መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » የተባበሩት አረብ ኢሚሬትስ

Brief History of UAE

- History of UAE

- Hierarchical structure

- The Constitution of UAE

- Federal Government

- Emirates Government

- Election

History of the UAE

Ancient History: In ancient times, the Persian Gulf, where the modern-day UAE is situated, was relatively cut off from other people. With vast deserts and treacherous mountains cutting the gulf off from most other contact, countries of the Persian Gulf only really communicated between themselves. The countries found in the Persian Gulf included (modern-day) the UAE, Oman, Qatar, Bahrain, Kuwait, Iraq, Iran, and others. These countries were influenced by the power of several empires, including the Ottoman Empire, the Sassanid Persian Empire, and the Parthian Empire. These empires and countries were famed for their naval prowess, and piracy was common along the Gulf.

Colonization: In the 1500s, Portuguese naval forces attempted their first invasions of the Gulf. Battling with Ottoman forces, the Portuguese conquered many of the Gulf countries and were not expelled for around 100 years. The Persian Gulf supplied trade routes to North Africa, India, and China, and was a valuable port for long voyages from Europe. The main trade of the Gulf countries was pearls, and these made up a large part of the history of the UAE and surrounding countries.

To overthrow Portuguese rule, the help of the British Navy was enlisted by the Persian emperor of 1622. This opened the gulf for more trade, and for many years the region prospered. The East India Trading Company and Kuwait formed alliances to help the British capitalize on this trade route and the booming pearl trade, and all was well for many years: the UAE and the Persian Gulf were peaceful.

Modern history of the UAE: In more modern times, at the start of the 19th century, the Gulf was ruled by the Sheiks. Much like an emirate, this was a territory ruled by a Sheik. Piracy had started to creep back into the waters of the gulf, and so to secure their trade in the region the British signed treaties for naval truce with many Sheikdoms. In 1853 this necessitated the creation of the Trucial States, which was a group of Sheikdoms that formed under the protectorate of the British, in return for piratical immunity. The British had control of foreign policy in the Trucial States for several years, although it cost them lots of money, and towards the end of the 19th century, they stopped seeing much point in the arrangement.

In the early 1900s, things changed forever in the Persian Gulf. With the invention of artificial pearls, the region’s main trade was devalued and eventually ceased. Many people moved away from the cities hoping to find work elsewhere, and for a while, the UAE was deserted. However, after a few years of hardship, one discovery in Iraq changed everything: oil.

Upon discovering this hugely valuable commodity, people quickly emigrated to the UAE, and populations rose again. To defend their new resource, the Trucial States decided to become independent of the British and formed the United Arab Emirates. The British stopped their protectorate in 1968, then three years later, on 2nd December 1971, the UAE was formed. This originally included 6 emirates, with Ras Al Khaimah joining two months later, to make the 7 emirates we know today.

Is the UAE a country? The United Arab Emirates is a country located in the Persian Gulf and is made up of 7 emirates. An emirate is a territory ruled by an emir, which means the UAE is governed by 7 emirs. These 7 emirs work together to form a governing body, from which a president is elected as the main figurehead for the UAE. This spokesperson is elected from Abu Dhabi, which is the largest and richest of the 7 emirates.

The emirates in the UAE: There are 7 emirates in the UAE, and contrary to popular belief, they are not all bustling desert cities. Abu Dhabi is the largest emirate, with Dubai being the second largest. These two emirates make up most of the wealth of the UAE and are the emirates people think of most frequently when the UAE is mentioned. The other emirates are smaller, and in many places are much more modest. Listed in order of size, the 7 emirates of the UAE are:

- Abu Dhabi

- Dubai

- Sharjah

- Ras Al Khaimah

- Fujairah

- Umm Al Quwain

- Ajman

It’s also worth noting that the capital city of each emirate has the same name as the emirate territory. The capital city of Abu Dhabi is Abu Dhabi, whilst this is also the name of the whole region. Abu Dhabi (capital) is 972 km2, whereas the region is 67,340 km2. This makes the capital only 1.4% of the entire Abu Dhabi regional area.

Hierarchical Structure of the UAE

The United Arab Emirates (UAE) has a hierarchical structure of government and leadership that reflects its federal system and the individual governance of its seven emirates. Here’s an overview of this structure:

Federal Structure: The UAE is a federation of seven emirates, each of which retains a considerable degree of autonomy. The seven emirates are Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, Fujairah, and Ras Al Khaimah.

Federal Supreme Council (FSC): The highest authority in the UAE is the Federal Supreme Council. This council consists of the rulers of each of the seven emirates. They convene to make significant decisions on national issues, including the election of the President and Vice President of the UAE.

President and Vice President: The President and Vice President of the UAE are elected from among the members of the Federal Supreme Council. The President serves as the head of state, while the Vice President assists in carrying out the federal functions. The President is also the ruler of Abu Dhabi, the largest and wealthiest emirate.

Cabinet: The UAE Cabinet, also known as the Council of Ministers, is responsible for formulating and implementing federal policies and laws. It is composed of ministers, each of whom oversees specific government ministries and departments. The Prime Minister chairs the Cabinet.

Prime Minister: The Prime Minister is appointed by the President and is usually the ruler of Dubai. The Prime Minister presides over Cabinet meetings and assists in the day-to-day administration of federal affairs.

Federal National Council (FNC): The Federal National Council is a legislative body with advisory powers. Its members are partially appointed and partially elected by the citizens of each emirate. The FNC reviews and suggests changes to federal laws and policies but does not have the authority to enact legislation. It serves as a platform for public discourse and engagement in federal matters.

Emirate-Level Government: Each emirate has its government structure, headed by a ruler or emir. The ruler appoints an executive council or cabinet to manage the emirate’s affairs. These emirate-level governments have authority over a wide range of local issues, including infrastructure, education, healthcare, and social services.

Local Councils: Emirate-level governments may establish local councils or municipalities responsible for local governance, public services, and urban planning. These councils’ specific structure and responsibilities can vary from emirate to emirate.

Judiciary: The UAE has an independent judiciary system, with both federal and emirate-level courts. The federal judiciary is responsible for interpreting federal laws, while the emirate-level courts handle issues that fall within the jurisdiction of individual emirates. The Federal Supreme Court serves as the highest judicial authority in the country.

The hierarchical structure of the UAE’s government is designed to balance the authority of individual emirates with the need for unified federal governance. This structure has contributed to the country’s political stability and economic development while respecting the distinct identities and traditions of each emirate.

The UAE Constitution

The United Arab Emirates (UAE) does not have a single, comprehensive written constitution like many other nations. Instead, the UAE’s constitutional framework is based on a combination of sources, including historical agreements, federal laws, and Islamic law principles (Sharia). Here’s a brief overview of the key elements of the UAE’s constitutional framework.

Historical Agreements: The UAE’s constitutional framework is primarily based on historical agreements between the seven emirates. These agreements include the “Union Agreement” signed on December 2, 1971, which established the UAE as a unified nation. Another important document is the “Constitution of the United Arab Emirates” issued by the Federal National Council (FNC) in 1996, which outlines the basic principles and structure of the federal government.

Islamic Law (Sharia): The UAE’s legal system is influenced by Islamic law, or Sharia. Sharia principles are embedded in the legal and judicial systems of the country and play a significant role in shaping its laws and regulations, particularly in family and personal matters.

Federal System: The UAE’s constitution emphasizes the federal nature of the country, recognizing the individual authority and autonomy of each emirate. The emirates have the right to manage their local affairs and resources.

