መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » ደቡብ አፍሪካ

Brief History of South Africa

- History of South Africa

- Hierarchical structure

- The Constitution of South Africa

- Federal Government

- Provincial Government

- Election

History of South Africa

Over a hundred thousand years ago people in what is now South Africa lived by hunting animals and gathering plants. They used stone tools. Then about 2,000 years ago people in the west learned to herd sheep and cattle. About 200 AD people mixed farming (growing crops as well as raising livestock) and iron tools were introduced into the east of South Africa.

At the end of the 15th Century, the Portuguese sailed past the Cape of Good Hope. However, it was not until 1652 that the Europeans founded a colony in South Africa. In 1652 the Dutch, led by Jan van Riebeeck founded a base where ships traveling to the Far East could be supplied. From 1658 the Dutch imported slaves into South Africa. Meanwhile, at first, the Europeans traded with the native people, but they soon fell out. In 1658 they fought their first war, the first of many.

Gradually the Dutch colony in South Africa expanded and in 1688 French Huguenots (Protestants) arrived fleeing religious persecution. Slowly the native people were driven from their land and in 1713 many died in a smallpox epidemic.

British South Africa: In 1795 the British captured Cape Colony (South Africa). They handed it back to the Dutch in 1803 but took it again in 1806. In 1814 a treaty confirmed British ownership of Cape Colony. In 1812 the British founded Grahamstown and in 1820 4,000 Britons were granted land by the Great Fish River.

The Boers (Dutch settlers) in South Africa resented British rule. When slavery was abolished in 18344, they were antagonized still more. Finally, the Boers began a mass migration away from the British called the Great Trek. In 1838 the Boers fought and defeated the Zulus at the Battle of Blood River. Eventually, the Boers founded two republics away from the British, Orange Free State, and Transvaal. In the 1850s the British recognized the two Boer republics.

However, the situation changed in 1867 when diamonds were found in the Northern Cape. In 1871 diamonds were also found at Kimberley. Gold was discovered at Gauteng in 1886.

Meanwhile, in 1879, the British fought the Zulus in South Africa. The British were badly defeated by the Zulus at the Isandhlwana but they went on to win the war.

Increasingly the British were keen to bring all South Africa, including the Boer republics under their control. In 1884 Lesotho became a British protectorate. In 1894 the Kingdom of Swaziland became a protectorate.

Meanwhile, British settlers had moved into the Transvaal Republic. The Boers called them Uitlanders (foreigners). Cecil Rhodes was Prime Minister of British South Africa from 1890 to 1895 and in 1895 he plotted a rebellion by Uitlanders in the Transvaal, which would be supported by a force from South Africa led by Leander Starr Jameson. The aim was to overthrow the government of Paul Kruger, President of the Transvaal.

However, the Jameson Raid of January 1896 was defeated by the Boers and Jameson himself was captured. The two Boer republics formed an alliance and hostility between them, and the British grew.

Finally in October 1899 war began in South Africa between the Boers and the British. At first, the Boers were successful but in 1900 more British troops arrived and the Boers were pushed back. The Boers then turned to guerrilla warfare. However, Kitchener, the British commander began herding Boer women and children into concentration camps where more than 20,000 of them died of disease.

20th Century South Africa: The Boers finally surrendered in 1902 and the British annexed the Boer republics. In 1910 a United South Africa was given a constitution. It became known as the Union of South Africa.

From the start, black people were very much second-class citizens in South Africa. Most lived in tribal reserves and the laws of 1913 and 1936 prevented them from owning land outside certain areas. Most blacks were not allowed to vote. In 1912 black South Africans founded the South African National Congress (later the ANC) but at first, they achieved little.

In 1914 South Africa joined the First World War against Germany. That year there was a rebellion by the Boers, which was crushed. In 1918 Afrikaners (descendants of Dutch settlers) founded a secret organization called the Broederbond (brotherhood).

In 1939 South Africa joined the Second World War against Germany. However, some Afrikaners opposed this decision.

In 1948 the National Party came to power in South Africa. The party introduced a strict policy of apartheid (separateness). Whites and blacks were already segregated to a large degree. New laws made segregation much stricter.

However, in 1955 organizations representing black people, white people, coloreds, and Indians formed the Congress Alliance. In 1955 they adopted the Freedom Charter. Yet divisions soon occurred. In 1958 some black South Africans broke away from the ANC and they formed the Pan Africanist Congress or PAC. They were led by Robert Sobukwe.

In 1960 both the ANC and the PAC planned demonstrations against the pass laws, which restricted the movements of black people. On 21 March 1960, Sobukwe led thousands of people in a demonstration. In Sharpeville, the police fired at them killing 69. The government banned the ANC and the PAC. And in 1963 Nelson Mandela was sentenced to life imprisonment.

Meanwhile, in 1961 South Africa left the Commonwealth and became a republic.

In 1966 Prime Minister Hendrik Verwoerd was assassinated but otherwise, South Africa was quiet until 1976, although naturally, black resentment continued to simmer below the surface. n Rioting began in Soweto on 16 June 1976. The riots spread and they continued into 1977.

In 1978 P. W. Botha became prime minister. He was determined to continue apartheid and in 1983 he introduced a new constitution with a tricameral parliament, with houses for whites, coloreds, and Indians (with no representation for blacks). However, the new constitution pleased nobody. Meanwhile, other countries were increasingly imposing economic sanctions on South Africa and inside the country resistance to apartheid grew. In 1989 Botha was forced from office.

He was replaced by Willem de Klerk who in 1990 pledged to end apartheid. He also released Nelson Mandela. De Klerk introduced a new constitution with rights for all. The first democratic elections were held in April 1994 and in May 1994 Nelson Mandela was elected president. He retired in 1999.

21st Century South Africa: In the early 21st century the economy of South Africa grew but recently it has slowed. South Africa suffers from high unemployment. The country also suffers from widespread poverty. However, tourism in South Africa is an important industry. South Africa is also rich in minerals. In 2020 the population of South Africa was 59 million.

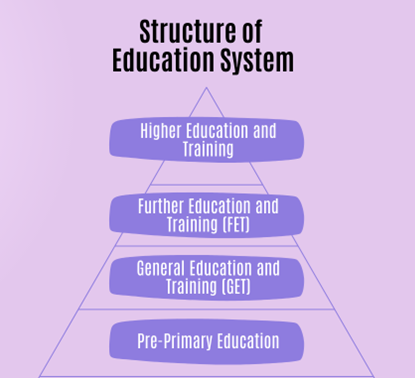

Hierarchical structure of the South Africa

South Africa is a constitutional democracy with a three-tier system of government and an independent judiciary. The national, provincial, and local levels of government all have legislative and executive authority in their spheres and are defined in the Constitution as distinctive, interdependent, and interrelated.

South Africa has a hierarchical structure of government and administration, which is based on a democratic system of governance. The country’s political structure can be divided into several levels, each with its own set of responsibilities and authorities.

Operating at both national and provincial levels are advisory bodies drawn from South Africa’s traditional leaders. It is a stated intention in the Constitution that the country be run on a system of cooperative governance. The government is committed to the building of a free, non-racial, non-sexist, democratic, united, and successful South Africa.

Executive Branch: The Executive Branch of the South African government holds a pivotal position within the country’s hierarchical structure. At its helm is the President, who serves as both the head of state and government. The President is elected by the National Assembly and plays a central role in shaping and implementing national policies. The Executive Branch includes various ministries and government departments, each headed by a minister appointed by the President. These ministries are responsible for specific areas of governance, such as finance, education, health, and defense. The Executive Branch wields executive powers, and it is tasked with executing and enforcing the laws passed by the legislature. It is also responsible for managing the day-to-day affairs of the nation, addressing domestic and international issues, and overseeing the implementation of government programs. As the highest level of government authority, the Executive Branch plays a crucial role in ensuring the effective functioning of the South African state and the delivery of essential services to its citizens.

Legislative Branch: In the hierarchical structure of the South African government at the federal level, the Legislative Branch is primarily embodied by the National Assembly and the National Council of Provinces (NCOP), both of which play integral roles in the legislative process of the country. The National Assembly, as the lower house of Parliament, consists of Members of Parliament (MPs) elected by the citizens through proportional representation. It holds the key responsibility of formulating and passing national legislation, as well as overseeing the activities of the executive branch. The National Council of Provinces, on the other hand, represents the interests of South Africa’s nine provinces and ensures that provincial concerns are considered in the national legislative process. This dual legislative structure, along with its adherence to democratic principles, facilitates a system of checks and balances in federal governance, allowing for the equitable representation of both national and provincial interests in the legislative decision-making process.

