መነሻ ገጽ » ጥቂት ስለ አገሪቱ ሥርዓት » ሰሜን አሜሪካ

Overview of USA

- USA Brief History

- Hierarchical structure of the USA

- The Constitution

- Federal Government

- State Government

- Election

USA Brief History

Welcome to the United States! Understanding the history of your new home will help you better understand its culture, values, and the principles that guide its people. Let’s take a brief journey through American history.

Colonial Period (1607-1775)

- The history of the U.S. began when English settlers landed at Jamestown, Virginia, in 1607. In 1620, the Pilgrims arrived on the Mayflower, settling in what is now Massachusetts. Throughout the 17th and 18th centuries, more settlers arrived from Europe, establishing 13 British colonies along the eastern seaboard.

Revolutionary War and Independence (1775-1783)

- The American Revolution began in 1775 due to political and economic conflicts with Britain. In 1776, representatives from the 13 colonies signed the Declaration of Independence, authored mainly by Thomas Jefferson. The Revolutionary War ended in 1783 with the Treaty of Paris, officially recognizing the United States as an independent nation.

Creating the Constitution (1787)

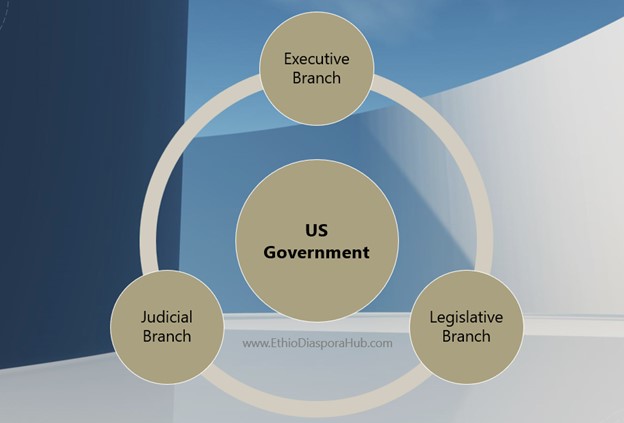

- In 1787, the S. Constitution was written and later ratified by the states. This document established the federal government’s structure with three branches: the executive branch led by the President, the legislative branch consisting of the Senate and the House of Representatives, and the judicial branch headed by the Supreme Court.

Westward Expansion (1803-1890)

- In the 19th century, the U.S. rapidly expanded westward. The Louisiana Purchase in 1803 doubled the country’s size. However, this expansion often came at a great cost to Native American tribes and Mexico, from which the U.S. acquired further territories following the Mexican-American War (1846-1848).

Civil War and Reconstruction (1861-1877)

- The S. Civil War began in 1861, primarily over the issue of slavery. The northern states, or the Union, wanted to end slavery, while the southern states, the Confederacy, wanted to maintain it. The war ended in 1865 with a Union victory. The Reconstruction period that followed sought to reintegrate the southern states and ensure civil rights for the newly freed enslaved people.

Industrialization and Immigration (late 19th – early 20th Century)

- The late 19th and early 20th centuries were characterized by rapid industrialization and immigration. Millions of people from around the world came to the U.S., contributing to its cultural diversity and economic growth. This period also saw important social and political reforms, including the women’s suffrage movement, which led to the 19th Amendment in 1920, granting women the right to vote.

World Wars and the Great Depression (1914-1945)

- The U.S. played significant roles in both World War I and World War II. Between these global conflicts, the nation experienced the Great Depression (1929-1939), the worst economic downturn in its history. President Franklin D. Roosevelt’s New Deal policies helped alleviate some of the hardship.

Postwar Era and Civil Rights Movement (1945-1968)

- After World War II, the U.S. emerged as a global superpower. Domestically, the Civil Rights Movement sought equality for African Americans, leading to landmark legislation like the Civil Rights Act of 1964 and the Voting Rights Act of 1965.

Late 20th Century (1969-2000)

- In the 1970s, the U.S. faced economic challenges like inflation, unemployment, and an energy crisis. The Vietnam War ended in 1975, but its divisive impact on American society lingered. The Watergate scandal (1972-1974) led to the resignation of President Richard Nixon, which deeply affected Americans’ trust in government.

- The 1980s, known as the Reagan Era, was characterized by conservative politics, deregulation, and tax cuts. During this time, the U.S. experienced significant economic growth. The decade also saw the escalation of the Cold War, which ended in 1991 with the dissolution of the Soviet Union, marking the U.S. as the world’s sole superpower.

- The 1990s brought a tech boom due to the rise of the Internet and other digital technologies, leading to economic prosperity. However, it also saw events like the Gulf War in 1991 under President George H.W. Bush, and the impeachment of President Bill Clinton in 1998 over perjury and obstruction of justice charges.

21st Century (2001-Present)

- The 21st century began with the September 11, 2001, terrorist attacks, in which nearly 3,000 people were killed. In response, the U.S. launched the War on Terror, leading to protracted wars in Afghanistan and Iraq under President George W. Bush. These events sparked debates about national security, civil liberties, and foreign policy.

- Under President Barack Obama, the first African American president, significant legislative changes occurred, such as the Affordable Care Act (or “Obamacare”) in 2010, which aimed to overhaul the U.S. healthcare system. The U.S. also faced the Great Recession (2007-2009), the worst economic downturn since the Great Depression, from which recovery was slow but steady.

- The 2016 election of President Donald Trump marked a shift towards more nationalistic and anti-immigration policies. His administration was characterized by a series of controversial decisions and significant political polarization.

- The COVID-19 pandemic began in 2020, profoundly impacting the U.S. and the world. It led to a public health crisis and economic recession, fundamentally changing daily life and accelerating shifts towards remote work and digital communication.

Throughout these decades, the U.S. has continued to grapple with issues such as climate change, healthcare, immigration, gun control and racial inequality. This history forms the backdrop of the ongoing national conversation about what the U.S. is and what it aspires to be.

Hierarchical structure of the USA

Understanding the hierarchical structure of the United States can be complex, but it’s crucial for navigating life in your new home. The U.S. operates under a federal system of government, which means power is divided between the national government and individual state governments.

Federal Level:

- Executive Branch: Headed by the President, who is both the head of state and the head of government. The Vice President supports the President and takes over if the President is unable to serve. The President’s Cabinet, composed of the heads of federal departments and agencies, advises the President on specific issues.

- Legislative Branch: This branch makes the laws and consists of two houses – the Senate and the House of Representatives. Together, they form the United States Congress. The Senate has 100 members, two from each state, while the House of Representatives’ 435 members are apportioned according to each state’s population.

- Judicial Branch: Headed by the Supreme Court, which interprets the constitution and laws of the country. The Supreme Court has nine justices, appointed for life. There are also lower federal courts across the country.

State Level:

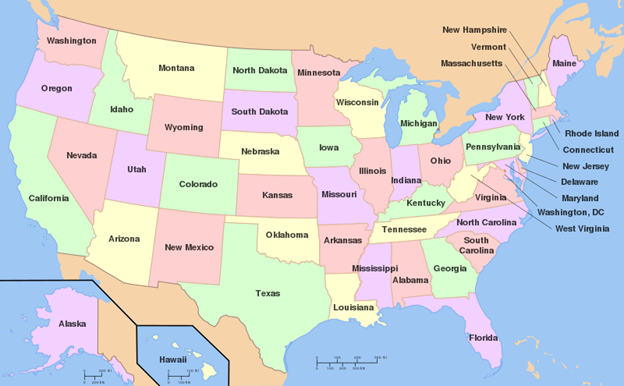

Each of the 50 states has its own constitution and a similar government structure to the federal government, with Executive, Legislative, and Judicial branches.

- Executive Branch: The Governor, elected by the state’s residents, heads this branch. They are supported by a Lieutenant Governor and a cabinet of advisors.

- Legislative Branch: Most states have a bicameral system (like the federal government) with a Senate and a House of Representatives, though some have a unicameral legislature. These bodies create state laws.

- Judicial Branch: Each state has its own court system. The highest court is usually called the Supreme Court, though it may have a different name in some states.

Local Level:

Below the state level are counties, cities, towns, or villages, each with their own form of local government. These can include mayors, city councils, and local courts. They handle issues like education, public safety, and local infrastructure.