Role of the Federal Supreme Council: The Federal Supreme Council (FSC), composed of the rulers of the seven emirates, is the highest constitutional authority in the UAE. The FSC has the power to make important decisions related to the federal structure, including electing the President and Vice President of the UAE.

Principles of Governance: The constitution establishes key principles of governance, including the rule of law, democracy, the separation of powers, and respect for human rights.

Federal National Council (FNC): The FNC is a key component of the UAE’s constitutional framework. While it is an advisory body without legislative powers, it plays a role in discussing and proposing changes to federal laws and policies.

Presidential Authority: The President of the UAE, elected by the FSC, holds executive authority at the federal level and represents the UAE internationally. The Prime Minister, usually the ruler of Dubai, assists the President in the administration of federal affairs.

Judiciary: The UAE has a well-established judiciary with federal and emirate-level courts. The Federal Supreme Court serves as the highest legal authority in the country, responsible for interpreting federal laws and resolving disputes between emirates.

Fundamental Rights and Freedoms: The UAE’s constitution recognizes fundamental rights and freedoms, including the right to equality, education, healthcare, and a fair trial. It also emphasizes the importance of preserving cultural heritage and the Arabic language.

It’s important to note that the UAE’s constitutional framework is a mix of written and unwritten elements, with flexibility that allows for adaptations and evolution over time. Federal laws, decrees, and regulations fill in many details and provisions, effectively shaping the legal and political landscape of the country.

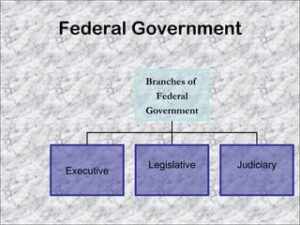

The Federal Government of the UAE

The Federation aims to maintain its independence and sovereignty, safeguard its security and stability, defend its existence or the existence of its member emirates from any act of aggression, and protect the rights and responsibilities of the people of the Federation. It aims to work in close cooperation with each of the emirates for their common benefit in realizing these objectives and promoting their prosperity and progress in all fields to provide a better life for all citizens, ensuring mutual respect by each emirate for the independence and sovereignty of the other emirates in matters related to their internal affairs within the framework of the Constitution.

The Federal Authorities in the UAE: The UAE Federal Authorities include the Federal Supreme Council, the President and Vice President, The Cabinet, the Federal National Council, and the Federal Judicial Authority.

Each emirate of the UAE shall handle all authorities not assigned by the Constitution to the Federation. Moreover, each emirate shall contribute to building and protecting the Constitution as well as benefiting from its services. All member emirates of the Federation will strive to coordinate their legislatures in all areas to achieve standardization.

The federal government of the United Arab Emirates (UAE) has three main branches, like many other democratic nations. These branches are:

The Executive Branch: The executive branch of the federal government of the United Arab Emirates (UAE) is headed by the President and Vice President, both of whom are elected by the Federal Supreme Council (FSC). The President serves as the head of state and represents the UAE on the international stage, while the Vice President assists in executing federal functions. The executive branch also encompasses the Cabinet, and the Council of Ministers, responsible for developing and implementing federal policies and laws. The Prime Minister, typically the ruler of Dubai, presides over Cabinet meetings and plays a crucial role in the administration of federal affairs. The executive branch is responsible for the day-to-day governance of the UAE, including the implementation of laws and policies at the federal level.

The legislative branch: The legislative branch of the federal government in the United Arab Emirates is embodied by the Federal National Council (FNC). The FNC serves as a crucial component of the UAE’s political landscape, acting as a consultative and advisory body. Its members are drawn from each of the seven emirates, with some being appointed by the respective emirate rulers and others being elected by citizens. While the FNC does not possess legislative powers, it plays a significant role in the decision-making process by reviewing and proposing changes to federal laws and policies. As a platform for public discourse and engagement, the FNC provides a voice for the citizens, contributing to the development of federal laws and ensuring that the government remains responsive to the needs and concerns of the people.

The judicial branch: The judicial branch of the federal government of the United Arab Emirates (UAE) comprises federal and emirate-level courts. At the federal level, the Federal Supreme Court serves as the highest judicial authority in the country. It is responsible for interpreting federal laws, resolving disputes between emirates, and ensuring uniformity in the application of legal principles across the nation. The emirate-level courts handle issues that fall within the jurisdiction of individual emirates, including local disputes and civil matters. This dual-tiered judicial system aims to provide citizens and residents with access to justice while maintaining a harmonious balance between federal and emirate-level governance within the UAE’s legal framework.

These three branches work together to govern the UAE, with the executive branch responsible for implementing policies, the legislative branch providing advice and discussion on legislation, and the judicial branch ensuring that the rule of law is upheld. The UAE’s political system is designed to maintain a balance between federal and emirate-level governance.

Emirates Government

The government structure in the United Arab Emirates (UAE) is based on a federal system that combines elements of a federal government with strong centralized authority. While I’ve previously discussed the broader aspects of the UAE’s government, here are the key aspects of the Emirates’ local government:

Rulers of the Emirates: The UAE comprises seven emirates, each headed by a hereditary ruler. These rulers are the ultimate authority within their respective emirates and play a central role in shaping policies, governance, and development within their territories.

Executive Councils: Each emirate has its own Executive Council, which serves as the highest executive authority within the emirate. The Executive Council is typically chaired by the ruler of the emirate and includes other key officials and advisors. It is responsible for managing local government affairs, developing policies, and overseeing the implementation of various initiatives.

Local Government Departments: Local government departments within each emirate handle a wide range of functions, such as education, healthcare, public infrastructure, urban planning, transportation, and public services. These departments are tasked with ensuring that the daily needs and services of the emirate’s residents are met.

Municipalities: Local municipalities operate within each emirate to manage urban planning, public spaces, and the delivery of municipal services. They are responsible for maintaining infrastructure, parks, and other local facilities. Municipal councils, often consisting of elected and appointed members, contribute to local governance and decision-making.

Economic Development: Each emirate has its approach to economic development and diversification. Some emirates, like Abu Dhabi and Dubai, have established major economic free zones and diversified their economies through sectors like finance, tourism, and industry. The emirates collaborated on some aspects of economic policy at the federal level to ensure a coordinated approach.

Cultural and Social Development: The emirates also invest in cultural and social development. They support initiatives related to education, healthcare, arts, culture, and heritage preservation. Additionally, they often have cultural and sports authorities that organize events, exhibitions, and activities to promote their cultural identity and heritage.

Local Laws and Regulations: Each emirate can enact its local laws and regulations within the framework of the UAE’s federal laws. This allows emirates to address issues specific to their region, although federal laws generally take precedence in areas such as criminal law and foreign policy.

Security and Law Enforcement: Local law enforcement agencies are responsible for maintaining law and order within each emirate. These agencies handle local security matters and collaborate with federal law enforcement agencies on broader security concerns.

Local Judicial System: While there is a federal judiciary in the UAE, each emirate also has its local court system responsible for civil, criminal, and family matters. The local judicial system works in conjunction with the federal legal framework.

Participation and Consultation: Emirati citizens often have opportunities to participate in local governance through various channels, such as advisory councils and public consultations. The level of citizen participation can vary from one emirate to another.

The key aspect of the Emirates’ government in the UAE is that each emirate has a considerable degree of autonomy in managing its affairs, including economic development, social services, and local governance. This system allows the emirates to tailor policies to their unique needs and priorities, while the federal government handles matters of national interest and foreign policy.