Judicial branch: In the hierarchical structure of the South African government at the federal level, the judicial branch occupies a pivotal role as an independent and impartial arbiter of the law. At the pinnacle of this hierarchy is the Constitutional Court, the highest judicial authority in the country, tasked with ensuring the constitutionality of all laws and government actions. Below it are the Supreme Court of Appeal and the High Courts, which handle appeals and cases of significant legal consequence. Judges in these courts are appointed based on their legal expertise and experience and are tasked with interpreting and applying the law fairly and consistently. The judiciary plays a crucial role in upholding the rule of law, safeguarding individual rights, and ensuring justice for all South Africans. Its independence from the executive and legislative branches is a cornerstone of South Africa’s democratic system, serving as a check on government power and contributing to the country’s commitment to the principles of constitutional democracy.

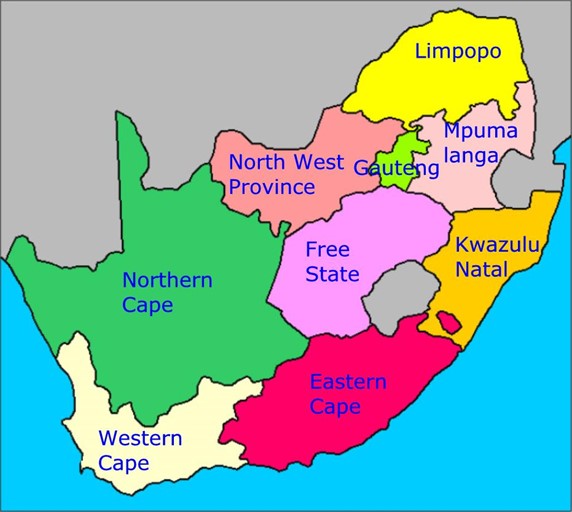

Province Level: South Africa is divided into nine provinces, each with its own provincial government and administrative structure. The hierarchical structure of South Africa at the province level typically follows a similar pattern across all provinces, with some variations in specific roles and responsibilities. Here’s an overview of the hierarchical structure at the provincial level in South Africa:

Premier: At the top of the provincial hierarchy is the Premier. The Premier is the head of the provincial government and is typically the leader of the political party that has the majority in the provincial legislature. The Premier is responsible for overseeing the administration of the province, representing the province at the national level, and setting the policy direction for the province.

Executive Council (Cabinet): The Executive Council, often referred to as the Provincial Cabinet, consists of Members of the Executive Council (MECs) appointed by the Premier. Each MEC is responsible for a specific portfolio, such as education, health, finance, or public works. The Executive Council assists the Premier in making decisions and implementing policies at the provincial level. It plays a crucial role in managing provincial affairs.

Provincial Legislature: The Provincial Legislature is the legislative body at the provincial level. It is responsible for making laws and regulations that pertain to the province. The legislature consists of Members of the Provincial Legislature (MPLs) who are elected by the citizens of the province during provincial elections. The number of MPLs in each province depends on the province’s population.

Speaker of the Provincial Legislature: The Speaker is responsible for presiding over the proceedings of the Provincial Legislature. They ensure that debates are conducted orderly and that legislative processes are followed.

Standing Committees: Within the Provincial Legislature, there are various standing committees responsible for specific areas of governance, such as finance, education, health, and public works. These committees review and scrutinize proposed legislation and government actions related to their respective areas.

Provincial Departments: Each provincial government is divided into various departments, each headed by an MEC. These departments oversee the implementation of government policies and provide public services in areas such as health, education, transportation, and social services. Departments are further divided into units or directorates responsible for specific functions within the department.

Municipalities: Provinces are further divided into municipalities, which are responsible for local government and the delivery of essential services to communities. Municipalities have their municipal councils and mayors. Municipalities are organized hierarchically with local councils, municipal managers, and various municipal departments responsible for services like water, sanitation, and local infrastructure.

The Constitution

South Africa’s Constitution is one of the most progressive in the world and enjoys high acclaim internationally. Human rights are given clear prominence in the Constitution. The Constitution of the Republic of South Africa, 1996 was approved by the Constitutional Court on 4 December 1996 and took effect on 4 February 1997. The Constitution is the supreme law of the land. No other law or government action can supersede the provisions of the Constitution.

The Preamble: The Preamble states that the Constitution aims to heal the divisions of the past and establish a society based on democratic values, social justice, and fundamental human rights, improve the quality of life of all citizens, and free the potential of each person, lay the foundations for a democratic and open society in which government is based on the will of the people, and in which every citizen is equally protected by law, and build a united and democratic South Africa that can take its rightful place as a sovereign state in the family of nations.

Founding provisions: South Africa is a sovereign and democratic state founded on the values of human dignity, the achievement of equality, the advancement of human rights and freedom, non-racialism, and non-sexism, the supremacy of the Constitution, and universal adult suffrage, a national common voters’ roll, regular elections, and a multiparty system of democratic government to ensure accountability, responsiveness, and openness.

Fundamental rights: The fundamental rights contained in Chapter 2 of the Constitution seek to protect the rights and freedom of individuals. The Constitutional Court guards these rights and determines whether actions by the state are by constitutional provisions.

Amendments: South Africa’s constitution, adopted in 1996, has been amended 18 times. These amendments have been made to address various issues and adapt the constitution to changing circumstances. Some of the key amendments include changes related to the structure of government, the powers of provincial governments, and provisions concerning land reform and property rights. Notably, many of the amendments have aimed to enhance the protection of human rights and promote social justice, reflecting South Africa’s commitment to a democratic and inclusive society. Amendments to the constitution are made through a deliberate and transparent process, often involving public consultation and the approval of Parliament, ensuring that the document remains a living instrument capable of addressing the evolving needs and challenges of the nation.

Federal Government

Executive Branch: The executive on a national level consists of the President, the Deputy President, ministers, and deputy ministers. On a provincial level, the executive branch consists of the Premier and Members of the Executive Council (MECs) — think of them as provincial ministers. The executive is empowered to develop and implement national policy and coordinate the functions of government. The executive also has the power to propose changes to existing legislation and initiate new policies. The Executive Branch includes various ministries and government departments, each headed by a minister appointed by the President. These ministries are responsible for specific areas of governance, such as finance, education, health, and defense.

Legislative branch: The Parliament of the Republic of South Africa is South Africa‘s legislature; under the present Constitution of South Africa, the bicameral Parliament comprises a National Assembly and a National Council of Provinces. The current twenty-seventh Parliament was first convened on 22 May 2019. From 1910 to 1994, members of Parliament were elected chiefly by the South African white minority. The first elections with universal suffrage were held in 1994. Both chambers held their meetings in the Houses of Parliament, Cape Town which were built 1875–1884. The National Council of Provinces, on the other hand, represents the interests of South Africa’s nine provinces and ensures that provincial concerns are considered in the national legislative process. This dual legislative structure, along with its adherence to democratic principles, facilitates a system of checks and balances in federal governance, allowing for the equitable representation of both national and provincial interests in the legislative decision-making process.

Judicial branch: The third branch of the national government is an independent judiciary. The judicial branch interprets the laws, using as a basis the laws as enacted and explanatory statements made in the Legislature during the enactment. The legal system is based on Roman-Dutch law and English common law and accepts compulsory ICJ jurisdiction, with reservations. The Constitution’s Bill of Rights provides for due process including the right to a fair, public trial within a reasonable time. The judiciary plays a crucial role in upholding the rule of law, safeguarding individual rights, and ensuring justice for all South Africans. Its independence from the executive and legislative branches is a cornerstone of South Africa’s democratic system, serving as a check on government power and contributing to the country’s commitment to the principles of constitutional democracy.

Provincial government

South Africa is divided into nine provinces, each of which has its provincial government. The provincial government structure in South Africa is outlined in the country’s constitution and follows a similar framework across all provinces. Here’s an overview of how the provincial government structure is organized in South Africa:

Premier: Each province is led by a Premier who is the head of the provincial government. The Premier is typically the leader of the political party that holds the majority in the provincial legislature, and they are responsible for appointing members of the provincial executive council.

Provincial Legislature: The provincial legislature is the legislative body in each province and is responsible for making and passing laws specific to that province. The number of members in a provincial legislature is determined by the population of the province, with each province having a different number of seats. Members of the provincial legislature (MPLs) are elected by the citizens of the province through a proportional representation system in general elections.