Additional Structures:

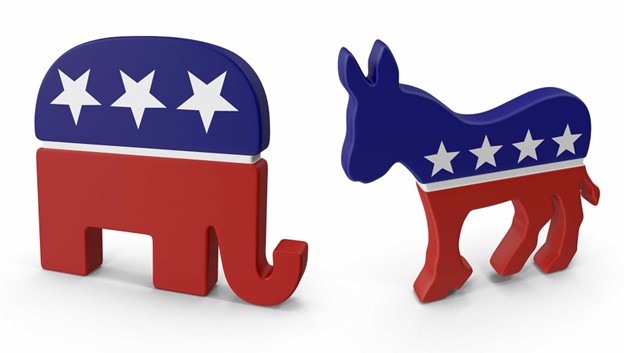

- The U.S. political system is primarily a two-party system dominated by the Democratic Party and the Republican Party. Other smaller parties, often referred to as third parties, do exist but have less influence.

- Apart from government, there are numerous non-governmental institutions that play significant roles in American society. These include corporations, non-profit organizations, interest groups, the media, and religious institutions.

- In the U.S., citizens have a significant role in electing representatives at all levels of government, from the President down to local officials, through regular elections. This democratic process is a vital part of the country’s hierarchical structure.

The U.S. Constitution

The U.S. Constitution is the supreme law of the land. It was written in 1787 and ratified in 1788, making it the oldest written constitution still in use today. The Constitution outlines the structure and powers of the federal government and guarantees certain fundamental rights to the people. It is seen as a living document, meaning it can be amended and interpreted to meet the needs of changing times.

The Constitution is divided into three main parts: the Preamble, seven Articles, and 27 Amendments:

- The Preamble: The Preamble is a brief introductory statement that sets out the Constitution’s purpose and guiding principles. It begins with the famous phrase, “We the People,” signifying that the government’s authority comes from its citizens.

- The Articles: The seven Articles detail the structure of the federal government. They describe the powers and responsibilities of the three branches of government—the legislative (Congress), the executive (the President), and the judicial (the Supreme Court and other federal courts). They also outline the relationship between the states and the federal government and provide the method for amending the Constitution.

- The Amendments: The 27 Amendments are changes to the Constitution that have been added over time. The first ten amendments, known collectively as the Bill of Rights, were added in 1791 and establish fundamental rights and freedoms such as freedom of speech, religion, and the right to a fair trial. Other important amendments include the 13th Amendment (abolition of slavery), the 19th Amendment (women’s right to vote), and the 26th Amendment (lowering the voting age to 18).

The Constitution has a significant impact on the lives of all who live in the U.S., including immigrants. It guarantees certain rights and freedoms, but also outlines certain responsibilities. Understanding the Constitution can help you better understand your rights, responsibilities, and the workings of your new home.

The Federal Government

The U.S. federal government is divided into three branches: the Executive, the Legislative, and the Judicial. This system, known as “separation of powers,” is designed to distribute authority and prevent any single part of the government from becoming too powerful.

- The Executive Branch: This branch is responsible for implementing and enforcing laws. It is headed by the President, who serves as both the head of state and the head of government. The President is elected by citizens (who are at least 18 years old) every four years. The Vice President supports the President and assumes the role of President if the President is unable to serve. The President’s Cabinet, composed of heads of federal departments and agencies, advises the President on various matters. Key parts of the Executive Branch include the Department of State, Department of Defense, and Department of Justice, among others.

- The Legislative Branch: Also known as Congress, this branch is responsible for creating laws. Congress is bicameral, meaning it’s divided into two chambers: the Senate and the House of Representatives. The Senate has 100 members—two from each state—serving six-year terms. The House of Representatives has 435 members, serving two-year terms. The number of representatives each state has depends on its population. Congress also has the power to declare war, confirm Presidential appointments, and control the budget.

- The Judicial Branch: This branch interprets the laws in light of the Constitution. It is headed by the Supreme Court, which consists of nine Justices: one Chief Justice and eight Associate Justices. They are nominated by the President and confirmed by the Senate, serving for life or until they choose to retire. The Judicial Branch also includes other federal courts below the Supreme Court: The Courts of Appeals and District Courts. These courts handle disputes about laws, the interpretation of the Constitution, and disagreements between states or with the federal government.

These three branches work together through a system of “checks and balances.” Each branch has ways to check the power of the other branches. For example, the President (Executive) can veto laws passed by Congress (Legislative), but Congress can override that veto with a high enough vote. The Supreme Court (Judicial) can declare laws unconstitutional, which effectively nullifies them. This system is designed to prevent the abuse of power and to safeguard the rights and freedoms of the people.

State Government

Each of the 50 states in the U.S. has its own constitution and government, which operate alongside the federal government.

Just like the federal government, state governments in the U.S. are divided into three branches:

- Executive Branch: The executive branch of a state is led by a Governor, who is elected by the residents of the state. The Governor is similar to the President on the federal level, responsible for implementing state laws and overseeing the operation of the state executive branch. States also have other executive officers, such as a Lieutenant Governor (similar to the Vice President), Attorney General, Secretary of State, and others, depending on the state.

- Legislative Branch: The legislative branch of a state is responsible for making state laws. Most states have a bicameral system, meaning the state legislature is divided into two parts: a Senate and a House of Representatives (or Assembly). However, Nebraska is an exception and has a unicameral legislature, with only one legislative chamber. These bodies are responsible for writing and passing state laws, as well as managing the state’s budget.

- Judicial Branch: The judicial branch of a state is responsible for interpreting state laws. Each state has its own court system, with a structure that can include Supreme Courts, Courts of Appeals, and District or Circuit Courts. These courts handle cases involving state law.

State governments have powers over areas not specifically granted to the federal government or denied to the states in the U.S. Constitution. These can include issues related to education, public health, transportation, and law enforcement, among others.

In addition to these branches, local governments, including county and city governments, also play a crucial role in providing services. County or city governments can be responsible for areas like local police forces, public transportation, and public works (like water and sewage services).

Finally, it’s important to note that each state also has its own constitution. While these state constitutions cannot conflict with the U.S. Constitution, they can and do provide additional rights and responsibilities to their residents.

Understanding your state government’s structure and responsibilities can help you navigate public services, understand your rights, and participate more fully in your new community.

US Election

One of the fundamental aspects of living in a democratic society like the U.S. is the process of elections. Elections in the U.S. occur at federal, state, and local levels and are a means for citizens to choose their government representatives and have a say in the laws and policies that govern them.

Federal Elections:

- Presidential Elections: The President and Vice President are elected together every four years during even-numbered years. They are chosen by citizens through a system called the Electoral College. While citizens cast their votes, they are technically voting for electors who pledge to vote for a specific candidate.

- Congressional Elections: The U.S. Congress, consisting of the Senate and the House of Representatives, is elected directly by the people. Representatives serve two-year terms, and all 435 seats in the House of Representatives are up for election every two years. Senators serve six-year terms, with elections staggered so that about one-third of the 100 Senate seats are up for election every two years.

State Elections:

- State elections are held for positions like Governor, State Legislators (Senators and Representatives), and other state officials. The frequency and timing of these elections can vary by state.

Local Elections:

- Local elections are held for city, county, town, or school district officials. These include positions like mayor, city council members, county commissioners, and school board members.

Referendums and Ballot Measures:

- In addition to voting for representatives, sometimes voters are asked to decide on specific policies or laws directly. These are called referendums or ballot measures and can be at the state or local level.

Voting Eligibility and Registration:

To vote in U.S. elections, you must be a U.S. citizen, at least 18 years old on Election Day, and meet your state’s residency and registration requirements. Note that some states do not allow individuals with felony convictions to vote, although policies vary.

It’s also important to know that you must register to vote in advance in most states. You can register at your local Department of Motor Vehicles (DMV), various public facilities, or often online.

Political Parties:

The U.S. primarily operates under a two-party system: the Democratic Party and the Republican Party. There are also several smaller third parties.

- Democratic Party: The Democratic Party is one of the two major political parties in the U.S. It is generally associated with more liberal policies, advocating for social and economic equality, and a stronger role for government in services like healthcare and education. The Democratic Party’s symbol is the donkey, and the color most associated with the party is blue. The symbol of the donkey is often credited to a cartoon by Thomas Nast, a 19th-century cartoonist. In his cartoon, he represented the Democratic Party as a donkey, and the image stuck.

- Republican Party: The Republican Party, also known as the GOP (Grand Old Party), is the other major political party. It traditionally supports conservative policies, advocating for limited government intervention, a free-market economy, and individual liberties. The Republican Party’s symbol is the elephant, and the color most associated with the party is red. This symbol also comes from a Thomas Nast cartoon; he represented the Republican Party as an elephant, an image that has remained to this day.

- In addition to these two major parties, there are several minor parties, known as third parties, that occasionally influence national politics:

- Libertarian Party: The Libertarian Party advocates for a much more limited government in both social and economic affairs. The party’s symbol is the Statue of Liberty, emphasizing the party’s commitment to individual liberties and limited government.

