መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » ሳውዲ ዓረቢያ

Brief History of Saudi Arabia

- History of Saudi Arabia

- Hierarchical structure

- The Constitution of Saudi Arabia

- Federal Government

- Provincial Government

- Election

History of the Arabia

The first concrete evidence of human presence in the Arabian Peninsula dates back 15,000 to 20,000 years. Bands of hunter-gatherers roamed the land, living off wild animals and plants. As the European ice cap melted during the last Ice Age, some 15,000 years ago, the climate in the peninsula became dry. Vast plains once covered with lush grasslands gave way to scrubland and deserts, and wild animals vanished. River systems also disappeared, leaving in their wake the dry riverbeds (wadis) that are found in the peninsula today.

This climate change forced humans to move into the lush mountain valleys and oases. No longer able to survive as hunter-gatherers, they had to develop another means of survival. As a result, agriculture developed – first in Mesopotamia, then the Nile River Valley, and eventually spread across the Middle East. The development of agriculture brought other advances. Pottery allowed farmers to store food. Animals, including goats, cattle, sheep, horses, and camels, were domesticated, and people abandoned hunting altogether. These advances made intensive farming possible. In turn, settlements became more permanent, leading to the foundations of civilization language, writing, political systems, art, and architecture.

An Ancient Trade Center: Located between the two great centers of civilization, the Nile River Valley and Mesopotamia, the Arabian Peninsula was the crossroads of the ancient world. Trade was crucial to the area’s development; caravan routes became trade arteries that made life possible in the sparsely populated peninsula. The people of the peninsula developed a complex network of trade routes to transport agricultural goods highly sought after in Mesopotamia, the Nile Valley, and the Mediterranean Basin. These items included almonds from Taif, dates from the many oases, and aromatics such as frankincense and myrrh from the Tihama plain.

Spices were also important trade items. They were shipped across the Arabian Sea from India and then transported by caravan. The huge caravans traveled from what is now Oman and Yemen, along the great trade routes running through Saudi Arabia’s Asir Province and then through Makkah and Madinah, eventually arriving at the urban centers of the north and west.

The people of the Arabian Peninsula remained largely untouched by the political turmoil in Mesopotamia, the Nile Valley, and the eastern Mediterranean. Their goods and services were in great demand regardless of which power was dominant Babylon, Egypt, Persia, Greece, or Rome. In addition, the peninsula’s great expanse of desert formed a natural barrier that protected it from invasion by powerful neighbors.

The Birth of Islam: Around the year 610, Muhammad, a native of the thriving commercial center of Makkah, received a message from God (in Arabic, Allah) through the Angel Gabriel. As more revelations bid him to proclaim the oneness of God universally, the Prophet Muhammad’s following grew. In 622, learning of an assassination plot against him, the Prophet led his followers to the town of Yathrib, which was later named Madinat Al-Nabi (City of the Prophet) and is now known simply as Madinah. This was the Hijrah, or migration, which marks the beginning of the Islamic calendar. Within the next few years, several battles took place between the followers of the Prophet Muhammad and the pagans of Makkah. By 628, when Madinah was entirely in the hands of the Muslims, the Prophet had unified the tribes so successfully that he and his followers reentered Makkah without bloodshed.

The Islamic Empire: Less than 100 years after the birth of Islam, the Islamic Empire extended from Spain to parts of India and China. Although the political centers of power had moved out of the Arabian Peninsula, trade flourished in the area. Also, many pilgrims began regularly visiting the peninsula, with some settling in the two holy cities of Makkah and Madinah. These pilgrims facilitated the exchange of ideas and cultures between the people of the peninsula and other civilizations of the Arab and Muslim worlds. The emergence of Arabic as the language of international learning was another major factor in the cultural development of the Arabian Peninsula. The Muslim world became a center for learning and scientific advances during what is known as the “Golden Age.” Muslim scholars made major contributions in many fields, including medicine, biology, philosophy, astronomy, arts, and literature. Many of the ideas and methods pioneered by Muslim scholars became the foundation of modern sciences.

The Islamic Empire thrived well into the 17th century when it broke up into smaller Muslim kingdoms. The Arabian Peninsula gradually entered a period of relative isolation, although Makkah and Madinah remained the spiritual heart of the Islamic world and continued to attract pilgrims from many countries.

The First Saudi State: In the early 18th century, a Muslim scholar and reformer named Shaikh Muhammad bin Abdul Wahhab began advocating a return to the original form of Islam. Abdul Wahhab was initially persecuted by local religious scholars and leaders who viewed his teachings as a threat to their power bases. He sought protection in the town of Diriyah, which Muhammad bin Saud ruled.

Muhammad bin Abdul Wahhab and Muhammad bin Saud formed an agreement to dedicate themselves to restoring the pure teachings of Islam to the Muslim community. In that spirit, bin Saud established the First Saudi State in 1727, which prospered under the spiritual guidance of bin Abdul Wahhab, known simply as the Shaikh. By 1788, the Saudi State ruled over the entire central plateau known as the Najd. By the early 19th century, its rule extended to most of the Arabian Peninsula, including Makkah and Madinah.

The popularity and success of the Al-Saud rulers aroused the suspicion of the Ottoman Empire, the dominant power in the Middle East and North Africa at the time. In 1818, the Ottomans dispatched a large expeditionary force armed with modern artillery to the western region of Arabia. The Ottoman army besieged Diriyah, which by now had grown into one of the largest cities in the peninsula. Ottoman forces leveled the city with field guns and made it permanently uninhabitable by ruining the wells and uprooting date palms.

The Second Saudi State: By 1824, the Al-Saud family had regained political control of central Arabia. The Saudi ruler Turki bin Abdullah Al-Saud transferred his capital to Riyadh, some 20 miles south of Diriyah, and established the Second Saudi State. During his 11-year rule, Turki succeeded in retaking most of the lands lost to the Ottomans. As he expanded his rule, he took steps to ensure that his people enjoyed rights, and he saw to their well-being.

Under Turki and his son, Faisal, the Second Saudi State enjoyed a period of peace and prosperity, and trade and agriculture flourished. The calm was shattered in 1865 by a renewed Ottoman campaign to extend its Middle Eastern empire into the Arabian Peninsula. Ottoman armies captured parts of the Saudi State, which was ruled at the time by Faisal’s son, Abdulrahman. With the support of the Ottomans, the Al-Rashid family of Hail made a concerted effort to overthrow the Saudi State.

Faced with a much larger and better-equipped army, Abdulrahman bin Faisal Al-Saud was forced to abandon his struggle in 1891. He sought refuge with the Bedouin tribes in the vast sand desert of eastern Arabia known as the Rub Al-Khali, or ‘Empty Quarter.’ From there, Abdulrahman and his family traveled to Kuwait, where they stayed until 1902. With him was his young son Abdulaziz, who was already making his mark as a natural leader and a fierce warrior for the cause of Islam.

The Modern Kingdom of Saudi Arabia: The young Abdulaziz was determined to regain his inheritance from the Al-Rashid family, which had taken over Riyadh and established a governor and garrison there. In 1902, Abdulaziz, – accompanied by only 40 followers – staged a daring night march into Riyadh to retake the city garrison, known as the Masmak Fortress. This legendary event marks the beginning of the formation of the modern Saudi state. After establishing Riyadh as his headquarters, Abdulaziz captured all of the Hijaz, including Makkah and Madinah, from 1924 to 1925. In the process, he united warring tribes into one nation.

On September 23, 1932, the country was named the Kingdom of Saudi Arabia, an Islamic state with Arabic as its national language and the Holy Qur’an as its constitution.

