US Address System

- US Address

- House Number

- Street name

- City

- State

- Zip Code

- Example of Address

US Address System

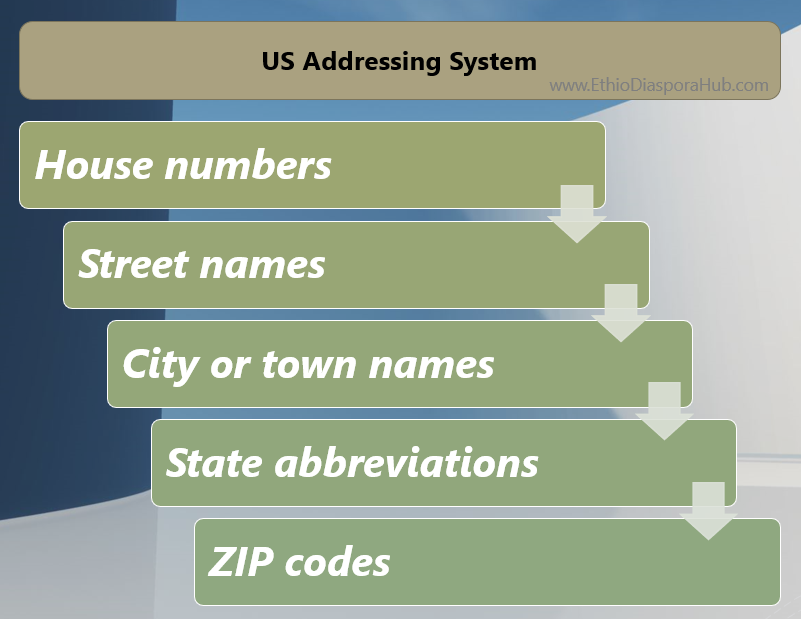

For immigrants entering the United States, understanding the addressing system is crucial for navigating daily life and ensuring efficient communication and mail delivery. The addressing system in the US follows a structured format that includes:

This system plays a vital role in identifying locations and facilitating the accurate delivery of mail and packages. Familiarizing yourself with the components and conventions of the US addressing system will help you effectively communicate your address, receive important correspondence, and navigate your new surroundings. This introductory guide aims to provide an overview of the US addressing system, empowering immigrants to navigate their new communities with confidence.

House numbers: House numbers are numerical identifiers assigned to individual buildings or residences along a street. They allow for precise location identification within a particular street. House numbers often increase in numerical order as you move along a street, with even numbers typically on one side and odd numbers on the opposite side.

Street names: Street names are the names given to roads or thoroughfares in a city or town. They help identify specific locations and provide a means of navigation. Street names are typically displayed on road signs and are an essential part of an address.

City or town names: City or town names refer to the name of the specific municipality or incorporated area where a particular address is located. These names help further narrow down the geographic location and assist in mail sorting and delivery.

State abbreviations: State abbreviations are two-letter codes that represent the names of the 50 states in the United States. For example, “CA” represents California, “NY” represents New York, and “TX” represents Texas. State abbreviations are used in addresses to indicate the specific state in which a city or town is located.

ZIP codes: ZIP codes, which stands for Zone Improvement Plan codes, are five-digit numerical codes assigned to specific geographic areas in the United States. ZIP codes help facilitate efficient mail sorting and delivery by designating the intended destination of mail and packages. ZIP codes can be further extended to include additional four-digit codes for even more precise location identification.

Understanding these components of the US addressing system is crucial for accurately communicating and identifying addresses. It ensures that mail and packages are delivered to the correct location and facilitates efficient navigation within cities and towns across the country. Here’s an example of a US address broken down into its components:

Example of Address

Street Address: 123 Main Street

City: Anytown

State: CA (California)

ZIP Code: 98765

In this example:

“123 Main Street” represents the specific street address and house number where the location is situated.

“Anytown” is the name of the city or town where the address is located.

“CA” is the state abbreviation, indicating that the address is in California.

“98765” is the ZIP code, which designates the specific geographic area for efficient mail sorting and delivery.

When combined, the full address would be:

123 Main Street

Anytown, CA 98765

This example demonstrates how the components of the US addressing system come together to create a complete and accurate address.

Immigration Status

- What is your immigration status

- Green Card Holder

- Fiancé

- Asylee

- Refuge

- Tourist Visa

- Immigration Benefit Programs

- Employment opportunities

- Education

- Social services

- Language programs

- Community resources

Immigration Status

Welcome to the United States, a nation of diversity and opportunity! As an immigrant, your journey to this country comes with a unique set of challenges and rewards. One of the most important aspects of settling in the U.S. is understanding your immigration status. Immigration status refers to the specific category or classification that determines your rights, responsibilities, and limitations within the U.S. immigration system. Whether you are a permanent resident, a refugee, an asylum seeker, or any other category, it is crucial to grasp the nuances of your immigration status to navigate the complex American society successfully. In this guide, we will explore the different immigration statuses available in the United States, providing you with a solid foundation to better understand your rights and obligations as you embark on your new life in this remarkable country.

In the United States, there are various types of immigration statuses available to individuals. Let’s explore some of these:

- Green Card Holder: A Green Card holder, also known as a Lawful Permanent Resident (LPR), is someone who has been granted authorization to live and work permanently in the United States. Green Card holders enjoy many benefits, such as the ability to travel in and out of the country, work legally, and eventually apply for U.S. citizenship. Green Card Holder: United States Citizenship and Immigration Services (USCIS): www.uscis.gov/greencard

- Fiancé: The Fiancé visa, officially known as the K-1 visa, is designed for foreign nationals who are engaged to U.S. citizens. It allows the foreign fiancé to enter the United States for the purpose of getting married within 90 days of arrival. Once married, the foreign national can then apply for a Green Card to become a Lawful Permanent Resident. Fiancé: United States Department of State – Bureau of Consular Affairs: www.travel.state.gov/content/travel/en/us-visas/immigrate/family-immigration/nonimmigrant-visa-for-a-fiance-k-1.html

- Asylee: An asylee is a person who has fled their home country due to a well-founded fear of persecution based on their race, religion, nationality, political opinion, or membership in a particular social group. Asylees are granted protection in the United States and can apply for asylum, which may lead to obtaining a Green Card and eventually citizenship. Asylee: United States Citizenship and Immigration Services (USCIS): www.uscis.gov/humanitarian/refugees-asylum/asylum