- Green Party: The Green Party focuses on environmental sustainability and social justice issues. Their symbol is a sunflower or the Earth, highlighting their environmental focus.

- Constitution Party: The Constitution Party advocates for principles they believe are rooted in the U.S. Constitution, including states’ rights and a strict interpretation of the Constitution. Their symbol is a minuteman, harkening back to the Revolutionary War era.

Remember, political parties in the U.S. can cover a wide range of views and positions within their broader platforms, and not all members of a party or its elected officials will agree on every issue. Additionally, many voters in the U.S. identify as independents, meaning they do not officially affiliate with a political party.

The US Immigration System

- Immigration Overview

- Types of Immigration

- Family-Based Immigration

- Employment-Based Immigration

- Diversity Visa Program

- Refugee and Asylum Programs

- Temporary Visas

- Asylum

- What is Asylum?

- Case writer vs Immigration Lawyer

- The Asylum Process

- Asylum Interview- with Asylum Officer

- Scheduling

- Preparation

- Interview Process

- Credibility Assessment

- Interpreter Availability

- Legal Representation

- Decision

- Immigration Court Proceedings (if necessary)

- Notice to Appear (NTA)

- Master Calendar Hearing

- Individual Merits Hearing

- Decisions

- Appeals

- Asylum Interview- with Asylum Officer

U.S. Immigration Overview

The United States has a complex immigration system governed by federal laws and regulations. The primary agency responsible for immigration matters is the U.S. Citizenship and Immigration Services (USCIS), which operates under the Department of Homeland Security. As an immigrant, it is crucial to get familiarize with the following terms to better understand the immigration system.

- Legal Immigration: The U.S. provides various pathways for individuals to legally immigrate and live in the country. These pathways include family-based immigration, employment-based immigration, refugee and asylum status, diversity visa lottery, and special immigrant visas.

- Visa Categories: The U.S. uses different visa categories to regulate entry into the country. Nonimmigrant visas are for temporary stays, such as for tourism, work, or study, while immigrant visas are for individuals planning to live permanently in the U.S.

- Green Card: A green card, or Permanent Resident Card, is proof of lawful permanent residency in the United States. Green card holders are authorized to live and work in the U.S. indefinitely. They enjoy many rights and benefits, such as access to education, healthcare, and social services.

- Naturalization: Naturalization is the process through which eligible green card holders can become U.S. citizens. It involves meeting certain requirements, such as residency, good moral character, knowledge of English and U.S. civics, and taking an oath of allegiance.

- Application Process: Applying for immigration benefits typically involves completing forms, gathering supporting documents, and paying fees. It’s crucial to follow the specific instructions provided by USCIS and submit accurate and complete information. Many immigration processes require thorough documentation and may involve interviews and background checks.

- Importance of Legal Assistance: Navigating the U.S. immigration system can be complex, and it’s advisable to seek legal assistance from immigration attorneys or accredited representatives. They can provide guidance, help with form preparation, and ensure compliance with immigration laws.

- Rights and Responsibilities: Immigrants in the United States have certain rights and responsibilities. These include the right to due process, freedom of speech, and protection against discrimination. Immigrants are also expected to obey U.S. laws, pay taxes, and register for selective service (if applicable).

- Resources and Support: Various organizations and resources are available to support immigrants in the United States. These include community centers, non-profit organizations, immigrant advocacy groups, and government agencies that provide information, legal services, English language classes, and assistance with integration.

Remember that immigration laws and policies can change, so it’s important to stay informed about any updates or changes that may affect your immigration status. Consulting reliable sources, such as USCIS or immigration attorneys, can help you navigate the immigration process effectively and accurately.

Types of Immigration

- Family-Based Immigration: This category allows U.S. citizens and lawful permanent residents (green card holders) to sponsor certain family members for immigration to the United States. Immediate relatives, such as spouses, parents, and unmarried children under 21, have priority.

- Employment-Based Immigration: This category is for individuals who have a valid job offer from a U.S. employer. There are several employment-based visa categories, including those for highly skilled workers, professionals, investors, and individuals with extraordinary abilities.

- Diversity Visa Program: Also known as the Visa Lottery, this program provides a limited number of visas to individuals from countries with low rates of immigration to the United States. Eligible participants are randomly selected for the opportunity to apply for permanent residency.

- Refugee and Asylum Status: Refugees are individuals who are forced to flee their home countries due to persecution or fear of persecution based on factors such as race, religion, nationality, or membership in a particular social group. Asylum seekers are individuals who are already in the United States or at a port of entry and seek protection due to similar fears.

- Special Immigrant Visas: These visas are designed for individuals who have provided valuable services to the U.S. government or have faced hardship due to their affiliation with the U.S. military or government abroad. Examples include visas for translators, Afghan and Iraqi nationals who have assisted the U.S. military, and religious workers.

- Temporary Nonimmigrant Visas: These visas allow individuals to enter the United States for a specific purpose and for a limited period of time. Examples include visas for students, tourists, temporary workers, exchange visitors, and individuals participating in cultural or athletic events.

It’s important to note that each immigration category has specific eligibility requirements, application processes, and limitations. Consulting with an immigration attorney or a reliable source of information, such as the U.S. Citizenship and Immigration Services (USCIS) website, is advisable to obtain accurate and up-to-date information about the immigration options that may be available to you.

Asylum

What is Asylum? Asylum is a form of protection granted to individuals who have fled their home countries due to persecution or a well-founded fear of persecution based on factors such as race, religion, nationality, political opinion, or membership in a particular social group.

- Application Process: To seek asylum in the United States, you must be physically present in the country or at a port of entry. You must file an application for asylum, Form I-589, with the S. Citizenship and Immigration Services (USCIS). The application should be filed within one year of your arrival, but there are exceptions for certain circumstances.

- Affirmative Asylum Process: If you are not in removal proceedings, your application will go through the affirmative asylum process. This involves an interview with an asylum officer from USCIS who will assess your claim and make a decision on your eligibility for asylum. It’s important to provide detailed and credible evidence to support your claim during the interview.

- Defensive Asylum Process: If you are in removal proceedings, such as if you have been apprehended at the border or if your visa has expired, you may apply for asylum as a defense against deportation. In this case, your asylum claim will be heard by an immigration judge in the Executive Office for Immigration Review (EOIR).

- Evidence and Documentation: It is crucial to gather and present evidence to support your asylum claim. This can include personal statements, affidavits, country condition reports, news articles, and other supporting documents that demonstrate the persecution you have faced or fear. It’s advisable to work with an experienced immigration attorney to help prepare your case.

- Adjudication and Decision: After reviewing your application and hearing your case, the asylum officer or immigration judge will make a decision on your asylum claim. If granted asylum, you will receive refugee status, which allows you to live and work in the United States. If your claim is denied, you may have the option to appeal the decision or explore other forms of relief.

- Benefits of Asylum: Asylees who are granted refugee status may be eligible for certain benefits, including employment authorization, access to public assistance programs, and the ability to petition for certain family members to join them in the United States.

- Permanent Residency and Citizenship: Asylees who have been physically present in the United States for one year after receiving refugee status can apply for permanent residency, also known as a green card. After meeting the necessary requirements, you may eventually become eligible to apply for U.S. citizenship.

The asylum process can be complex and it’s advisable to seek legal assistance from immigration attorneys or accredited representatives who specialize in asylum cases. They can guide you through the process, help you gather evidence, and present your case effectively.

Case Writers vs Immigration Lawyers

- Immigration lawyers: Immigration lawyers in the United States are legal professionals who specialize in immigration law and provide guidance and representation to individuals, families, and businesses navigating the complex U.S. immigration system. These lawyers possess in-depth knowledge of immigration laws, policies, and procedures, and they assist clients with various immigration matters, such as obtaining visas, green cards, and U.S. citizenship, as well as dealing with deportation and removal proceedings.

- Immigration lawyers work closely with their clients to understand their unique circumstances and immigration goals. They provide legal advice, explain the available options, and help clients navigate the application process. These lawyers assist with preparing and filing necessary paperwork, gathering supporting documents, and representing clients before immigration authorities, such as U.S. Citizenship and Immigration Services (USCIS), the Department of State, and immigration courts.

- Additionally, immigration lawyers may handle cases involving asylum, refugee status, employment-based immigration, family-based immigration, and other immigration-related matters. They stay updated with the latest developments in immigration law and regulations to provide the most accurate and effective counsel to their clients.

Overall, immigration lawyers play a vital role in helping individuals and businesses understand and comply with U.S. immigration laws, ensuring the best possible outcomes in their immigration processes

Case writers : Case writers are professionals who listen to your story for asylum application and help you to organize and write asylum declaration supporting your application.