Hierarchical Structure of Saudi Arabia

Saudi Arabia does not have a federal system like some other countries, as it operates under a unitary system of government. However, it does have a hierarchical structure of government at the provincial and local levels. Here’s an overview of the hierarchical structure of the government in Saudi Arabia:

Basic System of Government: The Basic System of Government identifies the nature of the state, its goals, and responsibilities, as well as the relationship between the ruler and citizens. It defines the Kingdom of Saudi Arabia as an Arab and Islamic sovereign state, its religion is Islam, and its constitution is the Holy Qur’an and the Sunnah. The King, who also acts as prime minister, ensures the application of the Sharia and the State’s general policy and supervises the protection and defense of the nation.

The Crown Prince is appointed by the King. Members of the Council of Ministers assist the King in the performance of his duties. The new bylaws introduced for the system in 1992 further explain that the purpose of the State is to ensure the security and rights of all citizens and residents. It emphasizes the importance of the family as the nucleus of Saudi society. The family plays a vital role by teaching its members to adhere to Islamic values. In defining the relationship between the ruler and the people, the system emphasizes the equality of all Saudi citizens. All are equal before God and in their concern for the well-being, security, dignity, and progress of their nation. All citizens are also equal before the law.

Central Government: At the highest level of the central government is the King (or monarch), who holds significant executive, legislative, and judicial powers. The Crown Prince assists the King in the governance of the country and is an important figure in the central government. The King or Crown Prince typically chairs the Council of Ministers, reflecting their central roles in the executive hierarchy. The executive branch plays a crucial role in shaping and executing the policies and decisions of the Saudi government, which operates within the framework of Islamic law (Sharia) and works to achieve the nation’s objectives and aspirations.

Provincial Government: Saudi Arabia is divided into 13 provinces, each of which is further subdivided into governorates or emirates. These provinces are administrative regions with their local governments. Each province is headed by a governor who is appointed by the King. The governor is responsible for overseeing and coordinating the administration of the province. The governor represents the central government in the province.

Local Government: Within each province, there are municipalities and municipal councils responsible for local governance and services. Municipalities are led by mayors, who are responsible for managing and administering local affairs, including urban planning, infrastructure, public services, and other local matters.

Shura Councils (Consultative Assemblies): Each province has its own Provincial Shura Council, which is an advisory body that provides input and advice to the local government on various matters. Members of these councils are appointed. At the municipal level, there are Municipal Shura Councils that serve a similar advisory function, offering input on local issues. Members are also appointed to these councils.

It’s important to note that the central government in Saudi Arabia has significant authority and influence over provincial and local governments. While there is a degree of decentralization in local governance, key decisions and policies are often determined at the central level. Additionally, the Saudi government has been working on various initiatives to enhance local governance and empower local authorities to play a more active role in local development and decision-making.

Saudi Arabia Constitution

The Kingdom of Saudi Arabia does not have a single, comprehensive written constitution in the conventional sense that many other countries do. Instead, Saudi Arabia is governed by a combination of Islamic law (Sharia) and a series of foundational documents and principles that serve as the guiding framework for the country’s governance. These documents and principles include:

The Quran and Hadith: Saudi Arabia’s legal and governance system is primarily based on Islamic law, also known as Sharia. The two most significant sources of Sharia law are the Quran and Hadith. The Quran is the holy book of Islam, believed by Muslims to be the word of God as revealed to the Prophet Muhammad. It serves as the ultimate source of guidance and principles for Muslims in all aspects of life, including legal matters. The Quran contains a wide range of guidance on personal conduct, morality, social justice, and more, which informs the legal framework in Saudi Arabia. Hadith consists of the sayings, actions, and approvals of the Prophet Muhammad. It provides additional context and interpretation of the Quran’s teachings. In Saudi Arabia, Hadith is used to derive specific legal rules and interpretations, helping to shape the legal system.

The Basic Law of Governance: The Basic Law of Governance was introduced in Saudi Arabia in 1992 and serves as a foundational document for the country’s governance. The Basic Law establishes the monarchy as the form of government, with the King serving as both the head of state and government. The King wields significant executive, legislative, and judicial powers. The document outlines the structure of the government, defining the roles and responsibilities of various government institutions and officials. It clarifies the relationship between the central government and local authorities. The Basic Law explicitly states that the Kingdom of Saudi Arabia is a sovereign Arab Islamic state, and its constitution is the Quran and the Sunnah (traditions of the Prophet). It emphasizes the importance of Islamic law in all aspects of governance. The Basic Law has been amended over the years to address evolving governance needs and priorities.

Royal Decrees and Edicts: In Saudi Arabia, the King has the authority to issue royal decrees and edicts. These royal pronouncements have a significant impact on various aspects of governance and policy. Royal decrees may be used to appoint government officials, introduce new laws or regulations, and address specific issues within the kingdom. They are a means by which the central government exercises its executive authority.

Customary and Traditional Practices: Saudi Arabia’s legal system also incorporates customary and traditional practices that have developed over time. These practices are often associated with family law, personal status, and property rights. Some aspects of family law, marriage, divorce, and inheritance, for instance, are influenced by traditional and cultural norms that have been practiced for generations.

Saudi Arabia’s unique legal and governance system is deeply rooted in its Islamic heritage and values. The country’s approach to governance and the legal system is distinct from Western-style constitutional systems, as it emphasizes the interpretation and application of Islamic law by religious scholars and judicial authorities. It’s important to note that Saudi Arabia’s legal and constitutional framework may continue to evolve.

The Federal Government

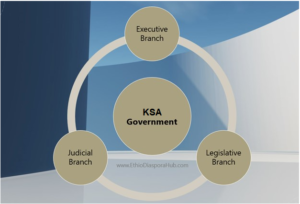

Saudi Arabia does not have a federal system of government. Instead, it operates as a unitary state with a centralized government. The Kingdom of Saudi Arabia is governed by a hereditary monarchy with a highly centralized system of authority. Here is an overview of the government structure in Saudi Arabia:

Executive branch: In the Kingdom of Saudi Arabia, the executive branch of the federal government is primarily centered around the monarchy, which is a fundamental pillar of the Saudi system. At the pinnacle of the executive branch is the King (or monarch), who serves as both the head of state and government. As of my last knowledge update in January 2022, King Salman bin Abdulaziz Al Saud was the reigning monarch. The King wields significant executive authority, with the power to make crucial decisions on national and international matters. The King is assisted by the Crown Prince, who plays a vital role in the governance of the country. The executive branch also includes the Council of Ministers, responsible for implementing the King’s directives and managing the country’s affairs. This council is composed of various ministers, each overseeing specific government departments. The King or Crown Prince typically chairs the Council of Ministers, reflecting their central roles in the executive hierarchy. The executive branch plays a crucial role in shaping and executing the policies and decisions of the Saudi government, which operates within the framework of Islamic law (Sharia) and works to achieve the nation’s objectives and aspirations.

Legislative branch: The legislative branch of the Kingdom of Saudi Arabia operates within a unique hierarchical structure closely tied to the principles of Islamic law (Sharia) and the country’s monarchy. While Saudi Arabia is not a federal state, it does have a national advisory and legislative body known as the Shura Council, which plays a significant role in shaping the country’s laws and policies. The Shura Council is divided into two branches: the Provincial Shura Councils, which operate at the regional level, and the national-level Shura Council, which is the most prominent component. The Shura Council is an advisory body with limited legislative powers, consisting of appointed members who provide counsel to the government. While it cannot independently enact laws, it can propose legislation and review draft laws presented by the Council of Ministers. The ultimate authority in legislative matters rests with the King, who has the power to issue royal decrees and approve or veto legislation, maintaining the hierarchical structure of government with the monarchy at its apex.