- Refugee: Similar to asylees, refugees are individuals who have fled their home countries due to persecution or fear of persecution. However, refugees are typically selected and processed outside of the United States through the United Nations or other organizations. Once granted refugee status, they can enter the United States and receive assistance to settle, work, and eventually apply for permanent residency. Refugee: United Nations Refugee Agency (UNHCR): www.unhcr.org United States Department of State – Bureau of Population, Refugees, and Migration: www.state.gov/bureau-of-population-refugees-and-migration

- Tourist Visa: A tourist visa, or B-2 visa, is a temporary nonimmigrant visa that allows individuals to visit the United States for tourism, pleasure, or medical treatment. It is intended for short stays and does not grant work authorization or the ability to live in the country permanently. Tourist visa holders must depart the United States before their authorized stay expires. Tourist Visa: United States Department of State – Bureau of Consular Affairs: www.travel.state.gov/content/travel/en/us-visas/tourism-visit/visitor.html

It’s important to note that each immigration status has its own eligibility requirements, application processes, and rights. It’s recommended to consult with an immigration attorney or trusted resources for specific guidance and information based on your individual circumstances.

Immigration Benefits

As an immigrant, it’s important to familiarize yourself with the various immigration status types and benefits available to you. The United States offers several pathways for individuals to legally reside and work in the country. These pathways include nonimmigrant visas for temporary stays, immigrant visas for permanent residency, and naturalization for becoming a U.S. citizen. Each status type has its own eligibility criteria, rights, and benefits. Understanding these options will empower you to navigate the U.S. immigration system and make informed decisions about your future in this diverse and welcoming nation.

In the United States, there are several immigration benefit programs that aim to support and empower immigrants. Let’s explore some of these programs:

- Employment opportunities: The U.S. offers various employment opportunities for immigrants, whether they are temporary workers, Green Card holders, or U.S. citizens. Immigrants can seek employment in a wide range of industries and professions, contribute to the economy, and build a stable livelihood for themselves and their families.

- Education: The U.S. provides access to education for immigrants of all ages. Immigrant children have the right to enroll in public schools, and there are also programs available for adult immigrants to improve their skills and pursue higher education. Additionally, colleges and universities often have resources and support services specifically tailored to immigrant students.

- Social services: Immigrants in the U.S. can access various social services that aim to provide assistance and support. These services may include healthcare programs, housing assistance, nutrition programs, and financial aid for those in need. Many non-profit organizations and government agencies are dedicated to helping immigrants integrate into society and access necessary resources.

- Language programs: Recognizing the importance of language proficiency, the U.S. offers language programs to help immigrants learn English. English as a Second Language (ESL) classes are widely available, both through formal institutions and community organizations. These programs assist immigrants in acquiring language skills that are essential for effective communication, employment, and overall integration.

- Community resources: Immigrants can find valuable support through community resources such as community centers, immigrant advocacy organizations, and cultural associations. These resources often provide guidance, information, cultural events, and networking opportunities. They serve as a platform for immigrants to connect with others from similar backgrounds, find support systems, and navigate the challenges of settling into a new country.

These immigration benefit programs aim to create an inclusive and supportive environment for immigrants in the United States. They provide opportunities for personal and professional growth, access to essential services, and a sense of belonging within the community. It’s important for immigrants to be aware of these programs and take advantage of the resources available to them.

Understanding Important Immigrant Documents

- Essential Immigrant Documents

- Green Card

- Social Security Number (SSN)

- Driver’s License

- Passport

- Travel Document

- Application for Asylum I-589

- Employment Authorization Document (EAD) Card

Essential Immigrant Documents

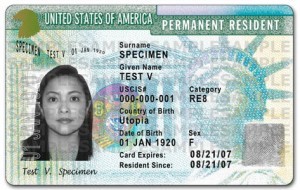

Understanding and possessing the necessary immigration documents is of paramount importance for immigrants in the United States. These documents serve as legal proof of status, grant access to various benefits and services, and enable individuals to fully participate in society. For example, the Green Card, also known as a Permanent Resident Card, establishes one’s lawful permanent resident status, providing the opportunity to live and work in the U.S. Similarly, obtaining a Social Security Number (SSN) is essential for employment, paying taxes, and accessing government benefits. Moreover, possessing a valid driver’s license allows immigrants to legally operate vehicles and serves as a primary form of identification for various purposes.

Additionally, a passport is crucial for international travel and serves as an identification document while abroad.

Understanding and complying with the requirements for these documents ensures that immigrants can exercise their rights, access opportunities, and navigate daily life in the United States smoothly. It is important for immigrants to seek reliable information, consult with immigration experts or organizations, and comply with the laws and regulations to maintain legal status and fully enjoy the benefits and opportunities available to them.

- Green Card: A Green Card, also known as a Permanent Resident Card, is an identification document issued by the United States government to foreign nationals who are authorized to live and work permanently in the United States. It serves as proof of legal permanent resident status and provides various benefits, such as the ability to work, access social services, and travel internationally.

Green Card: United States Citizenship and Immigration Services (USCIS):

- Social Security Number (SSN): A Social Security Number is a unique nine-digit identification number issued by the Social Security Administration (SSA) in the United States. It is used for various purposes, including employment, paying taxes, accessing government benefits, and opening financial accounts. An SSN is necessary for establishing a credit history and participating in the social security system. A regular Social Security Card is issued to individuals who are eligible to work in the United States. It signifies that the person has the legal right to work and does not require any additional authorization from the Department of Homeland Security (DHS). This card allows individuals to present their Social Security Number (SSN) as proof of their work eligibility to employers.

- On the other hand, a Social Security Card valid for work only with DHS authorization is issued to individuals who have specific work authorization based on their immigration status. It indicates that the person is authorized to work in the United States, but their work eligibility is contingent upon maintaining a valid authorization from the DHS. This type of Social Security Card is typically issued to individuals with temporary work permits or those who have certain visa statuses that require DHS authorization for employment.

Social Security Number (SSN): Social Security Administration (SSA):

- Driver’s License: A Driver’s License is an official government-issued document that grants permission to an individual to operate a motor vehicle. It serves as a primary form of identification and is often required for activities such as driving legally, opening bank accounts, and proving age or identity in various situations. The requirements and process for obtaining a driver’s license vary by state or country.

Driver’s License: Department of Motor Vehicles (DMV): Websites vary by state, so search for your specific state’s DMV website. For example, “California DMV” or “Texas DMV.”

- Passport: A Passport is an official travel document issued by a person’s country of citizenship or nationality. It certifies the holder’s identity and citizenship and allows them to travel internationally. Passports contain personal information, including a photo, name, date of birth, and other identifying details. They are necessary for entry into foreign countries and serve as a form of identification while abroad.

- Travel Document: A Travel Document, also known as a Refugee Travel Document or a Re-entry Permit, is an official document issued to individuals who have been granted asylum or are in a protected status in the United States. It allows them to travel internationally and return to the United States without jeopardizing their immigration status. Travel Documents provide temporary travel authorization when a person’s original passport is unavailable or cannot be used.

Travel Document: United States Citizenship and Immigration Services (USCIS): www.uscis.gov/humanitarian/refugees-asylum/refugees

- Application for Asylum I-589: The Application for Asylum, also known as Form I-589, is a crucial document for individuals seeking protection in a foreign country due to fear of persecution or harm in their home country. This application is typically submitted to the respective country’s immigration authorities and includes detailed information about the applicant’s background, reasons for seeking asylum, and supporting evidence. The application initiates the process for asylum consideration and evaluation by immigration authorities.

- Application for Asylum I-589: United States Citizenship and Immigration Services (USCIS): www.uscis.gov/i-589

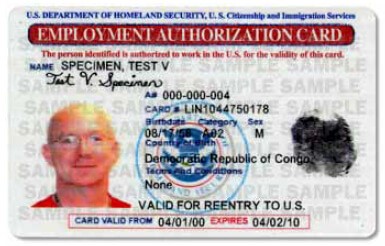

An Employment Authorization Document (EAD) card: also commonly referred to as a work permit, is a crucial document in the United States immigration system. Issued by the U.S. Citizenship and Immigration Services (USCIS), the EAD card grants temporary employment authorization to individuals who are not U.S. citizens or permanent residents but are eligible to work in the United States.

The EAD card serves as evidence that the holder is permitted to work legally in the U.S. for a specified period of time. It typically includes the individual’s name, photograph, alien number (if applicable), and the dates of validity.

Obtaining an EAD card is an important step for immigrants who are in certain nonimmigrant or immigrant visa categories, such as students, dependents, refugees, or asylum seekers, as it allows them to pursue employment opportunities and contribute to the American workforce while maintaining their immigration status. It is important to note that not all immigrants are eligible for an EAD card, and the specific requirements and application process may vary depending on the individual’s immigration status.

These documents play a vital role in the lives of immigrants, providing legal recognition, opportunities, and the ability to navigate various aspects of daily life, such as work, travel, and accessing social services. Understanding the purpose and requirements associated with each document is essential for immigrants to ensure compliance with immigration laws and to fully participate in their host country.

Understanding your finance

- Understanding your finance

- Employment Type

- Paycheck

- Direct Deposit

- Payroll Tax

- 401K

- Filing your Tax

- Bank Card

Understanding your finances

Understanding your finances is crucial for immigrants in the United States to build a strong foundation and navigate their financial journey effectively. It involves gaining knowledge about managing money, budgeting, saving, and making informed financial decisions. For immigrants, learning about the U.S. financial system, understanding concepts such as banking, credit, taxes, and expenses, and familiarizing oneself with available resources and tools can empower them to achieve financial stability and pursue their goals. By developing financial literacy and adopting sound financial practices, immigrants can navigate the complexities of the U.S. financial landscape, make informed choices, and work towards a secure and prosperous future in their new home.

Employment Types:Understanding the different types of employment in the United States is essential for individuals seeking work opportunities. In the U.S., employment types can vary, and it is crucial to comprehend the distinctions between them. The two main employment classifications are W-2 and 1099. W-2 employment refers to being hired as an employee by a company or organization.

- W-2: A W-2 form is a tax document provided by an employer to their employees at the end of each calendar year. It summarizes the employee’s earnings, taxes withheld, and other relevant information necessary for filing income taxes. For individuals working as employees, their employer will issue a W-2 form to report their income and tax withholding. This form is essential for accurately reporting income and filing tax returns with the Internal Revenue Service (IRS).

https://www.irs.gov/forms-pubs/about-form-w-2

- 1099: A 1099 form is a tax document used to report income received by an individual or business from sources other than an employer-employee relationship. It is typically issued to independent contractors, freelancers, and self-employed individuals. If someone is working as an independent contractor or receiving income from freelance work, clients or businesses may issue a 1099 form to report the payments made to them during the tax year. It is important to note that individuals receiving a 1099 form are responsible for reporting and paying their own taxes, as they are not classified as employees and do not have taxes withheld by an employer.

https://www.irs.gov/forms-pubs/about-form-1099-misc

Paycheck: A paycheck is the payment received by an employee from their employer for the work performed. It is important for immigrants to understand their paychecks to ensure they are being paid accurately and fairly. Key components of a paycheck include gross income (the total amount earned before deductions), net income (the amount received after deductions), and details of deductions such as taxes, insurance premiums, and retirement contributions. Immigrants should review their pay stubs regularly, ensuring that they are being paid the correct amount for their work.

https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

Direct deposit : Payroll direct deposit is a process where an employer electronically deposits an employee’s wages or salary directly into their bank account. It is a convenient and efficient method of payment that eliminates the need for physical paychecks.

To set up payroll direct deposit, an employee provides their employer with their bank account information, including the bank’s routing number and their account number. The employer then initiates the direct deposit process, transferring the employee’s net pay directly into their designated bank account on the scheduled payday.

Employers often require employees to complete a direct deposit authorization form, providing consent to deposit their pay directly into their bank account. Employees should ensure they provide accurate bank account information and regularly review their bank statements to confirm proper deposit of their wages.

Payroll Tax: Payroll tax refers to the taxes deducted from an employee’s wages or self-employment income to fund various government programs. In the United States, payroll taxes primarily go towards Social Security and Medicare. It is important for immigrants to understand the payroll tax system, including the Social Security and Medicare taxes withheld from their paychecks. Immigrants should be aware of the tax rates and thresholds, and understand their rights and benefits related to these programs.

https://taxfoundation.org/tax-basics/payroll-tax/

401K: A 401K is a retirement savings plan offered by some employers in the United States. Immigrants should explore and understand the benefits of participating in a 401K plan. A 401K allows individuals to contribute a portion of their pre-tax income into an investment account, which can grow over time. Employers may also offer matching contributions, which can further enhance savings. Immigrants should familiarize themselves with the eligibility criteria, contribution limits, investment options, and potential tax advantages associated with a 401K to make informed decisions about their retirement savings.

https://www.investopedia.com/terms/1/401kplan.asp

Tax Return: A tax return is an annual filing with the Internal Revenue Service (IRS) where individuals report their income, deductions, and tax liability. Immigrants in the United States are required to file a tax return if they meet the income thresholds or have other filing requirements. It is crucial for immigrants to understand the tax return process, including gathering the necessary documents, choosing the correct tax forms, and determining their filing status. By filing a tax return, immigrants can ensure they are fulfilling their tax obligations and potentially receive tax benefits or refunds they are eligible for.

https://www.investopedia.com/terms/t/taxreturn.asp

A bank card: A bank card is a plastic card issued by a bank or financial institution that enables individuals to access various financial services and perform transactions. Bank cards come in different types, such as debit cards and credit cards.

Bank cards, regardless of type, often include a magnetic strip or an embedded chip that stores information. This information is used to authenticate and authorize transactions at various points of sale, ATMs, or online platforms. Bank cards may also include additional security features like personal identification numbers (PINs) or signature requirements to ensure the card’s proper use.

- Debit Card: A debit card is a bank card that is linked directly to an individual’s bank account. When a debit card is used for a transaction, the funds are immediately deducted from the linked bank account. It allows users to make purchases, withdraw cash from ATMs, and perform other banking transactions. Debit cards offer convenience and security, as they eliminate the need to carry cash. They can also help individuals track their spending since transactions are recorded in their bank account statements. For immigrants, obtaining a debit card from a bank is a useful tool for managing day-to-day finances and accessing banking services.

https://consumer.gov/managing-your-money/using-debit-cards

- Credit Card: A credit card is a payment card that allows individuals to borrow money up to a certain credit limit to make purchases. Unlike a debit card, where funds are directly withdrawn from a bank account, credit cards enable individuals to borrow money from the card issuer, subject to repayment terms. Credit cards offer flexibility in managing expenses and provide a line of credit that can be useful in emergencies or for making larger purchases. It is important to use credit cards responsibly, making timely payments and managing credit limits to avoid debt and maintain a good credit history. Building a positive credit history through responsible credit card usage can be beneficial for immigrants in the United States, as it can help establish a strong financial foundation and access future financial opportunities.

https://consumer.gov/credit-loans-debt/using-credit

Transportation in the US

- Transportation

- Bus

- Metro

- Taxi

- Ride Sharing Apps

Transportation in the US

For a new immigrant in the US, understanding and utilizing different modes of transportation is important for getting around and becoming familiar with the local area. Here is a brief overview of the relationship between buses, metro systems, taxis, and ride-sharing apps:

- Bus: Buses are a common form of public transportation in many cities and towns across the United States. They operate on scheduled routes and typically have designated bus stops where passengers can board and alight. Buses provide an affordable option for commuting within a city or traveling short to moderate distances. The bus fare can vary depending on the location, and it is usually paid upon boarding or by using a contactless payment system. Buses are operated by local transit authorities or private companies, and routes and schedules are available through transit apps, websites, or at bus stops.

- Metro: Metro systems, also known as subways or undergrounds in some cities, are rapid transit systems that primarily operate within urban areas. They consist of underground or elevated rail lines with designated stations where passengers can board and disembark. Metros are a convenient and efficient way to travel longer distances or navigate heavily congested areas. The fare for the metro is typically based on the distance traveled or a fixed rate. Metro systems often have different lines and routes that connect various parts of a city or region. Maps, schedules, and fare information can be obtained from transit authorities or through their official websites and apps.

- Taxi: Taxis are a traditional mode of transportation where passengers can hire a licensed vehicle and driver for point-to-point travel. Taxis can be hailed on the street or hired from designated taxi stands. The fare is determined by a combination of distance traveled and time spent in the vehicle, usually calculated using a taximeter. Taxis offer convenience and flexibility, but they can be relatively more expensive compared to other modes of transportation. In larger cities, taxi services are regulated by local authorities, and it’s important to ensure that the taxi you use is licensed and has a functioning meter.

- Ride-Sharing Apps: Ride-sharing apps, such as Uber and Lyft, have gained popularity in recent years as a convenient and often cost-effective transportation option. These apps connect passengers with private drivers who use their personal vehicles to provide transportation services. Passengers can request a ride through the app, and the driver arrives at the specified location. The fare is usually determined based on factors like distance, duration, and demand. Ride-sharing apps offer the advantage of easy booking, real-time tracking, and cashless payments. They also provide the flexibility to choose the type of vehicle or service level based on the passenger’s preference.

https://www.uber.com/us/en/ride/

It’s important for new immigrants to familiarize themselves with the local public transportation options, including bus routes, metro lines, and taxi services, as they provide essential mobility within the community. Ride-sharing apps can complement these options and offer additional convenience, especially for on-demand transportation needs. Exploring and understanding the available transportation choices can help immigrants navigate their new surroundings and integrate into their local communities more easily.

Health Care Insurance

- Health Care Insurance Coverage

- Employer Sponsored Health Insurance

- Self-Sponsored Health Insurance

- No insurance visits of the emergency room

Navigating the healthcare Insurance Coverage

Navigating the healthcare system in a new country can be a daunting task, especially for immigrants who are unfamiliar with the intricacies of the healthcare system in the United States. One important aspect of accessing healthcare is having individual health insurance coverage. Individual health insurance provides financial protection and access to medical services for individuals and their families. The following is an overview of individual health insurance options for immigrants who are new to the USA, helping them understand the importance of securing health coverage and guiding them towards making informed decisions about their healthcare needs.

- Employer-Sponsored Health Insurance: Employer-sponsored health insurance is a type of health coverage provided by employers to their employees. Many employers in the United States offer health insurance as part of their employee benefits package. This means that if you work for a company or organization that provides health insurance, you may be eligible to enroll in their health insurance plan.Under an employer-sponsored health insurance plan, the employer typically pays a portion of the premium (the cost of the insurance), and the employee pays the remaining portion through payroll deductions. The insurance plan may cover various medical services, including doctor visits, hospitalization, prescription medications, and preventive care. The coverage and costs may vary depending on the specific plan and the employer’s contributions.When you start a new job, it’s important to inquire about the availability of health insurance benefits and understand the details of the coverage offered by your employer. This can include the enrollment process, the extent of coverage, any deductibles or co-payments required, and the network of healthcare providers available under the plan.

- Self-Sponsored Health Insurance: If you do not have access to employer-sponsored health insurance, or if you are self-employed or working as a freelancer, you may need to consider self-sponsored health insurance. Self-sponsored health insurance, also known as individual health insurance or private health insurance, is coverage that you purchase directly from an insurance company or through a healthcare marketplace. With self-sponsored health insurance, you have the flexibility to choose a plan that best fits your needs and budget. There are different types of plans available, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), and high-deductible health plans (HDHPs). These plans may vary in terms of cost, coverage options, and access to healthcare providers. https://www.healthcare.gov/get-coverage/When selecting self-sponsored health insurance, it’s important to consider factors such as monthly premiums, deductibles, co-payments, out-of-pocket maximums, and the network of healthcare providers. It’s also advisable to carefully review the plan’s coverage for services such as doctor visits, hospitalization, prescription drugs, and preventive care.

For immigrants who are new to the US healthcare system, it’s recommended to research and compare different health insurance options, both employer-sponsored and self-sponsored. Understanding the coverage, costs, and terms of each option will help you make informed decisions about your healthcare needs and ensure that you and your family have access to necessary medical services. Consulting with an insurance broker or using online tools and resources can be helpful in finding and selecting the right health insurance plan for your specific circumstances.

No Insurance Visits to the Emergency Room: If you don’t have health insurance and need to visit the emergency room (ER) due to a medical emergency, it’s important to seek the necessary medical care. In the United States, emergency rooms are legally required to provide treatment regardless of a patient’s insurance status or ability to pay.

Remember, it’s crucial to prioritize your health and seek necessary medical care, even if you don’t have insurance. Exploring the available options for financial assistance, negotiating bills, and seeking help from non-profit organizations can help alleviate the financial burden associated with emergency room visits and ensure you receive the care you need.

- Financial Assistance from the Hospital: Hospitals often have programs in place to assist individuals who are uninsured or facing financial difficulties. These programs can help reduce or eliminate the cost of emergency room visits and other medical services. It’s advisable to contact the hospital’s billing department or patient financial services to inquire about available financial assistance programs. They can guide you through the application process and determine your eligibility based on factors such as income and assets.

- Payment Plans: If you receive a bill for your emergency room visit, but you are unable to pay the full amount upfront, you can request a payment plan from the hospital. A payment plan allows you to make monthly installments towards the bill over a period of time. It’s important to communicate with the hospital’s billing department to discuss your situation and negotiate a payment plan that is manageable for you

- Negotiating the Bill: You have the option to negotiate with the hospital or healthcare provider to lower the cost of your emergency room bill. Hospitals may be willing to reduce charges or offer discounts for uninsured individuals. It’s important to review the itemized bill carefully and identify any errors or charges that seem unreasonable. You can discuss these concerns with the billing department and request a review of the charges. Being proactive and advocating for yourself can help in negotiating a more manageable bill.

- Seeking Help from Non-Profit Organizations or Charities: There are non-profit organizations and charities that provide assistance with medical bills and healthcare expenses. These organizations may offer financial aid, grants, or programs specifically for individuals without insurance. Research local non-profit organizations or charitable foundations in your area that focus on healthcare assistance and reach out to them for support and guidance.

It’s important to note that the availability and eligibility criteria for financial assistance programs may vary between hospitals and organizations. It’s advisable to start the process of seeking assistance as early as possible and be prepared to provide necessary documentation such as proof of income, identification, and medical bills.

Newcomers Dos and Don’ts

- Newcomer Dos and Don’ts

- Traffic Stop Police Interaction

- Credit Score

- Disciplining a Child

- Digital Footprint

- Disclosing PII

- Tax Filling

- 911 vs 311

- Professional Development Effort

- Ways to Pursue Professional Development

Newcomer Dos and Don’ts

Welcome to the United States, a land of new beginnings and diverse opportunities! As a newcomer to this vibrant nation, it’s important to familiarize yourself with some dos and don’ts to help you navigate your new environment with ease and respect. Understanding the cultural norms and expectations will not only help you integrate smoothly but also foster positive interactions with the local community. In this guide, we will provide you with valuable dos and don’ts, offering insights into the social customs, etiquette, and common practices that will contribute to your successful transition and enjoyable experience as you embark on your journey in the United States.

Interacting with the police during a traffic stop

Interacting with the police during a traffic stop can be a nerve-wracking experience, especially for newcomers to the United States. However, it is important to approach these situations with knowledge, respect, and a focus on safety. Understanding the procedures and expectations can help ensure a smooth and respectful interaction with law enforcement officers. In this guide, we will provide you with valuable tips and guidelines on how to navigate a traffic stop, including your rights and responsibilities, appropriate behavior, and effective communication. By familiarizing yourself with these essential dos and don’ts, you can promote a positive and safe encounter with the police, fostering mutual respect and ensuring a better understanding of the process.

- Do not panic or make sudden movements: Stay calm and composed during the traffic stop. Avoid sudden movements that may cause the officer to perceive a threat. Keep your hands visible on the steering wheel or dashboard, as it reassures the officer of your intentions.

- Do not reach for items without informing the officer: If you need to retrieve your driver’s license, registration, or insurance documents, politely inform the officer about your actions before reaching for anything. This helps to alleviate any concerns the officer may have about potential threats.

- Do not discuss the case with the officer or admit guilt: It’s generally advisable to avoid discussing the details of the case or admitting guilt during the traffic stop. Anything you say can be used against you later. It’s best to exercise your right to remain silent and consult with an attorney before providing any statements.

- Do not withhold information or lie: Provide accurate and honest information when asked by the police. This includes providing your driver’s license, vehicle registration, and proof of insurance. Lying or withholding information can lead to further complications and legal consequences.

- Do not consent to a search without understanding your rights: Generally, the police need probable cause or your consent to conduct a search of your vehicle. If an officer asks to search your vehicle, you have the right to ask if you are free to leave. If you are free to leave, you can politely decline the search. However, if the officer has probable cause, they may proceed with the search.

- Do not resist or obstruct the police: Resisting or obstructing the police can escalate the situation and lead to serious legal consequences. Follow any lawful orders given by the officer, even if you disagree with them. If you believe your rights have been violated, make a note of the details and address the issue through appropriate channels later.

Remember, each traffic stop situation can vary, and it’s important to be aware of your rights and responsibilities. Following these guidelines can help ensure a safer and smoother interaction with the police during a traffic stop.

Maintaining good credit score

Maintaining a good credit score is a vital aspect of financial success in the United States, especially for immigrants who are establishing themselves in a new country. Your credit score reflects your creditworthiness and plays a significant role in your ability to secure loans, obtain favorable interest rates, and even rent an apartment. As an immigrant, building and maintaining a positive credit history may seem daunting, but with the right knowledge and responsible financial habits, it is achievable. In this guide, we will explore the importance of maintaining a good credit score, provide practical tips on how to build credit from scratch, and offer insights on how to navigate the U.S. credit system effectively. By understanding the factors that influence your credit score and adopting smart financial practices, you can lay a solid foundation for a bright financial future in your new home.

- Late or missed payments: Avoid making late payments or missing payments on your credit cards, loans, or other financial obligations. Payment history is a significant factor in determining your credit score, and consistently making timely payments demonstrates financial responsibility.

- Maxing out credit cards: It’s important to avoid maxing out your credit cards or using a high percentage of your available credit. This can negatively impact your credit utilization ratio, which compares your credit card balances to your credit limits. Keeping your credit utilization below 30% is generally recommended for a healthy credit score.

- Applying for too much credit at once: Avoid applying for multiple credit cards or loans within a short period of time. Each credit application triggers a hard inquiry on your credit report, which can temporarily lower your credit score. Apply for credit only when necessary and after careful consideration.

- Closing old credit accounts: Length of credit history is an important factor in your credit score calculation. Closing old credit accounts shortens your credit history and may negatively impact your score. If you have old accounts in good standing, it’s generally beneficial to keep them open, even if you’re not actively using them.

- Ignoring your credit report: Regularly monitor your credit report to ensure accuracy and identify any errors or fraudulent activity. Ignoring your credit report can lead to discrepancies that may harm your credit score. Review your credit report from the major credit bureaus annually and report any inaccuracies or suspicious activity.

- Co-signing without careful consideration: Co-signing a loan or credit card for someone else means you are equally responsible for the debt. Before co-signing, carefully evaluate the risks and the other person’s ability to make payments. If the co-signer defaults, it can negatively impact your credit score.

- Settling debts without understanding the consequences: Settling a debt for less than the full amount owed may seem appealing, but it can have negative consequences for your credit score. Debt settlements are typically reported to credit bureaus and can be seen as a negative factor in your credit history. If you’re struggling with debt, consider seeking advice from a credit counselor or financial professional to explore alternatives.

- Not building a credit history: Simply avoiding credit altogether can make it challenging to establish a good credit score. Building a positive credit history is important for future financial opportunities. Consider responsible credit card usage, timely bill payments, and other credit-building strategies to establish a solid credit history.

By avoiding these common pitfalls, you can set yourself on the path to building a good credit score as a new immigrant in the United States. It’s important to practice responsible financial habits, educate yourself about credit, and be mindful of your credit-related decisions.

Disciplining a child

Disciplining a child is a crucial aspect of parenting, and as a newcomer to the United States, it’s important to understand the cultural norms and approaches to effective discipline in this country. Establishing clear boundaries, instilling values, and teaching appropriate behavior are essential for a child’s development. However, discipline should always be approached with care, respect, and a focus on positive guidance.

When disciplining a child in the United States, it’s important to be aware of cultural norms and legal guidelines. Here are some things to avoid when disciplining a child in the US:

- Physical or corporal punishment: It is generally advised to avoid physical or corporal punishment when disciplining a child in the United States. Physical discipline that causes harm or injury to a child is not only ineffective but can also be considered abusive and may result in legal consequences. Instead, focus on positive discipline techniques that promote communication, understanding, and teaching appropriate behavior.

- Emotional or verbal abuse: Avoid using emotionally or verbally abusive language when disciplining a child. Name-calling, belittling, or using derogatory remarks can have long-lasting negative effects on a child’s self-esteem and emotional well-being. Encourage open communication, active listening, and respectful dialogue to address behavioral issues.

- Extreme punishments: It’s important to avoid using extreme or excessive punishments that are disproportionate to the misbehavior. Discipline should be fair and appropriate, taking into consideration the child’s age, developmental stage, and the severity of the situation. Extreme punishments can be detrimental to a child’s emotional and psychological well-being.

- Withholding basic needs: Avoid using withholding basic needs, such as food, water, or shelter, as a form of punishment. These actions are considered neglectful and can have serious consequences for the child’s health and well-being. Ensure that the child’s physical and emotional needs are consistently met, even during disciplinary situations.

- Shaming or public humiliation: Publicly shaming or humiliating a child is not recommended when disciplining them. This can cause lasting emotional harm and damage the parent-child relationship. Instead, focus on addressing the behavior in a private and respectful manner, helping the child understand the impact of their actions and guiding them towards more appropriate behavior.

- Ignoring the child’s perspective: It’s important to avoid dismissing or ignoring the child’s perspective during disciplinary situations. Take the time to listen to the child, understand their point of view, and validate their feelings. Engage in constructive conversations to help them learn from their mistakes and make better choices in the future.

- Inconsistent discipline: Inconsistency in disciplinary measures can lead to confusion and undermine the effectiveness of discipline. It’s important to establish clear and consistent expectations, rules, and consequences for behavior. Consistency helps children understand boundaries and promotes a sense of stability and structure.

Remember, discipline should be focused on teaching, guiding, and nurturing a child’s development. It’s important to create a safe and supportive environment that fosters positive behavior, communication, and growth. If you have concerns about disciplining your child, it can be helpful to seek guidance from pediatricians, child psychologists, or parenting resources in your community.

Your digital footprint

To protect yourself from becoming a victim of your digital footprint, it’s essential to be mindful of your online activities and take precautions to safeguard your personal information. Here are some things to avoid minimizing the risks associated with your digital footprint:

- Oversharing personal information: Be cautious about the personal information you share online. Avoid posting sensitive details like your full name, address, phone number, Social Security number, or financial information on public platforms or with untrusted sources. This information can be used by cybercriminals for identity theft or other malicious activities.

- Weak or reused passwords: Avoid using weak or easily guessable passwords for your online accounts. Additionally, refrain from reusing passwords across multiple accounts. Instead, create strong, unique passwords for each of your accounts, incorporating a combination of letters, numbers, and special characters. Consider using a trusted password manager to securely store and generate complex passwords.

- Clicking on suspicious links or downloading unknown files: Be cautious when clicking on links or downloading files from unknown sources, especially if they arrive via email, text messages, or social media. These could be phishing attempts or contain malware that can compromise your digital security. Verify the legitimacy of the sender and exercise caution before interacting with unknown links or files.

- Ignoring privacy settings: Regularly review and adjust privacy settings on your social media accounts and other online platforms. Limit the visibility of your personal information and posts to trusted individuals or groups. Be mindful of what you share and consider the potential consequences of making certain information public.

- Falling for online scams: Avoid responding to suspicious emails, messages, or requests for personal information that appear to be scams. Be skeptical of unsolicited offers, requests for money, or requests for sensitive data. Familiarize yourself with common online scams, such as phishing, lottery scams, or romance scams, and learn how to identify the warning signs.

- Ignoring software updates and security patches: Keep your devices and software up to date with the latest security patches. Software updates often include important security enhancements that can protect your devices and data from vulnerabilities. Regularly update your operating system, web browsers, antivirus software, and other applications to ensure you have the latest security features.

- Not monitoring your digital footprint: Regularly monitor your digital footprint by conducting online searches of your name and personal information. This helps you identify any potentially harmful or inaccurate information about you that could impact your reputation or privacy. Address any issues promptly by contacting website administrators or taking appropriate action.

By avoiding these risky behaviors and being proactive in managing your digital footprint, you can reduce the chances of becoming a victim of cybercrime or compromising your personal information. Stay informed about best practices for online security and privacy, and remain vigilant in protecting your digital presence.

Protect Disclosing PII

To protect your Personally Identifiable Information (PII) from unauthorized disclosure and potential misuse, it’s important to be mindful of certain actions and practices. Here are some things not to do in order to safeguard your PII:

- Avoid sharing PII on unsecured platforms: Refrain from sharing sensitive personal information, such as your full name, address, date of birth, Social Security number, financial details, or login credentials, on unsecured platforms. Only provide such information on trusted websites with secure connections (look for “https” in the website URL) or when necessary for legitimate purposes.

- Be cautious with unsolicited requests: Be skeptical of unsolicited requests for your PII, whether through email, phone calls, text messages, or social media. Avoid providing personal information to unknown individuals or entities without verifying their identity and legitimacy. Be particularly wary of requests for sensitive information or offers that sound too good to be true, as these could be phishing attempts or scams.

- Don’t overshare on social media: Be mindful of the information you share on social media platforms. Avoid posting PII publicly, such as your home address, phone number, or personal identification documents. Be cautious about sharing details about your daily routine or upcoming travel plans, as this information can be used by malicious individuals to track or exploit you.

- Don’t use weak passwords or reuse them: Avoid using weak or easily guessable passwords for your online accounts. Similarly, refrain from reusing passwords across multiple accounts. Instead, create strong, unique passwords for each account and consider using a reliable password manager to securely store and generate complex passwords. This practice reduces the risk of unauthorized access to your accounts and helps protect your PII.

- Avoid using public Wi-Fi for sensitive activities: Public Wi-Fi networks are often unsecured, making it easier for hackers to intercept your online communications and potentially gain access to your PII. Avoid transmitting sensitive information, such as financial or personal details, while connected to public Wi-Fi networks. Instead, use a secure, password-protected network or a virtual private network (VPN) for enhanced data encryption and protection.

- Don’t discard sensitive documents without shredding: When disposing of documents containing PII, such as bank statements, medical records, or credit card statements, avoid simply throwing them in the trash. Instead, shred these documents using a cross-cut shredder to prevent unauthorized individuals from accessing your personal information.

- Avoid falling for impersonation scams: Be cautious of individuals impersonating trusted entities, such as financial institutions, government agencies, or service providers, to trick you into revealing your PII. These scams often involve emails, phone calls, or text messages that appear legitimate but are attempts to obtain your sensitive information. Be skeptical and independently verify the authenticity of any communication before sharing personal details.

By avoiding these actions and practicing responsible information handling, you can significantly reduce the risk of disclosing your PII to unauthorized individuals or falling victim to identity theft, fraud, or other privacy breaches. Stay vigilant, be proactive in protecting your personal information, and follow best practices for online and offline security.

Tax filing

Tax filing is an important responsibility for individuals living in the United States, including newcomers to the country. Understanding the process and requirements of tax filing is essential for complying with the law and ensuring your financial obligations are met. Whether you are an employee, self-employed, or have other sources of income, filing your taxes accurately and on time is crucial. By familiarizing yourself with the tax filing process and seeking guidance when needed, you can fulfill your tax obligations effectively and maximize any available benefits, setting a solid foundation for your financial future in the United States.

When it comes to tax filing, it’s important to be aware of certain actions to avoid potential issues or complications. Here are some things not to do when filing your taxes:

- Don’t procrastinate: Avoid waiting until the last minute to file your taxes. Procrastination can lead to mistakes, missing important deadlines, or even incurring penalties. Give yourself ample time to gather necessary documents, review your tax forms, and accurately complete your tax return.

- Don’t ignore tax obligations: It’s crucial not to ignore your tax obligations. Failing to file your taxes or pay any owed taxes can result in penalties, interest, and other legal consequences. Even if you are unable to pay your full tax liability, it’s important to file your return on time and explore options for payment plans or arrangements with the tax authorities.

- Don’t overlook important tax documents: Be diligent in collecting and reviewing all the necessary tax documents, such as W-2 forms, 1099 forms, and other income statements. Failing to include income from all sources can result in underreporting income, triggering penalties or an audit. Carefully review your documents to ensure accuracy and report all income accordingly.

- Don’t rush through your tax return: Take the time to review your tax return thoroughly before submitting it. Rushing through the process increases the likelihood of errors or omissions. Mistakes can delay your refund, lead to additional tax liabilities, or prompt further scrutiny from tax authorities. Double-check your calculations, verify that all information is correct, and consider using tax software or consulting a tax professional for assistance.

- Don’t overlook deductions and credits: Be aware of the deductions and credits available to you. Failing to claim eligible deductions and credits means potentially missing out on reducing your taxable income or maximizing your refund. Research and understand the deductions and credits that apply to your situation, such as education expenses, homeownership deductions, or retirement contributions.

- Don’t ignore changes in tax laws: Stay informed about any changes in tax laws or regulations that may impact your tax filing. Tax laws are subject to updates and amendments, and remaining unaware of these changes can lead to incorrect filings or missed opportunities for tax benefits. Stay updated through reliable sources, such as the Internal Revenue Service (IRS) or consult with a tax professional.

- Don’t be afraid to seek professional help: If your tax situation is complex or if you’re unsure about certain aspects of your tax return, don’t hesitate to seek guidance from a qualified tax professional. They can provide valuable expertise, ensure accurate filing, and help you navigate any specific tax considerations or circumstances.

By avoiding these common pitfalls and following proper tax filing practices, you can ensure a smoother and more accurate tax filing experience. Pay attention to deadlines, gather the necessary documents, review your return carefully, and stay informed about relevant tax regulations to fulfill your tax obligations accurately and on time.

Use of 911 and 311

The use of 911 and 311 is an important distinction to understand for accessing emergency and non-emergency services in the United States. Here’s a discussion on the use of 911 and 311:

911: 911 is the emergency telephone number used throughout the United States for immediate assistance in life-threatening situations or emergencies that require urgent response from law enforcement, fire departments, or medical personnel. It is the number to call when there is an immediate threat to life, property, or public safety.

When to call 911:

- Medical emergencies: For situations involving severe injuries, sudden illnesses, or any life-threatening medical condition.

- Fires: When there is a fire or any indication of a fire, including smoke or visible flames.

- Crimes in progress: If you witness or are a victim of a crime in progress, such as assaults, robberies, or burglaries.

- Accidents and dangerous situations: For traffic accidents with injuries, hazardous material spills, downed power lines, or other immediate threats.

It’s crucial to provide clear and concise information to the 911 operator, including the location of the emergency, nature of the emergency, and any necessary details requested.

311: 311 is a non-emergency telephone number used in many cities across the United States for accessing non-emergency government services and information. It serves as a centralized helpline to address community concerns, report non-urgent issues, and obtain information about city services, such as public utilities, transportation, housing, and other non-emergency matters.

When to call 311:

- Reporting non-urgent issues: Such as noise complaints, potholes, graffiti, streetlight outages, or other public nuisances.

- Obtaining city information: For general inquiries about city services, hours of operation, or government programs.

- Requesting assistance: To seek information or assistance with permits, licenses, or other administrative processes.

- Accessing non-emergency services: To reach city agencies responsible for public works, parks and recreation, transportation, or other non-urgent matters.

311 is designed to alleviate the burden on the emergency 911 system by providing an alternative for non-emergency inquiries and services.

It’s important to note that the availability and specific services offered through 311 may vary depending on the city or municipality. It’s advisable to consult the local government website or contact 311 to understand the services available in your area.

Understanding the distinction between 911 and 311 helps ensure that appropriate resources are dispatched efficiently for emergencies and that non-emergency concerns are directed to the appropriate channels.

Professional development

Professional development is highly beneficial for immigrants who are new to the United States as it offers opportunities to enhance skills, gain knowledge, and adapt to the local job market. Here’s a discussion on the benefits and ways of pursuing professional development as a new immigrant:

Benefits of Professional Development:

- Skill Enhancement: Professional development programs help immigrants acquire new skills or enhance existing ones. This can include technical skills, industry-specific knowledge, leadership abilities, communication skills, or proficiency in tools and technologies. By strengthening their skill set, immigrants can become more competitive in the job market and increase their employment prospects.

- Industry Insights and Networking: Engaging in professional development activities allows immigrants to gain valuable insights into their chosen industry. They can stay updated on industry trends, best practices, and emerging technologies. Additionally, professional development events, workshops, and conferences provide opportunities to network with professionals in the field, potentially leading to job referrals, mentorship, or collaboration opportunities.

- Cultural Adaptation: Professional development programs offer a platform for cultural adaptation. Immigrants can familiarize themselves with workplace norms, professional etiquette, and business practices specific to the United States. This helps build confidence, understanding, and integration into the professional environment.

- Professional Credentials and Recognition: Some professional development programs offer certifications or credentials that validate individuals’ expertise and qualifications. These credentials can enhance their professional credibility and increase their chances of securing employment or career advancement opportunities.

Ways to Pursue Professional Development:

- Continuing Education: Enroll in formal educational programs, such as community colleges, vocational schools, or universities. Pursuing degree programs, certificate courses, or specialized training can provide comprehensive education and credentials tailored to specific career paths.

- Workshops and Seminars: Attend workshops, seminars, or conferences relevant to your industry. These events often offer insights into industry trends, provide valuable networking opportunities, and feature expert speakers sharing their knowledge and experiences.

- Online Courses and Webinars: Take advantage of online platforms that offer professional development courses or webinars. Websites like Coursera, Udemy, LinkedIn Learning, and industry-specific platforms offer a wide range of online courses that can be completed at your own pace and convenience.

- Professional Associations and Organizations: Join professional associations or organizations related to your field. These associations often provide resources, networking events, and educational programs specifically designed for professionals in that industry. Becoming a member can offer access to valuable industry-specific information and connections.

- Mentoring and Coaching: Seek out mentorship or coaching relationships with experienced professionals in your field. Mentors can provide guidance, support, and valuable insights as you navigate the local job market. Networking events or industry-specific associations can be good places to find potential mentors.

- Language and Communication Skills Development: Enhance your language and communication skills through language courses, conversation groups, or public speaking workshops. Strong communication skills are highly valued in the professional environment and can significantly enhance your job prospects.

Remember to explore scholarships, grants, or financial aid options that may be available for immigrants pursuing professional development. Local community organizations, nonprofits, or government agencies may offer assistance or resources specifically for immigrants.

Investing in professional development as a new immigrant can equip you with the necessary skills, knowledge, and connections to thrive in the US job market. Embrace the opportunities available and seek out resources that align with your career goals and interests.