- When you apply for asylum in the United States, you must also submit not only an application form (I-589), but an asylum declaration (also sometimes referred to as a “statement”). The reason is to explain why you fear persecution if you are returned to your country of citizenship. The idea is to give the U.S. asylum officer or immigration judge who reviews your case a clear picture of your story and why you should be granted this form of humanitarian protection. It is one of the most important pieces of evidence in an asylum case.

- These professionals are skilled at organizing and presenting affidavits to your asylum application in a clear and concise manner. Case writers help ensure that these documents adhere to legal standards, are properly formatted, and meet the specific requirements of the court or jurisdiction where the case is being heard. Sometimes they will also help you to be your interpreter in the USCIS office interview with the Immigration Officer. But they are not your Immigration Lawyer.

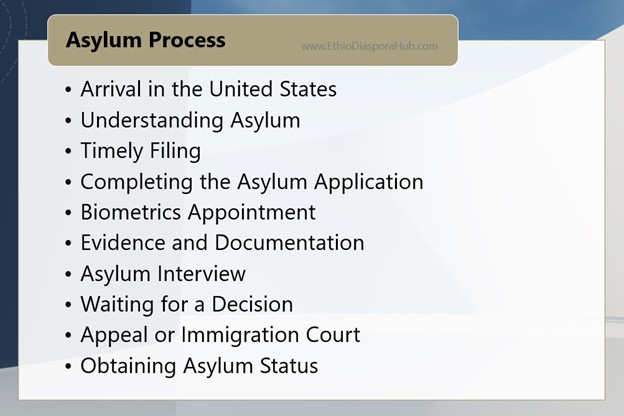

The Asylum Process

The asylum process in the United States is a legal system designed to provide protection and refuge to individuals who have fled their home countries due to persecution or fear of persecution based on their race, religion, nationality, political opinion, or membership in a particular social group. This process allows eligible individuals to seek asylum and present their case to the U.S. government, demonstrating why they should be granted protection and allowed to remain in the country. The asylum process involves various stages, including application submission, interviews, and hearings, all aimed at determining the validity of the asylum claim and ensuring the safety of those seeking refuge in the United States.

- Arrival in the United States: To seek asylum, you must physically be present in the United States or arrive at a U.S. port of entry. You can request asylum regardless of how you entered the country, whether it was legally or illegally.

- Understanding Asylum: Asylum is a form of protection granted to individuals who have fled their home country due to persecution or a well-founded fear of persecution based on factors such as race, religion, nationality, political opinion, or membership in a particular social group.

- Timely Filing: It is important to file your asylum application as soon as possible. Generally, you must submit your application within one year of your arrival in the United States. However, there are exceptions to this rule, such as changed circumstances or extraordinary circumstances that prevented you from filing on time.

- Completing the Asylum Application: To apply for asylum, you need to complete Form I-589, Application for Asylum and for Withholding of Removal. This form collects information about your personal background, your reasons for seeking asylum, and any supporting evidence you have.

- Biometrics Appointment: A biometrics appointment for asylum in the United States is a scheduled appointment where an applicant is required to provide their biometric information to the U.S. Citizenship and Immigration Services (USCIS). Biometrics refers to unique physical characteristics, such as fingerprints, photographs, and signature, that are collected to verify a person’s identity.

- During the biometrics appointment, the applicant will visit a designated USCIS Application Support Center (ASC). The specific ASC location and appointment details are provided by USCIS prior to the appointment.

- Evidence and Documentation: It is essential to gather and present evidence to support your asylum claim. This can include personal statements detailing your experiences, affidavits from witnesses, country condition reports, medical records, or other documents that verify the persecution or fear you have faced or may face in your home country.

- Asylum Interview: Once your application is filed, you will be scheduled for an interview with an asylum officer from the U.S. Citizenship and Immigration Services (USCIS). The purpose of the interview is to evaluate the credibility of your claim and gather additional information about your case. It is crucial to be honest and provide a detailed and consistent account of your experiences.

- Waiting for a Decision: After the interview, the asylum officer will review your case, including the evidence and statements provided. The officer will then make a decision on whether to grant or deny your asylum application. This decision may be given on the spot or provided in writing at a later date.

- Appeal or Immigration Court: If your asylum claim is denied, you may have the option to appeal the decision to the USCIS Administrative Appeals Office (AAO) or to present your case before an immigration judge in the Executive Office for Immigration Review (EOIR). It is crucial to consult with an immigration attorney to understand your options and navigate the appeals process effectively.

- Obtaining Asylum Status: If your asylum claim is approved, you will be granted asylum status. This allows you to remain in the United States and work legally. After one year of continuous presence in the country as an asylee, you may apply for a green card (permanent residency).

It’s important to seek legal assistance from immigration attorneys or accredited representatives who specialize in asylum cases. They can provide guidance, help with form preparation, gather supporting evidence, and represent you throughout the asylum process.

Asylum Interview – with Asylum Officer

The asylum interview in the United States is a crucial step in the asylum application process. It is conducted by an asylum officer from the U.S. Citizenship and Immigration Services (USCIS) or an immigration judge from the Executive Office for Immigration Review (EOIR). The purpose of the interview is to gather detailed information about the applicant’s asylum claim and assess the credibility of their case.

Here are some important points about the asylum interview:

- Scheduling: Once the asylum application is filed, the applicant will receive a notice indicating the date, time, and location of the interview. The interview is typically scheduled several weeks or months after the application is submitted.

- Interview Setting: The interview usually takes place at a USCIS office or an immigration court, depending on whether the applicant is in the affirmative or defensive asylum process.

- Preparation: It is crucial to thoroughly prepare for the asylum interview. This includes reviewing and organizing all relevant documentation, such as personal statements, affidavits, country condition reports, and supporting evidence. It is advisable to consult with an immigration attorney who can guide you through the preparation process and help you present your case effectively.

- Interpreter: If the applicant is not fluent in English, they have the right to request an interpreter. USCIS will provide a qualified interpreter to ensure effective communication during the interview.

- Interview Process: The interview generally begins with the asylum officer or immigration judge administering an oath, affirming the applicant’s commitment to tell the truth. The officer/judge will then proceed to ask questions about the applicant’s personal background, reasons for seeking asylum, and the basis of their claim. It is crucial to provide honest and consistent answers.

- Credibility Assessment: The asylum officer or immigration judge will assess the credibility of the applicant’s claim by evaluating the consistency of their statements, the plausibility of their story, and the supporting evidence provided. They may also ask probing questions to test the applicant’s knowledge of their home country’s conditions.

- Legal Representation: It is highly recommended to have legal representation during the asylum interview. An immigration attorney can help prepare the applicant for the interview, attend the interview with them, and advocate on their behalf. The attorney can also object to improper questioning or provide clarifications when necessary.

- Decision: After the interview, the asylum officer or immigration judge will review the information provided, along with any supporting documentation. They will then make a decision on the asylum claim. The decision may be provided on the spot or sent in writing at a later date.

- Appeal or Further Proceedings: If the asylum claim is denied, the applicant may have the opportunity to appeal the decision or pursue other forms of relief, depending on the specific circumstances of their case. Consulting with an immigration attorney is crucial to understanding the available options and taking appropriate action.

The asylum interview is a critical stage in the asylum process, and careful preparation and presentation of the case are essential. Seeking professional legal assistance can greatly increase the chances of a successful outcome.

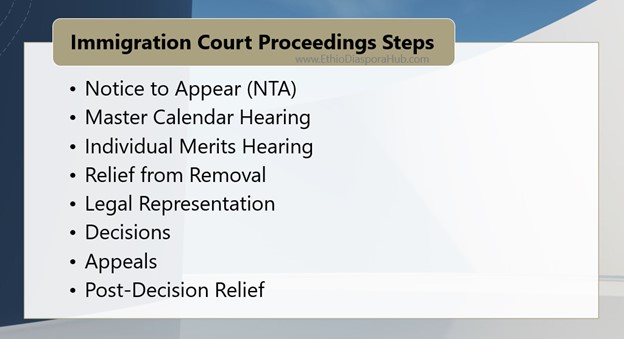

Immigration Court Proceedings Steps

Immigration Court: Immigration court proceedings take place in the Executive Office for Immigration Review (EOIR), which is a part of the U.S. Department of Justice. The immigration court is responsible for deciding immigration cases, including removal (deportation) proceedings.

- Notice to Appear (NTA): The immigration court proceedings usually begin with the issuance of a Notice to Appear (NTA) by the U.S. Department of Homeland Security (DHS). The NTA includes the charges against the individual and the date and location of the initial hearing.