Judicial Branch: In the Kingdom of Saudi Arabia, the judicial branch of the federal government plays a crucial role in interpreting and applying the law, primarily based on Islamic law (Sharia). The judiciary is structured hierarchically, with the Supreme Court, known as the Supreme Judicial Council, at the pinnacle. The Supreme Judicial Council is responsible for overseeing the entire judicial system, including the appointment of judges and the administration of justice. Below the Supreme Judicial Council, there are various levels of courts, including general courts, specialized courts, and administrative tribunals, each with specific areas of jurisdiction. Judges at these courts are appointed to interpret and apply the law, ensuring that it aligns with Islamic principles and Saudi Arabia’s legal framework. The judicial branch operates independently but within the boundaries of Islamic law, and its decisions have a significant impact on legal matters, including civil, criminal, and family cases, contributing to the overall legal and social order of the kingdom.

Provincial government

Saudi Arabia is divided into 13 provinces. Each province has a governor, a deputy governor, and a provincial council. These councils deliberate on the needs of their province, work on the development budget, consider future development plans, and monitor ongoing projects. The governor and deputy governor of each province serve as chairman and vice-chairman of their respective provincial council. Each council consists of at least ten private citizens. As with the Majlis Al-Shura, members of the council participate in committees that focus on various issues of interest to the province. The councils issue reports that are submitted to the Minister of the Interior, and then passed on to the appropriate government ministries and agencies for consideration.

The provincial council system is the result of bylaws established by King Fahd in 1992. These bylaws divided the country into 13 provinces and defined their administrative structure, how they would be administered, and the responsibilities of the governors and other regional officers.

Executive branch: The executive branch of the provincial government in the Kingdom of Saudi Arabia is headed by a governor, who is appointed by the King. The governor serves as the chief executive officer of the province and plays a pivotal role in administering and overseeing local affairs within their jurisdiction. The governor represents the central government in the province and is responsible for coordinating various government agencies and departments to ensure the effective delivery of public services, infrastructure development, and the enforcement of national policies at the local level. They work in collaboration with municipal authorities and various government bodies to address the needs and priorities of the province’s residents. While the governor holds considerable authority, their actions and decisions are ultimately aligned with the policies and directives issued by the central government, ensuring a centralized form of governance in Saudi Arabia’s provincial structure.

Legislative branch: The legislative branch of the provincial government in the Kingdom of Saudi Arabia comprises Provincial Shura Councils. These councils serve as advisory bodies at the provincial level, offering input and recommendations on various local matters. They play a consultative role in the legislative process, reviewing and providing feedback on proposed laws and policies that affect their respective provinces. Members of the Provincial Shura Councils are appointed by the central government, including the governor of the province. While they don’t have the authority to make laws, their advice and recommendations carry weight in the decision-making process. This legislative structure ensures that local perspectives and concerns are taken into account in shaping provincial policies and laws, even though the central government retains significant authority over the final legislative decisions.

Judicial Branch: In the hierarchical structure of the Kingdom of Saudi Arabia, the judicial branch at the provincial level plays a vital role in administering justice and upholding the rule of law. The judicial system in each province operates within the framework of Islamic law (Sharia) and consists of a hierarchy of courts, with the Supreme Court at the top. Each province has its court system, typically including appellate and first-instance courts, which handle a wide range of civil and criminal cases. Judges at the provincial level are appointed based on their expertise in Islamic law and jurisprudence, and they interpret and apply the law according to Islamic principles. The provincial judiciary is responsible for resolving legal disputes, ensuring fair trials, and upholding justice in their respective regions. While the judiciary is independent in its decisions, it operates within the broader framework of the country’s legal and cultural norms, which are deeply rooted in Islamic tradition. The provincial judicial branch is a critical component of the overall legal system in Saudi Arabia, contributing to the administration of justice and the protection of individuals’ rights and freedoms.

Election system

The election system in Saudi Arabia has been allocated to executive positions in the Kingdom, allowing citizens to participate in decision-making and management. The concept of elections is generally based on casting a group of citizens who meet the conditions necessary to exercise the right to vote for the candidates within an organized process according to the approved voting systems.

Saudi Arabia did not conduct country-level general elections in the traditional sense, as it is not a democracy with elected representatives at the national level. Instead, Saudi Arabia operates under a monarchy, and governance is primarily based on a combination of Islamic law (Sharia) and the authority of the King.

However, there have been some limited forms of local and municipal elections in the country:

Municipal Elections: Municipal council elections allow citizens to participate in decision-making by selecting qualified and experienced people to manage local affairs and municipal services. Municipal council members’ elections derive their importance from citizens’ participation in government agencies in managing municipal services, as this participation is a catalyst in supporting government decisions in citizens’ interest. Saudi Arabia has held municipal elections to select representatives at the local level. These elections have been introduced as part of the government’s efforts to promote citizen participation in local governance. Voters could elect members of municipal councils, which are responsible for local administrative and service-related matters, such as urban planning, infrastructure development, and public services.

Majlis Ash-Shura (Consultative Council): While not a directly elected body, the Majlis Ash-Shura, or Shura Council, plays an advisory role in Saudi governance. Its members are appointed, and they advise the King and government on various issues, including legislation and policy matters. The Shura Council does not have legislative authority but can propose and review legislation presented by the government.

It’s important to note that these elections have been relatively limited in scope, and the ultimate authority in the Kingdom of Saudi Arabia rests with the King and the central government. Political reforms and changes to the electoral system may occur over time, but the country remains a monarchy with centralized decision-making.

Voting Eligibility: Voting is a right for every Saudi citizen, male or female. However, some conditions must be met first, He or she should be eighteen years old at the polling date, secondly, He should not be a military man. And to be a resident of the electoral district, choose one electoral district in his place of residence.

Stages of the electoral process

Voter registration: Those who meet the eligibility requirements are listed and recorded in specialized registers known as voter registration tables.

Candidate registration: The nomination application must be registered in the voters’ registration lists. The nomination shall occur within a specified period according to specific procedures issued and published in the electoral districts.

Candidates ‘election campaigns: Advertising campaigns begin after publishing the final lists of candidates’ names, and the accepted candidates are allowed to start their election campaigns and inform voters about them, their electoral programs, their ideas, and their plans.

Voting: The most crucial stage in the electoral process, where voters cast their votes on polling day and select their candidates according to approved procedures, and at the polling stations, they are registered.

The screening process: it is an organized process through which seat winners are known, as the election and winning committees work on counting and counting the votes.

Announcement of results: The list of winners for municipal council membership is announced with the number of votes obtained by each of them, and at this stage, the electoral process ends.

Appeals and grievances: It is an entirely independent committee, in which every voter or candidate has the right to grievance before it against the decisions of the Electoral Commission against him, or against the refusal of the committees to make a decision in his favor, or to challenge the inclusion of any of the names mentioned in the lists of voters or candidates registration according to specific times and dates in the regulations and the instructions.

Political Parties: Saudi Arabia does not have political parties in the conventional sense that are found in democratic systems. The country’s political landscape is fundamentally different from multi-party democracies. Instead, Saudi Arabia is a monarchy with a political system heavily influenced by Islamic law (Sharia) and tribal and family affiliations. Saudi Arabia does not have formal political parties that compete in elections or engage in the traditional political process, such as campaigning and running for office. The Kingdom of Saudi Arabia is ruled by a monarchy, and the ultimate authority resides with the King. The King and the royal family make key decisions regarding the governance of the country.

The Majlis Ash-Shura, or Shura Council, plays an advisory role in Saudi governance. Members of the Shura Council are appointed, not elected, and they provide advice and recommendations to the King and the government on various issues. Saudi society is characterized by tribal and family affiliations that hold significant influence, particularly in local and regional governance. Tribal leaders often play an important role in mediating local issues and concerns. Islamic law (Sharia) is a fundamental source of governance and law in Saudi Arabia. Religious authorities and clerics have an influential role in shaping and interpreting government policies and decisions.

