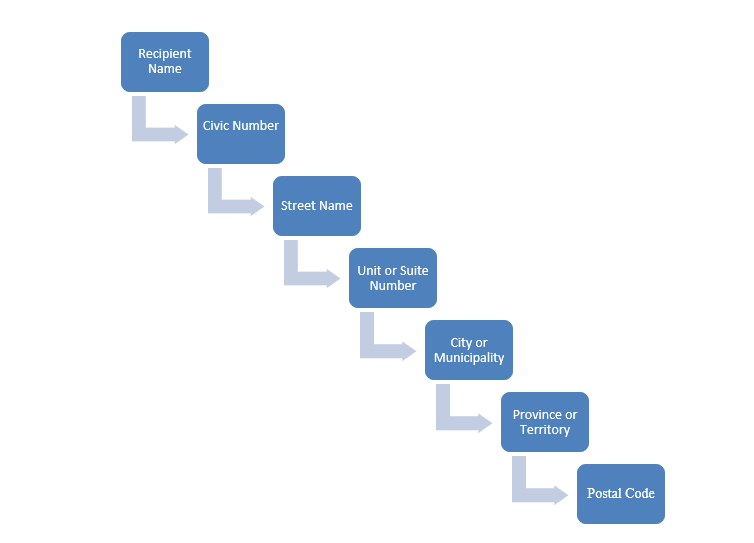

Address system of Canada

- Address system of Canada

- Recipient Name

- Civic Number

- Street Name

- Unit or Suite Number

- City or Municipality

- Province or Territory

- Postal Code

- Address Example

Address system of Canada

An addressing system is a standardized method used to identify and locate specific places, individuals, or organizations within a given geographical area. It is a fundamental component of postal services and mail delivery systems, ensuring that letters, packages, and other forms of communication can be accurately routed to their intended recipients.

An addressing system typically includes various components, such as the recipient’s name, street or road name, building or house number, unit or suite number (if applicable), city or municipality, province or territory, and a postal code or ZIP code. The specific format and details of an addressing system may vary from country to country, and even within regions of a country.

The address system in Canada follows a specific format, and it’s essential to use the correct format for official purposes. Canadian addresses typically consist of the following components:

Recipient’s Name: The full name of the person or organization intended to receive the mail or package.

Civic Number: This is the building number, indicating the specific location along a street or road.

Street Name: The name of the street or road where the recipient resides or the organization is located.

Unit or Suite Number (if applicable): If the recipient resides in an apartment, condominium, or any unit within a building, this number indicates the specific unit.

City or Municipality: The name of the city, town, or municipality where the address is located.

Province or Territory: The province or territory in which the address is situated. Canada has ten provinces and three territories.

Postal Code: A unique six-character alphanumeric code that helps the postal service identifies the precise location of the address.

Here’s an example of how an official Canadian address might look:

- Recipient’s Name

- Civic Number, Street Name

- Unit or Suite Number (if applicable)

- City, Province

- Postal Code

- Canada

For instance:

- John Smith

- 123 Main Street

- Apt. 4B

- Toronto, ON

- M4R 1A2

- Canada

A few additional tips:

- Always use capital letters when writing an address.

- Make sure the postal code is accurate, as it is crucial for proper mail sorting and delivery.

- Include any relevant additional information, such as building names or landmarks, if available, to assist with delivery.

It’s important to adhere to this format to ensure that your mail or packages reach their intended destinations efficiently.

Immigration Status and Benefits

- Your Canadian Immigration Status

- Temporary Resident Status

- Permanent Resident Status

- Canadian Citizenship

- Temporary Resident Permit

- International Mobility Program (IMP) Work Permits

- Open Work Permit

- Studying without a Study Permit

- Canadian Immigration Benefits

- Access to Social Services.

- Employment Opportunities

- Education Benefits

- Social Security Benefits

- Family Sponsorship

- Travel Freedom

- Pathway to Citizenship

Your Canadian Immigration Status

Here are several types of immigration status in Canada. Each type of status grants different rights and privileges to individuals in Canada. It’s important to note that immigration policies may change over time, so it’s always best to refer to the official Immigration, Refugees, and Citizenship Canada (IRCC) website for the most current information. Here are some of the main types of immigration status in Canada:

Temporary Resident Status:

Visitor Visa: Allows individuals to visit Canada for tourism, business, or family visits for a limited period.

Study Permit: Issued to foreign students to study at designated educational institutions in Canada.

Work Permit: Granted to individuals who have a job offer from a Canadian employer and are allowed to work in Canada for a specific employer and duration.

Permanent Resident Status:

Express Entry: A points-based immigration system for skilled workers who want to become permanent residents based on factors such as age, education, work experience, language proficiency, and adaptability.

Provincial Nominee Program (PNP): Allows provinces and territories to nominate individuals who have the skills and experience needed in their respective regions for permanent residency.

Family Sponsorship: Canadian citizens and permanent residents can sponsor their close family members, including spouses, common-law partners, parents, and dependent children, for permanent residency.

Refugee and Protected Person Status: Individuals who are granted refugee status or are determined to need protection may become permanent residents.

Canadian Citizenship: Canadian citizens have full rights and privileges in Canada, including voting rights, unrestricted travel, and eligibility for certain government jobs.

Temporary Resident Permit (TRP): A TRP may be issued to individuals who are otherwise inadmissible to Canada due to criminality or other reasons, but who have a valid reason to enter the country temporarily.

International Mobility Program (IMP) Work Permits: Allows individuals from certain countries or occupations to work in Canada without the need for a Labor Market Impact Assessment (LMIA) under specific international agreements.

Open Work Permit: A type of work permit that allows the holder to work for any Canadian employer without the need for a specific job offer.

Study without a Study Permit: some short-term courses or programs in Canada do not require a study permit for individuals to study.

It’s important to remember that each immigration status has its own eligibility criteria, requirements, and limitations. The Canadian immigration system is complex, and the process can vary depending on the specific program an individual applies for. Always refer to the official IRCC website or seek advice from a qualified immigration professional for accurate and up-to-date information regarding immigration status in Canada.