- Master Calendar Hearing: The first hearing is called a Master Calendar Hearing. During this hearing, the immigration judge reviews the charges against the individual, explains their rights, and asks for a response to the charges. The individual is also given the opportunity to seek legal representation and may request additional time to prepare their case.

- Individual Merits Hearing: If the individual contests the charges or seeks relief from removal, they will be scheduled for an Individual Merits Hearing. This hearing provides an opportunity to present evidence, witnesses, and arguments in support of their case. The individual may testify and be cross-examined, and the immigration judge will make a decision based on the merits of the case.

- Relief from Removal: During the Individual Merits Hearing, the individual may seek relief from removal, such as asylum, withholding of removal, protection under the Convention Against Torture, cancellation of removal, adjustment of status, or other forms of relief available under immigration law. The individual must provide evidence and legal arguments to support their eligibility for the requested relief.

- Legal Representation: It is highly recommended to have legal representation during immigration court proceedings. An immigration attorney can provide guidance, prepare the case, present evidence, and advocate on behalf of the individual.

- Decisions: After considering the evidence and arguments presented, the immigration judge will make a decision. The decision may be issued orally at the hearing or provided in writing at a later date. The judge can grant relief, which allows the individual to remain in the United States, or order removal if the charges are upheld and no relief is granted.

- Appeals: If the individual disagrees with the judge’s decision, they may have the right to appeal to the Board of Immigration Appeals (BIA) within a specific timeframe. The BIA reviews the decision and may affirm, reverse, or remand the case back to the immigration court for further proceedings.

- Post-Decision Relief: In some cases, even after a final order of removal is issued, there may be options for post-decision relief. These include motions to reopen or reconsider the case based on new evidence, changed circumstances, or legal errors.

It is crucial for individuals involved in immigration court proceedings to seek legal advice and representation from qualified immigration attorneys. They can provide personalized guidance, help build a strong case, and navigate the complexities of the immigration court system.

The US Financial System

- Overview of US financial system

- Banking

- Commercial Banks

- Savings and Loan Associations

- Credit Unions

- Online Banks

- Investment Banks

- Capital Market

- Stock Market

- Bond Market

- Commodities Market

- Derivatives Market

- Foreign Exchange Market

- Real Estate Market

- Investment Management

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Hedge Funds

- Robo-Advisors

- Pension Funds

- Private Equity

- Insurance

- Federal Reserve

- Board of Governors

- Federal Reserve Banks

- Federal Open Market Committee (FOMC)

- Government Regulations

- Monetary Policy

- Banking Regulations

- Securities Regulations

- Consumer Protection Regulations

- Anti-Money Laundering (AML) Regulations

- Tax Regulations

Overview of US financial system

A financial system refers to the network of institutions, markets, and processes that facilitate the flow of money and resources within an economy. Understanding the financial system is crucial for immigrants as it helps them navigate and make informed decisions about their finances in their new country.

- In a financial system, there are various key components that immigrants should be aware of. Firstly, banks and credit unions are important institutions where individuals can open accounts to safely store their money. These institutions provide services such as checking and savings accounts, loans, and credit cards. Immigrants should research different banks to find the ones that offer services suited to their needs and consider factors like fees, accessibility, and customer support.

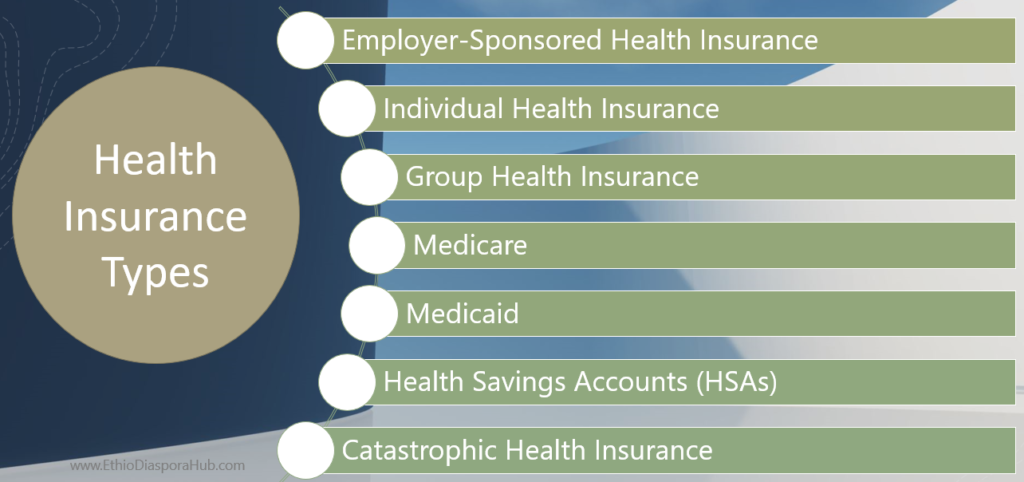

- Another crucial aspect of the financial system is the concept of credit. Credit plays a significant role in the United States and can affect the ability to obtain loans, rent an apartment, or get a credit card. Immigrants should understand the importance of building a good credit history by making timely payments on loans and credit cards, as well as by maintaining a low level of debt. Click here to see the details on Insurance

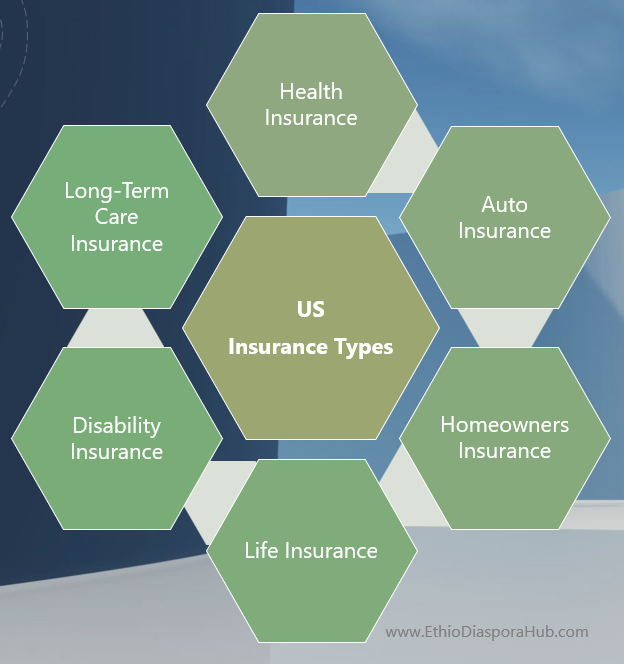

- Immigrants should also be aware of the various financial products and services available, such as insurance, investments, and retirement accounts. Insurance provides protection against unexpected events and is available for health, auto, home, and other purposes. Investments, such as stocks and bonds, can help individuals grow their wealth over time, but it’s important to understand the risks involved. Retirement accounts, such as 401(k) plans or Individual Retirement Accounts (IRAs), allow individuals to save for their future and enjoy tax benefits.

- Additionally, the financial system includes markets where individuals can buy and sell assets, such as stocks, bonds, and commodities. Understanding the basics of investing and the risks involved can help immigrants make informed decisions and potentially grow their wealth.

By understanding the financial system and its various components, immigrants can make informed decisions about their finances, access the services they need, and work towards achieving their financial goals in their new country. It’s important to seek guidance from reputable financial professionals and educate oneself to ensure financial well-being and security.

The major components of the US financial system include banking, capital markets, investment management, insurance, the Federal Reserve, and government regulations.

Banking

Banking refers to the services and activities provided by financial institutions, such as banks and credit unions. Banks offer a variety of services, including checking and savings accounts, loans, credit cards, and money transfers. Immigrants can open bank accounts to securely store their money, make payments, and build a financial history. Banks also provide access to ATMs, online banking, and customer support for their account holders.

- Commercial Banks: Commercial banks are financial institutions that provide a wide range of services to individuals and businesses. They offer checking accounts, savings accounts, loans, credit cards, and other financial products. Immigrants can open accounts with commercial banks to securely store their money, access loans for various purposes, and conduct everyday financial transactions.

- Savings and Loan Associations: Savings and Loan Associations, also known as S&Ls or thrift institutions, are financial institutions that primarily focus on accepting deposits and providing mortgage loans to individuals and businesses. These institutions help individuals save money and achieve their homeownership goals by offering competitive interest rates on savings accounts and mortgage loans.