Federal Elections

Federal elections in the United Arab Emirates (UAE) are a significant aspect of the country’s political landscape, allowing Emirati citizens to participate in selecting representatives for the Federal National Council (FNC). The FNC is the UAE’s legislative body with advisory and limited legislative powers at the federal level. Here are the key points about federal elections in the UAE:

Limited Electoral System: The UAE has a limited electoral system, where eligible voters are Emirati citizens. Expatriates, who make up a significant portion of the UAE’s population, do not have the right to vote in federal elections. Eligible voters must meet certain criteria, including being at least 25 years old and having a family book (Khulasat Al Qaid) that certifies their Emirati citizenship.

Electoral College: The electoral system in the UAE uses an electoral college, with half of the members of the Federal National Council (FNC) being elected by the citizens, and the other half being appointed by the rulers of the seven emirates. The total number of FNC members can vary depending on decisions by the rulers, but it has typically been around 40 members.

Emirate Representation: The number of FNC members elected by each emirate is determined by its population. As a result, the more populous emirates, such as Dubai and Abu Dhabi, have more elected members in the FNC. Each emirate has its own electoral body to oversee the election process.

Electoral Committees: Electoral committees are established in each emirate to facilitate the election process. These committees manage voter registration, candidate registration, and the overall organization of the elections. They also ensure that the elections are conducted in a free and fair manner.

Candidates: To run for the FNC, candidates must meet specific eligibility criteria, including being at least 25 years old, holding Emirati citizenship, and having a good reputation. Candidates must also present a specified number of signatures from registered voters in their respective emirates as a show of support.

Campaigning: Candidates are allowed to campaign to inform voters about their platforms and policies. Campaigning typically includes rallies, meetings, and the use of traditional and social media.

Voting Process: UAE citizens who meet the eligibility criteria and have registered to vote can participate in the elections. Voting is done in person at designated polling stations, which are set up in various locations across the Emirates. The voting process is secure and transparent.

Election Results: The winners of the elections become members of the Federal National Council. They serve four-year terms. The FNC members elected by the citizens and the appointed members work together to represent the interests of the UAE’s population and provide advice and recommendations on various issues to the government.

Role of the FNC: The FNC has both advisory and legislative functions. While its decisions are not binding, it plays a crucial role in discussing and proposing federal laws and regulations. It also provides input on national policies, budgets, and other important matters.

Political Engagement: Federal elections in the UAE are seen as an opportunity for Emirati citizens to engage in the political process and have a voice in the country’s governance. The UAE government has taken steps to promote civic participation and encourage greater political engagement among its citizens.

It’s important to note that the political landscape in the UAE is unique, and the country has a political system that combines elements of traditional and modern governance. Federal elections are part of a broader political framework in which the leadership values stability, continuity, and consensus in decision-making.

Emirates Elections

Elections in the United Arab Emirates (UAE) are limited in scope and primarily take place at the federal and local levels, with varying degrees of political participation. Here are the key points related to elections in the UAE:

Federal National Council (FNC) Elections:

The FNC is the federal legislative body in the UAE, and half of its members are elected. The FNC is responsible for reviewing and proposing federal laws and discussing national issues. FNC elections are held every five years. In the elections, a limited number of Emirati citizens are eligible to vote or run for office. Eligible voters are appointed by the rulers of each emirate to represent the electorate. The FNC has 40 members, with half of them elected. In the 2019 elections, 20 members were elected, and 20 members were appointed.

Electoral Process: FNC elections use a specific electoral college system where eligible voters in each emirate choose half of the FNC members. The electoral process involves a select group of Emirati citizens, including tribal leaders, intellectuals, and community figures, who are tasked with nominating candidates and voting for the FNC members.

Limited Eligibility: Eligibility to participate in FNC elections is restricted. Citizens who meet certain criteria, such as age, education, and community standing, may be selected by the emirate’s rulers to participate in the electoral process.

Nomination and Campaigning: Emiratis interested in running for the FNC must seek nomination from the electoral college members. Campaigning for FNC elections is a controlled process, and candidates are expected to adhere to strict guidelines and avoid controversial or divisive issues.

Representation: The FNC represents the interests of the UAE’s citizens and addresses their concerns, but its powers are limited. It can review and propose federal laws but doesn’t have legislative authority. The appointed members of the FNC, who are not elected, serve to complement the council’s work.

Local Council Elections: Some emirates, such as Dubai and Abu Dhabi, have introduced local council elections at the emirate level. These elections allow eligible Emirati citizens to participate in selecting local representatives who focus on municipal and community matters.

It’s important to note that while elections in the UAE represent a step toward political participation, the system is characterized by limited suffrage and significant control by the ruling families and authorities. The emphasis is on maintaining stability, national unity, and a measured transition toward more inclusive political processes.

Political Parties

The United Arab Emirates (UAE) does not have traditional political parties as seen in many other countries. Instead, the UAE operates under a system where political participation and power are primarily held by the ruling families of each of the seven emirates. The political landscape is characterized by a lack of formal political parties, and the focus is on consensus-building and maintaining stability. However, there are some noteworthy aspects related to political participation and entities that play a role in shaping policy and governance in the UAE:

Federal National Council (FNC): The FNC is the closest entity to a legislative body in the UAE, and it is responsible for discussing national issues and reviewing and proposing federal laws. While not a political party in the traditional sense, the FNC includes members who represent different emirates and serve as representatives of their communities. Half of the FNC’s members are elected, while the other half are appointed by the rulers of the emirates.

Ruling Families: The ruling families of the seven emirates, particularly the rulers, play a central role in shaping policy and governance. They wield significant influence in decision-making at both the emirate and federal levels. The rulers of the emirates are responsible for appointing members to the electoral college for FNC elections and hold considerable authority over key appointments and decisions.

Elite Advisory Bodies: The UAE has established elite advisory bodies that contribute to policy discussions and provide counsel to the government. These include the Abu Dhabi Executive Council, Dubai Executive Council, and other similar entities in different emirates. These advisory councils consist of prominent individuals, experts, and community figures who advise the rulers on various matters.

Civil Society Organizations: While not political parties, there are civil society organizations and non-governmental groups that focus on specific issues and work to influence policy decisions in the UAE. These organizations often have specific goals related to areas such as culture, education, social development, and healthcare. They work closely with government bodies to achieve their objectives.

Women’s Representation: The UAE has made efforts to promote women’s participation in political and public life, including the Federal National Council. Women have achieved significant representation in the FNC, and the government has supported initiatives to empower women in various fields.

It is important to understand that the political landscape in the UAE differs significantly from multi-party democratic systems. The UAE’s political structure is focused on maintaining stability, national unity, and consensus, and political power is largely concentrated in the hands of the ruling families and government authorities. While there are avenues for participation and input from Emirati citizens and advisory bodies, formal political parties do not exist as independent entities with the power to compete in elections and shape the direction of the government.

Immigration System of UAE

- Immigration Overview

- Types of Immigration

- Asylum

- The Asylum in UAE

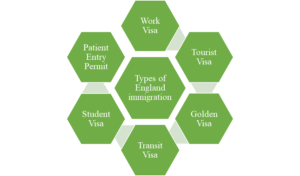

UAE Immigration Overview

The immigration system in the United Arab Emirates (UAE) is well-structured and regulated, reflecting the country’s role as a hub for international business, tourism, and expatriate employment. It offers various types of visas and residency options, including tourist visas for short-term visits, employment visas for those joining the workforce, family visas for residents’ relatives, student visas for educational pursuits, and investor visas for individuals making significant financial commitments. The UAE also introduced long-term residency (Golden Visa) options to attract investors, skilled professionals, and outstanding students. The specific documents and requirements vary depending on the type of visa or residency sought. While the UAE is open to welcoming expatriates from around the world, its immigration system is characterized by certain regulations and requirements, ensuring that those entering the country meet the established criteria for their intended stay. It’s advisable for individuals considering relocation to the UAE to consult with the relevant authorities or sponsors to navigate the application process and remain compliant with the latest immigration regulations.