Provincial Executive Council (PEC): The PEC, also known as the provincial cabinet, is composed of Members of the Executive Council (MECs) appointed by the Premier. Each MEC is responsible for a specific portfolio or department, such as education, health, finance, and transportation. The PEC is collectively responsible for implementing and overseeing provincial government policies and programs.

Provincial Departments: The provincial government is divided into various departments, each responsible for a specific area of public policy and administration. These departments handle various functions such as education, health, social development, agriculture, public works, and more. Heads of provincial departments (HODs) are responsible for managing the day-to-day operations of their respective departments.

Provincial Budget: The provincial government is responsible for managing its budget, which is allocated from the national government’s revenue. The provincial legislature plays a crucial role in approving the provincial budget, which is then managed and executed by the provincial departments under the guidance of the PEC.

Provincial Powers and Responsibilities: Provinces have legislative authority in certain areas specified in the Constitution, such as education, health, agriculture, and housing. They also have the power to levy certain taxes and generate revenue for provincial services. The provincial government works in collaboration with national and local governments to provide essential services to citizens within its jurisdiction.

It’s important to note that while provinces have a degree of autonomy and control over certain policy areas, the national government in South Africa still retains significant authority and responsibilities, including matters related to defense, foreign affairs, and national economic policy. The provincial government structure is designed to ensure decentralized governance and responsiveness to the needs of the local population.

South Africa’s electoral system

National and provincial elections: In South Africa, we use a PR system to vote for parliament and provincial legislatures. Parliament has 400 seats and each of the nine provincial legislatures has between 30 and 90 seats depending on the number of people who live in the province. Provincial and national elections are held together and must take place every five years. Voters vote for the national and provincial legislatures on separate ballot papers.

The elections are run by an Independent Electoral Commission (IEC) which administers every part of the elections to ensure that they are free and fair. All registered political parties are represented on a Party Liaison Committee that gives advice to and gets information from the IEC

Before the elections, political parties draw up a list of candidates for each of the legislatures they wish to contest. For the national assembly, parties can submit half their candidates on a national list and half on provincial lists. When the results are announced the IEC works out how many people from each party list should take up seats in the legislatures.

Local elections (municipal): There are three different categories of municipalities in South Africa, and they have slightly different electoral systems.

Metropolitan municipalities (Category A): Metropolitan municipalities exist in the six biggest cities in South Africa. They have more than 500 000 voters and the metropolitan municipality co-ordinates the delivery of services to the whole area. There are metropolitan municipalities in Johannesburg, Cape Town, Ethekweni (Durban), Tshwane (Pretoria), Nelson Mandela (Port Elizabeth) and the Ekhuruleni (East Rand). These municipalities are broken into wards. Half the councilors are elected through a proportional representation ballot, where voters vote for a party. The other half are elected as ward councilors by the residents in each ward.

Local municipalities (Category B): Areas that fall outside of the six metropolitan municipal areas are divided into local municipalities. There is a total of 231 of these local municipalities and each municipality is broken into wards. The residents in each ward are represented by a ward councilor. Voters in these municipalities also vote for district councils. Half the local councilors are elected through a proportional representation ballot, where voters vote for a party. The other half are elected as ward councilors by the residents in each ward. Only people who live in low-population areas, like game parks, do not fall under local municipalities. The areas are called district management areas (DMA) and fall directly under the district municipality.

District municipalities (Category C): District municipalities are made up of several local municipalities that fall in one district. There are usually between 4 – 6 local municipalities that come together in a district council and there are 47 district municipalities in South Africa. The district municipality must coordinate development and delivery in the whole district. The district council is made up of two types of councilors:

Elected councilors: They are elected to the district council on a proportional representation ballot by all voters in the area. (40% of the district councilors)

Councilors: who represent local municipalities in the area are local councilors sent by their council to represent it on the district council. (60% of the district councilors)

Who can vote? All South African citizens over the age of 18 who are registered voters are allowed to vote in elections. You need an ID book to vote. Voters are registered to a particular voting district and in local elections may only vote at the voting station in that district. For national and provincial elections voters should still vote where they are registered, but in some cases are allowed to vote outside the voting district if they have proof that they are registered.

Voter registration: South Africa is divided into about 19,000 voting districts, each with its voting station. To vote, you must be on the voter’s roll for your voting district.

Registration works like this:

- You need a green ID book with a bar code (issued after 1986) or a temporary ID document.

- Go to the voting station on a public registration day (or the municipal office on a normal working day) and fill in a form to show that you live in the area.

- A special machine (Zip–Zip) will be available in each voting district it can read the bar code in your ID book and automatically record the correct information about your name and ID number for the voter’s roll.

- The machine also prints a sticker that will be pasted in your ID book to show that you have registered at that voting station.

The IEC has the whole voters roll on one national computer and when you register the computer will check if your ID number already appears somewhere else. If it does, the computer will automatically cancel your registration at your old voting district and only accept the latest registration.

The rights of voters and political parties

- Voters have the right to a secret vote – No one may know who you voted for.

- Voters have the right to choose, no one may force, intimidate, or bribe a voter to vote or not vote for a party.

- Voters have the right to vote, no one may stop you from voting by forcing you to work or by preventing you from getting to the voting station.

- Voters have a right to get information from parties one may stop parties or candidates from reaching voters.

Political parties and their candidates are bound by the Electoral Code of Conduct which forms part of the Electoral Act. Political parties that break the Code can be fined, stopped from working in an area, or have their votes in an area canceled. An individual who breaks the Code or commits other offenses under the Electoral Act can be fined or jailed.

Political parties

The African Christian Democratic Party: The African Christian Democratic Party is a South African political party founded in 1993. It aspires to bring ‘stability, prosperity, and hope’ to the nation and values ‘unity with diversity’, offering leadership of trust and integrity with a passionate commitment to addressing the needs of all the people of South Africa. The African Christian Democratic Party brings to South Africa hope for a strong, healthy prosperous, and purpose-driven nation. It is a political party standing for Christian Democratic principles and recognizes that vibrant, healthy families are the building blocks of a strong, value-based society. The ACDP stands for a ‘shared future’ and is determined to provide reliable, trustworthy leaders who are passionate about addressing the needs and improving the lives of all South Africans. We value unity and diversity and are committed to protecting freedom of religion and family integrity. The ACDP is your hope for a great future.

The Al Jama-ah Political Party: The Al Jama-ah Political Party was established in 2007 by its Party Leader, Ganief Hendricks, that instead of finger-pointing, Muslims could play a sincere and positive role, contributing to the transformation of post-Apartheid South Africa, for the benefit of all South Africans. The Constitution of South Africa supports the system of a multi-party democracy, as opposed to a single-party state. According to The African Peer Review Mechanism (APRM), the domination of one political party in South Africa will be detrimental to freedom in South Africa. What is best for South Africa is a diversity of political parties with competing policies.

African National Congress: The African National Congress(ANC) is a national liberation movement. It was formed in 1912 to unite the African people and spearhead the fundamental political, social, and economic change struggle. For ten decades the ANC has led the struggle against racism and oppression, organizing mass resistance, mobilizing the international community, and taking up the armed struggle against apartheid. The ANC achieved a decisive democratic breakthrough in the 1994 elections, where it was given a firm mandate to negotiate a new democratic Constitution for South Africa. The new Constitution was adopted in 1996. The ANC was re-elected in 1999 to national and provincial governments with an increased mandate. The policies of the ANC are determined by its membership and its leadership is accountable to the membership.

Economic Freedom Fighters: The Economic Freedom Fighters (EFF) is a radical and militant economic emancipation movement, formed in the year 2013 to bring together revolutionary, militant activists, community-based organizations as well as lobby groups under the umbrella of the political party pursuing the struggle of economic emancipation.

Inkatha Freedom Party (IFP): The IFP has three key values. These are Solidarity, Freedom, and Unity in Diversity. They are all interconnected. Each is associated with other, secondary values. In our service to the people, the IFP will stand by those affected by poverty, unemployment, abuse, crime, violence, discrimination, and other social ills. South Africa has an enormous number of people who left to the exigencies of the market or a minimalist state, would suffer even more severe depredations than those that fate has bestowed upon them. The IFP will not stand aloof as our people suffer but will work with them, assisting in an expression of compassion and fraternity.