Benefits of Canadian Permanent Residency and Citizenship:

class=”accesssto”Access to Social Services: Permanent residents and citizens have access to Canada’s publicly funded healthcare system, education, and other social services.

Employment Opportunities: Permanent residents can work for any employer in Canada without needing a separate work permit. Citizenship provides further access to government jobs and contracts that may have citizenship requirements.

Education Benefits: Permanent residents and citizens can study in Canadian schools and universities at domestic tuition rates, which are often lower than international rates.

Social Security Benefits: Permanent residents and citizens are eligible for certain social benefits, such as unemployment insurance, pension plans, and other government assistance programs.

Family Sponsorship: Canadian citizens and permanent residents can sponsor their close family members for permanent residency, allowing them to reunite with their loved ones in Canada.

Travel Freedom: Permanent residents can travel in and out of Canada freely. Canadian citizens can travel visa-free or with visa-on-arrival to many countries around the world, providing a high level of mobility.

Pathway to Citizenship: Permanent residents can eventually apply for Canadian citizenship after meeting residency and other requirements.

Please keep in mind that the immigration process and specific benefits may vary depending on the immigration program and the applicant’s circumstances. For the most up-to-date and comprehensive information, it’s essential to refer to the official Immigration, Refugees, and Citizenship Canada (IRCC) website or consult with a qualified immigration professional.

Your Essential Documents

- Permanent Resident Card

- Canadian Citizenship Certificate

- Canadian Passport

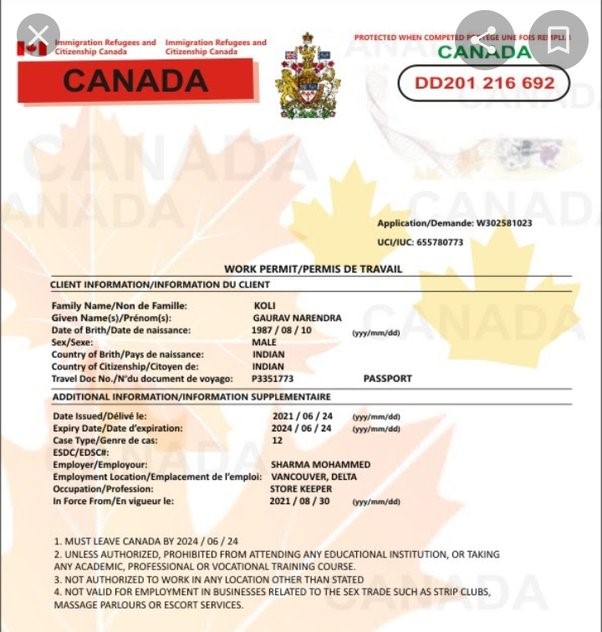

- Work Permit

- Study Permit

- Visitor Record or Temporary Resident Visa

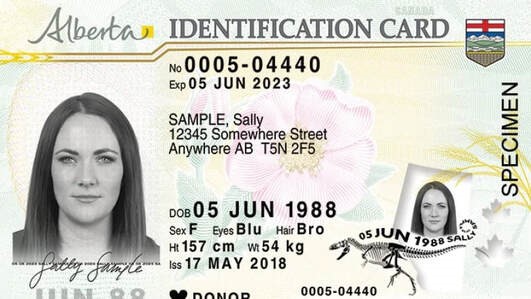

- Provincial Identification Card

- Social Insurance Number

- Health Insurance Card

Essential immigrant documents

Essential immigrant documents in Canada are the official government-issued documents that are required for individuals who are immigrating to Canada or becoming permanent residents in the country. These documents serve as proof of identity, status, and eligibility for various services and benefits in Canada. The essential immigrant documents in Canada include:

Permanent Resident Card (PR Card): This card is issued to permanent residents of Canada as proof of their status. It allows them to travel outside Canada and return to the country.

The Permanent Resident Card (PR Card) of Canada is an official identification document issued by the Canadian government to permanent residents of Canada. It serves as proof of a person’s status as a permanent resident in the country. Permanent residents are individuals who have been granted the right to live and work in Canada indefinitely, but they are not Canadian citizens

Canadian Citizenship Certificate: If you are a Canadian citizen, you should have a Canadian citizenship certificate as proof of your citizenship. The Canadian Citizenship Certificate is an official document issued by the Canadian government to individuals who have acquired Canadian citizenship.

It serves as formal proof of their status as Canadian citizens. Unlike the Permanent Resident Card (PR Card) that is issued to permanent residents, the Canadian Citizenship Certificate is specifically for those who have become citizens of Canada through naturalization or other means.

Canadian Passport: As a Canadian citizen, you should obtain a valid Canadian passport if you plan to travel internationally. The Canadian Passport is an official travel document issued by the Canadian government to Canadian citizens. It serves as proof of identity and Canadian citizenship, allowing citizens to travel internationally and re-enter Canada. The Canadian Passport is recognized worldwide and is an essential document for Canadian citizens who wish to travel abroad.

Work Permit: If you are in Canada on a temporary work visa, you should have your work permit with you as it confirms your authorization to work in the country. The Work Permit of Canada, also known as a work visa, is an official document issued by the Canadian government that allows foreign nationals to work legally in Canada for a specific employer and a limited period. It is a temporary immigration program that enables employers in Canada to hire foreign workers to fill temporary job positions when they cannot find suitable Canadian citizens or permanent residents to do the job.

Study Permit: A study permit is an official document issued by the Canadian government that allows foreign nationals to study at designated learning institutions (DLIs) in Canada. It is a temporary resident visa that enables international students to pursue academic or vocational programs in Canada for a specific period. For international students in Canada, a study permit is essential as evidence of their authorization to study in the country.

Visitor Record or Temporary Resident Visa (TRV): In Canada, a Visitor Record or Temporary Resident Visa (TRV) is an official document issued by the Canadian government to foreign nationals who wish to visit Canada temporarily for tourism, business, or family visits. It allows them to enter and stay in Canada for a limited period as a temporary resident. If you are in Canada as a temporary visitor, you should have your visitor record or TRV, which shows the dates of your authorized stay.

Provincial Identification Card: In Canada, a Provincial Identification Card is an official government-issued identification document that serves as proof of identity and residency within a specific province or territory. It is a valuable form of identification for individuals who do not hold a driver’s license or a passport but still need a recognized ID for various purposes within their province or territory of residence. If you are not eligible for a driver’s license or do not drive, you can obtain a provincial identification card from the provincial government. This card serves as an official government-issued identification document.

Social Insurance Number (SIN): The Social Insurance Number (SIN) is a unique nine-digit number issued by the Canadian government to individuals for identification purposes and to administer various government programs and benefits. It is an essential piece of personal identification used in Canada for tax, employment, and government-related purposes.

Health Insurance Card: In Canada, the Health Insurance Card, also known as the Health Card or Provincial Health Card, is an essential government-issued document that provides proof of an individual’s eligibility for publicly funded healthcare services within a specific province or territory. Each province and territory in Canada have its health insurance plan, and residents are required to hold a valid Health Insurance Card to access medically necessary healthcare services without paying out-of-pocket fees In Canada, healthcare is primarily administered by the provinces and territories. Each province or territory issues a health insurance card that provides access to basic medical services.

It’s important to note that the list provided above is not exhaustive, and the specific documents you need will depend on your immigration status, the purpose of your stay, and the province or territory where you are residing. Always ensure that you have the necessary documents based on your situation and comply with Canadian immigration and identification requirements.

Understanding your finance

- Understanding your finance

- Budgeting

- Income

- Expenses

- Savings

- Debts

- Investments

- Tax Planning

- Financial Literacy

- Retirement Planning

- Insurance

Understanding Your Finance

Understanding your finance in Canada refers to having a comprehensive knowledge and awareness of your financial situation, including your income, expenses, savings, debts, investments, and financial goals. It involves being informed about various financial concepts, tools, and resources to make informed decisions and manage your money effectively.

Here are some key aspects of understanding your finance in Canada:

Budgeting: Creating and following a budget is fundamental to understanding your finances. It involves tracking your income and expenses to ensure that your spending aligns with your financial goals and priorities. Here are keys points that should be considered while preparing your budget

Income: Start by identifying all sources of income, such as your salary, wages, bonuses, or any other earnings. It’s essential to clearly understand your total monthly or yearly income. Here are keys points that should be considered while preparing your budget

Expenses: Categorize your expenses into essential and non-essential categories. Essential expenses include necessities like housing, utilities, groceries, transportation, and healthcare. Non-essential expenses cover discretionary spending, such as entertainment, dining out, and hobbies.

Fixed vs. Variable Expenses: Differentiate between fixed expenses (constant and predictable, like rent) and variable expenses (fluctuating, like groceries or entertainment).

Creating a Budget: Based on your income and expenses, create a budget that allocates specific amounts to each category. Ensure that your total expenses do not exceed your total income.

Savings and Goals: Include savings as part of your budget. Allocate funds to build an emergency fund and save for short-term goals (e.g., vacations) and long-term objectives (e.g., buying a home, retirement).

Tracking and Adjusting: Monitor your spending regularly and compare it to your budget. Adjust as needed to stay on track and align your financial choices with your goals.

Cutting Costs: Look for opportunities to cut unnecessary expenses or find more cost-effective alternatives to save money.

Debt Management: If you have debts, include debt payments in your budget. Aim to pay off debts strategically to reduce interest costs.

Financial Discipline: Stick to your budget and avoid overspending on non-essential items. Financial discipline is essential to achieve your financial objectives.

Budgeting Tools: Utilize various budgeting tools and apps available to help you manage your finances effectively.

Flexibility: While it’s essential to have a structured budget, allow room for flexibility to accommodate unexpected expenses or changes in your financial situation

Income: Understanding your sources of income, such as salary, wages, bonuses, or investments, is essential. This helps you plan your budget, save, and invest wisely. Some major employment types are listed below:

Full-time Employment: Full-time employees work a standard number of hours per week as defined by the employer or labor laws. Generally, this is around 35 to 40 hours per week. Full-time employees often receive benefits such as health insurance, vacation pay, and other entitlements.

Part-time Employment: Part-time employees work fewer hours per week than full-time employees. The exact number of hours varies by employer and industry. Part-time employees may or may not receive the same benefits as full-time employees, depending on the company’s policies.

Temporary Employment: Temporary employees are hired for a specific period or a particular project. Their employment is time-bound and may be used to fill short-term staffing needs or cover seasonal work fluctuations.

Contract Employment: Contract workers are hired for a fixed duration to complete a specific task or project. They are usually not considered employees and may not receive the same benefits as full-time employees.

Permanent Employment: Permanent employees have an ongoing employment relationship with the employer and are not hired for a fixed period. They enjoy more job security and are entitled to various benefits.

Self-Employment: Self-employed individuals work for themselves and run their businesses. They are not considered employees and are responsible for managing their taxes, insurance, and other business-related matters.

Casual Employment: Casual employees work on an irregular or as-needed basis and do not have a regular schedule. They may be called in to work when the employer requires additional staff.

Seasonal Employment: Seasonal workers are hired to meet the demands of specific seasons or events, such as holiday seasons or agricultural harvests.

Apprenticeship: Apprentices are individuals learning a trade or skill while working under the guidance of experienced professionals. They combine on-the-job training with classroom learning.

Internship: Interns are individuals, often students or recent graduates, who work temporarily to gain practical work experience in their chosen field.

Expenses: Knowing where your money is going and categorizing your expenses (e.g., housing, groceries, transportation, entertainment) helps identify areas where you can potentially cut costs or reallocate funds to meet your financial objectives. You have to manage your all expense like Fixed Expenses, Variable Expenses, Debt Payments, Savings and Investments, Taxes, Emergency Funds, Insurance, Education and Training, Personal Care, and Charitable Donations properly.

Savings: Building and maintaining an emergency fund and saving for short-term and long-term goals, such as education, homeownership, retirement, or travel, are crucial aspects of financial planning.

Debts: Understanding your debts, including credit card balances, loans, or mortgages, is essential. Managing debt responsibly and making timely payments are vital for financial stability.

Investments: Learning about various investment options, such as stocks, bonds, mutual funds, and retirement accounts, helps you make informed decisions about growing your wealth over time.

Tax Planning: Understanding how the Canadian tax system works and optimizing your tax strategy can help you minimize tax liabilities and take advantage of available tax credits and deductions.

Tax planning is a crucial aspect of personal finance in Canada. It involves organizing your financial affairs in a strategic manner to legally minimize the amount of taxes you need to pay while ensuring compliance with tax laws. Effective tax planning can help you retain more of your income, optimize your investments, and achieve your financial goals. Here are some key points to understand about tax planning in Canada:

Understanding Tax Laws: The first step in tax planning is to have a good understanding of the Canadian tax system, including federal and provincial tax laws. This includes knowing the tax rates, deductions, credits, and various tax incentives available to you.

Utilizing Tax-Advantaged Accounts: Canada offers several tax-advantaged accounts, such as Registered Retirement Savings Plans and the Tax-Free Savings Account (TFSA). Contributions to RRSPs are tax-deductible, and investment growth is tax-deferred until withdrawal, while TFSA contributions and growth are tax-free.

Maximizing Deductions and Credits: Identifying eligible deductions and tax credits can significantly reduce your taxable income. Examples include deductions for eligible employment expenses, medical expenses, charitable donations, and credits for children’s fitness and arts activities, among others.

Capital Gains and Losses: Proper management of capital gains and losses from investments can help minimize your overall tax liability. Understanding the tax treatment of different investment gains is essential for optimizing your tax position.

Income Splitting: For families with multiple earners, income splitting strategies can be used to allocate income to lower-income family members, potentially reducing the overall tax burden.

Timing of Income and Expenses: Strategically timing the receipt of income and payment of expenses can impact the amount of tax owed in a given year. This may involve deferring income or accelerating expenses to lower your taxable income.

Business and Self-Employment Tax Planning: If you run a business or are self-employed, there are various tax planning opportunities available to optimize deductions, expenses, and income reporting.

Estate Planning: Tax planning should also consider your estate and the potential tax implications for your heirs. Proper estate planning can help minimize taxes on inheritances.

Seeking Professional Advice: Tax laws can be complex and subject to change. Consulting with a tax professional or financial advisor can provide valuable insights and personalized strategies to optimize your tax situation.

Financial Literacy: Improving your financial literacy through workshops, courses, or educational resources helps you make better financial decisions and navigate the complex financial landscape in Canada.

Retirement Planning: Planning for retirement involves understanding pension options, Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and other retirement vehicles to secure a comfortable future.

Credit Score: Monitoring and understanding your credit score is crucial, as it affects your ability to access credit and can impact interest rates on loans and mortgages.

Insurance: Having appropriate insurance coverage, such as health insurance, home insurance, or life insurance, is essential for protecting yourself and your family from unexpected financial burdens.

Understanding your finance in Canada requires continuous learning and proactive financial management. It enables you to make informed decisions, set achievable financial goals, and work towards financial security and independence. Seeking advice from financial advisors or experts can also be beneficial in making complex financial decisions and achieving your financial objectives

Transportation in Canada

- Understanding Transportation System in Canada

- History

- Transportation Modes

Understanding Transportation System in Canada

Transportation in Canada is well-developed and offers various options for getting around the country. The transportation system is efficient, safe, and reliable, connecting cities, towns, and remote areas. The importance of transportation to a trading nation as vast as Canada cannot be underestimated. The great distances between mines, farms, forests, and urban centers make efficient transport systems essential to the economy so that natural and manufactured goods can move freely through domestic and international markets.

History: The history of transportation in Canada is closely linked to the country’s development and expansion over the centuries. From Indigenous peoples‘ traditional modes of transportation to the modern and diverse transportation network of today, Canada’s transportation history has evolved significantly.

Before the arrival of Europeans, Indigenous peoples in Canada relied on various modes of transportation, including birchbark canoes, paddling rivers and lakes, and using overland trails for trade and travel.

In the 17th and 18th centuries, the fur trade played a significant role in Canada’s early history. Canoes continued to be vital for transporting furs and trading goods across vast distances, helping to establish early trade routes.

In the 19th century, as settlements and trade expanded, the construction of roads and canals became crucial.

Railways have always been important in Canada. They were built to open new areas for settlement. The first railway line in Canada was built in 1836; some ten years after England built its first steam railway line. In 1854 the Great Western Railway built a line between the Niagara and the Detroit rivers via Hamilton. It connected with US railways in New York and Michigan.

The Canadian Pacific Railway (CP) was completed in 1885, connecting the east and west coasts of Canada and facilitating the country’s expansion and unification.

The early 20th century saw the rise of automobiles, leading to the development of road infrastructure. The construction of the Trans-Canada Highway, completed in 1962, further enhanced Canada’s road network and enabled easier overland travel between provinces.

In the early 20th century, aviation emerged as a transformative mode of transportation. Charles Lindbergh’s first non-stop transatlantic flight in 1927 sparked increased interest in aviation in Canada, leading to the growth of the airline industry.

Transportation Modes: Canada offers a diverse range of transportation modes, catering to both urban and rural areas. The transportation system is well-developed and efficient, connecting cities, towns, and remote regions. Here are the main transportation modes in Canada:

Air: Due to Canada’s large size, people often travel between major cities by airplane. All main cities have airports with regularly scheduled flights to and from many places. Some places don’t have a main airport, such as small towns or rural areas.

To fly in Canada, you need a piece of photo identification issued by the federal, provincial, or territorial government in Canada, or a foreign passport.

Air Canada is the country’s largest flag carrier airline. It operates a vast network of domestic and international flights, serving numerous destinations across Canada, the United States, Europe, Asia, and other regions.

WestJet, Air Transat, Porter Airlines, Sunwing, Flair Airlines, Air North, Canadian North, and First Air also operates in Canada.

Rail: Canada’s rail network runs across the country. Trains in Canada are safe and comfortable. It’s often cheaper to buy train tickets in advance.

The Canadian Pacific Railway (CP) is one of the most iconic and historically significant railways in Canada. The Canadian National Railway (CN) is another major railway in Canada. It was created in 1918 as a government-owned railway to manage and consolidate several struggling private railways.

Bus: Canada has an extensive bus system that plays a crucial role in connecting communities, providing affordable transportation options, and supporting intercity and regional travel. The bus system includes several types of services, ranging from urban transit within cities to long-distance intercity buses.

Megabus operates in various regions of Canada, offering affordable intercity bus services between major cities in Ontario, Quebec, and Western Canada.

Red Arrow, Ontario Northland, Maritime Bus, Coach Canada, and Pacific Western Transportation (PWT) are different companies that provided bus services in Canada.

Ferry: In coastal areas of Canada such as British Columbia and the Atlantic region, ferry boats are a common way to travel. Many ferries transport both passengers and vehicles. It operates along its coasts, connecting islands, and remote communities, and providing transportation across bodies of water.

BC Ferries is one of the largest and most well-known ferry operators in Canada. They operate along the coastal region of British Columbia, providing essential transportation links between the mainland and various islands, including Vancouver Island, the Gulf Islands, and other communities along the coast

Public Transportation (Public Transit): Public transit in Canada refers to the publicly funded transportation systems that operate within cities and urban areas, providing mass transit options for residents and visitors. It includes buses, subways, light rail transit (LRT), and street cars.

To use public transportation, you must buy a ticket or a transit pass. Transit passes give you unlimited use of public transportation for a certain period (one month or more). They are usually cheaper than buying many tickets if you plan to use public transportation often.

Taxis: All cities and towns have one or more companies that offer services. Taxis are quite expensive, so many people only use them when they don’t have another option. If you want to know how much your trip will cost, ask the driver before the trip starts.

Taxi costs include setting rates used by meters to calculate the cost of your trip based on mileage and fees. These rates are fixed and can’t be negotiated. You pay the amount shown on the meter at the end of your trip.

Yellow Cab is one of the most recognizable taxi brands in Canada. It operates in various cities, including Vancouver, Edmonton, Calgary, Winnipeg, and others. The other famous taxi providers include:

Health Care Insurance

- Understanding Health Care Insurance in Canada

- Essentials of Health Care for Newcomers

- Provincial Health Insurance Card

- Understanding the Health Coverage Provided

Understanding Health Care Insurance in Canada

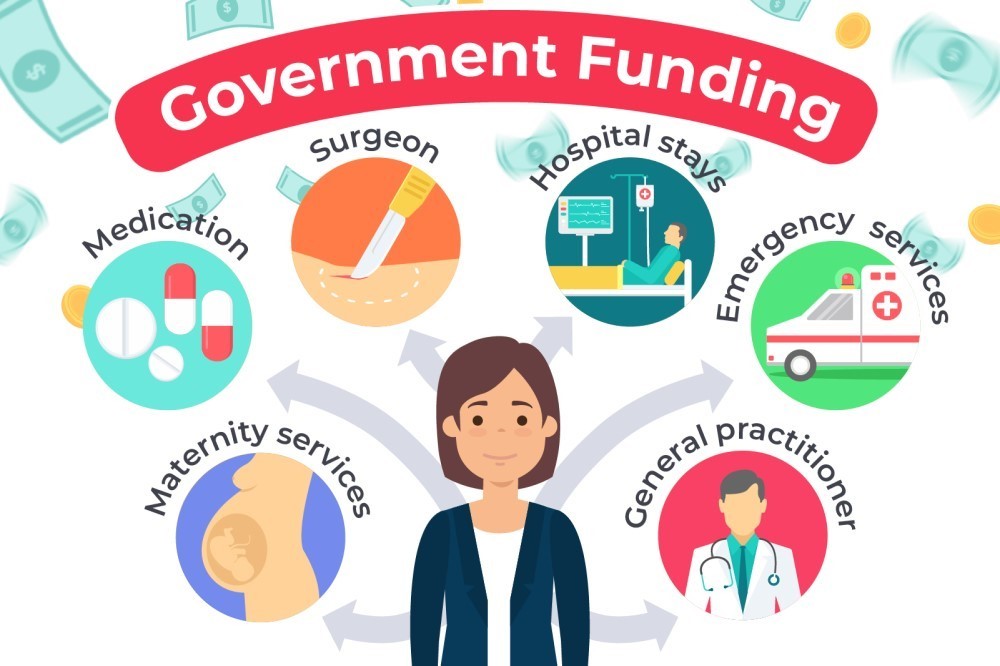

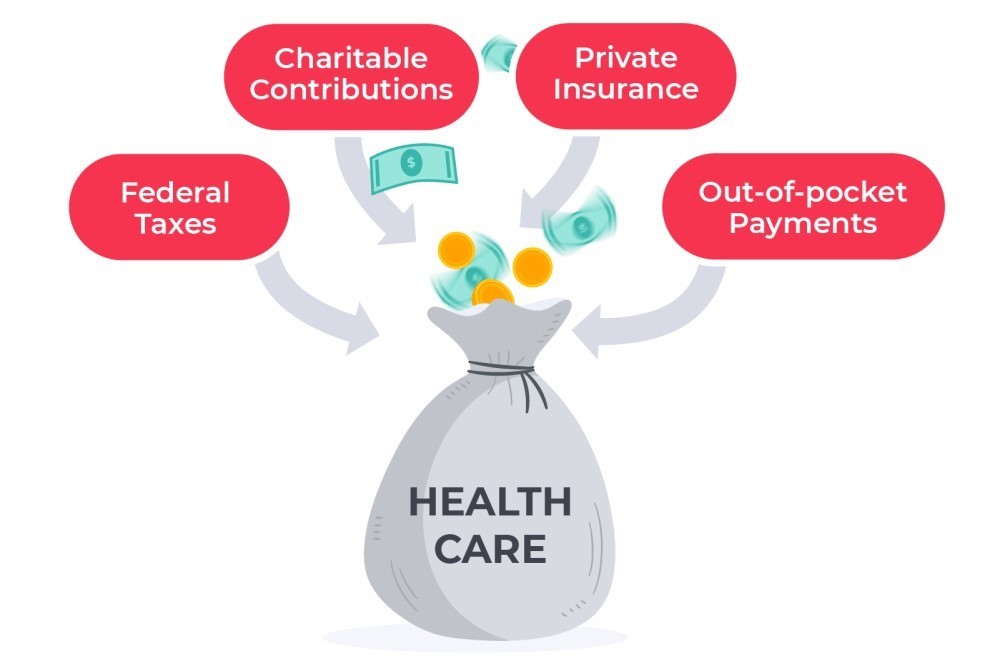

One of the top reasons newcomers choose Canada as their new home is access to a publicly-funded universal healthcare system. In each Canadian province, a portion of the taxes paid by citizens and residents is utilized by the provincial government to administer health services. This enables eligible individuals to receive basic health and medical assistance for free or at a fraction of the cost.

It’s important to note that each province and territory has its health insurance plan with specific eligibility criteria and coverage details. There are 13 distinct provincial and territorial health insurance plans. For instance, if you’re moving as a permanent resident, and you intend to reside in Ontario or British Columbia, you may have to wait for up to three months from the time you land until you’re eligible to receive health benefits, while if you decide to settle in Alberta, there is no waiting period and you’re covered from the day you land.

If the new entrant is not eligible for provincial health insurance coverage (e.g., temporary residents, certain visa holders, etc.), they may need to arrange private health insurance during their stay in Canada to ensure they have adequate healthcare coverage.

Essentials of Health Care for Newcomers

As a newcomer to Canada, understanding the essentials of healthcare is crucial to ensure you have access to necessary medical services and support. Here’s a list of the essential healthcare action items you should familiarize yourself with as a newcomer in Canada:

Provincial Health Insurance Card: In Canada, to get access to medical services, you need a health insurance card. Each province or territory issues these cards to its residents. As a newcomer, you have to apply to the provincial government to get the card.

Eligibility: To be eligible for provincial health insurance coverage, you typically need to be a Canadian citizen, permanent resident, or have a valid work or study permit. Some provinces may have specific eligibility requirements, so check with your provincial health ministry to confirm your eligibility.

Waiting Period: If you are residing in a province that has a waiting period to get public insurance, your timeline for eligibility is counted from the day you land in the province and not from the day you apply. For example, if you are in Toronto and you landed on March 1, 2019, but submitted an application for your health insurance card on May 25, 2019, you would become eligible within approximately 5 days. And if you apply in June, beyond the three-month waiting period, you will be covered immediately from the time you apply.

Understanding the Health Coverage Provided: Depending on your immigration status, the government of Canada provides free emergency medical services, even if you don’t have a government health card. If you have an emergency, it is recommended to visit the nearest hospital. A walk-in clinic may charge fees if you’re not a resident of that province or territory.

Typically, provincial insurance only covers basic medical services. Items such as prescription medicines, dental care, physiotherapy, ambulance services, and prescription eyeglasses may not be covered by the government, and you will have to pay out-of-pocket if you don’t have any other private insurance plan. Many employers offer some form of extended health insurance benefits to their employees to cover scenarios or situations that provincial insurance does not. So, it’s a good idea to check with your employer about these benefits and be well-informed about your options before signing the offer letter.

Below are some points you need to understand about the health coverage provided by Government and even your employer.

- Universal Coverage

- Provincial and Territorial Coverage

- Medical Services Covered

- Primary Care

- Hospital Care

- Emergency Care

- Mental Health Services

- Maternity and Childcare

- Prescription Drugs

- Dental and Vision Care

- Accessibility

- Wait Times

You have to understand and go through all these points to understand your health coverage which means that the insurance plan you have either from Government or your employer which things usually covers.

It’s important to note that while healthcare is publicly funded, the delivery of some services may involve private clinics and practitioners. Additionally, eligibility and coverage details may vary for temporary residents, refugees, and others who are not Canadian citizens or permanent residents.

For specific information about the healthcare coverage provided in your province or territory, including any recent updates or changes, it’s best to contact the provincial or territorial health ministry or visit their official website.

Dos and Don’ts

- Newcomer Dos and Don’ts

- Credit History

- Competitive Job Market

- Open a Bank Account

- Interacting with Law Enforcement

- High Initial Expenses

- Emergency Situations

- Professional Development for Newcomers

Newcomer Dos and Don’ts

Canada is one of the best countries to migrate to if you want to explore more life and career opportunities. Canada is known to be a paradise for immigrants, and it’s all because of the perks that it offers to the people. Refugees are also whole-heartedly welcomed to the land from all around the world.

Canada has much to offer, from beautiful scenery to one of the most culturally diverse societies in the world. Before you pack up and make this exciting journey, be sure you are prepared for the transition so that you can avoid common mistakes.

Credit History: Building good credit is essential to everyday life in Canada and many new immigrants are not well-versed in credit-building best practices. As a newcomer in Canada, you will likely have little to no credit history in the country. If that’s the case, your first opportunity to build good credit is with your renter. Then you will want to head to the bank as fast as you can to learn more about your credit-building options.

Apply for a Secured Credit Card: As a newcomer with little credit history, you may not qualify for a regular unsecured credit card right away.

Do not sign up for easy-to-get department store credit cards at all costs. These have hidden high fees and none of us have time to read the small print.

Dos: Your first credit card ideally should be with your bank. A secure credit card, with a manageable limit that you use to pay your necessary bills. This should be just what you need for the first few months.

Pay your credit balance in full and pay your bills on time. Set up auto-payments to decrease your chances of defaulting.

Here we discuss some of the things through which a newcomer can start building his credit history.

Obtain a Social Insurance Number (SIN): Before you can start building credit, you’ll need to get a Social Insurance Number (SIN) from Service Canada. The SIN is a unique identifier necessary for various financial transactions and credit reporting.

Dos: Visit a Service Canada office in person to apply for your SIN. You will need to provide the required documents and complete the application process. Apply for your SIN as soon as possible after arriving in Canada. You will need it for various purposes, including starting a job or filing taxes.

Treat your SIN as sensitive information and keep it secure. Avoid sharing it unless it’s required for a legitimate purpose, such as employment or tax-related matters.

Once you receive your SIN, provide it to your employer as soon as you start working. Your employer will need it for payroll and tax purposes. Memorize your SIN, and avoid carrying your SIN card with you. Instead, store it in a safe place.

Don’ts: Avoid giving out your SIN unless it’s legally required. Beware of scams or fraudulent activities related to your SIN. Service Canada will not ask for your SIN over the phone or through email.

Applying for multiple SINs is illegal and can lead to serious consequences. You are only allowed one valid SIN for your entire life. Avoid using your SIN as a form of identification, especially in public or online settings.

Avoid providing your SIN to potential landlords during the rental application process. It’s not required for renting a property.

Credit-Builder Loans: Credit-building programs, are financial products designed to help individuals with limited or no credit history build or improve their credit scores. These loans are offered by some financial institutions in Canada, particularly those that specialize in assisting newcomers and individuals with thin or no credit files.

Competitive Job Market: For many newcomers getting ahead in the competitive job market depends on how prepared you are. Newcomers make the mistake of not knowing the job market very well. Navigating a competitive job market requires a strategic approach and a strong understanding of what employers are looking for.

Newcomers have an employment rate of 69.8% compared to 82% for immigrants who have been living in the country for close to a decade.

Dos: To start, know the industries you want to work in, and where the opportunities are, and keep up to date on labor trends and news in your chosen province. Find out the best organizations to join to get you closer to meeting people in that industry.

Thoroughly research companies you’re interested in to understand their values, culture, and specific job requirements. Build a professional network by attending industry events, joining relevant online communities, and connecting with people on platforms like LinkedIn.

If you’re struggling to secure a full-time job, consider volunteering or freelancing in your field. Practice answering common interview questions and prepare thoughtful questions to ask the interviewer.

Don’ts: While online applications are essential, don’t solely rely on them. Use your network to get referrals and try reaching out to hiring managers directly. Tailor each application to demonstrate how your skills align with the specific job requirements.

Be honest about your qualifications and experiences. Exaggerating or lying on your resume can harm your chances and damage your professional reputation.

If you receive feedback from interviews or job applications, use it constructively to improve your approach and performance.

Open a Bank Account: You should choose a bank and open an account within the first week of arrival. Newcomers assume that they need more documentation to be eligible to open a bank account. Once you have two pieces of ID you are eligible to open a bank account. When you open a bank account you can get your debit card and secure credit card. This will help you secure your finances, curb your spending and start building your credit.

Dos: Research different banks and credit unions to find the one that best suits your needs. Consider factors such as account fees, services offered, branch locations, and online banking options.

Prepare the necessary documents, such as valid identification (passport, driver’s license, or permanent resident card), proof of address (utility bill or rental agreement), and Social Insurance Number (SIN).

Select an account type that aligns with your banking preferences. Compare account fees and service charges associated with different accounts. Some banks offer no-fee accounts for specific demographics, such as students or newcomers.

Don’ts: Take your time to choose the right bank and account that best suits your needs. Rushing into a decision may lead to unnecessary fees or unsuitable services.

Be cautious when providing personal information, especially online or over the phone. Use secure channels and verify the legitimacy of the request before sharing sensitive data. Pay attention to hidden fees or charges that may apply to certain account transactions.

If using mobile banking apps, take security precautions such as setting a strong password, enabling two-factor authentication, and keeping your device updated. Regularly review your account transactions to ensure accuracy and identify any unauthorized activity promptly.

Interacting with Law Enforcement: Interacting with the police in Canada requires a balance of cooperation and protecting your rights. Don’t be tense after seeing the police officer talk with confidence.

Dos: Stay calm and be respectful when dealing with the police. A cooperative and respectful demeanor can help defuse tense situations. If asked, provide identification, such as your name and address. In certain situations, you may also need to show identification documents, such as a driver’s license.

If you’re unsure why the police are stopping you or questioning you, politely ask for the reason. They should provide a valid explanation. If you’re not being detained or arrested, you have the right to ask if you’re free to leave. If the police say yes, you can calmly walk away.

Don’ts: If you’re being arrested, do not resist, as this can lead to additional charges and potential harm to yourself or others. Giving false information to the police can have serious consequences. Be honest in your interactions.

Fleeing from the police, even if you believe you’ve done nothing wrong, can escalate the situation and lead to further issues. Avoid interfering with police officers while they are performing their duties, as this can be considered an obstruction of justice.

While racial profiling is unacceptable, it’s essential not to assume that every interaction with the police is based on discrimination. Focus on remaining calm and respectful during the encounter.

High Initial Expenses: In our eagerness to secure a place to say, many of us rush to pay high rent to secure a place. Requests for credit reports by landlords and months of rent in advance can lead to high initial expenses. In addition to securing a place to stay, getting a cellphone plan to stay in touch with loved ones back home, taking cabs, and ordering takeout food until we get settled and the expenses pile on. Especially as a newcomer or someone going through a major life change, it’s essential to manage your finances wisely.

Dos: Make a 30-day plan and plan out all your expenses. Consider starting with a one-month AirBnB or staying at a hostel and that will give you the flexibility to look for shared living spaces and advertising for a roommate.

Identify and prioritize essential expenses, such as housing, utilities, food, and transportation. Make sure these necessities are covered before allocating funds to non-essential items. Build an emergency fund to cover unexpected expenses.

Consider purchasing second-hand items or using online marketplaces for essentials like furniture, household goods, and clothing to save money.

Don’ts: Avoid relying on high-interest credit cards or payday loans to cover initial expenses. High-interest debt can quickly become unmanageable and lead to financial stress. Resist the temptation to splurge or overspend on non-essential items during times of financial strain. Stick to your budget and focus on necessities.

If you are facing financial difficulties, seek help from financial advisors, credit counselors, or community resources. Early intervention can prevent the situation from escalating. Avoid comparing your financial situation to others, as everyone’s circumstances are unique. Focus on your own financial goals and work towards achieving them steadily.

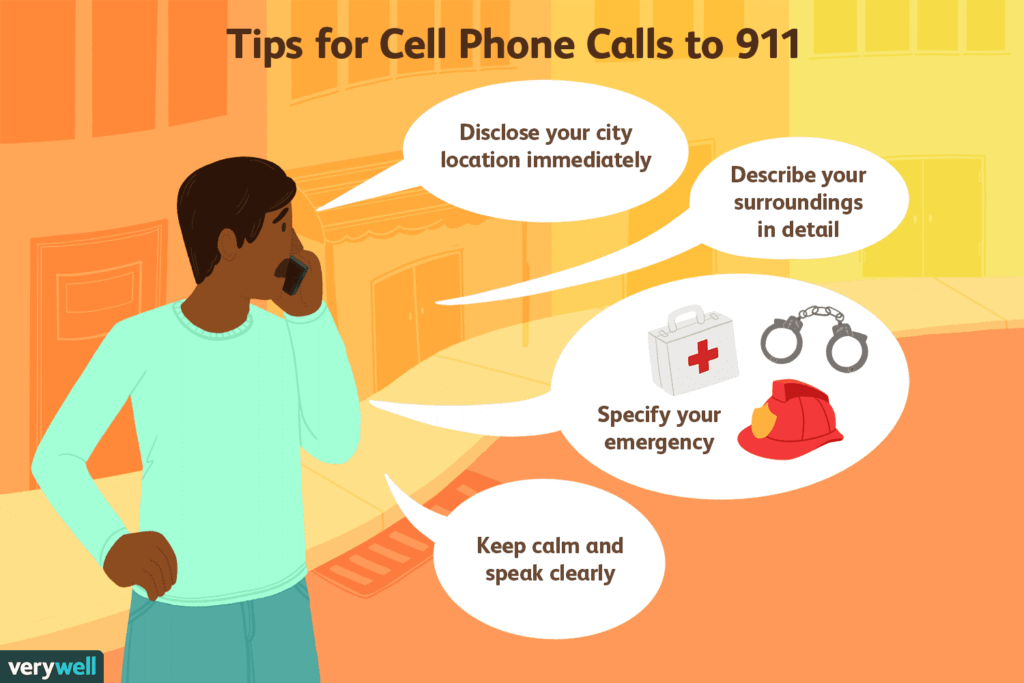

Emergency Situations: Using the emergency call 911 in Canada is reserved for situations that require immediate assistance from law enforcement, fire departments, or medical services. It’s crucial to use this emergency service responsibly to ensure that help reaches those who need it urgently.

There are also other numbers according to states which can be used in emergencies.

Dos: Stay calm and provide the dispatcher with accurate and relevant information about the emergency, the location, and any injuries or hazards present. Listen carefully to the dispatcher’s instructions and follow them.

Clearly state the exact location of the emergency, including the address, nearby landmarks, or any other information that can help emergency responders find you quickly. Stay on the line until the dispatcher tells you to hang up.

Don’ts: Avoid calling 911 for non-emergencies or situations that do not require immediate assistance. If you accidentally dial 911, do not hang up without explaining to the dispatcher. Stay on the line and inform them that it was a mistaken call.

Misusing 911 for pranks or non-emergency situations is illegal and can divert valuable resources from genuine emergencies. If you find yourself in a dangerous situation and have called 911, do not hang up out of fear. Keep the line open so the dispatcher can stay informed of the situation and coordinate help.

Professional Development for Newcomers: Professional development in Canada is essential for individuals to enhance their skills, knowledge, and competencies in their chosen fields. It involves continuous learning and improvement to stay relevant and competitive in the job market.

Professional development often begins with formal education and training. This may include pursuing higher education degrees, attending workshops, seminars, or obtaining certifications in specialized areas. Professional development focuses on improving job-specific skills, soft skills, and technical competencies that are essential for success in the workplace.

Canada offers numerous online learning platforms and resources, providing accessible and flexible options for professional development. Attending workshops, conferences, and industry events can provide opportunities for professional growth, exposure to new trends, and networking with peers and experts.

How to Pursue: Pursuing professional development in Canada involves actively seeking opportunities to enhance your skills, knowledge, and expertise in your chosen field. Here’s a step-by-step guide to help you embark on your professional development journey:

- Identify Your Goals

- Conduct Research

- Consider Continuing Education

- Utilize Online Learning

- Join Professional Associations

- Attend Workshops and Conferences

- Seek Mentorship

- Utilize Employer Resources

- Consider Volunteer Work

- Create a Professional Development Plan

- Set a Budget

- Stay Committed to Lifelong Learning

- Update Your Resume and LinkedIn Profile

- Network and Collaborate

- Evaluate Your Progress

Remember that professional development is a personal and ongoing journey. Be proactive in seeking opportunities, and focus on developing skills that align with your career aspirations. By investing in your professional development, you can increase your value to employers, advance your career, and seize new opportunities in Canada’s dynamic job market.

Ways to Pursue: There are various ways to pursue professional development in Canada to enhance your skills, knowledge, and career prospects. Here are some effective methods:

- Formal Education: Enroll in degree programs, diploma courses, or certificate programs at colleges and universities. These provide in-depth knowledge and recognized qualifications in your chosen field.

- Seminars and Short Courses: Attend workshops, seminars, and short courses offered by professional organizations, community centers, or online platforms to stay updated on industry trends and best practices.

- Industry Certifications: Pursue industry-specific certifications and licenses relevant to your career. These credentials can improve your employability and demonstrate your expertise to employers.

- Professional Associations: Join professional associations related to your field. They offer networking events, workshops, webinars, and access to industry-specific resources.

- Volunteer Work and Internships: Gain practical experience and develop skills through volunteer opportunities or internships in your area of interest.

- Leadership Development Programs: Participate in leadership development programs that focus on building leadership and management skills.

- Research and Publications: Stay informed about the latest research, publications, and industry journals to stay updated on cutting-edge developments in your area of expertise.

- Self-Directed Learning: Take the initiative to learn new skills independently through reading books, watching webinars, or experimenting with new tools or technologies.

The more you invest in your professional development, the more you will stand out in the competitive job market and advance in your chosen field.