Legal Immigration: Legal immigration to the United Arab Emirates (UAE) involves obtaining the appropriate visa or residency status for your intended purpose, such as employment, family reunification, study, or investment. The process typically requires a valid passport, the completion of visa application forms, relevant documentation (e.g., job offer letters, sponsorship letters, educational certificates), and compliance with medical and security checks.

Visa types: The UAE has various types of visas, including tourist visas, employment visas, family visas, student visas, and investor visas. In some cases, long-term residency options are available. It’s essential to adhere to UAE immigration regulations, which can change periodically, and to work with the relevant authorities or sponsors to ensure a smooth and legal immigration process.

Golden Visa: The Golden Visa program in the United Arab Emirates (UAE) is a prestigious and long-term residency initiative that offers eligible investors, entrepreneurs, skilled professionals, and outstanding students the opportunity to secure extended residency for 5 or 10 years. It is designed to attract individuals who make significant financial investments, contribute to the UAE’s economy, or excel in their fields of expertise. The program varies slightly between emirates but generally requires applicants to meet specific investment or qualification criteria, such as property investments, business ventures, academic achievements, or outstanding skills.

Naturalization: Naturalization in the United Arab Emirates (UAE) refers to the process by which foreign individuals can become Emirati citizens. It is a selective and highly regulated process, typically requiring exceptional contributions to the UAE, including significant investments, outstanding achievements, or exceptional services. The criteria for naturalization are not publicly disclosed and can vary, but individuals who are granted Emirati citizenship gain access to the country’s extensive benefits, including social services, the right to own property, and participation in the country’s economy and society. Naturalization is not a common pathway to UAE citizenship, and the government exercises discretion in granting it.

Application Process: The application process for immigration to the United Arab Emirates (UAE) involves several steps. First, you must secure a sponsor, which can be an employer, family member, or educational institution, depending on your visa type. The sponsor will initiate the visa application. After submitting your application and documents, you’ll typically need to attend biometric data collection. Once your visa is approved, you’ll receive your entry permit. On arrival in the UAE, you’ll need to complete the residence visa process, including medical tests and fingerprinting. Keep in mind that visa requirements can change, so it’s essential to verify the latest regulations with the UAE’s General Directorate of Residency and Foreigners Affairs or the relevant UAE embassy or consulate.

Importance of legal assistance: Legal assistance is of paramount importance for immigration to the United Arab Emirates (UAE) due to the country’s strict and evolving immigration regulations. A qualified immigration attorney can help applicants navigate the complex visa and residency processes, ensuring all required documents are in order, and that applicants meet eligibility criteria. Legal experts can also guide the latest legal changes and visa options, helping individuals make informed decisions and avoid potential pitfalls. Given the UAE’s commitment to maintaining security and controlling expatriate inflow, legal assistance is instrumental in ensuring a smooth and successful immigration experience, whether for employment, business, or family reunification in the UAE.

Rights and Responsibilities: Immigrants in the United Arab Emirates (UAE) enjoy certain rights and are expected to fulfill specific responsibilities. Immigrants have the right to work, access public services, and practice their religion. They are entitled to legal protections, such as fair treatment and access to the judicial system. However, immigrants must respect local laws, customs, and culture. They are responsible for abiding by the UAE’s strict legal and moral standards, including adhering to labor regulations and respecting Islamic traditions.

Resources and Supports: The United Arab Emirates (UAE) provides immigrants with a range of resources and support to help them integrate and thrive in the country. These include access to quality healthcare and education, as well as legal protections for workers. The UAE also offers cultural and religious tolerance, with various places of worship and diverse expatriate communities. Additionally, the government has introduced policies to enhance long-term residency options for investors, entrepreneurs, and skilled professionals.

Types of UAE Immigration

The United Arab Emirates (UAE) has various immigration types and visa categories to regulate the entry and residence of foreigners in the country. These immigration types are subject to change and have specific eligibility requirements and conditions. Here are some of the key UAE immigration types:

UAE Work Visa: A UAE Work visa is usually used for expats taking up a job in the UAE which is valid for 2 years for LLCs and 3 years for free zone companies. A residence visa should be applied by the employer (sponsor), medical is mandatory to get this visa. In 2019, the UAE implemented a new system for long-term residence visas. The new system enables foreigners to live, work, and study in the UAE without the need for a national sponsor and with 100 percent ownership of their business on the UAE’s mainland. These residence visas will be issued for 5 or 10 years and will be renewed automatically.

Tourist Visa: A UAE Tourist visa is for those who are not eligible for a visa on arrival or a visa-free entry to the United Arab Emirates. Tourist visas can be obtained for eligible individual tourists from around the world. Females below the age of 18 are not eligible to apply for this type of visa unless they are traveling with their parents. According to a Cabinet resolution passed in July 2018, children under the age of 18 years who are accompanying adults can get a free visa for their visit from 15 July to 15 September each year. Depending on your plan, tourist visas to the UAE can be issued for 30 days or 90 days duration, single entry or multiple entries.

Golden Visa: The UAE’s Golden Visa is a long-term residence visa that enables foreign talents to live, work, or study in the UAE while enjoying exclusive benefits which include an entry visa for six months with multiple entries to proceed with residence issuance, a long-term, renewable residence visa valid for 5 or 10 years, the privilege of not needing a sponsor, the ability to stay outside the UAE for more than the usual period of six months to keep their residence visa valid, the ability to sponsor their family members, including spouses and children regardless of their ages, the ability to sponsor an unlimited number of domestic helpers, and the permit for family members to stay in the UAE until the end of their permit duration if the primary holder of the Golden visa passes away.

Transit Visa: There are two types of transit visas: one for 48 hours which is free of charge and another for 96 hours for AED 50 only. Transit visas are sponsored only by UAE-based airlines and must be processed and approved before entering the UAE. Both types of transit visas are not extendable. To get a UAE transit visa, you must have a passport or travel document with a minimum validity of three months, A photo of yourself against a white background, and, an onward ticket booking to a 3rd destination, other than the one you are coming from.

Student Visa: A UAE student’s visa is a 1-year renewable visa for a university or a college student studying in the UAE. It is issued to expatriate students who are residing in UAE under the sponsorship of their parents or relatives, or to foreign international students who come from abroad to join one of the higher educational institutes across UAE. On 24 November 2018, the UAE government approved a decision to grant a 5-year visa to outstanding students. School students must graduate with a grade of at least 95 percent from secondary schools whether public or private. University students must graduate with a distinctive GPA of at least 3.75 from universities within and outside the country.

Patient Entry Permit: Through a patient entry permit foreign patients can enter the UAE for treatment under the sponsorship of medical establishments and government and private hospitals. The sponsor (medical establishment) takes the responsibility of processing entry permits for treatment upon the patient’s request. The sponsor must be a hospital licensed and registered in the UAE. The documents needed to process the entry permit include the Patient’s passport copy, a letter from a registered hospital explaining the reasons for the visit, the Patient’s health insurance, and financial security.

It’s important to note that immigration regulations and visa categories may have changed since my last knowledge update. The specific requirements, fees, and processes can vary between emirates within the UAE, so it’s essential to check with the relevant UAE authorities or the official government website for the most up-to-date information and requirements for each immigration type.

Asylum

Asylum is a legal status granted by a country to foreign nationals who are unable or unwilling to return to their home country due to well-founded fears of persecution based on their race, religion, nationality, political beliefs, or membership in a particular social group. The primary purpose of asylum is to provide protection to individuals who face persecution in their home country and to ensure their safety. Asylum seekers are typically granted certain legal rights and protections while their asylum claims are being assessed.