Immigration System of South Africa

- Immigration Overview

- Types of Immigration

- Asylum

- The Asylum Process

South African Immigration Overview

Immigration in the South African context involves the movement of individuals from other countries to South Africa to establish permanent or semi-permanent residence. South Africa, with its diverse culture, economy, and natural beauty, is a popular destination for immigrants from various African and non-African countries. Here are the major elements and factors associated with immigration in South Africa:

Push and Pull Factors: Like other countries, immigration to South Africa is driven by push and pull factors. Push factors from the immigrants’ home countries may include political instability, economic hardship, conflict, and persecution. Pull factors in South Africa include better job opportunities, a relatively stable political environment, access to social services, and the country’s natural beauty.

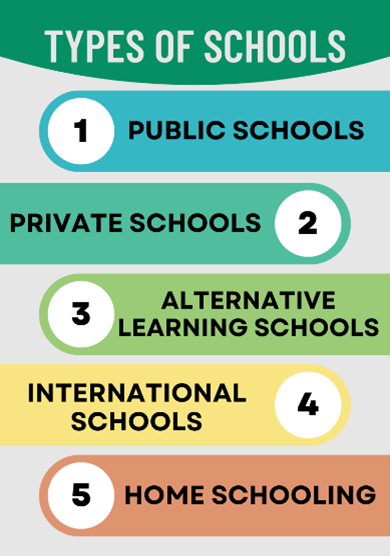

Immigrant Categories: South Africa hosts a diverse range of immigrant categories, including economic migrants and individuals seeking better job prospects and economic opportunities in sectors like mining, agriculture, and services. People fleeing violence, persecution, and conflict in their home countries often seek asylum in South Africa. Immigrants who come to join family members already residing in the country. South Africa is a destination for students pursuing higher education. Some immigrants come to invest in businesses in South Africa, contributing to economic growth.

Immigration Policies: South Africa has immigration policies and laws that regulate who can enter and stay in the country. These policies include visa requirements, work permits, and regulations specific to different immigrant categories.

Visas and Documentation: Immigrants typically need visas and documentation to enter and reside legally in South Africa. The type of visa required depends on the immigrant category and the purpose of their stay.

Integration: Successful immigration in South Africa often involves the process of integration, where immigrants adapt to the local culture, learn languages like English and one or more of South Africa’s official languages, and contribute to the economy and society.

Economic Impact: Immigrants can contribute to South Africa’s economy by filling labor gaps, investing in businesses, and contributing to innovation. However, immigration can also be a source of competition for jobs and resources, leading to social and economic tensions.

Social and Cultural Impact: Immigration in South Africa has enriched the country’s cultural diversity but has also posed challenges related to cultural assimilation, language barriers, and social cohesion.

Security and Border Control: like many countries, South Africa has measures in place to control its borders and ensure the security of its citizens. These measures include border control agencies, immigration enforcement, and efforts to combat human trafficking and illegal immigration.

Humanitarian Considerations: South Africa is a signatory to international conventions on refugees and asylum seekers, which means the government has obligations to provide protection and assistance to those in need.

Public Opinion and Politics: Immigration is a contentious issue in South Africa, and public opinion and government policies can vary. Immigration often features prominently in political discourse and can influence elections and policy decisions.

Xenophobia: South Africa has experienced incidents of xenophobia, where foreign nationals have been targeted in violence and discrimination. These incidents underscore the need for addressing social tensions and fostering inclusivity.

Global Migration Trends: South Africa’s immigration patterns are influenced by global trends, including regional conflicts, economic developments, and climate change.

In summary, immigration in the South African context is shaped by a combination of factors, including economic, political, social, and humanitarian considerations. South Africa needs to have effective immigration policies that balance the country’s economic and humanitarian interests while addressing social and cultural challenges.

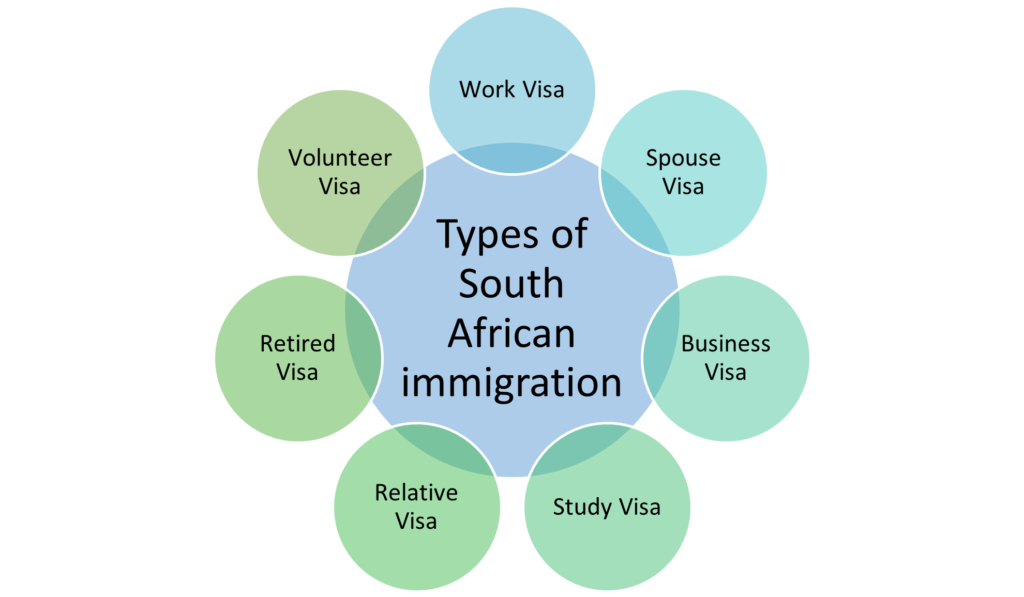

Immigration Types

Immigration to South Africa means applying for a visa. These visas and permits are issued by the Department of Home Affairs for immigrants seeking Immigration to South Africa. The type of immigration permit or visa, that immigrants should apply for is dictated by the activity they wish to undertake when they relocate to South Africa. Below are introductions to the main different types of permits and visas that can be applied for when seeking Immigration to South Africa.

Work Visa: There are four work visas provided for by the South African Immigration Act Critical skills work visa, In this visa, You must have a job offer, your occupation must appear on South Africa’s critical skills list, and you must register with the relevant professional body. In a General work visa, You must have a formal job offer to apply and your future employer must be able to prove that they could not find a suitable South African resident or citizen to fill the position. Intra-company transfer work visa is to transfer employees from an overseas company to a South African branch, affiliate, or subsidiary. In a Corporate visa, the application process starts with a company that wants to employ a large number of employees for an extended period.

Spouse Visa: Spousal permits/visas for immigration to South Africa are issued in the case of a husband or wife of a South African citizen or permanent residence holder wishing to immigrate to South Africa. A spousal visa is a temporary visa that is normally issued for 2 to 3 years, whereas a spousal permit is for permanent residency that allows for an indefinite stay in South Africa. As with most applications to the Department of Home Affairs; various documents need to be completed and supporting evidence supplied. One of the main items is the proof that the marriage is valid; this is achieved simply by submitting the marriage certificate as part of the application.

Business visa: A business visa in South Africa can be applied for by those seeking temporary and /or permanent residency in the Republic and wishing to set up and run their own business. The business can be a start-up, a purchased company, or a partnership. All the normal eligibility criteria apply to a business visa application but in addition, prospective applicants should be aware of The need for a capital equivalent or cash investment of at least ZAR 5 million into the business via funds from abroad; the need for 60% of your workforce to be South African citizens or permanent residency holders; and should also be aware of the setting up of a suitable company structure and comprehensive business plan.

Study Visa: The study visa for South African immigrants serves as a critical gateway for international students seeking to pursue educational opportunities within the country’s diverse and vibrant academic landscape. South Africa, with its world-class universities and institutions, has become an increasingly popular destination for students from various corners of the globe. This visa category allows foreign nationals to enroll in accredited educational programs, ranging from undergraduate to postgraduate levels and offers them the chance to immerse themselves in South Africa’s rich cultural tapestry. The study visa not only provides access to quality education but also fosters cross-cultural exchanges, contributing to the nation’s intellectual and social growth. It plays a pivotal role in attracting international talent and building global partnerships, positioning South Africa as an educational hub on the African continent and beyond.

Relative Visa: The South African Immigration Act allows applications for permanent residence from those who have a first-kin relationship with either a South African Permanent Resident or Citizen. This category of permit is known as a relative’s permit. The regulations that govern the relatives permit define a first-kin relationship as Parent and Child. Therefore, an immigration application, under the relatives permit can be made by the Child of a South African citizen or permanent residence holder or Parent of a South African citizen or permanent residence holder.

