canada, credit scores are calculated based on various criteria and credit factors from an individual’s credit report. Credit reporting agencies, Equifax Canada and TransUnion Canada use specific algorithms to analyze credit data and generate credit scores. While the exact calculations are proprietary and not publicly disclosed, several key factors influence credit scores in Canada. These factors include:

Payment History (35%)

Payment history is one of the most significant factors affecting credit scores. It refers to how consistently individuals make their credit account payments on time. Timely payments positively impact credit scores, while late payments, delinquencies, or defaults can lower scores.

Amount Owed (30%)

Credit utilization measures the percentage of available credit that individuals are using. It is calculated by dividing the total credit card balances by the total credit card limits.

Credit History Length (15%)

The length of an individual’s credit history also influences credit scores. A longer credit history demonstrates a more extensive track record of credit management.

1.Credit Mix (10%)

Credit mix refers to the different types of credit accounts an individual has, such as credit cards, installment loans, mortgages, etc.

2.Recent Credit Inquiries (10%)

Credit inquiries are generated when individuals apply for new credit accounts. Each inquiry can have a minor, short-term impact on credit scores.

Credit Cards in Canada

A credit card allows you to borrow a pre-approved amount of money. It may help you pay for goods and services. When using a credit card, you must pay your minimum payment by the due date. If you don’t pay your balance in full, your credit card issuer usually charges an interest fee. Credit card issuers offer a variety of cards.

The key differences are:

- The Interest Rates

- The Fees

- The Rewards and Benefits

Comparing Credit Card Interest Rates

A credit card’s interest rate may be an important factor if you regularly carry a balance. A balance is the amount of money you owe on your credit card. The higher the interest rate, the more interest you’ll pay on an outstanding balance. A lower interest rate card may save you money over time.

The interest rate may not be an important factor in choosing a credit card if you:

- Pay Your Balance in Full Every Month

- Don’t Take Out Cash Advances

- Don’t Make Cash-Like Transactions

There are many credit cards with low-interest rates available. Some low-rate cards charge an annual fee. Even if there is a fee, a low-rate card may be a better option.

Comparing Credit Card Rewards and Benefits

Credit cards may offer rewards and benefits. When you use your card to make purchases, you may earn cash back or discounts on products and services. You may have to pay a fee for this type of card.

Before you choose a credit card for its rewards program or benefits, consider the following:

- The Impact of Carrying A Monthly Balance

- The Interests You’ll Pay

- The Frequency at Which You Expect to Use the Card’s Benefit

These factors may reduce the value of the card’s rewards or benefits.

Comparing Credit Card Fees

When you use a credit card, you may have to pay fees for services. These fees include taking out a cash advance or using your card in foreign countries. Different credit cards have different fees.

Annual Fees

Financial institutions may charge an annual fee for some of their credit cards. Usually, the charge will appear on your credit card statement once a year. Cards with an annual fee usually offer extra rewards and benefits or a lower interest rate.

Other Fees

You may also have to pay fees such as foreign currency charges, over-the-limit fees, reprinting charges for statements or receipts from previous transactions, dishonored payment fees, inactive account fees, and insurance fees, also known as premiums for credit card balance insurance.

Specialized Credit Cards in Canada

Depending on your credit history and spending habits, a specialized credit card may suit your needs.

Student Credit Cards

Some credit cards are made for students. These cards often have lower credit limits than standard credit cards. They may have benefits tailored to students, such as discounts at certain retailers.

S. dollar credit cards

A U.S. dollar credit card may work for you if you often purchase goods or services in U.S. dollars. With this type of credit card, you may avoid having to pay foreign currency conversion rates.

Retail credit cards

A retail credit card is a credit card that lets you earn rewards, such as discounts, at a specific retailer. Retailers often offer buy now, pay later plans with extended interest-free periods. They may also offer discounts or reward programs with in-store credit cards.