Here are some key points to understand about asylum in general:

Eligibility: To be eligible for asylum, individuals must demonstrate that they have a well-founded fear of persecution on the grounds of one of the protected categories mentioned earlier. They must prove that they cannot obtain protection in their home country.

Asylum Process: The asylum process typically involves an application or petition, interviews with immigration officials, and the presentation of evidence to support the asylum claim. This process can vary from country to country.

Refugee Status: If an individual’s asylum claim is approved, they are typically granted refugee status. This status provides them with legal rights and protections, including the right to work and live in the host country.

Rights and Benefits: Asylum seekers and refugees are entitled to certain rights and benefits, which may include access to healthcare, education, and social services. They are also protected from deportation to their home country.

Temporary vs. Permanent Asylum: Some countries grant temporary asylum, while others offer permanent asylum or a path to citizenship. The specific terms and conditions vary depending on the country’s laws and policies.

Asylum in the UAE

The United Arab Emirates (UAE) does not have a formalized asylum system or a specific legal framework for granting asylum or refugee status, which is why it does not grant asylum in the traditional sense as many Western nations do. Instead, the UAE approaches cases of individuals seeking protection on a case-by-case basis, often in response to humanitarian or geopolitical crises. While the country has a history of providing humanitarian assistance and temporary shelter to those affected by conflicts or persecution, its approach is not characterized by a formal asylum application process, refugee status recognition, or permanent asylum status. As a result, those seeking asylum in the UAE may find that their cases are handled differently compared to countries with established asylum systems, which can make the process less predictable and may not provide the same legal rights and protections associated with refugee status in other nations. The UAE’s approach to asylum is shaped by its commitment to humanitarian aid and support, but it may not align with the conventional international asylum framework as defined by the 1951 Refugee Convention. It’s essential for individuals seeking asylum in the UAE to consult with legal experts or relevant authorities in the country for the most accurate and up-to-date guidance on their specific situations.

Financial System of UAE

- Overview of the UAE Financial System

- Banking System

- Islami Finance

- Stock Market

- Financial Free Zones

- Real estate and investments

- Foreign Investment

- Sovereign wealth funds

- Regulatory Framework

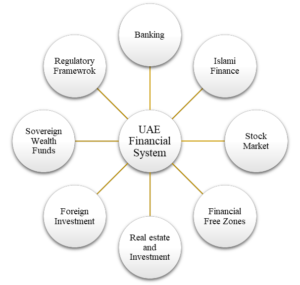

UAE Financial System Overview

The United Arab Emirates (UAE) boasts a dynamic and sophisticated financial system that underpins its rapidly growing economy. At the core of this system is a well-developed banking sector, comprising both local and international banks, all regulated by the vigilant Central Bank of the UAE. These institutions offer a wide range of services, from retail banking to corporate finance, contributing significantly to economic development.

One distinguishing feature of the UAE’s financial landscape is its leadership in Islamic finance. The country hosts numerous Islamic banks and financial institutions that provide Sharia-compliant products, attracting investors seeking ethical and interest-free financial solutions. This sector’s robust growth has solidified the UAE’s reputation as a global hub for Islamic finance.

In terms of capital markets, the UAE has two primary stock exchanges: the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX). These exchanges serve as critical platforms for businesses to raise capital and investors to diversify their portfolios. Additionally, the country offers financial free zones, like the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM), which provide an enticing environment for financial institutions and fintech companies through special regulations and incentives.

The real estate market plays a pivotal role in the UAE’s financial system, attracting local and international investors to its burgeoning property sector. Cities like Dubai, in particular, have seen a boom in real estate development, contributing to economic growth and diversification.

The UAE has also taken substantial steps to attract foreign investment, with liberalized regulations and double taxation avoidance agreements in place. This approach has made the country a favored destination for international investors looking for opportunities in a stable and business-friendly environment.

Sovereign wealth funds, including the Abu Dhabi Investment Authority (ADIA) and the Investment Corporation of Dubai (ICD), are instrumental in managing the country’s vast wealth. These funds invest in a wide array of sectors worldwide, further diversifying the UAE’s financial portfolio.

The UAE Dirham (AED), pegged to the United States Dollar (USD), provides currency stability for international trade and investments, ensuring predictability in financial transactions. The regulatory framework in the UAE is robust, with the Central Bank and regulatory authorities like the Securities and Commodities Authority (SCA) overseeing the various aspects of the financial sector, ensuring the system’s integrity and stability.

In summary, the UAE’s financial system is renowned for its openness to foreign investment, innovation, and its role as a regional and global financial hub. This system has been a key driver of the country’s economic growth and diversification efforts, supporting its ambitions to become a dynamic and globally competitive economy.

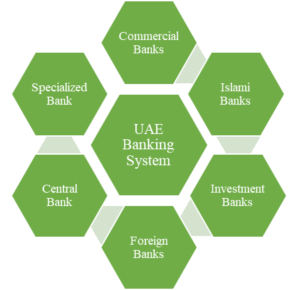

Banking: The banking system in the United Arab Emirates (UAE) is a pivotal component of its financial sector, offering a wide range of services and contributing significantly to the country’s economic growth. It consists of various types of banks and financial institutions, each serving distinct functions within the financial landscape.

Commercial Banks: Commercial banks play a central and multifaceted role in the United Arab Emirates (UAE) financial system. These institutions are the backbone of the UAE’s banking sector, offering a wide range of financial services to individuals, businesses, and the broader economy. Commercial banks provide essential services such as savings and current accounts, loans, credit cards, and wealth management solutions, serving the daily financial needs of individuals. They also play a pivotal role in corporate banking, providing businesses with financing, and cash management services, and facilitating trade and international transactions. Notable commercial banks in the UAE include Emirates NBD, First Abu Dhabi Bank (FAB), and Dubai Islamic Bank.

Islamic Banks: Islamic banks play a significant role in the UAE’s financial system, adding a unique dimension to the country’s diverse banking landscape. These banks strictly adhere to Sharia principles, offering financial products and services that are compliant with Islamic law. They facilitate ethical and interest-free transactions, attracting a segment of customers seeking such alternatives. Islamic banks in the UAE provide a wide array of services, including Islamic financing, savings accounts, wealth management, and insurance. Their presence not only caters to the local population’s religious and ethical preferences but also contributes to the country’s leadership in Islamic finance, attracting international investors and positioning the UAE as a global hub for Sharia-compliant financial services. Moreover, their growth has helped diversify the financial sector, enhancing the overall resilience and competitiveness of the UAE’s financial system. Examples include Emirates Islamic Bank, Abu Dhabi Islamic Bank (ADIB), and Dubai Islamic Bank.

Investment Banks: Investment banks play a crucial role in the United Arab Emirates (UAE) financial system by facilitating a wide range of capital market activities and corporate finance functions. They are instrumental in supporting businesses and governments in raising capital through activities like underwriting securities, initial public offerings (IPOs), and bond issuances. Investment banks also provide advisory services, helping clients with mergers and acquisitions (M&A), corporate restructuring, and financial strategies. In a rapidly evolving financial landscape, they contribute to the development of innovative financial products and services. These institutions are pivotal in connecting investors with opportunities in the UAE’s dynamic and growing economy, making the country a vibrant hub for capital market activities and financial services.

Foreign Banks: Foreign banks play a significant and beneficial role in the UAE’s financial system. They bring global expertise, capital, and a wide array of financial services to the country, enhancing the depth and diversity of the financial sector. These banks facilitate international trade, connect UAE businesses to the global market, and offer a variety of specialized financial products and services. Their presence fosters competition, which can result in better financial products, services, and interest rates for consumers and businesses. Additionally, foreign banks attract foreign investments and contribute to the UAE’s status as a global financial hub, further solidifying the country’s position as an international business and finance destination.

Central Bank: The Central Bank of the United Arab Emirates (UAE) plays a pivotal role in the country’s financial system. As the primary monetary authority, its responsibilities encompass regulating and supervising all banks and financial institutions operating within the UAE. The Central Bank formulates and implements monetary policy, managing interest rates and money supply to maintain price stability and economic growth. It also oversees the stability of the UAE Dirham (AED) and its peg to the United States Dollar (USD).

Specialized Banks: Specialized banks in the United Arab Emirates (UAE) play a targeted and crucial role within the country’s financial system. These banks are designed to address specific financial needs or promote certain economic sectors. For instance, they may focus on industrial development, agricultural financing, or housing loans. By catering to niche segments of the market, specialized banks help support the UAE’s economic diversification efforts and targeted development initiatives. They provide tailored financial services, often with a deep understanding of the unique requirements of their designated sectors. These institutions contribute to economic growth by channeling funds and expertise to sectors that are strategically important for the UAE’s long-term economic development, further enhancing the overall stability and sustainability of the country’s financial system.

The UAE’s banking system is characterized by its modernity, efficiency, and global connectivity. It has a strong regulatory framework in place, overseen by the Central Bank, to maintain the stability and integrity of the financial system. This well-diversified and regulated banking sector supports the country’s economic growth, attracting both local and international investors and contributing to the UAE’s position as a global financial hub.

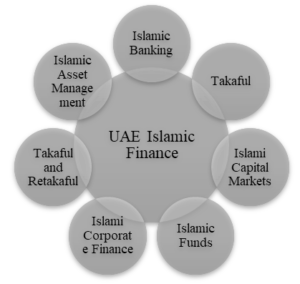

Islami Finance

Islamic finance plays a significant role in the United Arab Emirates (UAE), where it has experienced substantial growth and innovation. This sector adheres to Islamic principles, primarily avoiding interest (usury) and promoting risk-sharing and ethical investment. Here’s a detailed but brief overview of Islamic finance in the UAE and its key types:

Islamic Banking: Islamic banks in the UAE offer financial services in compliance with Sharia principles. They operate without charging or paying interest, adhering to Islamic prohibitions on usury (riba). Instead, they engage in profit-and-loss sharing, trade-based financing, and asset-backed lending. Prominent Islamic banks in the UAE include Dubai Islamic Bank, Abu Dhabi Islamic Bank, and Sharjah Islamic Bank.

Takaful (Islamic Insurance): Takaful is an Islamic alternative to conventional insurance. In the UAE, Takaful companies provide insurance products that adhere to Sharia principles. Participants contribute to a common pool, and the funds are used to cover losses and liabilities. Companies like Takaful Emarat and Salama Islamic Insurance offer Takaful services in the UAE.

Islamic Capital Markets: The UAE hosts Sharia-compliant stock exchanges and investment instruments, such as Sukuk (Islamic bonds) and Sharia-compliant equities. The Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) facilitate the trading of these instruments. Sukuk are interest-free bonds that grant investors a share in the profits generated by the underlying assets.

Islamic Funds: In the UAE, various financial institutions offer Islamic investment funds, including mutual funds and real estate investment trusts (REITs), which comply with Islamic finance principles. These funds invest in assets that align with Sharia requirements, making them appealing to investors seeking ethical and Halal investment opportunities.

Islamic Corporate Finance: Islamic finance is increasingly used for corporate and project finance in the UAE. Businesses can obtain funding through Sharia-compliant contracts such as Mudarabah (profit-sharing), Murabaha (cost-plus financing), and Ijarah (leasing) to support their operations and expansion.

Takaful and Retakaful: These are reinsurance products adhering to Islamic principles. They provide insurance companies with risk management solutions that are consistent with Sharia law. Takaful companies in the UAE engage in re-takaful to spread their risk exposure.

Islamic Asset Management: Islamic asset management firms in the UAE offer investment and wealth management services that ensure portfolios are structured according to Sharia guidelines. These firms cater to individual and institutional investors seeking to invest in line with their faith.

In summary, the UAE’s Islamic finance sector has witnessed considerable growth and diversification, offering a wide range of financial products and services that adhere to Islamic principles. This has attracted not only the country’s Muslim population but also international investors seeking ethical and Sharia-compliant financial opportunities. Islamic finance types in the UAE encompass banking, insurance, capital markets, investment funds, corporate finance, and asset management, contributing to the country’s position as a global Islamic finance hub.

Stock Market

The United Arab Emirates (UAE) has two primary stock exchanges: the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX), each serving as a significant component of the country’s financial system.

Dubai Financial Market (DFM): The Dubai financial market is Situated in Dubai, the DFM is one of the UAE’s major stock exchanges. The DFM hosts a diverse range of listed companies, including local and international firms from various sectors such as real estate, finance, and telecommunications. The DFM operates under the supervision of the Securities and Commodities Authority (SCA), the UAE’s primary regulatory authority for financial markets. The DFM attracts a broad investor base, including both institutional and retail investors. The DFM General Index is the main benchmark index, tracking the performance of listed companies on the DFM.

Abu Dhabi Securities Exchange (ADX): The Abu Dhabi Securities Exchange is located in Abu Dhabi, and the ADX is another key stock exchange in the UAE. The ADX also lists a diverse range of local and international companies, with a focus on sectors such as energy, banking, and industrial entities. The ADX is regulated by the Securities and Commodities Authority (SCA), ensuring transparency and compliance with regulatory standards. Like the DFM, ADX caters to a wide spectrum of investors, including institutions and individual investors. The ADX General Index is the primary benchmark index for tracking the performance of companies listed on the ADX.

Both the DFM and ADX play crucial roles in facilitating capital raising for businesses and providing investment opportunities for both domestic and international investors. They contribute to the overall development and diversification of the UAE’s financial markets, making the country an attractive destination for investment in the Gulf region.

Financial free zones

The United Arab Emirates (UAE) is home to several financial-free zones, which are designated areas with distinct regulations and incentives to attract businesses, particularly those in the financial and business sectors. These free zones offer an array of benefits to companies looking to establish a presence in the UAE. Here’s a detailed but concise overview of the major financial free zones in the UAE:

Dubai International Financial Centre (DIFC): DIFC is a financial-free zone located in the heart of Dubai. DIFC is a well-established and highly reputable financial hub. It’s known for its modern infrastructure and a comprehensive legal framework based on English common law. It hosts a wide range of financial institutions, including banks, asset management firms, insurance companies, and fintech startups. DIFC offers 100% foreign ownership, zero tax on corporate income and profits, and no restrictions on capital repatriation.

Abu Dhabi Global Market (ADGM): ADGM is located in the capital city, Abu Dhabi. ADGM is another prominent financial free zone in the UAE. It’s known for its robust regulatory framework and flexible business setup options. ADGM hosts a diverse range of financial and professional services companies, including banks, insurance firms, and wealth management entities. It offers benefits such as full foreign ownership, zero taxes for a specified period, and a common law jurisdiction with English as the working language.

Dubai International Academic City (DIAC): DIAC is a free zone focused on the education sector. DIAC is designed to promote education and research. It’s home to a multitude of universities, colleges, and academic institutions. Businesses operating in DIAC enjoy benefits like 100% foreign ownership, full repatriation of profits, and access to a skilled talent pool in the education sector.

Dubai Media City (DMC) and Dubai Internet City (DIC): DMC and DIC are media and technology-focused free zones. These free zones cater to media, information technology, and communications companies. DMC is a hub for media-related businesses, while DIC is known for technology and digital companies. They offer business-friendly regulations, 100% foreign ownership, and tax exemptions.

RAK International Corporate Centre (RAK ICC): RAK ICC is an offshore free zone located in Ras Al Khaimah. RAK ICC is an offshore jurisdiction that caters to international businesses looking to establish a presence in the UAE. It provides offshore company registration, allowing companies to conduct activities outside the UAE. It offers privacy, asset protection, and tax benefits.

These financial free zones in the UAE serve as magnets for foreign investment, fostering economic growth and diversification. They offer a range of structures to accommodate various business needs, whether you’re a multinational corporation, a startup, or an educational institution, making the UAE an attractive destination for a diverse array of businesses.

The Real estate and investment

The real estate and investment sector in the United Arab Emirates (UAE) is a vital component of the country’s economy, known for its rapid growth and attracting both local and international investors. Here’s a more detailed overview of the UAE’s real estate and investment landscape, including its types and key characteristics:

Residential real estate: Residential real estate plays a significant role in the UAE financial system by contributing to economic growth and diversification. It serves as a magnet for local and international investments, with cities like Dubai and Abu Dhabi offering a wide range of luxurious residential properties. This sector drives demand for construction, real estate services, and financing, bolstering the overall economy. Residential real estate in the UAE is closely tied to the influx of expatriates and tourists, as well as the government’s initiatives to develop world-class living spaces. Moreover, it is a source of government revenue through fees and taxes, and it underpins the broader real estate and financial markets, making it a vital component of the country’s economic landscape.

Commercial real estate: Commercial real estate plays a pivotal role in the UAE’s financial system, serving as a cornerstone for economic growth and diversification. It acts as a catalyst for attracting international businesses, investors, and entrepreneurs, making the UAE an attractive destination for foreign investments and trade. The sector encompasses office spaces, retail centers, industrial facilities, and logistics hubs, facilitating various industries and sectors. As one of the Middle East’s prime business and financial hubs, especially in cities like Dubai and Abu Dhabi, commercial real estate not only provides physical infrastructure but also fosters economic activities, and job creation, and contributes significantly to the country’s GDP. The stability and growth of the commercial real estate market are closely intertwined with the overall financial stability and prosperity of the UAE.

Hospitality and tourism: Hospitality and tourism play a crucial role in the UAE’s financial system. The country is renowned as a global travel and leisure destination, attracting millions of visitors each year. This sector significantly contributes to the UAE’s GDP, creating jobs and stimulating economic growth. The UAE boasts iconic landmarks, luxurious hotels, world-class shopping, and cultural attractions, making it a preferred destination for both business and leisure travelers. The country’s strategic location as a transit hub further bolsters its appeal. With continuous investment in tourism infrastructure and hosting major international events, such as Expo 20202 (now Expo 2023), the hospitality and tourism industry is a linchpin of the UAE’s economic diversification and development strategy. It not only generates revenue but also supports other sectors like real estate, retail, and transportation, thus fueling the broader financial system.

Industrial and warehousing: Industrial and warehousing sectors play a crucial role in the UAE’s financial system. The country’s strategic geographic location at the crossroads of global trade routes has made it a major hub for logistics and trade. Industrial parks and warehousing facilities are essential components of this ecosystem, supporting the efficient movement and storage of goods. The UAE’s modern infrastructure, free zones, and business-friendly policies have attracted both domestic and international businesses, spurring investments in these sectors. This, in turn, drives economic growth, and job creation, and contributes significantly to the country’s overall financial stability, making industrial and warehousing pivotal elements of the UAE’s financial system.

Mixed-use developments: Mixed-use developments play a pivotal role in the UAE’s financial system by offering a diverse range of investment opportunities and contributing to economic growth. These developments combine residential, commercial, and retail spaces, creating vibrant urban centers that cater to both residents and businesses. They attract local and international investors, stimulate economic activity, and foster a sense of community. As integrated hubs, mixed-use developments enhance the utilization of real estate, boost rental yields, and stimulate consumer spending. In cities like Dubai, have become focal points for tourism, commerce, and lifestyle, driving demand for properties and bolstering the financial system through increased real estate transactions, business activities, and job opportunities.

Foreign Investments

Foreign investment in the United Arab Emirates (UAE) has played a pivotal role in the country’s economic development. The UAE has actively sought to attract foreign capital and expertise across various sectors. Here’s a detailed yet brief overview of foreign investment in the UAE, including its types:

Direct Foreign Investment (FDI): Foreign Direct Investment (FDI) involves foreign individuals or entities making substantial investments in UAE-based companies. It can take the form of either acquiring a significant ownership stake in an existing company or establishing new business operations. The UAE has encouraged FDI by creating free zones that offer various incentives, such as full foreign ownership, tax exemptions, and streamlined administrative procedures. These zones, like the Jebel Ali Free Zone and Dubai International Financial Centre (DIFC), have attracted many foreign investors.

Portfolio Investment: Portfolio investment includes the purchase of shares, bonds, or other financial assets in UAE companies or government entities without seeking a controlling interest in these entities. Investors can participate in UAE stock markets (Dubai Financial Market and Abu Dhabi Securities Exchange) to engage in portfolio investment, potentially benefiting from capital gains and dividends.

Sovereign Wealth Funds (SWFs): The UAE manages several sovereign wealth funds, the most prominent being the Abu Dhabi Investment Authority (ADIA) and the Investment Corporation of Dubai (ICD). These SWFs invest in a wide range of international assets, including equities, fixed-income securities, real estate, and infrastructure projects, helping the UAE diversify its investments globally.

Real Estate Investment: The UAE, particularly Dubai, has been a magnet for foreign real estate investment. Investors buy residential or commercial properties with the expectation of rental income and potential capital appreciation. Dubai, known for its luxury real estate market, has attracted investors from various parts of the world, contributing to the city’s skyline and economic development.

Infrastructure Investment: Foreign entities have the opportunity to participate in infrastructure projects in the UAE, including the construction and operation of roads, airports, ports, and utilities. Public-private partnerships (PPPs) are common structures for infrastructure investment, allowing the private sector to collaborate with the UAE government on these projects.

Renewable Energy Investments: The UAE has shown a commitment to renewable energy, with projects such as large-scale solar and wind farms. These initiatives have piqued the interest of foreign companies and investors. The UAE aims to reduce its carbon footprint and diversify its energy sources by attracting foreign capital into renewable energy ventures.

Technology and Startups: The UAE has been actively fostering a thriving tech ecosystem. Foreign venture capital firms, technology companies, and angel investors are engaging with local startups. Hubs like Dubai Internet City and Dubai Knowledge Park provide platforms for innovation and growth in the tech sector.

Free Zones and Special Economic Zones: The UAE has established multiple free zones and special economic zones to attract foreign businesses. These zones offer unique advantages, including 100% foreign ownership, zero taxation, and simplified regulations. For instance, the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM) are home to many international financial institutions due to their favorable regulatory environments.

Trade and Manufacturing: Foreign investors often engage in trade and manufacturing activities in the UAE due to its strategic location as a global trade hub. The country’s excellent connectivity and world-class logistics infrastructure make it an ideal place for foreign companies to establish operations and expand their trade activities.

Tourism and Hospitality: The UAE’s tourism and hospitality sectors have attracted substantial foreign investment. Investors have been funding the development of hotels, resorts, theme parks, and entertainment facilities. Tourism is a significant driver of the UAE’s economy, with attractions like the Burj Khalifa, Palm Jumeirah, and various cultural and leisure destinations drawing millions of visitors each year.