Retired Visa: A retired permit, visa, as a means of immigration to South Africa, is granted to immigrants wishing to spend their retirement years in South Africa. For immigration to South Africa, under the category of a retired permit, the criteria are based on the premise that the immigrant is not looking to work, study, or carry out their own business. As with all permit applications and visa applications associated with immigration to South Africa, several criteria must be satisfied including that there are no age restrictions on a retired persons permit, either for a minimum age or maximum, Applications for retired person permits can be made under the temporary and permanent categories, Both income and capital can be used when a temporary or permanent retired person permit is being applied for and Pension, retirement or an irrevocable annuity and other lifetime guaranteed income can be utilized when applying for a Permanent Residency in the Retired Persons category.

Volunteer visas: Volunteer visas are required for all foreigners who wish to take up non-remunerative or charitable activities with bona fide institutions within South Africa. Amongst the requirements applicants will need to provide a statement confirming the purpose and duration of the visit, Proof of sufficient financial means, and In the case of a sojourn not exceeding 12 months, submission of proof of a valid return air ticket.

Asylum

Asylum is a legal status and protection granted by a country to individuals who have fled their home countries due to a well-founded fear of persecution based on factors such as their race, religion, nationality, political opinion, or membership in a particular social group. Asylum allows these individuals to seek refuge and protection in another country, as they are unable or unwilling to return to their home country due to the fear of persecution.

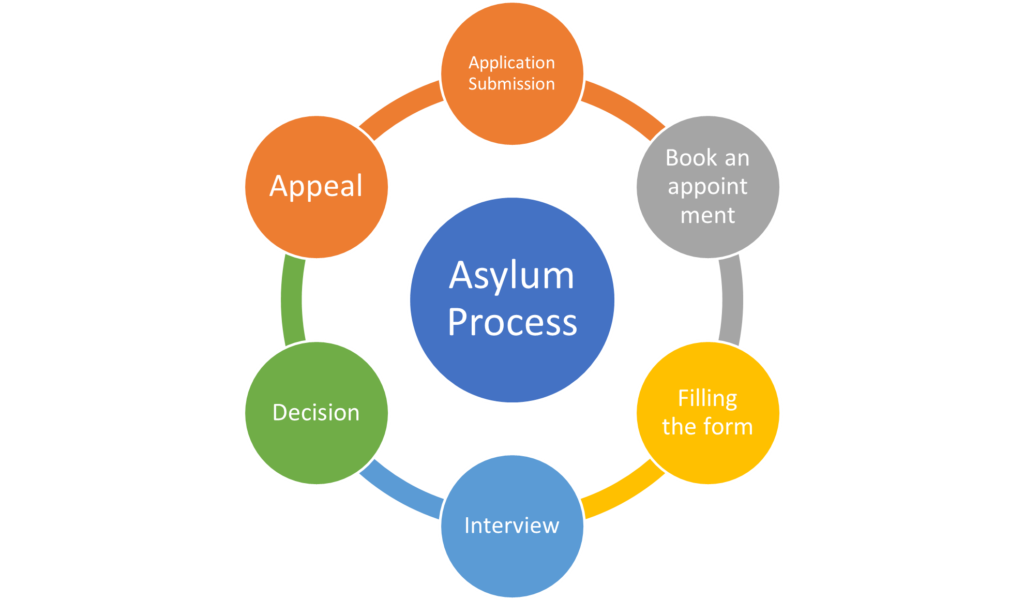

The process for seeking asylum in South Africa generally follows a specific set of steps, although it’s important to note that immigration and asylum procedures may change over time, so it’s advisable to consult with the South African Department of Home Affairs or a legal expert for the most up-to-date information. As of my last knowledge update in September 2021, here is a general overview of the asylum process in South Africa.

Application process: Individuals seeking asylum must first arrive in South Africa and present themselves to immigration authorities or border officials. Once in South Africa, individuals must proceed to one of the Refugee Reception Offices (RROs) or a designated Port of Entry to lodge their asylum application. There, they will be given a date for their first interview. At the initial interview, the asylum seeker will provide information about their reasons for seeking asylum and their fear of persecution in their home country. This information will be recorded and used as part of the assessment process.

Refugee Status Determination (RSD) Process: After the initial interview, the asylum seeker will undergo a Refugee Status Determination (RSD) process to assess the validity of their claim. This process typically involves a series of interviews, background checks, and investigations to establish whether the individual meets the criteria for refugee status under South African law.

Documentation and Refugee Status: If the authorities determine that an individual qualifies for refugee status, they will be issued with the necessary documentation, including a Refugee ID card. This documentation grants them legal protection and certain rights within South Africa. If an asylum application is rejected, there may be opportunities for the applicant to appeal the decision through h the appropriate legal channels.

Asylum Benefits: Asylum benefits refer to the rights and protections granted to individuals who have been granted asylum in a host country. These benefits are essential for ensuring the safety, well-being, and integration of asylum seekers into their new communities. Key asylum benefits typically include legal protection from deportation to their home country, the ability to work and access education, healthcare, and social services on par with the host country’s citizens or residents, and the opportunity to eventually apply for permanent residency or citizenship.

Permanent residency or citizenship: In South Africa, permanent residence and citizenship are two significant milestones for individuals who have been granted asylum. Once an individual has been recognized as a refugee in South Africa, they are entitled to certain rights and opportunities regarding permanent residence and citizenship.

Permanent Residence: Asylum seekers who have been granted refugee status can apply for permanent residence in South Africa. Permanent residence status allows them to live and work in the country indefinitely, with the same rights as South African citizens, including access to education, healthcare, and social services. To obtain permanent residence, refugees typically need to meet certain residency requirements and demonstrate their commitment to contributing positively to South African society. It’s important to note that the specific requirements and procedures for permanent residence may vary, so it’s advisable to consult with the South African Department of Home Affairs for the most up-to-date information.

Citizenship: After holding permanent residence for a specified period, refugees may become eligible to apply for South African citizenship through naturalization. The requirements for naturalization usually include a minimum period of residence, good moral character, and an adequate knowledge of South Africa’s official languages, among other criteria. Once granted South African citizenship, individuals enjoy the same rights and responsibilities as any other citizen, including the ability to vote and participate fully in the country’s civic and political life.

It’s essential to note that the process for obtaining permanent residence and citizenship in South Africa can be complex and may change over time. As such, individuals interested in pursuing these options should seek legal advice and guidance from immigration authorities or experts to ensure they understand the current requirements and procedures applicable to their specific situation.

Asylum Process

The Department for Home Affairs of the South African government runs the asylum process in South Africa. You can read about the process in the Refugees Act (see Sections 21, 22, and 24) together with the Refugees Act Regulations (see Sections 2, 7, 8, and 14) and the Immigration Act (section 23).

Application Process: The Department of Home Affairs of the South African government runs the asylum process in South Africa. If you have come to South Africa to seek asylum, it is important to apply for asylum as soon as you arrive in South Africa.

You will need an appointment at a Refugee Reception Office to apply for asylum. Choose a Refugee Reception Office where you want to apply for asylum.

Your choices are:

- Cape Town Refugee Reception Office

- Durban Refugee Reception Office

- Desmond Tutu Refugee Reception Office (Pretoria)

- Musina Refugee Reception Office

- Gqeberha Refugee Reception Office (formerly Port Elizabeth)

Remember you will need to travel to this office at your own cost, so choosing the one closest to where you live is important.

Appointment booking process: Send an email to the Department of Home Affairs and make sure you use your email account. If you do not have an email account, you will have to create one. You should use an email account that you can access in the future so that you can receive the Department of Home Affairs’ replies to you.

When you send your email to the Department, the email message must have the name of the Refugee Reception Office in the subject line (for example, Durban Refugee Reception Office or Desmond Tutu Refugee Reception Office – Pretoria, etc.), your full name and contact number in the body of the email and you can write in the email, “I want to apply for asylum in South Africa”. You must email the Department of Home Affairs at [email protected] for an appointment. Complete the form that the Department of Home Affairs sends you back.

Fill out the Form: After you have emailed the Department of Home Affairs, they will send you back a form to complete (make sure to check your Junk and Spam folders). This form is called “Request for Appointment to Apply for Asylum.”

When you are completing the form, remember that you can complete this form digitally on a computer OR print it out and complete it by hand. All the information must be true and correct. You must list all your family members that are with you in South Africa (for example, wife, husband, children, elderly family). You do not need a copy of your passport to apply for asylum. Only attach copies of supporting documents that you have with you. Examples of supporting documents include birth certificates, marriage certificates, and identity documentation from your home country.

You will have to scan the completed form and documents or take clear photographs on your phone to attach the images to the email. Ensure you attach the completed form to the email and any supporting documents before sending it back to the Department of Home Affairs.

You must send the completed form and the scans or images of any documents back to the Department of Home Affairs at [email protected]. Go to the Refugee Reception Office on your appointment date.

Once you have sent your email, the Department of Home Affairs will send you another email with your appointment details (date, location, and time). You will have to go to the Refugee Reception Office you chose on the day of your appointment with your family.

At the appointment at the Refugee Reception Office: You will have to provide your biometrics (photographs and fingerprints). All family members listed in the form sent to the Department of Home Affairs will have to be present to give their biometrics. You will be asked to give brief reasons about why you are seeking asylum in South Africa. After applying for asylum, you and your dependents must be given an asylum-seeker visa. Each family member should be given an asylum-seeker visa (also known as a ‘Section 22 permit’). Make copies of these documents and always keep them very safe. You will have an interview with a Refugee Status Determination Officer. The interview could happen on the day you make your asylum application, or you could be asked to come on a different day for this interview.

Interview: You will have to complete an interview with a Refugee Status Determination Officer. During your interview, remember the Refugee Status Determination Officer must explain the procedure to you. The Refugee Status Determination Officer should ask you why you fled your country and why it may be unsafe to return. The Refugee Status Determination Officer may request evidence or more details on what you tell them. Your husband or wife may be interviewed separately. The interview must be recorded, and you should be given the help of an interpreter if you need one. You must tell the truth during your interview. If it is discovered that you provided false, dishonest, or misleading information, your asylum application may be rejected.

Decision: After the interview the Refugee Status Determination Officer must provide you with a decision. They might give you the decision immediately after the interview or ask you to come back on another day for the decision. You should receive the decision in writing. The decision may be to grant you refugee status, or it may be to reject your claim for asylum as unfounded or manifestly unfounded, fraudulent, or abusive.

What happens if you are recognized as a Refugee? This means the Department of Home Affairs has given you asylum, and you may remain in South Africa. Recognized refugees living in South Africa have rights and responsibilities. Your recognition of refugee status document (also known as ‘Section 24 permit’) should Be valid for four years and be given to the main file holder and all dependent family members (spouse, children, dependent family members included in the first asylum application or added to the file later). You will have to reapply for a refugee status document at least 90 days before it expires. You should apply for an identity document immediately (this ‘refugee ID’ is valid for the same period as the refugee status document).

What happens if you are not recognized as a Refugee? This means the Refugee Status Determination Officer has decided to reject your asylum application. The rejection as ‘unfounded’ and the reasons for the rejection should be written in the Refugee Status Determination Officer’s written decision. If you do not agree with this decision or how the Refugee Status Determination Officer made the decision, you have a right to appeal to the Refugee Appeals Authority. The Refugee Appeals Authority will then look at the Refugee Status Determination Officer’s decision and make a

final decision about your asylum application.

Appeal: After considering your appeal, the RAASA may decide one of the following:

To uphold your rejection and issue a final rejection which means your asylum claim has failed and you can no longer legally remain in South Africa. You will be notified of how many days you have in South Africa before you must leave the country. A ‘judicial review ‘is the only way to challenge this decision. You will need a lawyer for this; see the section on Judicial Reviews below. You will need a lawyer for this, see Legal Assistance for a list of UNHCR’s partner organizations to contact.

To grant refugee status means the RAASA has overturned your first rejection and recognized you as a refugee. You must be provided with a refugee recognition document.

To send your application back to the Refugee Status Determination Officer which means the RAASA wants the Refugee Status Determination Officer (RSDO) to consider your application again. You will then be re-interviewed by the RSDO for a new decision on your asylum application.

There is no set time within which the Refugee Appeals Authority must decide on an appeal. There is a backlog of cases with the Refugee Appeals Authority, which means it may take a long time for your appeal to be decided.

What if you receive a final rejection? If the Refugee Appeals Authority or the Standing Committee for Refugee Affairs gives you a final rejection, you will no longer be able to stay in South Africa legally. This means your asylum application has failed, and you will be given a written notice to leave the Republic of South Africa. If you remain in South Africa, you risk deportation back to your home country. If you cannot return to your home country because it is still unsafe or your life and safety might be at risk, you can challenge the final decision with a judicial review. A judicial review means you will take the Department of Home Affairs to the High Court to challenge the final rejection of your asylum application.

Source and more information

South African Government: Department of Home Affairs: Refugee Status & Asylum

Refugees Act [No. 130 of 1998] and Refugees Regulations

Scalabrini Centre of Cape Town: Refugee Law in South Africa

University of Cape Town, Refugee Rights Unit: Refugee Status Determination Manual

Financial System of South Africa

- Overview of South Africa’s Financial System

- Banking System

- Insurance

- Stock Market

- Bond Market

- Derivative Market

- Private equity funds, pension funds, and other non-bank financial institutions

- Government Regulations

Overview of the South African financial system

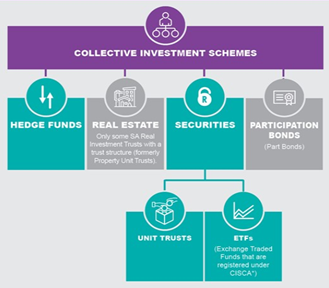

Africa is a continent made up of 53 countries. The continent is economically and culturally diverse, with different regional economic blocs. The financial systems in these countries are as diverse as the countries. South Africa’s financial system is well-developed and diverse, consisting of a robust banking sector, a major stock exchange, a thriving insurance industry, and a regulatory framework designed to oversee these entities. The country’s banking sector is served by both domestic and international banks, with the South African Reserve Bank (SARB) as its central authority.

The Johannesburg Stock Exchange (JSE) ranks among the world’s largest stock exchanges, offering a platform for trading various financial instruments. South Africa also hosts a substantial insurance sector, with companies like Old Mutual and Sanlam providing coverage. Regulatory oversight is divided between the Financial Sector Conduct Authority (FSCA), responsible for market conduct, and the Prudential Authority (PA), which focuses on prudential supervision.

The country’s pension and retirement fund industry is notable, with contributions from employers and employees alike. Additionally, South Africa has a well-developed foreign exchange market, and efforts have been made to enhance financial inclusion, especially in underserved regions. However, the financial system faces ongoing challenges related to inequality and regulatory issues, which remain priorities for policymakers in the country.

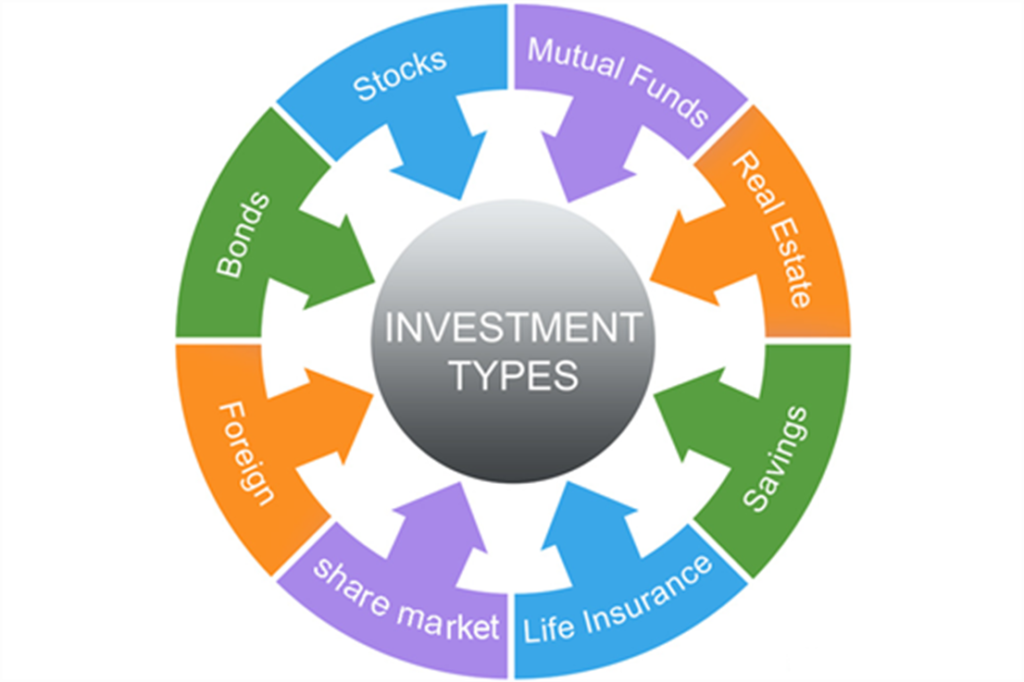

Understanding the financial system of South Africa is of paramount importance for new immigrants to the country. A robust knowledge of the financial landscape can significantly aid in their successful integration and financial stability. Firstly, familiarity with South Africa’s banking sector, including the major banks and financial institutions, is essential for managing day-to-day finances, opening accounts, and accessing banking services efficiently.

Secondly, comprehending the Johannesburg Stock Exchange (JSE) and the investment opportunities it offers is vital for those considering long-term financial growth through investments in

stocks, bonds, or other financial instruments.

Thirdly, insurance plays a crucial role in safeguarding against unexpected events. Being aware of the country’s insurance providers, their products, and the coverage they offer is crucial for ensuring financial protection.

Additionally, knowledge of the regulatory framework, including agencies like the South African Reserve Bank (SARB), the Financial Sector Conduct Authority (FSCA), and the Prudential Authority (PA), is important to understand the rules and regulations governing financial activities, consumer protection, and financial market conduct.

Understanding the pension and retirement funds available in South Africa is also vital, especially for long-term financial planning. This includes knowledge of contributions, options, and benefits.

Moreover, being well-informed about the foreign exchange market and exchange control regulations is crucial for immigrants who may have financial interests or family abroad.

Lastly, grasping the concept of financial inclusion initiatives and knowing how to access banking and financial services in underserved areas can greatly enhance financial accessibility for new immigrants.

In summary, a solid understanding of South Africa’s financial system equips new immigrants with the tools and knowledge necessary to navigate the country’s financial landscape, make informed financial decisions, and ultimately achieve financial stability and success in their new home.

Banking

Banks assist and promote the economy of a country by providing financial capital for businesses as well as a person’s personal needs. A bank encourages the people of a country to save. It allows their clients to invest surplus money that they can use for various reasons at a later stage. The bank acts as a link in various business transactions and it facilitates business between two parties. The entity uses its surplus funds from other investor’s deposits and lends them to clients who then pay them back with interest. It also assists small-scale businesses like farms by providing a line of credit.

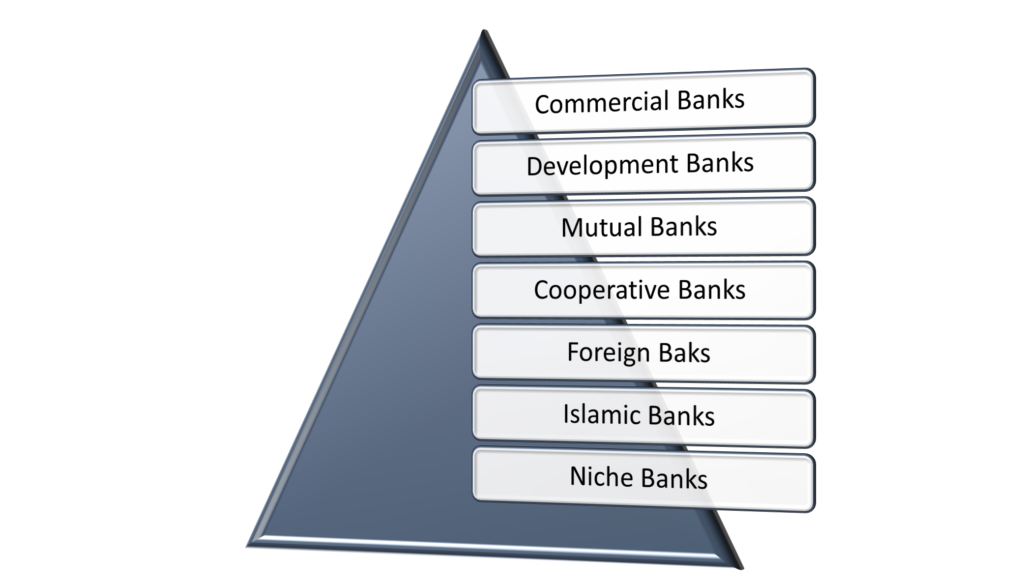

South Africa’s banking sector is diverse and consists of various types of banks, each serving different functions and catering to distinct segments of the population. Here are the main types of banks in South Africa:

Commercial Banks: Commercial banks are the most common type of banks in South Africa, and they provide a wide range of financial services to individuals, businesses, and institutions. These banks offer services such as savings and checking accounts, loans, mortgages, credit cards, and foreign exchange services. Major commercial banks in South Africa include Standard Bank, FirstRand (which owns First National Bank or FNB), Absa Group (formerly Barclays Africa Group), Nedbank, and Capitec Bank, among others.

Development Banks: Development banks in South Africa focus on providing long-term financing and investment in various sectors of the economy to stimulate economic development and growth. The Industrial Development Corporation (IDC) is a prominent example of a development bank in South Africa, and it supports projects in industries such as manufacturing, mining, and infrastructure development.

Mutual Banks: Mutual banks in South Africa are member-owned financial institutions that offer banking services to their members. These banks operate with a cooperative structure, where members have a say in the bank’s governance and decision-making. Mutual banks may offer services like savings accounts, loans, and other banking products.

Cooperative Banks: Cooperative banks are financial institutions that operate on a cooperative basis, with members often sharing a common bond, such as a specific profession or community. These banks emphasize community development and financial inclusion. Some cooperative banks in South Africa focus on serving specific communities or sectors.

Foreign Banks: Foreign banks with branches or subsidiaries in South Africa provide services to both local and international clients. These banks can offer specialized services tailored to the needs of multinational corporations and international trade.

Islamic Banks: Islamic banking in South Africa is a specialized sector within the country’s financial system that adheres to Shariah (Islamic law) principles in its operations. Islamic banks in South Africa offer a range of financial services and products that are compliant with Islamic finance principles. These principles include the prohibition of interest (Riba), investments in businesses that engage in prohibited activities (Haram), and a focus on risk-sharing and ethical financial conduct. Islamic banks in South Africa provide services like Islamic savings accounts, Islamic home financing, and investment products that adhere to these principles. They cater to a specific segment of the population that seeks banking solutions that align with their religious and ethical beliefs.

Niche Banks: A niche bank in South Africa is a specialized financial institution that focuses on serving a specific market segment or providing financial services, often tailored to unique needs. These banks differentiate themselves from traditional commercial banks by offering specialized expertise and customized solutions. Niche banks in South Africa may target high-net-worth individuals, small and medium-sized enterprises (SMEs), or other distinct customer groups.

It’s important to note that the South African Reserve Bank (SARB) serves as the central bank and regulator, overseeing the operations of all banks in South Africa. These various types of banks contribute to the overall diversity and competitiveness of South Africa’s financial sector, offering a range of options to meet the banking and financial needs of the population and the economy.

Insurance

Insurance is an integral component of the South African financial system, providing individuals, businesses, and institutions with risk mitigation and financial protection. In South Africa, insurance is regulated by the Financial Sector Conduct Authority (FSCA) to ensure fair and transparent practices. There are several types of insurance available in the South African market:

Life Insurance: Life insurance policies provide financial protection to beneficiaries in the event of the insured person’s death. Types of life insurance in South Africa include term life insurance (providing coverage for a specified term), whole life insurance (covering the insured’s entire life), and endowment policies (combining life coverage with savings or investment components).

Health Insurance: Health insurance, often referred to as medical aid or medical insurance, covers medical expenses and healthcare services. There are various health insurance providers in South Africa, offering a range of plans with different coverage levels.

Motor Insurance: Motor insurance is mandatory for all vehicle owners in South Africa and includes two main types: comprehensive and third-party. Comprehensive motor insurance covers damage to your vehicle as well as liability for damage to others’ vehicles, while third-party insurance only covers liability for damage to others’ vehicles.

Home Insurance: Home insurance, also known as property insurance, protects homeowners against financial losses resulting from damage to their properties caused by events like fire, theft, or natural disasters. It can also include coverage for personal belongings within the home.

Business Insurance: Business insurance encompasses a wide range of policies designed to protect businesses from various risks, including property damage, liability claims, and business interruption. Common types of business insurance in South Africa include commercial property insurance, liability insurance, and professional indemnity insurance.

Travel Insurance: Travel insurance provides coverage for unexpected events that may occur while traveling, such as trip cancellations, medical emergencies, or lost luggage. It is essential for both domestic and international travel.

Funeral Insurance: Funeral insurance, also known as burial insurance, offers financial assistance to cover the costs associated with funerals and burials. It is a popular form of insurance in South Africa, given the cultural significance of funerals.

Crop and Agricultural Insurance: Agriculture is a significant sector in South Africa, and crop insurance helps protect farmers against losses due to weather-related events, pests, or crop failures.

Specialized Insurance: South Africa also offers specialized insurance products, such as marine insurance for cargo and shipping, aviation insurance for aircraft, and trade credit insurance for businesses involved in international trade.

Insurance in South Africa is essential for managing risk and ensuring financial security. The variety of insurance types allows individuals and businesses to tailor their coverage to their specific needs and circumstances. It plays a crucial role in the overall financial stability of the country by mitigating the impact of unforeseen events on individuals and the economy.

Stock Market

The stock market in South Africa, like in many other countries, is a vital component of the financial system where investors buy and sell financial instruments such as stocks, bonds, commodities, and derivatives. It serves as a platform for companies to raise capital by issuing shares to the public and for investors to trade these securities.

In South Africa, the primary stock market is the Johannesburg Stock Exchange (JSE).

The Johannesburg Stock Exchange (JSE)

Equities Market: The JSE’s equities market is the most prominent segment, where companies issue shares (equity) to raise capital and investors buy and sell these shares. It includes various indices, such as the FTSE/JSE All Share Index (ALSI), which tracks the performance of all listed companies.

Bond Market: The JSE also has a bond market where both government and corporate bonds are traded. This market allows investors to buy and sell fixed-income securities, including government bonds, corporate bonds, and other debt instruments.

Derivatives Market: The JSE’s derivatives market offers a platform for trading financial derivatives, including futures and options contracts on various underlying assets such as equities, currencies, and interest rates. This market is essential for risk management and speculation.

Commodity Market: The JSE provides a platform for trading commodity derivatives, allowing investors to participate in price movements of commodities like gold, platinum, and agricultural products.

Types of Stock Market Participants

Retail Investors: Retail investors are individual investors who buy and sell stocks and other securities for personal investment purposes.

Institutional Investors: Institutional investors include pension funds, insurance companies, and mutual funds. They manage large pools of capital and invest on behalf of their clients or policyholders.

Stockbrokers: Stockbrokers facilitate the buying and selling of securities on behalf of their clients. They can be individuals or firms licensed to trade on the JSE.

Listed Companies: These are businesses that have gone public by issuing shares that are traded on the stock exchange. They use the stock market to raise capital and allow shareholders to trade their shares.

Market Makers: Market makers are firms or individuals who provide liquidity to the market by quoting buy and sell prices for securities. They play a crucial role in ensuring a smooth trading process.

Regulators: Regulatory authorities like the Financial Sector Conduct Authority (FSCA) oversee the stock market to ensure compliance with regulations and to protect investors.

The South African stock market, particularly the JSE, is an integral part of the country’s financial system, offering investment opportunities, a source of capital for companies, and a barometer of economic health. It provides a variety of investment options for both retail and institutional investors, making it a significant driver of economic growth and wealth creation in South Africa.

Bond Market

The bond market in South Africa is a crucial component of the country’s financial system, serving as a platform for the issuance and trading of various types of debt securities. It provides a means for governments, municipalities, corporations, and other entities to raise capital by issuing bonds, while also offering investment opportunities to individuals and institutions.

Here are the main types of bonds in the South African financial system:

Government Bonds: Government bonds, also known as sovereign bonds or Treasuries, are issued by the South African government through the National Treasury. These bonds are considered low-risk investments and are often used to fund government spending and manage national debt. Different types of government bonds include fixed-rate bonds, inflation-linked bonds, and floating-rate bonds.

Corporate Bonds: Corporate bonds are debt securities issued by private corporations to raise capital for various purposes, such as expansion, refinancing, or working capital. South African companies issue corporate bonds to access alternative sources of funding beyond traditional bank loans. These bonds can offer investors a higher yield than government bonds but also come with higher credit risk, depending on the issuer’s financial health.

Municipal Bonds: Municipal bonds, also known as municipal debt securities or “muni bonds,” are issued by local municipalities, provinces, and state-owned enterprises (SOEs). The proceeds from these bonds are used to finance infrastructure projects, public services, or other local government initiatives. Investors in municipal bonds typically receive interest income that is exempt from South African income tax, making them attractive to local investors.

State-Owned Enterprise (SOE) Bonds: Certain SOEs, such as Eskom (the electricity utility) or Transnet (the transport and logistics company), issue bonds to fund their operations and infrastructure projects. These bonds may offer competitive yields, but investors should assess the creditworthiness of the specific SOE.

Supranational and Development Bonds: South Africa also participates in the issuance of bonds by supranational institutions like the African Development Bank (AfDB) or the World Bank. These bonds are often aimed at financing development projects and are considered safe investments.

Inflation-Linked Bonds: Inflation-linked bonds are designed to protect investors from the eroding effects of inflation. They provide periodic interest payments linked to the country’s inflation rate, ensuring that the real purchasing power of the investment is preserved.

Zero-Coupon Bonds: Zero-coupon bonds do not pay periodic interest; instead, they are issued at a discount to their face value and mature at face value. The return on investment comes from the difference between the purchase price and the face value.

The South African bond market is an essential part of the country’s capital markets, offering both issuers and investors a range of options to meet their financing and investment needs. Investors in the bond market can access a diverse set of instruments with varying risk and return profiles, allowing them to build balanced portfolios based on their investment objectives and risk tolerance.

Derivatives Market

The derivatives market in South Africa is a crucial component of the country’s financial system. Derivatives are financial instruments whose value is derived from an underlying asset, index, or reference rate. They are used for various purposes, including risk management, speculation, and hedging. In South Africa, the derivatives market is regulated by the Financial Sector Conduct Authority (FSCA) and operates on the Johannesburg Stock Exchange (JSE). Here are some types of derivatives commonly traded in the South African financial system:

Futures Contracts: Futures contracts are standardized agreements to buy or sell an underlying asset at a predetermined price and date in the future. In South Africa, the JSE offers futures contracts on a variety of underlying assets, including equity indices (such as the FTSE/JSE Top 40 Index), commodities (such as gold, platinum, and agricultural products), and interest rates.

Options Contracts: Options give the holder the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset at a specified price within a predetermined period. The South African derivatives market includes options on equity indices and individual stocks, allowing investors to hedge their portfolios or engage in speculative trading strategies.

Currency Derivatives: South Africa’s currency derivatives market allows traders and businesses to hedge against currency exchange rate fluctuations. This market includes currency futures and options, helping participants manage the risk associated with international trade and currency exposure.

Interest Rate Derivatives: Interest rate derivatives are used to manage interest rate risk. They include instruments like interest rate futures and interest rate swaps. Market participants can use these derivatives to hedge against fluctuations in interest rates, particularly important for businesses and financial institutions.

Single Stock Futures (SSFs): SSFs are futures contracts based on the performance of individual stocks listed on the JSE. Investors use SSFs for various purposes, including hedging stock portfolios, speculating on stock price movements, and leveraging their exposure to specific stocks.

Commodity Derivatives: Commodity derivatives is also another type of derivative that deals with commodity. South Africa is a major producer of commodities like gold, platinum, and agricultural products. The JSE offers futures contracts on these commodities, allowing producers, traders, and investors to manage price risk.

Credit Derivatives: Credit derivatives are used to manage credit risk associated with debt instruments. While not as common as some other derivatives, credit default swaps (CDS) are occasionally used in South Africa to hedge against credit risk.

Equity Index Derivatives: Equity index derivatives, such as index futures and options, are linked to the performance of stock market indices. They are used for portfolio diversification, speculation on market movements, and risk management.

The derivatives market in South Africa provides valuable tools for investors and businesses to manage risk, enhance liquidity in financial markets, and access investment opportunities. However, derivatives also carry inherent risks, and market participants need to have a solid understanding of these instruments before trading them. Strict regulatory oversight ensures transparency and fairness in the South African derivatives market.

Private equity funds, pension funds, and other non-bank financial institutions

In the South African financial system, various non-bank financial institutions play crucial roles in investment, savings, and retirement planning. Here are explanations of private equity funds, pension funds, and other non-bank financial institutions, along with their types:

Private Equity Funds: Private equity funds are investment vehicles that pool capital from various investors, such as high-net-worth individuals, institutional investors, and endowments, to invest in private companies. These funds typically take an active ownership stake in private companies, often to increase their value over time and eventually sell them for a profit. Types of private equity funds in South Africa include buyout funds (focused on acquiring and enhancing companies), venture capital funds (investing in early-stage companies), and mezzanine funds (providing a combination of debt and equity financing).