Immigration System of Saudi Arabia

- Immigration Overview

- Types of Immigration

- Asylum

- The Asylum in Saudi Arabia

Saudi Arabia Immigration Overview

Saudi Arabia has a relatively strict and complex immigration system, and obtaining a visa or residency in the country can be challenging. The immigration system in Saudi Arabia is designed to regulate the entry and stay of foreign nationals, considering various factors such as employment, business, and family ties.

Here’s an overview of the Saudi Arabia immigration system and its key processes:

Types of Visas: Foreign nationals who wish to work in Saudi Arabia typically require a work visa sponsored by a Saudi employer. Employers are responsible for initiating the visa application process for their prospective employees. There are several types of visit visas for tourists, business travelers, and those visiting family members in Saudi Arabia. These visas are usually granted for a specific duration and purpose. After obtaining a work visa, foreign employees can apply for a residence permit, which allows them to reside in Saudi Arabia for an extended period.

Sponsorship System: Saudi Arabia operates under a sponsorship (kafala) system, where a local sponsor, usually an employer or a Saudi citizen, is responsible for the foreign national’s legal status in the country. The sponsor is responsible for the visa application, employment arrangements, and legal matters.

Eligibility and Requirements: Eligibility criteria for visas and residence permits vary depending on the type of visa and the individual’s circumstances. Common requirements include a valid passport, medical examinations, a sponsor, and the necessary fees.

Application Process: The application process for visas and residence permits typically involves submitting the required documents to the Saudi embassy or consulate in the applicant’s home country. The Saudi sponsor initiates the application and provides the necessary support.

Changes and Renewals: Visa holders may need to renew their visas or residence permits before they expire. Employers are usually responsible for renewing work visas, while individuals may be required to renew their visit visas or residence permits.

Immigration Regulations: Saudi Arabia has specific regulations regarding dress codes, behavior, and cultural norms, and it is important for immigrants to be aware of and respect these rules to avoid legal issues.

It’s important to note that Saudi Arabia’s immigration policies and procedures may change over time, and they can be quite restrictive. Therefore, prospective immigrants need to check the latest requirements and seek guidance from the nearest Saudi embassy or consulate before starting the immigration process. Additionally, consulting with an immigration attorney or expert can help navigate the complex immigration system in Saudi Arabia.

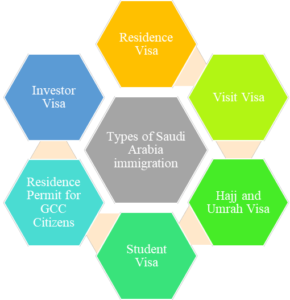

Types of Immigration

Saudi Arabia has several types of immigration and residency categories, each with its own set of requirements and eligibility criteria. here’s an overview of the main types of immigration in Saudi Arabia:

Residence visa (Iqama): The Resident Visa, commonly referred to as the Iqama, is a foundational element of Saudi Arabia’s immigration system. It serves as the primary residency permit for foreign nationals seeking to live and work in the country. The Iqama is typically sponsored by a Saudi employer, and individuals must secure a job offer to obtain it. Once granted, it provides legal status for foreign workers, enabling them to reside in Saudi Arabia. This visa must be renewed annually and is closely tied to an individual’s employment situation, as it is typically sponsored by the employing company. Should an individual change employer, the new company assumes sponsorship responsibilities for the Iqama. This system is central to the regulation of expatriate labor in Saudi Arabia and plays a crucial role in the country’s workforce management.

Visit Visa: A visit visa is a key category in Saudi Arabia’s immigration system, designed to facilitate short-term stays for various purposes, including tourism, family visits, and business trips. This type of visa allows foreigners to enter the country temporarily and engage in activities specific to the purpose of their visit. Visit visas come in several subcategories, each tailored to the nature of the visit, such as family visit visas for those wishing to reunite with relatives, business visit visas for professionals attending meetings or conferences, and tourist visas for travelers exploring the kingdom’s cultural and historical attractions. The specific requirements, duration, and limitations of visit visas vary based on the subcategory, and applicants need to adhere to the guidelines outlined by Saudi authorities, including providing necessary documentation and adhering to the visa’s validity period.

Hajj and Umrah Visa: Hajj and Umrah visas are specialized types of visas granted by Saudi Arabia, primarily for religious pilgrims visiting the holy cities of Mecca and Medina. The Hajj visa is issued for the annual Hajj pilgrimage, which is one of the Five Pillars of Islam and an obligation for all Muslims who can afford to make the journey. The Umrah visa, on the other hand, is for the lesser pilgrimage, Umrah, which can be performed at any time of the year. These visas are typically available to Muslims who meet specific criteria, including financial capability and health requirements, as well as adherence to the regulations and procedures set by the Saudi government. Pilgrims should apply for these visas through authorized agencies and tour operators specializing in religious travel. Both Hajj and Umrah visas are subject to quotas and specific guidelines, with the Saudi government taking various measures to ensure the safety and well-being of pilgrims during their sacred journeys. It’s important to check with Saudi authorities or accredited travel agencies for the most up-to-date information and requirements for obtaining these visas.

Student Visa: The student visa in Saudi Arabia is a vital category that enables foreign nationals to pursue higher education within the country’s academic institutions. Typically sponsored by the educational institution itself, this visa is designed for individuals who wish to enroll in academic programs, such as undergraduate, graduate, or doctoral studies, and often comes with a specific duration tied to the length of the academic program. Student visa applicants should ensure they meet the admission requirements of their chosen institution and have the necessary financial means to support their education and living expenses during their stay. Additionally, students on this visa are typically required to maintain full-time student status and comply with academic and residency regulations, and it’s essential to stay informed about any policy changes or updates related to student visas in Saudi Arabia.

The Resident Permit for GCC Citizens: The Resident Permit for GCC Citizens is a unique aspect of Saudi Arabia’s immigration system, allowing citizens of other Gulf Cooperation Council (GCC) countries, such as the United Arab Emirates, Qatar, and Kuwait, to live and work in Saudi Arabia without requiring a local sponsor. This arrangement is made possible through a unified GCC agreement that provides GCC citizens with certain privileges and access to Saudi Arabia’s job market and various services. This initiative fosters economic and social integration among the member states and promotes free movement and cooperation within the region. It’s important to note that while GCC citizens enjoy these benefits, there may still be some administrative procedures and documentation requirements to fulfill when residing in Saudi Arabia, although they are typically less complex than for non-GCC expatriates.

Investor Visa: The Investor Visa in Saudi Arabia is a specific residency category designed to attract foreign investment into the country. It generally offers the opportunity for individuals who make substantial financial investments in Saudi Arabia to obtain long-term residency. To be eligible for an Investor Visa, individuals typically need to invest a specific amount of capital in sectors that align with the country’s economic development goals. These investments may include real estate, business ventures, or other strategic areas. The Investor Visa not only promotes foreign direct investment but also supports the broader goals of Saudi Arabia’s Vision 2030, which aims to diversify the economy and reduce its dependence on oil revenue.

Golden Visa (Premium Residency): Saudi Arabia had announced plans to introduce a “Golden Visa” program as part of its broader Vision 2030 initiative. This program aimed to provide long-term residency to foreign investors, highly skilled professionals, and retirees, to attract talent and investments to the country. While the specific criteria, investment thresholds, and application procedures were not fully detailed at that time, the program was expected to offer a pathway for eligible individuals to secure extended residency in Saudi Arabia, potentially bypassing the traditional sponsorship system.

Asylum

Asylum is a legal protection granted by a country to individuals who are fleeing persecution, violence, or other forms of harm in their home country. The primary purpose of asylum is to provide a haven for people at risk and to ensure that they are not returned to a place where their life or freedom is in danger.

Here is an overview of the general asylum process:

Seeking Asylum: The process typically begins when an individual arrives in a foreign country and expresses the need for asylum. This can be done at a port of entry, immigration office, or through an asylum application process.