The UAE’s commitment to diversifying its economy and encouraging foreign investment has created a vibrant and dynamic business environment, making it an attractive destination for investors across various industries. These investments have significantly contributed to the UAE’s economic growth and its position as a regional and global economic powerhouse.

Sovereign Wealth Funds

The United Arab Emirates (UAE) manages several sovereign wealth funds (SWFs), which are investment vehicles primarily funded by the government’s revenues, particularly from oil and other sources. These SWFs are created to invest in various assets, both domestically and internationally, to preserve and grow the nation’s wealth. Here’s a brief overview of the key UAE sovereign wealth funds and their types:

Abu Dhabi Investment Authority (ADIA): ADIA is one of the largest and most prominent sovereign wealth funds globally. It operates as a government-owned investment fund, primarily focused on long-term investments. ADIA was established to invest in Abu Dhabi’s oil revenues to ensure the country’s financial security and economic stability for future generations. ADIA has a diverse portfolio, including equities, fixed income, real estate, infrastructure, and alternative investments worldwide.

Investment Corporation of Dubai (ICD): ICD is a sovereign wealth fund wholly owned by the Government of Dubai. It was created to manage the government’s investments and promote economic development in Dubai. ICD has investments in various sectors, including finance, transportation, hospitality, real estate, and other key industries in Dubai.

Mubadala Investment Company: Mubadala is a government-owned investment fund that operates as a global investment and development company. It aims to diversify Abu Dhabi’s economy and create sustainable, long-term economic growth through investments in multiple sectors, including technology, aerospace, and healthcare. Mubadala’s investments span aerospace, semiconductors, renewable energy, healthcare, and technology, among others.

Emirates Investment Authority (EIA): EIA is the UAE’s federal sovereign wealth fund. It was established to invest federal government revenues and manage assets for the benefit of the UAE. EIA invests in various asset classes, including equities, fixed income, and real estate.

Ras Al Khaimah Investment Authority (RAKIA): RAKIA is the investment arm of the government of Ras Al Khaimah, one of the emirates of the UAE. It focuses on attracting foreign direct investments (FDI) to Ras Al Khaimah and managing local investments. RAKIA primarily invests in real estate, industrial projects, and infrastructure.

These sovereign wealth funds play a crucial role in managing and diversifying the UAE’s vast wealth, while also contributing to economic development and stability in their respective emirates and the country. Each fund has its specific investment focus and objectives, contributing to the UAE’s position as a global financial and investment hub.

Regulatory Framework

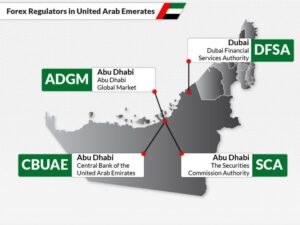

The United Arab Emirates (UAE) has a well-established regulatory framework for its financial system, overseen by several key regulatory bodies. Here’s a brief overview of the regulatory framework and the primary financial regulatory bodies in the UAE:

Central Bank of the UAE: The Central Bank of the UAE is the country’s central monetary authority, responsible for maintaining monetary stability and ensuring the soundness of the banking system. Its key functions include implementing monetary policy, issuing and managing the UAE Dirham (AED), and regulating and supervising commercial banks operating in the UAE. The Central Bank sets interest rates, manages foreign exchange reserves, and acts as the lender of last resort to maintain financial stability.

Securities and Commodities Authority (SCA): SCA is the primary regulatory body for the securities and commodities markets in the UAE. It regulates and supervises various aspects of the financial markets, including the activities of public joint-stock companies, stock exchanges, and securities trading. SCA’s mission is to ensure transparency and protect the interests of investors by enforcing regulations and market standards.

Dubai Financial Services Authority (DFSA): DFSA is an independent regulatory authority responsible for the Dubai International Financial Centre (DIFC), a major financial free zone in Dubai. It sets and enforces regulations for financial and non-financial firms operating within the DIFC, ensuring compliance with international best practices. The DFSA’s main objective is to maintain the integrity and stability of the financial services industry within the DIFC.

Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority: ADGM Financial Services Regulatory Authority is the regulatory body for financial services activities in the Abu Dhabi Global Market, another significant financial free zone in the UAE. It oversees regulatory matters in the ADGM, ensuring that businesses and financial institutions adhere to relevant laws, regulations, and international standards.

Insurance Authority (IA): The Insurance Authority is responsible for the regulation and supervision of the insurance sector in the UAE. It establishes and enforces standards for insurance companies to ensure they provide fair and secure services to policyholders. IA’s mandate includes licensing, compliance, and consumer protection in the insurance industry.

UAE Ministry of Economy: While not a traditional regulatory body, the Ministry of Economy plays a vital role in formulating economic policies and legislation that affect the financial sector. It manages intellectual property rights, commercial affairs, and trade policies that contribute to the overall economic environment in the UAE.

Federal Tax Authority (FTA): The FTA is responsible for implementing and regulating the UAE’s tax framework, which includes value-added tax (VAT) and excise tax. It ensures compliance with tax laws and collects taxes from businesses and individuals to support government revenue.

Other Specialized Regulators: Depending on the specific financial activities, other specialized regulators may be involved. For example, the UAE Central Securities Depository (CSD) is responsible for overseeing the securities depository and settlement system, ensuring the efficient functioning of the stock market.

The regulatory framework in the UAE is comprehensive and designed to maintain financial stability, protect the interests of investors, and encourage business and financial sector growth. These regulatory bodies adapt to international standards and best practices to ensure the UAE remains an attractive destination for financial services and investments.

UAE Credit System

- Overview of the UAE Credit System

- Credit Score in UAE

- Credit Agencies in UAE

- Types of Credit Cards in UAE

- Sources of Credit Cards in UAE

- Types of Loans in UAE

Overview of the UAE Credit System

The United Arab Emirates (UAE) boasts a well-established and highly regulated credit system that underpins its robust financial industry. Governed by the UAE Central Bank and closely monitored by various financial institutions, this credit system is instrumental in facilitating lending and borrowing activities across the nation. Central to this system is the concept of credit scores and credit histories, which serve as the yardstick for evaluating an individual’s or business’s creditworthiness.

These scores consider various factors, including payment history, outstanding debts, the length of one’s credit history, the diversity of credit accounts, and the frequency of new credit applications. A favorable credit history can unlock access to an array of financial products, from loans to credit cards, while a less-than-favorable one can limit these opportunities. Ultimately, the UAE’s credit system is a cornerstone of its financial infrastructure, promoting responsible and transparent financial practices in the region. The UAE’s credit system is a cornerstone of its financial infrastructure, fostering responsible and transparent financial practices within the country.

Additionally, the UAE has implemented various consumer protection laws to safeguard the rights and interests of borrowers, promoting transparency and fairness in lending practices. The legal framework also includes regulations on interest rates, debt collection, and bankruptcy procedures, all aimed at maintaining the stability and integrity of the UAE’s credit system. Overall, the legal infrastructure surrounding the UAE’s credit system is designed to foster responsible and ethical financial conduct, benefiting both lenders and borrowers alike.

Role of UAE Central Bank in Credit System: The UAE Central Bank plays a central and vital role in the UAE’s credit system, serving as the principal regulatory authority and guardian of financial stability within the nation. It is responsible for formulating and implementing policies and regulations that govern the credit sector, ensuring it operates efficiently, transparently, and by international best practices. The Central Bank monitors and supervises the financial institutions, credit reporting agencies, and lending practices, safeguarding the interests of both borrowers and lenders.