- Credit Unions: Credit unions are not-for-profit financial cooperatives owned by their members. They offer similar services to commercial banks, including savings accounts, loans, and other financial products. Credit unions typically offer lower fees and competitive interest rates, as they prioritize serving their members’ interests rather than maximizing profits. Immigrants may consider joining credit unions for their financial needs and community-oriented approach.

- Online Banks: Online banks operate primarily through online platforms, allowing customers to manage their finances digitally. They offer services similar to traditional banks, including checking and savings accounts, loans, and other financial products. Online banks often have lower overhead costs, allowing them to offer competitive interest rates and lower fees. Immigrants can conveniently access and manage their finances through online banking platforms.

- Investment Banks: Investment banks primarily focus on providing financial services to corporations, institutional investors, and governments. They specialize in assisting with mergers and acquisitions, underwriting securities offerings, and facilitating large-scale financial transactions. Investment banks also offer advisory services on various financial matters. While immigrants may not typically interact directly with investment banks, these institutions play a crucial role in the broader financial system and capital markets.

It’s important for immigrants to explore and compare different types of financial institutions to find the ones that best meet their specific needs and preferences. Each type of institution offers unique services and advantages, so immigrants should consider factors such as fees, accessibility, customer service, and product offerings when choosing the financial institutions that align with their financial goals.

Capital Market

The capital market is a marketplace where individuals and organizations can buy and sell financial instruments such as stocks, bonds, and derivatives. It enables the flow of capital between investors and borrowers, allowing companies and governments to raise funds for various purposes. Immigrants may engage in the capital market to invest in stocks or bonds, potentially earning returns or owning shares of companies.

Stock Market: Stock market is a marketplace where people buy and sell ownership shares in companies, known as ‘stocks’. When you purchase a stock, you become a shareholder in that company, which can potentially entitle you to a portion of the company’s profits and give you some influence over its major decisions. The prices of stocks fluctuate based on supply and demand, and these fluctuations are influenced by factors like the company’s financial performance, general economic conditions, and investors’ perceptions of the company’s future prospects. The following are common types of stock trading:

“Stock Trading” is the act of buying, selling, or exchanging stocks among buyers and sellers. A stock represents a share in the ownership of a company and constitutes a claim on part of the company’s assets and earnings.

Here’s a simple way to understand it:

- Buying: When you buy shares in a company, you’re essentially buying a piece of that company. You become a shareholder, meaning you now own a part of the company’s value and may have the right to a portion of the company’s profits, which can be paid out as dividends.

- Selling: Selling is the act of getting rid of stocks that you currently own. You might sell a stock for several reasons – because it’s increased in value and you want to take your profits, because it’s decreased and you want to cut your losses, or simply because you need the cash for something else.

Trading: The act of buying and selling stocks within a short timeframe is generally referred to as “trading”. Traders aim to profit from short-term price fluctuations in the stock market.

Different strategies exist within stock trading. These are:

- Day Trading: Day trading is a strategy where traders buy and sell stocks within the same day. The goal is to make quick profits from small price changes in the stock. Day traders typically use technical analysis and short-term price fluctuations to make their trading decisions. They don’t usually hold positions overnight due to the risk of prices changing while the market is closed. It requires deep knowledge of the market, and it carries high risk, but the potential for quick profits makes it appealing for some traders.

- Swing Trading: Swing trading is a style of trading where the trader holds a position in a stock for a period of days to weeks, trying to profit from ‘swings’ in the price. Unlike day traders, swing traders do hold positions overnight, and their trades are often based on technical analysis, but they also pay attention to certain fundamental indicators. The goal is to capture larger price moves than day trading can provide, while not tying up capital for as long as investing.

- Investing: Investing involves buying and holding securities for a longer-term, typically months to years, with the hope that the stocks will appreciate in value over time. Investors typically focus on stocks from companies that they believe will grow or continue to be successful in the future. This can include dividends as a source of return. Investing is less about timing and more about making informed decisions about potential long-term growth. It requires patience and a good understanding of the fundamentals of the company and the market, but it is generally less risky than day or swing trading.

“Stock Trading Markets” refers to the various platforms and exchanges where buying and selling of shares in publicly traded companies occur. These markets are places where sellers offer their shares and buyers bid on them, which helps determine the share price. They facilitate the exchange of securities between buyers and sellers, providing a platform where participants can trade efficiently and securely.

Here are some examples of Stock Trading Markets:

- New York Stock Exchange (NYSE): New York Stock Exchange (NYSE) is the largest stock exchange in the world by market capitalization. It’s located on Wall Street in New York City. Many of the biggest and most influential companies in the world are listed on the NYSE. It operates as an auction market, where buyers and sellers meet to trade at prices set by supply and demand.

- NASDAQ: The NASDAQ (National Association of Securities Dealers Automated Quotations) is a global electronic marketplace where you can buy and sell securities. It was the world’s first electronic stock market. NASDAQ is known for listing many technology companies, including giants like Apple, Google, and Microsoft. Unlike the NYSE, which uses a physical trading floor, NASDAQ uses a network of computers to execute trades electronically.

- Over The Counter (OTC) Market: Over The Counter (OTC) Market is a decentralized market (meaning it doesn’t have a physical location) where trading of financial instruments like stocks, commodities or currencies is done directly between two parties. It’s often used to trade shares of smaller companies that aren’t listed on the major stock exchanges. OTC trading can be less transparent than trading on an exchange because information is not publicly available, and it can also be riskier because many OTC companies do not meet the standards required to list on an exchange.

- Pink Sheets: This term refers to an OTC market where shares in companies are traded, often those not listed on the major stock exchanges. The term originated from the color of the paper the quotes were originally printed on. Pink sheet companies aren’t required to file with the Securities and Exchange Commission (SEC), so investing in these companies can be risky due to a lack of reliable information.

- International Stock Exchanges: These are stock exchanges located outside of the United States. Some of the largest and most well-known include the Tokyo Stock Exchange in Japan, the London Stock Exchange in the United Kingdom, the Shanghai Stock Exchange in China, and the Euronext which spans multiple European countries. Each international stock exchange operates under its own rules and regulations, and listings may include companies from their home country as well as multinational corporations. Investors may choose to trade on international exchanges as a way to diversify their portfolio or to invest in specific international companies or economies.

Bond Market: Bond Market is where organizations such as governments and corporations raise money by issuing bonds, which are basically IOUs. When you buy a bond, you’re lending money to the issuer in exchange for regular interest payments and the promise that the principal amount will be paid back on a specified future date. Bond prices are influenced by factors such as interest rates, inflation, and credit risk of the issuer.

Commodities Market: Commodities Market is a marketplace where raw materials and primary products are traded. Commodities include things like oil, gold, wheat, and coffee. They’re traded on specialized exchanges, and their prices can fluctuate based on supply and demand dynamics, geopolitical issues, and economic factors.

Derivatives Market: In Derivatives Market marketplace, people trade financial contracts whose value derives from the value of another asset, known as the underlying asset. The underlying asset can be a stock, bond, commodity, currency, interest rate, or even another derivative. Examples of derivatives include options, futures, and swaps. They are often used to hedge risk or speculate on future price movements.

Foreign Exchange Market: Foreign Exchange Market also known as ‘Forex’, this is a global marketplace for trading national currencies against each other. Because of international trade and investment, companies and individuals need to convert one currency to another, and that’s where the foreign exchange market comes in. Currency exchange rates fluctuate based on factors such as economic indicators, interest rates, and geopolitical events.

Real Estate Market: Real Estate Market is the marketplace where properties, including land and buildings, are bought, sold, and rented. The real estate market can be divided into residential, commercial, and industrial segments. Factors influencing the real estate market include interest rates, economic growth, demographics, and government policies. Prices in this market can fluctuate based on supply and demand dynamics, location, and the physical condition of the property.

Investment Management

Investment management involves the professional management of investment portfolios on behalf of individuals or institutions. Investment managers make decisions on buying, selling, and holding various investment assets, such as stocks, bonds, and mutual funds, with the goal of growing the value of the portfolio over time.

- Mutual Funds: Mutual funds are investment vehicles that pool together funds from multiple investors to invest in a diversified portfolio of securities. Managed by professional fund managers, these funds could include stocks, bonds, and other assets, depending on the fund’s investment objectives. The value of mutual fund shares fluctuates as the value of the assets in the fund rises or falls. It offers a way for smaller or individual investors to access professionally managed, diversified portfolios that would otherwise be difficult to create with a small amount of capital.

- Exchange-Traded Funds (ETFs): An ETF is a type of security that involves a collection of securities—such as stocks—that often aims to track a specific index. However, they are listed on exchanges and the shares trade throughout the day just like an ordinary stock. ETFs can contain many types of investments including stocks, commodities, bonds, or a mixture of investment types. This offers an advantage in terms of liquidity and price transparency.