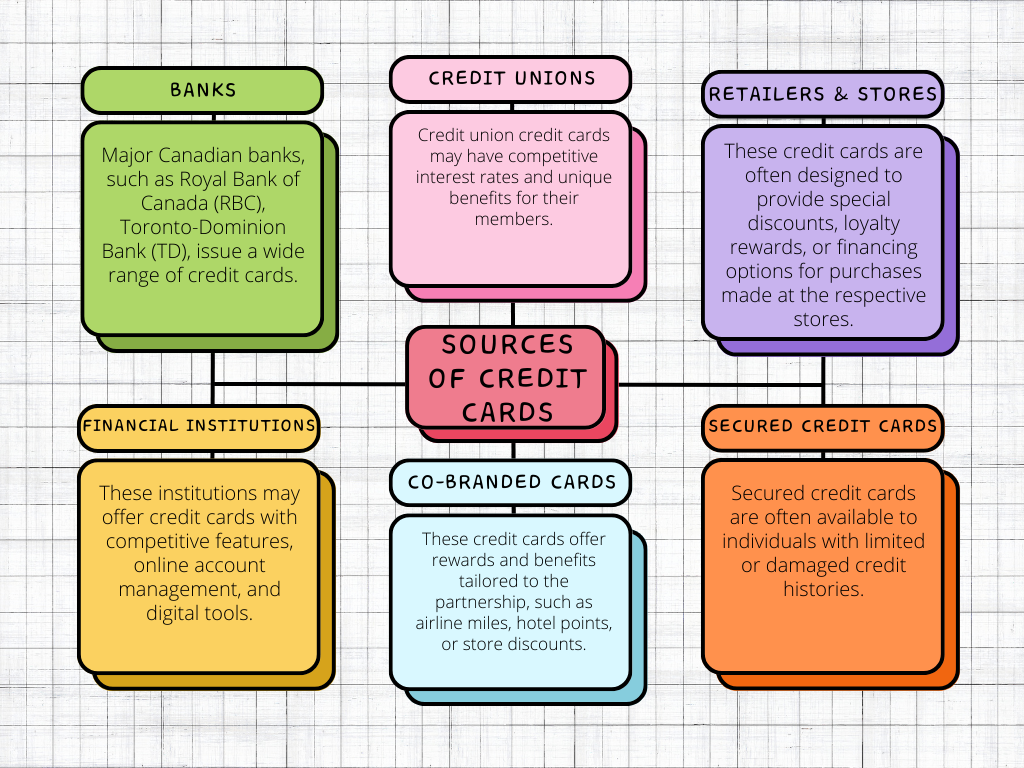

Sources of Credit Cards in Canada

In Canada, credit cards are typically issued by banks, credit unions, and other financial institutions. These financial institutions offer a variety of credit card options, each with its features, benefits, and eligibility requirements.

Here are the main sources of credit cards in Canada:

Before applying for a credit card, it’s essential to review the terms and conditions, including interest rates, annual fees, rewards programs, and any additional charges.

Sources of Credit Cards in Canada

In Canada, there are various types of loans available to meet different financial needs and circumstances. These loans can be obtained from banks, credit unions, online lenders, and other financial institutions.

1.Personal Loans

With a personal loan, you borrow a fixed amount of money and agree to pay it back over some time. You must pay back the full amount, interest, and any applicable fees. You do this by making regular payments, called installments. Personal loans are also called long-term financing plans, installment loans, and consumer loans.

Types of Personal Loans in Canada

Secured Loans

A secure personal loan uses an asset, such as your car, as a promise to your lender that you will pay back the loan. This asset is called collateral.

Unsecured Loans

An unsecured personal loan is a loan that doesn’t require collateral. If you don’t make your payments, the lender may sue you. They also have other options, such as the right of offset.

2.Payday Loans

A payday loan is a short-term loan with high fees that make it an expensive way to borrow money. It is also called a high-cost loan and high-cost credit. You may borrow up to $1,500 and you may have up to 62 days to pay it back.

3.Buy Now, Pay Later Plans

Many companies offer buy now, pay later (BNPL) plans for the purchase of products and services. With this plan, you’re financing your purchase with credit.

Types of BNPL

Equal Payment Plan

With an equal payment plan, you make regular payments. These are also called installment payments. The terms of your agreement set out the minimum amount you must pay and at what frequency. You make payments until you pay the full balance.

Deferred payment plan

In a deferred payment plan, you must pay the balance you owe by the due date. There are no set payment amounts. You manage your payment plan.

4.Rent-to-Own Plans

Many companies offer rent-to-own plans for purchases such as furniture, appliances, electronics, and cars. These plans are also called lease-to-own, rent-to-buy, option leases, and consumer leases. With this type of plan, you can spread the payment of your purchase over a predetermined period.

5.Title Loans

A title loan is an option for borrowing money if you have a low credit score and own a car or another vehicle. You use your car as a promise you’ll pay the money back. You keep and continue to use your car when you get a title loan. If you don’t make your payments, you could lose your car.

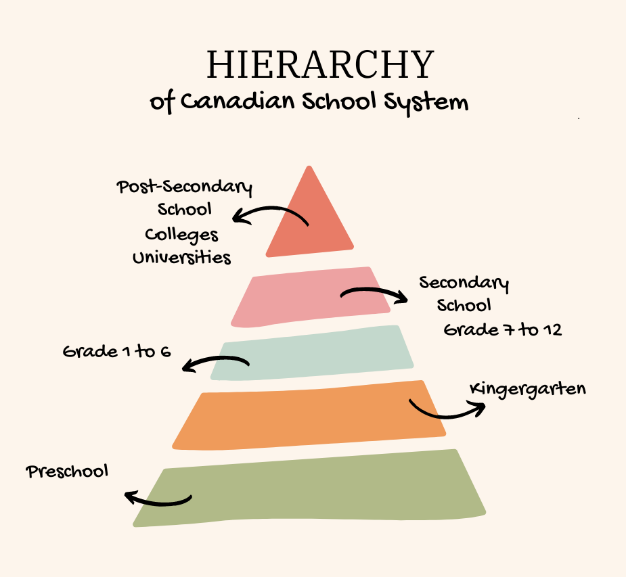

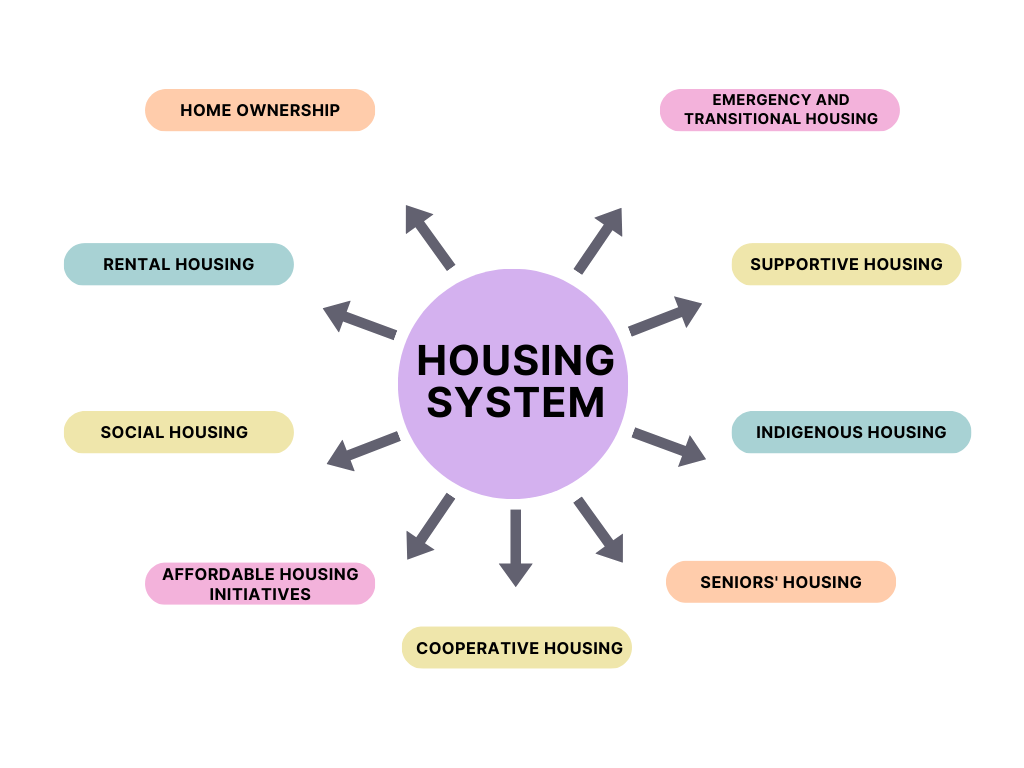

Canadian Education System

- Canadian School System Hierarchy

- Types of Schools in Canada

- Higher Studies in Canada

- Enrollment Overview

Education in Canada is primarily the responsibility of the provinces and territories, resulting in some variations in the structure and curriculum across the country. In Canada, it’s the law that children go to school. Depending on the province or territory, they can start primary school as young as 4 years old and finish secondary school when they’re 18 years old.

- Primary (or Elementary) School

- Secondary School

- Post-Secondary

Primary (or Elementary) School

Primary education is generally for kids 5 to 12 years old. This usually includes.

1.Preschool (optional)

2.Kindergarten

3.Grades 1 to 6

Canadian primary schools strive to provide inclusive education, catering to students with diverse learning needs and abilities. The education system in Canada is decentralized, with each province and territory having its education department responsible for setting curriculum guidelines and standards.

Secondary School

Grades 7 to 12

The secondary education system in Canada, commonly referred to as high school, typically covers grades 7 to 12 (ages 12 to 18). The final year of high school is often referred to as Grade 12 or senior year. Secondary schools in Canada aim to provide inclusive education, offering support and accommodations for students with diverse learning needs and abilities.

Post-Secondary

In Canada, there are 3 different types of post-secondary schools.

1.Colleges

2.Institutes

3.Universities

Colleges & Institutes

Colleges and institutes usually offer shorter programs than universities (1 to 3 years). Instead of degrees, they issue diplomas and certificates that qualify graduates to do specific jobs in different industries. Many colleges are also starting to offer bachelor’s degrees and master’s degrees in certain industries.

There are many types of colleges and institutes recognized by provinces and territories, including.

- Community Colleges

- Colleges of Applied Arts or Applied Technology

- Institutes of Technology or Science

- Collèges d’enseignement général et professionnel (CEGEPs) in Quebec

- Career Colleges

Universities

Universities offer programs on a wide range of topics at different levels of difficulty and complexity. When you complete a university program, you’re awarded a university degree that reflects the type of program you completed.

There are 3 types of degrees.

- Bachelor’s degree: This is the simplest degree offered by Canadian universities. It typically takes 3 to 4 years to complete.

- Master’s degree: This is a more advanced degree that usually takes 1 to 3 extra years of study after you get a bachelor’s degree.

- Doctoral degree: This is the most advanced degree offered by Canadian universities. It can take another 3 to 4 more years of study and research following a master’s degree.

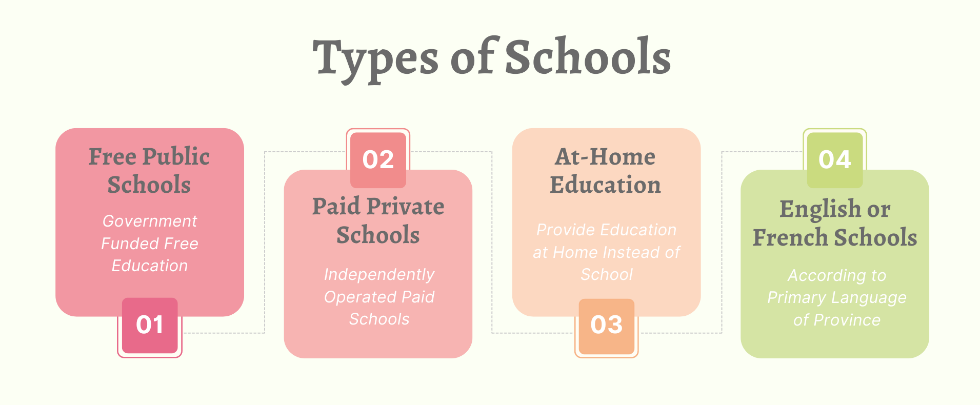

Types of Schools:

As a parent or guardian, it’s up to you to choose a school system. Depending on where you live, your options may include.

- Free Public Schools

- Paid Private Schools

- At-Home Education

- English or French Schools

Free Public Schools

Public schools are government-funded institutions that provide free education to Canadian residents. They follow the provincial or territorial curriculum and are open to all students within the designated catchment area.

Paid Private Schools

Private schools are independently operated and funded by tuition fees, donations, or endowments. They may offer alternative curricula, religious education, or specialized programs not available in public schools.

Private schools have the freedom to set their admission requirements and may focus on specific teaching methods or philosophies.

At-Home Education

Homeschooling involves parents or guardians providing education to their children at home instead of sending them to a traditional school. Homeschooling regulations vary by province and territory.

English or French Schools

In Canada, the choice between English and French schools largely depends on the province or territory in which you reside. English and French are the two official languages of Canada, and each province and territory has its language education policies.

In most provinces and territories, English is the primary language of instruction in schools. In English Schools, the curriculum and teaching materials are in English.

In some provinces, particularly Quebec and parts of New Brunswick, French is the primary language of instruction in schools.

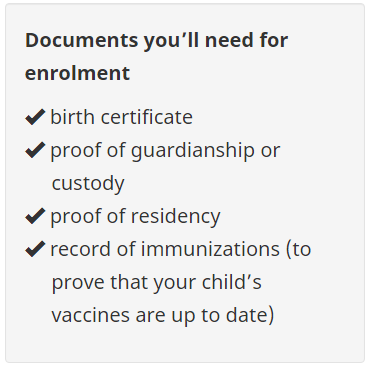

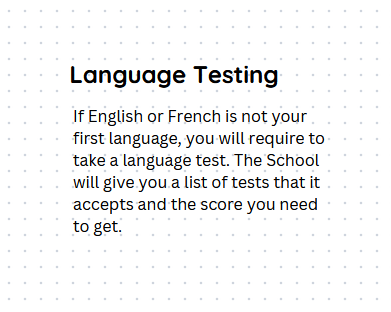

Enrollment

In Canada, you have to apply or enroll in a school depending on the level of school you’re interested in and where you live. It is typically managed by the respective provincial or territorial education departments.

Enroll in Primary (or Elementary) and Secondary (or High) Schools

Parents or legal guardians of school-age children typically need to register their child at their local public school, based on their residential address.

Apply to a Post-Secondary School