Eligibility Determination: The host country’s government reviews the asylum seeker’s claim to determine if they meet the criteria for asylum. To be eligible, individuals must demonstrate a well-founded fear of persecution based on factors such as race, religion, nationality, political opinion, or membership in a particular social group. This fear of persecution must be rooted in their home country.

Application Submission: Asylum seekers are often required to complete an asylum application, detailing their background, reasons for seeking asylum, and any evidence supporting their claim. It is essential to meet any deadlines and provide accurate and complete information.

Interview and Screening: In many countries, asylum seekers are interviewed by immigration officials or asylum officers to gather additional information about their claims. This interview helps assess the credibility of the applicant and the validity of their asylum claim.

Decision: The government reviews all the information and decides on the asylum claim. This process can take several months or even years.

Appeal: If the initial application is denied, asylum seekers may have the right to appeal the decision through the legal system or an administrative process, depending on the country’s laws.

Status Grant or Denial: If the application is approved, the individual is granted asylum status, allowing them to live and work in the host country. If the application is denied and there is no successful appeal, the individual may be subject to deportation.

Resettlement or Integration: In some cases, asylum seekers who are granted refugee status may have the opportunity to resettle in a third country, while others are expected to integrate into the host country’s society.

It’s important to note that the asylum process and eligibility criteria can vary significantly from one country to another. Additionally, the political climate, international agreements, and domestic laws may impact the asylum process. For the most accurate and up-to-date information on seeking asylum in a specific country, individuals should consult with the relevant government agencies or organizations specializing in refugee and asylum matters.

“>Asylum in Saudi Arabia

Saudi Arabia did not have a formal asylum system, and the reasons for this can be attributed to various factors:

Historically Low Numbers of Asylum Seekers: Saudi Arabia has not historically been a common destination for refugees and asylum seekers. The country has not experienced the same level of forced displacement or conflict-related displacement as many other nations, which may have contributed to a limited focus on establishing a formal asylum system.

Regional Dynamics: Saudi Arabia is part of the Gulf Cooperation Council (GCC), and there has been a practice of free movement and reciprocal benefits for citizens of GCC countries within the member states. This may have influenced the approach to asylum, as GCC citizens could typically reside and work in each other’s countries without the need for formal asylum procedures.

Strong State Control: Saudi Arabia has traditionally maintained strict control over immigration and residency. The country’s legal and administrative systems prioritize the sponsorship (kafala) system, which requires foreign workers to have sponsors, usually employers or individuals, to live and work in the country. This system does not align with traditional asylum practices.

Bilateral Agreements: Saudi Arabia has historically addressed migration and protection issues through bilateral agreements and arrangements with specific countries or organizations rather than a general asylum framework.

It’s important to note that countries with limited asylum systems often rely on the broader framework of international refugee law and humanitarian principles to address the protection needs of individuals who may be at risk. In such cases, individuals seeking protection may be referred to the United Nations High Commissioner for Refugees (UNHCR), which plays a central role in aiding and supporting refugees globally.

Financial System of Saudi Arabia

- Overview of the Saudi Arabia Financial System

- Banking System

- Islami Finance

- Stock Market

- Capital Market Authority

- Insurance Sector

- Sovereign wealth funds

- Government Initiatives

- Regulatory Framework

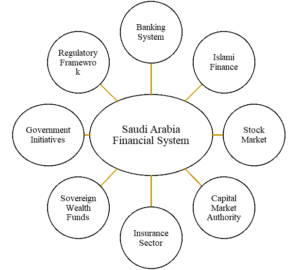

Overview of Saudi Arabia’s Financial System

Saudi Arabia’s financial system is a multifaceted framework that is crucial to the nation’s economic vitality. At its core is the Saudi Arabian Monetary Authority (SAMA), the central bank, which oversees and regulates the financial landscape. The banking sector is a dynamic mix of local and international banks, contributing to a well-established and stable financial environment.

One distinctive feature of Saudi Arabia’s financial system is its leadership in Islamic finance. A significant portion of financial activities in the country adhere to Sharia principles, with Islamic banks and financial institutions offering a wide array of products and services that comply with Islamic law.

The Tadawul, the Saudi Stock Exchange, is the largest stock market in the Arab world. It serves as a crucial platform for capital mobilization, attracting a diverse range of investors, both domestic and international. The Capital Market Authority (CMA) oversees the functioning of the capital markets, ensuring transparency, fairness, and the protection of investor rights.

The insurance sector, under the regulatory purview of SAMA, has experienced substantial growth, providing a range of insurance products to meet diverse needs. SAMA’s vigilant regulation ensures stability and adherence to regulatory standards within the insurance industry.

The Public Investment Fund (PIF) is a key player in Saudi Arabia’s financial landscape, holding the distinction of being one of the world’s largest sovereign wealth funds. The PIF is instrumental in supporting economic diversification efforts and strategically investing in various domestic and international sectors.

Looking towards the future, Saudi Arabia is actively fostering fintech and innovation within its financial sector. This commitment aligns with the broader goals of Vision 2030, a transformative initiative aimed at reducing the country’s reliance on oil and promoting economic diversification. By embracing technological advancements and encouraging innovation, Saudi Arabia aims to position itself as a dynamic and diversified economic powerhouse in the global arena.

Banking System

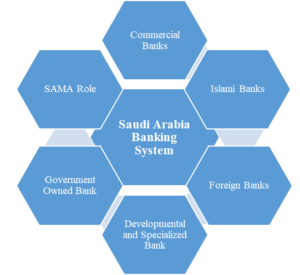

The banking system in Saudi Arabia is a vital component of the country’s financial infrastructure, contributing significantly to economic development and stability. Governed by the Saudi Arabian Monetary Authority (SAMA), the central bank, the banking sector is characterized by a diverse range of institutions and services.

Commercial Banks: Saudi Arabia’s banking system is anchored by a robust network of commercial banks, serving as the primary financial institutions for individuals, businesses, and government entities. These banks offer a comprehensive suite of services, including retail and corporate banking, loans, and investment products. The National Commercial Bank (NCB), one of the largest banks in the Middle East, exemplifies the prominence of local commercial banks. Riyadh Bank, Saudi British Bank (SABB), and others contribute to the sector’s vitality. International banks, such as HSBC and Citibank, further diversify the commercial banking landscape, catering to the needs of a globalized economy.

Islamic Banks: Reflecting Saudi Arabia’s commitment to Islamic finance, the banking sector features a significant presence of Islamic banks. These institutions adhere strictly to Sharia principles, eschewing interest-based transactions and emphasizing ethical and socially responsible financial practices. Al Rajhi Bank, the world’s largest Islamic bank, leads the way, offering a range of Sharia-compliant products. Other key players include Saudi Investment Bank and Bank AlJazira, collectively contributing to the growth and prominence of Islamic banking in the country.

Foreign Banks: Saudi Arabia’s banking sector is open to international players, with foreign banks establishing a notable presence. These banks cater to the needs of multinational corporations, expatriates, and international trade. HSBC Saudi Arabia, a subsidiary of the global banking giant, exemplifies the international footprint in the country. Citibank, with its extensive global network, also plays a significant role, in facilitating cross-border financial transactions and contributing to the internationalization of the Saudi banking sector.

Developmental and Specialized Banks: In addition to conventional and Islamic banks, Saudi Arabia has specialized institutions focusing on specific sectors and developmental goals. Developmental banks, such as the Saudi Industrial Development Fund (SIDF), provide crucial financial support to promote industrial projects and economic diversification. The Saudi Agricultural and Livestock Investment Company (SALIC) contributes to the agricultural sector’s development. These institutions play a pivotal role in advancing strategic initiatives and sustaining long-term economic growth.

Government-Owned Banks: Certain banks in Saudi Arabia have a government stake, playing a strategic role in supporting national economic objectives. The Saudi Arabian Development Bank (SADB) is a prime example, actively involved in providing financial support to entrepreneurs and small businesses. These government-owned banks align their operations with national development goals, contributing to the overall economic agenda of the country.

SAMA’s Role: The Saudi Arabian Monetary Authority (SAMA) serves as the central bank and regulatory authority, playing a pivotal role in shaping and overseeing the banking sector. SAMA establishes monetary policies, regulates interest rates, and monitors the overall health of the financial system. Its mandate includes maintaining monetary stability, safeguarding the integrity of the financial system, and ensuring compliance with regulatory standards. SAMA’s proactive approach contributes to the resilience and stability of Saudi Arabia’s banking sector.

In summary, Saudi Arabia’s banking system is characterized by a diverse and dynamic landscape, encompassing commercial, Islamic, foreign, developmental, and government-owned banks. This comprehensive framework, overseen by SAMA, reflects the adaptability and resilience of the financial sector, positioning Saudi Arabia as a key player in the global financial arena.

Islamic Finance

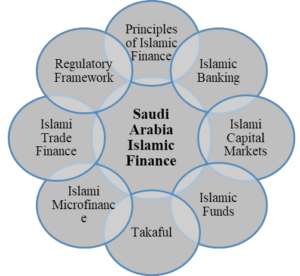

Islamic finance in Saudi Arabia is a significant and growing segment of the financial sector, reflecting the country’s commitment to Islamic principles and Sharia-compliant economic practices. Here’s a detailed explanation of Islamic finance in Saudi Arabia and its various types:

Principles of Islamic Finance: In Islamic finance, the prohibition of riba is absolute. Riba refers to any excess or increase obtained without giving anything in return. This prohibition is based on the Islamic principle that wealth should be generated through legitimate and ethical means. The avoidance of gharar emphasizes the importance of clarity and transparency in financial transactions. Gharar refers to excessive uncertainty or ambiguity that could lead to unfair advantage or exploitation. Contracts in Islamic finance are structured to minimize uncertainty and ensure fairness. Islamic finance encourages investments in businesses and activities that align with ethical and moral values. This involves avoiding industries such as gambling, alcohol, pork, and other activities deemed incompatible with Islamic principles. The emphasis is on socially responsible and ethical investment practices.

Islamic Banking: The mudarabah contract is a profit-sharing arrangement. The provider of capital (rab-ul-maal) entrusts their funds to a manager (mudarib) who invests it in a business venture. Profits are shared based on a pre-agreed ratio, and losses are borne by the capital provider. Musharakah is a form of partnership where both parties contribute capital to a business venture. Profits and losses are shared according to an agreed-upon ratio. This arrangement promotes risk-sharing and collaboration.

Islamic Capital Market: Sukuk is structured to comply with Sharia principles. They represent ownership in an underlying asset, project, or business, providing an alternative to conventional interest-based bonds. The returns are generated from the performance of the underlying asset. Companies listed on the Tadawul that adhere to Islamic principles, ensure that their business activities are in line with ethical and Sharia-compliant standards.

Islamic Funds: Islamic mutual funds pool funds from multiple investors and invest in a diversified portfolio of Sharia-compliant assets. The profits generated are distributed among the investors based on the fund’s performance. Sharia-compliant REITs allow investors to participate in real estate ventures without violating Islamic principles. Returns come from rental income and capital appreciation.

Islamic Insurance (Takaful): Takaful is a cooperative insurance system where participants contribute to a common fund to provide mutual financial assistance in case of loss or damage. The surplus funds, after covering claims and expenses, are distributed among the participants.

Islamic Microfinance: Qard al-Hasan represents an interest-free loan provided for charitable purposes. Islamic microfinance institutions use this mechanism to support individuals and small businesses in need, promoting financial inclusion.

Islamic Trade Finance: Murabaha is a common structure in trade finance where the bank purchases an asset and sells it to the customer at a marked-up price. This arrangement allows for deferred payments, aligning with Islamic finance principles.

Regulatory Framework: SAMA acts as the central bank and the primary regulatory authority for banks and financial institutions in Saudi Arabia. It oversees the implementation of Sharia principles in Islamic financial institutions, ensuring compliance with ethical standards. CMA regulates the capital markets in Saudi Arabia. It plays a vital role in ensuring that Islamic financial products and services offered in the securities market adhere to Sharia principles and comply with regulatory standards. The collaborative efforts of SAMA and CMA contribute to the stability, transparency, and ethical functioning of the Islamic financial system in Saudi Arabia.

In conclusion, Islamic finance in Saudi Arabia represents a comprehensive and sophisticated system deeply rooted in Islamic principles. The various financial instruments and structures aim to provide ethical alternatives to conventional finance, promoting economic development while adhering to the values of Sharia. The regulatory framework ensures the integrity and compliance of Islamic financial institutions, fostering a robust and sustainable financial ecosystem.

Saudi Stock Exchange

Tadawul, the Saudi Stock Exchange, stands as the largest stock market in the Arab world, formed in 2007 through the consolidation of the Riyadh, Jeddah, and Dammam stock exchanges. Operating under the oversight of the Capital Market Authority (CMA), Tadawul comprises the Main Market, where established companies list for public trading, and the Parallel Market (Nomu), designed for smaller to mid-sized companies. Governed by its own set of rules and regulations, Tadawul hosts a diverse range of companies spanning various sectors, including finance, petrochemicals, and telecommunications. The market has actively sought foreign investment, allowing Qualified Foreign Investors (QFIs) to participate within specified conditions. Tadawul operates electronically, with two daily trading sessions and a T+2 settlement cycle. Notable indices like the Tadawul All Share Index (TASI) and the Parallel Market Index (NOMU) reflect market performance. The exchange plays a crucial role in facilitating IPOs, and corporate actions, and has witnessed significant developments, including the inclusion of Saudi stocks in global indices, marking its pivotal role in the economic landscape and efforts to attract international investors.

The Capital Market Authority

The Capital Market Authority (CMA) in Saudi Arabia, established in 2003, serves as the regulatory cornerstone of the nation’s capital markets. Its multifaceted functions encompass the meticulous formulation and enforcement of regulations governing the issuance and trading of securities, disclosure requirements, and corporate governance standards. A primary objective lies in safeguarding investor rights, fostering confidence in the capital markets, and ensuring fair and transparent market practices. The CMA achieves these goals through a comprehensive approach that includes licensing and authorizing financial institutions, intermediaries, and market participants, thereby maintaining stringent regulatory standards.

The CMA operates under the guidance of a board comprised of seasoned professionals in finance, law, and related fields, which sets the overarching direction and policies of the regulatory body. Additionally, the CMA may establish various committees focusing on specific regulatory aspects such as licensing, market development, and investor protection. This committee-based structure enables the CMA to address diverse facets of the capital markets, ensuring a well-rounded and effective regulatory framework.

In its role as a guardian of market integrity, the CMA actively participates in market development initiatives. This involves introducing new financial instruments, encouraging innovation, and supporting endeavors that contribute to the growth and dynamism of the securities market. The CMA also facilitates dispute resolution within the capital markets, providing a fair and efficient mechanism to address conflicts that may arise between market participants.

Within the CMA’s organizational structure, specialized departments play key roles. The Market Supervision Department diligently monitors market activities, ensuring compliance with regulations and investigating potential violations. The Legal Affairs Department handles the legal intricacies of capital market regulations, including formulation, interpretation, and enforcement. Given the increasing reliance on technology, the Information Security Department ensures the robustness and confidentiality of market-related information.

In essence, the Capital Market Authority in Saudi Arabia is a pivotal institution, contributing significantly to the stability, transparency, and overall development of the country’s capital markets. Through its regulatory prowess, the CMA nurtures an environment conducive to investment, innovation, and sustainable economic growth.

Insurance Sector

The insurance sector in Saudi Arabia has experienced significant growth and development in recent years, reflecting the country’s expanding economy and the increasing awareness of the importance of risk management. The sector is regulated by the Saudi Arabian Monetary Authority (SAMA), which ensures compliance with Sharia principles for Islamic insurance (Takaful) companies. Here’s a detailed overview of the insurance sector in Saudi Arabia:

Conventional Insurance: Motor Insurance is Compulsory for all motor vehicle owners in Saudi Arabia, providing coverage for damages or injuries caused by accidents. Health Insurance Covers medical expenses, including hospitalization, surgeries, and other healthcare services. Property Insurance Protects against damage or losses to physical properties, such as homes and businesses, due to events like fire or natural disasters. Liability Insurance Provides coverage for legal liabilities arising from third-party claims, including professional liability and product liability.

Takaful (Islamic Insurance): Takaful is Similar to conventional property and liability insurance but operates on Islamic principles. Participants contribute to a common fund to support each other in case of loss or damage. Islamic health insurance follows Sharia principles, ensuring that the system is free from interest (Riba) and uncertainty (Gharar). Combines insurance coverage with an investment component, allowing participants to earn returns on their contributions.

Recent Developments and Initiatives: The Saudi government has taken steps to liberalize the insurance market, allowing foreign insurance companies to establish a presence in the country. Insurers in Saudi Arabia are embracing digital technologies to enhance customer experience, streamline operations, and improve efficiency. There is a growing focus on Environmental, Social, and Governance (ESG) considerations in the insurance sector, aligning with global trends toward sustainable and responsible business practices. The sector is placing increased emphasis on robust risk management practices and compliance with regulatory requirements.

Challenges and Opportunities: Increased competition among insurance companies has led to innovation and the introduction of new products and services. Despite growth, there is still room

for increasing insurance penetration in Saudi Arabia, and efforts are being made to raise awareness about the importance of insurance. Insurance companies in Saudi Arabia are exploring opportunities for collaboration and partnerships with global players to enhance expertise and expand market reach.

In conclusion, the insurance sector in Saudi Arabia is evolving to meet the changing needs of individuals and businesses, with a focus on innovation, regulatory compliance, and sustainable practices. The coexistence of conventional and Takaful insurance reflects the diverse preferences of the population in a rapidly changing economic landscape.

Sovereign Wealth Fund

The Sovereign Wealth Fund (SWF) in Saudi Arabia, specifically the Public Investment Fund (PIF), plays a crucial role in the country’s financial system and economic development. The PIF’s role in revenue diversification is pivotal to the economic transformation envisioned by Vision 2030. Beyond the immediate goal of reducing reliance on oil, the fund aims to create a resilient and dynamic economy. This involves identifying and investing in sectors that not only generate revenue but also foster innovation, job creation, and sustainability. PIF’s strategic investments are meticulously aligned with the broader economic vision. Domestically, the focus extends to sectors like technology, where investments can drive innovation and create a knowledge-based economy. Internationally, strategic investments position Saudi Arabia as a global player, promoting economic diplomacy and cross-border collaborations.

The support provided by PIF goes beyond mere financial backing. It involves strategic partnerships, capacity-building initiatives, and the creation of an ecosystem conducive to business growth. This support is not just about investment returns but also about nurturing a robust and self-sustaining industrial landscape within Saudi Arabia. The global diversification strategy of PIF involves a nuanced understanding of international markets. It not only mitigates risks associated with economic fluctuations but also positions the fund to capitalize on emerging trends and industries. This diversification is a strategic move to ensure stable returns and secure the long-term financial health of the fund. The stabilizing role of PIF involves a dynamic approach to economic challenges. During periods of downturns, the fund can be deployed strategically to stimulate economic activity, create jobs, and mitigate the impact on businesses. This proactive stance enhances the fund’s role as a stabilizing force in the face of global economic uncertainties.

Commodity-based SWFs: Commodity-based SWFs like the PIF are intricately linked to the country’s commodity exports. The fund’s inflow is tied to the revenue generated from the export of oil. The challenge lies in effectively managing this windfall, converting it into a diversified portfolio that ensures long-term financial sustainability beyond the commodity boom.

Reserve Investment Funds: Reserve Investment Funds operate on the premise of managing a nation’s foreign exchange reserves. Beyond the immediate goal of preserving the value of reserves, these funds must strike a delicate balance between liquidity and returns. They act as custodians of a nation’s wealth, safeguarding it against currency fluctuations and external economic shocks.

Pension Reserve Funds: The intricacies of Pension Reserve Funds go beyond mere investment strategies. These funds have a long-term horizon, requiring a prudent approach to ensure they can meet future pension obligations. The challenge lies in balancing risk and return to ensure the financial security of the aging population while contributing to the overall economic development.

Stabilization Funds: Stabilization Funds, as fiscal stabilizers, face the challenge of timing. Effective utilization during economic downturns requires a keen understanding of economic cycles. These funds must be agile and responsive, ready to inject liquidity when needed while maintaining a long-term perspective on economic stability.

Development Funds: Development Funds play a transformative role in shaping a nation’s future. The challenge lies in identifying projects that not only align with long-term economic goals but also contribute to sustainable development. These funds must navigate complex infrastructure projects, innovation initiatives, and strategic investments to create a lasting impact on the nation’s economic landscape.

In essence, the role and types of SWFs, particularly the PIF in Saudi Arabia, are embedded in a complex interplay of economic foresight, strategic investments, and the challenge of balancing short-term needs with long-term sustainability. Each facet requires a nuanced understanding of global markets, economic dynamics, and a commitment to shaping a resilient and diversified economy.

Government Initiatives

Saudi Arabia has implemented various government initiatives to enhance and modernize its financial system. These initiatives are often aligned with broader economic development plans, such as Vision 2030. Here are some key government initiatives in the Saudi Arabian financial system:

Vision 2030: Launched in 2016, Vision 2030 is a comprehensive plan that aims to transform Saudi Arabia’s economy and reduce its dependency on oil. The vision emphasizes the development of a more diversified and dynamic financial sector to support economic growth. This includes strengthening the role of the private sector, encouraging foreign investment, and promoting financial market stability. Vision 2030 outlines plans to enhance the efficiency and transparency of the capital market. This involves implementing reforms to Tadawul (Saudi Stock Exchange) and increasing the market’s attractiveness to both domestic and international investors. The vision emphasizes the importance of improving financial literacy and increasing access to financial services for all segments of society. This includes initiatives to promote digital financial services and enhance financial education.

Fintech Saudi: Fintech Saudi is an initiative launched by the Saudi Arabian Monetary Authority (SAMA) to promote financial technology and innovation in the country. It aims to position Saudi Arabia as a leading hub for fintech in the region. Fintech companies are provided with a regulatory sandbox environment where they can test their innovative financial products and services in a controlled setting, allowing for experimentation without compromising regulatory standards. SAMA has introduced a fintech regulatory framework, including licensing procedures for fintech companies. This framework is designed to foster a conducive environment for fintech growth while ensuring regulatory compliance. Fintech Saudi encourages collaboration between traditional financial institutions and fintech startups. This collaborative approach aims to leverage the strengths of both sectors for mutual benefit and the advancement of financial services.

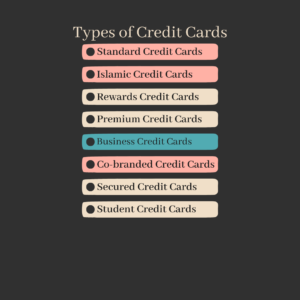

Saudi Payments: Saudi Payments is an initiative aimed at enhancing the country’s payment systems and infrastructure. It focuses on promoting a cashless society and facilitating secure, efficient, and innovative payment solutions. MADA is the national payment scheme in Saudi Arabia, operated by Saudi Payments. It oversees various payment methods, including debit and credit cards, to promote electronic transactions and reduce reliance on cash. The initiative includes the development and implementation of instant payment systems to enable real-time transactions, providing convenience to individuals and businesses. Saudi Payments is working on the implementation of open banking standards, allowing for increased collaboration and integration between traditional banks and fintech companies.

These initiatives collectively contribute to the transformation and growth of Saudi Arabia’s financial system, making it more resilient, inclusive, and technologically advanced. They reflect the government’s commitment to fostering innovation, attracting investments, and achieving sustainable economic development.

Fintech, short for financial technology, refers to the use of innovative technologies to deliver financial services and solutions. In Saudi Arabia, like in many other countries, the fintech sector has been experiencing significant growth and innovation.

Digital Payments: Mobile payment apps, like STCPay and Apple Pay, have gained popularity in Saudi Arabia. These apps allow users to link their bank accounts or credit cards to make secure and convenient transactions using their smartphones. The adoption of contactless payment technology has increased, with many merchants accepting payments through Near Field Communication (NFC) technology.

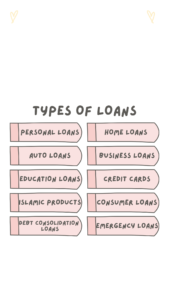

Peer-to-Peer Lending (P2P): P2P lending platforms in Saudi Arabia cater to various needs, from personal loans to small business financing. These platforms connect borrowers with individual lenders, providing an alternative to traditional banking channels. Fintech lenders often leverage advanced data analytics and machine learning algorithms to assess the creditworthiness of borrowers and determine interest rates.

Robo-Advisors: Robo-advisors use algorithms to analyze financial data and provide automated investment advice. Investors can access these services through online platforms, making wealth management more accessible to a broader audience. The automated nature of robo-advisors often results in lower fees compared to traditional financial advisory services.

Blockchain and Cryptocurrencies: Some financial institutions in Saudi Arabia have initiated pilot projects to explore the potential of blockchain technology for enhancing security and transparency in financial transactions. While there is interest in blockchain, the Saudi Arabian Monetary Authority (SAMA) has maintained a cautious stance on cryptocurrencies, with regulatory frameworks evolving to address potential risks.

Regulatory Sandbox: The regulatory sandbox in Saudi Arabia allows fintech startups to test their products and services in a controlled environment without immediately facing the full regulatory requirements. This fosters innovation and helps companies refine their offerings.

Open Banking: Open banking initiatives encourage financial institutions to share customer data securely with third-party fintech providers. This sharing of data can lead to the development of innovative financial products and services. Consumers can benefit from a more seamless and integrated banking experience as they use a variety of financial services from different providers.

Insurance Technology (Insurtech): Insurtech companies in Saudi Arabia are introducing digital platforms that simplify the purchase and management of insurance policies. Insurtech firms leverage data analytics to assess risks more accurately, leading to more personalized insurance products.

Digital Banks: Digital banks operate without physical branches, providing banking services entirely through online platforms and mobile apps. Digital banks contribute to financial inclusion by reaching individuals who may not have access to traditional banking services.

Personal Finance Management: Fintech apps offer comprehensive personal finance management tools, including budgeting features, expense tracking, and investment insights. Some platforms provide educational resources to help users make informed financial decisions.

Crowdfunding: Crowdfunding platforms in Saudi Arabia support various models, such as reward-based crowdfunding for startups and donation-based crowdfunding for charitable causes. Fintech-driven crowdfunding provides alternative funding sources for entrepreneurs and projects.

Regtech: Regtech solutions help financial institutions comply with regulations efficiently by automating processes such as transaction monitoring, identity verification, and regulatory reporting. Fintech companies invest in advanced cybersecurity measures to protect sensitive financial data and ensure compliance with data protection regulations.

The Saudi Arabian government’s commitment to fostering a digital economy through Vision 2030, coupled with regulatory support and a growing tech-savvy population, positions the country as a hub for fintech innovation in the region. Continued collaboration between traditional financial institutions and fintech startups is likely to shape the future of the financial services sector in Saudi Arabia.

Regulatory Bodies

Certainly, Saudi Arabia has established regulatory bodies to oversee and ensure the stability, integrity, and compliance of its financial system. The primary regulatory bodies include:

Saudi Arabian Monetary Authority (SAMA): The Saudi Arabian Monetary Authority (SAMA) serves as the central bank of Saudi Arabia, playing a pivotal role in the country’s economic and financial landscape. Established in 1952, SAMA operates under the jurisdiction of the Ministry of Finance and is tasked with formulating and implementing monetary policy to ensure price stability and support the overall economic objectives of the Kingdom. One of its key responsibilities is the issuance and regulation of the national currency, the Saudi Riyal. SAMA oversees and regulates commercial banks and financial institutions, working to maintain a sound and stable banking sector. In addition to its focus on monetary policy, SAMA manages the country’s foreign exchange reserves, contributing to economic stability. Authority plays a crucial role in ensuring the integrity and resilience of the financial system, employing measures for crisis management and contingency planning. As a driver of financial sector development, SAMA continues to adapt to emerging trends, embracing technological advancements while upholding its commitment to maintaining the stability and integrity of the Kingdom’s monetary and financial framework.

Capital Market Authority: The Capital Market Authority (CMA) plays a pivotal role in the Saudi Arabian financial system, serving as the regulatory authority for the capital markets. Established to ensure transparency, fairness, and investor protection, the CMA oversees a wide array of entities within the capital market, including publicly listed companies, investment funds, and brokerage firms. Its primary objective is to foster a secure and efficient market environment, enabling the growth and development of the capital market in alignment with international best practices. The CMA is responsible for approving initial public offerings (IPOs), regulating securities trading, and enforcing compliance with market regulations. By setting and enforcing stringent standards, the CMA aims to safeguard the interests of investors, promote market integrity, and contribute to the overall stability and competitiveness of Saudi Arabia’s capital markets. Additionally, the CMA plays a crucial role in shaping regulatory frameworks, adapting to evolving market dynamics, and supporting initiatives that enhance the sophistication and efficiency of the country’s financial ecosystem.

Saudi Arabian Monetary Agency Insurance (SAMA Insurance): The Saudi Arabian Monetary Agency Insurance (SAMA Insurance) plays a pivotal role in the Kingdom of Saudi Arabia’s financial system as the regulatory authority overseeing the insurance sector. As a division of the Saudi Arabian Monetary Authority (SAMA), its primary mandate is to formulate and enforce regulations that govern the operations of insurance companies within the country. SAMA Insurance ensures the stability and integrity of the insurance industry by implementing stringent standards related to financial solvency, risk management, and adherence to Sharia principles for Islamic insurance (Takaful). It grants licenses to insurance companies, monitors their financial health, and intervenes when necessary to safeguard the interests of policyholders. By maintaining a vigilant oversight, SAMA Insurance contributes to the overall stability of the financial system, instills confidence in the insurance market, and aligns with the broader economic objectives outlined in Vision 2030.

Saudi Arabian Financial Sector Development Program (FSDP): The Saudi Arabian Financial Sector Development Program (FSDP) plays a pivotal role in shaping and advancing the financial landscape of Saudi Arabia. Initiated by the government, FSDP is a comprehensive program designed to enhance the efficiency, competitiveness, and resilience of the country’s financial sector. Focused on aligning with the overarching goals of Vision 2030, FSDP spearheads initiatives to modernize the financial industry, improve regulatory frameworks, and foster innovation in financial products and services. By promoting the adoption of advanced technologies and best practices, the program aims to create a dynamic and inclusive financial ecosystem. FSDP’s strategic vision extends beyond immediate objectives, addressing long-term sustainability and global competitiveness. Through its multifaceted approach, the program contributes significantly to the economic diversification and transformation efforts outlined in Vision 2030, positioning Saudi Arabia as a hub for financial innovation and growth in the region.