- Hedge Funds: Hedge funds are alternative investments using pooled funds that employ different strategies to earn active returns for their investors. They may use advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). They are typically open to a limited range of investors and require a large initial minimum investment. Investors in hedge funds are typically high-net-worth individuals and institutional investors.

- Robo-Advisors: Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey, and then uses the data to offer advice and/or automatically invest client assets. They are known for their low fees and ease of use.

- Pension Funds: Pension funds are a type of investment plan that allows an employer or employee to set aside a portion of a worker’s earnings to save for retirement. They are pooled together and invested on behalf of the fund’s members. These funds can invest in various assets such as equities, bonds, property, and more. The goal is to grow the funds to pay the pension benefits to employees when they reach retirement.

- Private Equity: Private equity refers to a type of investment funds that invest directly into private companies or conduct buyouts of public companies that result in a delisting of public equity. They are composed of funds and investors that directly invest in private companies, or that engage in buyouts of public companies, with the aim of helping a company to achieve its full potential. Private equity investors often use leveraged buyouts to acquire distressed companies. They restructure them and aim to sell them at a profit. Investments in private equity often require long holding periods to allow for a turnaround of a distressed company or a liquidity event such as an IPO or sale to a public company.

Insurance

Insurance provides protection against financial losses resulting from unexpected events. Individuals or businesses pay premiums to insurance companies, which then provide compensation in case of covered events, such as accidents, illnesses, property damage, or theft. Immigrants can purchase various types of insurance, such as health insurance, auto insurance, or renter’s insurance, to mitigate financial risks and ensure their well-being in times of adversity. Click here to see the details on Insurance

Federal Reserve

The Federal Reserve, often referred to as the “Fed,” is the central bank of the United States. It is responsible for implementing monetary policy, regulating banks, and maintaining stability in the financial system. The Federal Reserve influences interest rates, manages the money supply, and acts as a lender of last resort to banks. Its actions impact the overall economy, including factors like borrowing costs and employment levels.

- Board of Governors: The Board of Governors of the Federal Reserve System is a seven-member body that oversees and makes key decisions for the Federal Reserve System. This includes setting reserve requirements and playing a key role in monetary policy. The members are nominated by the President of the United States and confirmed by the Senate. The board is headquartered in Washington, D.C., and its decisions are designed to promote the health and stability of the U.S. economy.

- Federal Reserve Banks: The Federal Reserve System consists of 12 regional Federal Reserve Banks located in various major cities across the United States. These banks operate under the supervision of the Board of Governors and carry out various functions, including overseeing member banks in their regions, implementing monetary policy, issuing currency, and providing financial services to the U.S. government and depository institutions.

- Federal Open Market Committee (FOMC): The FOMC is a branch of the Federal Reserve Board that meets eight times a year to discuss and make decisions about the monetary policy of the United States. The committee consists of 12 members, including the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. The FOMC is responsible for open market operations, which involve the buying and selling of government securities, an important tool for influencing short-term interest rates.

Government Regulations

Government regulations refer to rules and laws imposed by federal, state, and local authorities to govern various aspects of the economy, including financial services. These regulations aim to protect consumers, ensure fair practices, and maintain stability within the financial system. Immigrants should familiarize themselves with government regulations that affect their financial activities, such as banking regulations, tax laws, and consumer protection laws, to ensure compliance and make informed financial decisions.

- Monetary Policy: Monetary Policy refers to the actions undertaken by a country’s central bank (in the U.S., that’s the Federal Reserve) to control the supply of money and interest rates in the economy to promote economic growth and stability. The main tools of monetary policy are open market operations, reserve requirements, and the discount rate.

- Banking Regulations: Banking Regulations are a form of government regulation that subject banks to certain requirements, restrictions, and guidelines. This is done to create market transparency between banking institutions and the individuals and corporations with whom they conduct business. Regulations ensure the banks are operating safely and soundly, protecting consumers’ deposits and the overall health of the financial system.

- Securities Regulations: Securities Regulations are laws and rules that govern activities around the issuance and trading of securities (like stocks and bonds). In the U.S., the Securities and Exchange Commission (SEC) is the primary regulatory body that oversees securities markets, protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.

- Consumer Protection Regulations: Consumer Protection Regulations are laws and rules designed to ensure the rights of consumers, as well as fair trade, competition, and accurate information in the marketplace. They are designed to prevent businesses from engaging in fraud or unfair practices, to protect individuals from scams and fraud, and to ensure consumer rights.

- Anti-Money Laundering (AML) Regulations: AML regulations are a set of laws and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Banks and other financial institutions are required to put systems in place to detect suspicious activity, report cash transactions over a certain amount, and perform customer due diligence, among other things.

- Tax Regulations: Tax regulations are laws that define how much individuals and corporations must pay in taxes to the government. They are made up of various laws and rules put in place by the government to regulate the statutory obligation of businesses and individuals towards the tax system. This could include income tax, corporation tax, import taxes, and more. The Internal Revenue Service (IRS) in the U.S. is the government agency that oversees the collection of taxes and enforces tax laws.

The US Credit System

- Overview of US Credit System

- Credit Reporting Agencies

- Equifax:

- Experian

- TransUnion

- Credit Score Types

- FICO Score:

- Vantage Score

- Experian Score

- Equifax Score

- TransUnion Score

- Credit Score Rating

- Excellent Credit:

- Good Credit:

- Fair Credit:

- Poor Credit

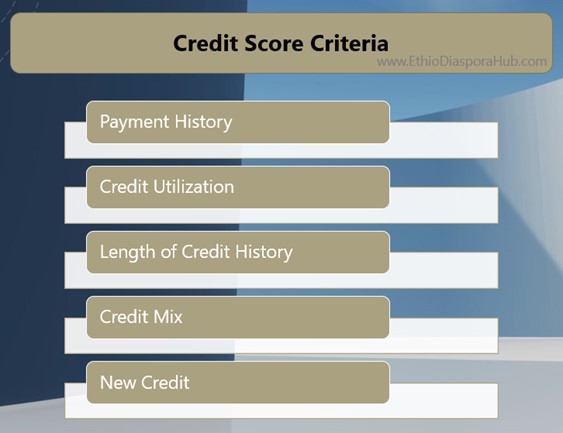

- Credit Score Criteria

- Payment History

- Credit Utilization

- Length of Credit History

- Credit Mix

- New Credit

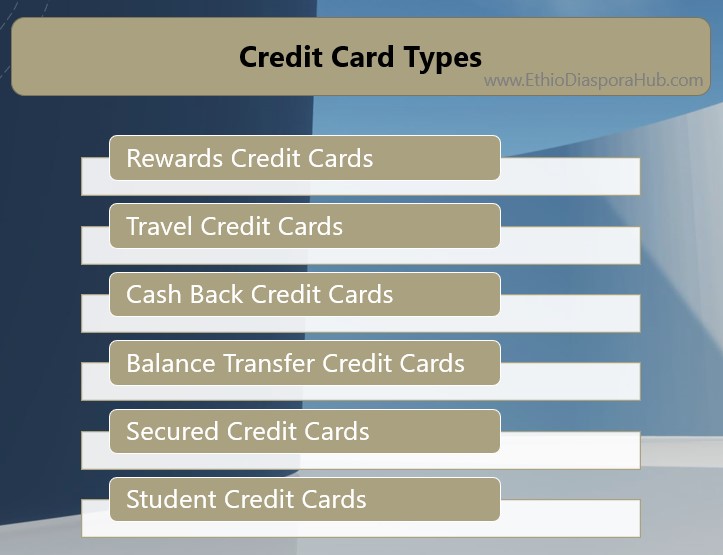

- Credit Card Types

- Rewards Credit Cards

- Travel Credit Cards

- Cash Back Credit Cards

- Balance Transfer Credit Cards

- Secured Credit Cards

- Student Credit Cards

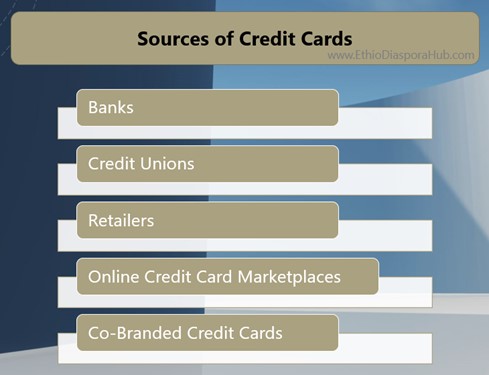

- Sources of Credit Cards

- Banks

- Credit Unions

- Retailers

- Online Credit Card Marketplaces

- Co-Branded Credit Cards

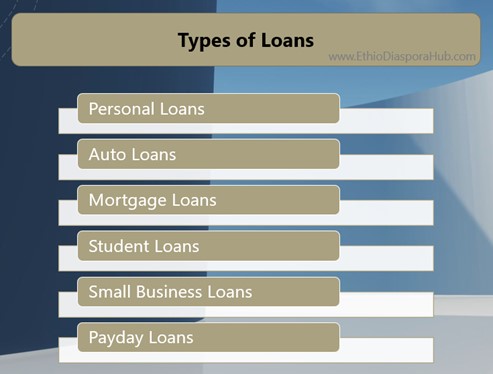

- Loans

- Personal Loans

- Auto Loans

- Mortgage Loans

- Student Loans

- Small Business Loans

- Payday Loans

- Credit Counseling and Debt Management

- Credit Counseling

- Debt Management Plans

- Bankruptcy Counseling

- Non-profit vs. For-profit Services

Overview of US Credit System

The credit system in the United States is an extensive, multifaceted financial structure that facilitates various forms of borrowing and lending, influencing a host of financial activities for individuals, businesses, and governments. This system includes a wide range of institutions, including commercial banks, credit unions, credit card companies, and mortgage lenders, among others.

- One of the key features of the U.S. credit system is the concept of creditworthiness, which is primarily determined through credit scores and credit reports. Credit scores are calculated based on a variety of factors, including payment history, amount of debt, length of credit history, types of credit, and new credit inquiries. The most commonly used scoring model is the FICO score, which ranges from 300 (poor) to 850 (exceptional).

- Credit reports, produced by three major credit bureaus (Experian, TransUnion, and Equifax), include a detailed record of an individual’s credit history, including open and closed accounts, payment history, credit inquiries, and public records such as bankruptcies or tax liens.

- Access to credit in the U.S. is governed by a variety of laws and regulations designed to promote fairness and prevent discrimination. The Equal Credit Opportunity Act, for example, prohibits discrimination in any aspect of a credit transaction based on race, color, religion, national origin, sex, marital status, age, or because a person receives public assistance.

Credit is fundamental to many aspects of life in the U.S., influencing everything from mortgage and auto loan approvals to employment checks. As a result, maintaining a good credit score and managing credit responsibly is considered crucial for financial health. Misuse of credit, on the other hand, can lead to serious financial difficulties and long-lasting damage to one’s credit score.

Credit Reporting Agencies

In the United States, credit reporting agencies, also known as credit bureaus, are responsible for collecting and maintaining consumer credit information. They generate credit reports and scores that are used by lenders, landlords, employers, and others to assess an individual’s creditworthiness. The three major credit reporting agencies in the U.S. are Experian, TransUnion, and Equifax.

- Experian: Based in Ireland, but with operational headquarters in California, Experian is one of the three largest credit bureaus. It provides credit reports and scores to lenders and individuals, gathers data from lenders, creditors, and public records, and offers credit monitoring and identity theft protection services.

- TransUnion: Based in Chicago, Illinois, TransUnion is a global credit bureau that collects and aggregates information on millions of individual consumers in the U.S. and worldwide. In addition to credit reporting, TransUnion offers credit and identity related services to businesses and consumers, including fraud detection and credit risk management services.

- Equifax: Equifax, based in Atlanta, Georgia, collects and aggregates information from over 800 million individual consumers and more than 88 million businesses worldwide. It provides credit reports and scores, sells data to businesses, and offers identity theft protection services.

These agencies collect data from various sources, including lenders, creditors, and public records to compile an individual’s credit report, which includes information like the person’s name, address, social security number, credit history, inquiries, and public records. This report is used to generate a credit score, which is a numerical expression of the person’s creditworthiness. Each agency may have slightly different information, and hence, credit scores can vary between agencies.

These credit reporting agencies are regulated by the Fair Credit Reporting Act (FCRA), a U.S. federal law designed to promote accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

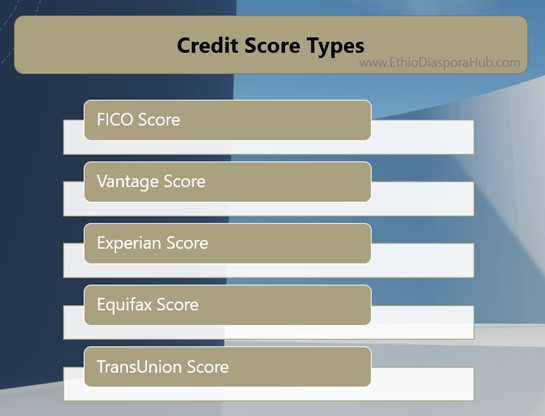

Credit Score Types

A credit score is a numerical expression derived from an analysis of an individual’s credit files. It’s used by lenders such as credit card companies, banks, and auto dealerships to decide how likely you are to repay your loans. The higher the score, the less risky you are perceived to be.

In the United States, there are several types of credit scores, but the most commonly used is the FICO score, developed by the Fair Isaac Corporation.

- FICO Score: The FICO score is one of the most commonly used credit scoring models and is named after the Fair Isaac Corporation, which developed the scoring method. The FICO score ranges from 300 to 850 and is used by lenders to evaluate an individual’s credit risk—how likely they are to repay a loan on time. The score is calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used.

- Experian Score: The Experian Score is also known as the Experian PLUS Score and ranges from 330 to 830. While this score is not commonly used by lenders, it can give consumers a general idea of their credit health. However, Experian also provides FICO scores and VantageScores based on the data they collect.

- Equifax Score: Equifax has its own credit score, known as the Equifax Credit Score, which ranges from 280 to 850. Similar to Experian, while this score is less commonly used by lenders, it can still provide consumers with valuable insight into their credit standing. Equifax also provides FICO scores and VantageScores to lenders and consumers.

- TransUnion Score: TransUnion uses its own proprietary model known as the TransUnion New Account Score, which ranges from 300 to 850. This score is designed to help lenders assess risk when opening new accounts. Like the other two major credit bureaus, TransUnion also provides FICO scores and VantageScores.

- VantageScore: VantageScore is a credit scoring model that was created collaboratively by the three major credit bureaus (Experian, TransUnion, and Equifax) as an alternative to the FICO score. Like the FICO score, VantageScore ranges from 300 to 850. It uses a slightly different calculation model, giving more weight to the last 24 months of a consumer’s credit history and less to older items.

Keep in mind, while all these credit scores are designed to assess credit risk, they may not always align, as they use different scoring models and might have slightly different information on file. As a consumer, it’s important to understand the various types of credit scores and to check your credit report regularly for accuracy.

Credit Score Rating

A credit score rating is a numerical expression based on the level of analysis of a person’s credit files. It is used to represent the creditworthiness of an individual, or in simpler terms, it predicts the likelihood that a person will pay their debts on time. Lenders, such as banks and credit card companies, use credit score ratings to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. The rating typically encapsulates a scale from poor to excellent:

- Excellent Credit: If your credit score ranges between 800-850, it is considered excellent. Consumers with this credit score rating have a long history of no late payments, as well as low balances on credit cards. People with excellent credit have usually demonstrated responsible credit behavior over a long period of time and have a mix of credit types, including credit cards, mortgages, and installment loans. They tend to have the easiest time getting approved for new loans and will receive the best interest rates.

- Good Credit: Good credit scores typically fall between 670-799. People in this range are almost always approved for loans and have credit card balances considerably lower than their limits. Though they may have had a late payment or two, it’s often a rare occurrence. Interest rates from lenders are still relatively low in this credit score range.

- Fair Credit: A fair credit score ranges from 580-669. People with fair credit are considered subprime borrowers, meaning they may face higher interest rates or have trouble getting approved for loans or credit. This group may have experienced some credit issues, such as missed payments or bankruptcy, in the past.

- Poor Credit: A credit score that’s 579 and below is considered poor. Many lenders will refuse to issue credit to consumers in this score range because they are considered to be at high risk of defaulting on a loan. This group may have a history of unpaid bills or late payments, high credit utilization rates, or might have experienced severe financial setbacks such as repossession, foreclosure, or bankruptcy.

Remember that these score ranges can vary slightly between different credit score models (FICO, VantageScore, etc.). No matter the score, it’s always a good idea to monitor your credit reports regularly for accuracy and any signs of fraud.

Credit score criteria

Credit score criteria refer to the various factors that credit bureaus use to calculate an individual’s credit score. These factors analyze a person’s credit history to determine their creditworthiness, or likelihood to repay borrowed money. The criteria generally include the following: